Skaffold

-

And now… to a short commercial break

Roger Montgomery

September 2, 2014

We interrupt our regular programming to take a quick look at what our friends over at Skaffold have been cooking up. continue…

by Roger Montgomery Posted in Skaffold.

- 1 Comments

- save this article

- POSTED IN Skaffold

-

Skaffold Features Get Richer…

Roger Montgomery

August 15, 2013

As many of you know Skaffold is one of the tools we use at Montgomery and I have got to give credit where it’s due. Chris Batchelor and his team over at Skaffold are doing an amazing job. Chris, you are doing an incredible job! Well done! continue…

by Roger Montgomery Posted in Skaffold.

- 3 Comments

- save this article

- POSTED IN Skaffold

-

An offshore Montgomery fund?

Roger Montgomery

April 6, 2013

“There is a tide in the affairs of men, which taken at the flood, leads on to fortune. Omitted, all the voyage of their life is bound in shallows and miseries. On such a full sea are we now afloat. And we must take the current when it serves, or lose our ventures.” William Shakespeare

At Montgomery we have received innumerable requests to launch an offshore fund. The Montgomery Global Fund, for example. This is something we have the capability to do.

by Roger Montgomery Posted in Insightful Insights, Skaffold.

- 16 Comments

- save this article

- POSTED IN Insightful Insights, Skaffold

-

MEDIA

Playing It Safe by Adding Custard

Roger Montgomery

January 16, 2013

In His 8 December 2012 Australian column, Roger explains why quality and value are an essential combination for value investors. Read here.

by Roger Montgomery Posted in In the Press, Investing Education, Skaffold.

- save this article

- POSTED IN In the Press, Investing Education, Skaffold

-

Important enhancements to Skaffold

Roger Montgomery

November 5, 2012

If like me, you are a Skaffold member, you will have noticed something dramatic has happened when you logged in recently.

(If you are not a member, what are you waiting for?)

Quietly and without much fanfare, Skaffold just got a whole lot more valuable to me.

I’d like to share with you – just this once – some of the information that Skaffold members received recently and tell you a bit about the change.

continue…by Roger Montgomery Posted in Companies, Skaffold.

- 1 Comments

- save this article

- POSTED IN Companies, Skaffold

-

Where is the value? Let Skaffold keep you posted!

Roger Montgomery

October 22, 2012

Last week on 2GB I didn’t speak to Ross Greenwood as I normally do. He was off in New York for Channel Nine. Instead I had a terrific chat with my friend and former fund manager Matthew Kidman.

As usual we didn’t have a great deal of time but I asked Matthew whether he was seeing much value and his reply was telling. Like me, it seems to Matthew that value was getting thin on the ground, particularly among the higher quality companies.

There is still a few pockets of value and we named a few stocks. Matthew mentioned that he also predicted that the market would now strengthen and stocks that are fairly valued may continue to rally well beyond fair value.

I am less able to predict stocks and their short term price direction. To reduce risk what we do is simply analyse those companies that come into value as their prices, values and quality scores change.

by Roger Montgomery Posted in Companies, Insightful Insights, Intrinsic Value, Skaffold.

-

Takeover bids distract from questions over steelmakers viability

David Buckland

October 3, 2012

The $0.75 bid for Arrium Limited (ARI), formerly One Steel, by a Korean Consortium including their largest steelmaker, Posco, values the company at $1.0 billion. Including the $2.2 billion of debt, Arrium has an Enterprise Value of $3.2 billion. Forecasts for the year to June 2013, has Revenue of $8.7 billion, Net Profit of $210m and an after tax return on equity of 4.6%. The Arrium share price has declined from more than $7.00 in mid-2008. A number of brokers are now valuing the Company north of $1.00 per share.

This bid is also raising the question as to whether BlueScope Steel (BSL) will propose a merger with Arrium. “Mergeco” would have $17 billion of annualised revenue.

BlueScope has also seen its share price smashed, down from $8.00 in mid-2008 to the current $0.43 per share. Its market capitalisation is $1.44 billion, and with a forecast net debt of $380 million, BlueScope’s Enterprise value is $1.82 billion. BlueScope has recorded an extraordinarily disappointing four year period to June 2012, with after tax losses aggregating to $2.5 billion while the tripling of their shares on issue to 3329 million shares has been associated with an additional $2.7 billion of capital put into the company.Arrium and BlueScope were downgraded to below “investment grade” by the Skaffold screening process in 2005 and 2008, respectively.

by David Buckland Posted in Insightful Insights, Intrinsic Value, Manufacturing, Skaffold.

-

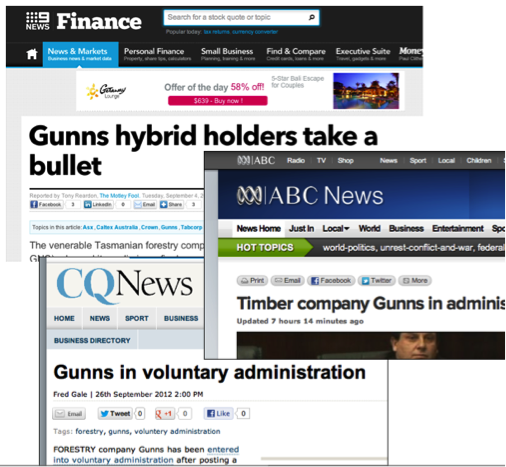

Gunns collapse. If only they’d been Skaffold members!

Roger Montgomery

September 29, 2012

Chalk up another win for Skaffold members.

Substantial capital losses are difficult to make back and irrespective of whether you are still in accumulation mode, retiring or retired it is essential to avoid major losses. One way to do this of course is to diversify and ensure that losses are mitigated through position sizing. Another technique and the one we will discuss here, is to simply avoid the companies most likely to collapse.

This week Gunns (ASX:GNS), was placed into voluntary administration and happily for Skaffold members it is unlikely that anyone owned shares.

Gunn’s was never investment grade. Anyone who purchased the stock from 2003 onwards were taking a massive risk and Skaffold can explain why.

Skaffold’s Verdict (Figure. 1) is a picture of danger.

by Roger Montgomery Posted in Companies, Insightful Insights, Market Valuation, Skaffold, Value.able.

-

If Only They Had Skaffold

Roger Montgomery

September 20, 2012

Notch up another win for investors who use Skaffold. Back in August last year I was asked by a viewer on Sky Business what I thought of MacMahon Holdings (ASX:MAH).

Notch up another win for investors who use Skaffold. Back in August last year I was asked by a viewer on Sky Business what I thought of MacMahon Holdings (ASX:MAH).You can watch the video here at 5 mins 20 seconds.

When asked the question, I looked at Skaffold.com and noting the very small change in intrinsic value over many years I said “This business is not going to deliver sustainable long-term outperformance”.

Today’s near-40% share price decline, announcement of a cost blowout, a downgrade to previous earnings guidance and the immediate resignation of the CEO Nick Bowen is a blow to those investors who own the shares of MacMahon and do not own Skaffold.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Skaffold.

-

Reporting Season Update

Roger Montgomery

August 18, 2012

Over the past week more than 100 companies have reported their full year results. These results have begun to flow through Skaffold, resulting in the changes listed below for each company. A membership to Skaffold ensures you are constantly up to date with changes to the quality and valuations of every Australian listed company.

To become a Skaffold member and start taking advantage of market inefficiencies that may transpire during reporting season CLICK HERE

And here’s a list of the elements in Skaffold that change automatically as companies report:

1. Earnings and Dividends, Capital History and Cash Flow Evaluate screens updated with 2012 figures

2. New 2012 Skaffold Score

3. 2012 Intrinsic Value – Actual

4. 2013, 2014 and 2015 Intrinsic Value forecasts

continue…by Roger Montgomery Posted in Companies, Investing Education, Market Valuation, Skaffold.