Skaffold

-

Does your adviser agree with these stocks?

Roger Montgomery

February 9, 2012

The ability to pick stocks that never go down, is NOT one of our skills. Plenty of you can attest to that. Value investing using the method we advocate in Value.able and using Skaffold.com cannot prevent losses, it is about minimising the cases of permanent impariment.

The ability to pick stocks that never go down, is NOT one of our skills. Plenty of you can attest to that. Value investing using the method we advocate in Value.able and using Skaffold.com cannot prevent losses, it is about minimising the cases of permanent impariment.Asked by BRW’s Tony Featherstone which small caps we liked we nominated a few. Here’s the list and if you cannot read it properly or would like to also read about the TOP 10 Start Ups of 2011, grab this week’s copy of the BRW.

Remember to seek and take personal professional advice before engaging in any security transactions.

Posted by Roger Montgomery, Value.able and Skaffold author and Fund Manager, 9 February 2012.

by Roger Montgomery Posted in Companies, Energy / Resources, Insightful Insights, Skaffold.

-

First base.

Roger Montgomery

February 6, 2012

US jobs data was stronger than expected and resulted in global equity markets following the US reaction higher. But is all as it seems?

US jobs data was stronger than expected and resulted in global equity markets following the US reaction higher. But is all as it seems?The increase in jobs was 243,000 but 490,000 were said to be temporary jobs. The employment number is now the same as a decade ago but a decade ago there were 30 million fewer people living in the US!

Charles Biderman notes that “Either there is something massively changed in the income tax collection world, or there is something very, very suspicious about today’s BLS hugely positive number,” adding, “Actual jobs, not seasonally adjusted, are down 2.9 million over the past two months. It is only after seasonal adjustments – made at the sole discretion of the Bureau of Labor Statistics economists – that 2.9 million fewer jobs gets translated into 446,000 new seasonally adjusted jobs.” A 3.3 million “adjustment” solely at the discretion of the BLS? And this from the agency that just admitted it was underestimating the so very critical labor participation rate over the past year? Perhaps with a hint of conspiracy theorist (all hints of which we run from as fast as possible) Biderman wonders whether the BLS is being pressured by the Obama administration during an election year to paint an overly optimistic picture. Hmmmmm…

The BLS however constantly ‘adjust’ its numbers and an January overadjustment occurs annually. Without the BLS smoothing calculation, the real economy lost 2,689,000 jobs, while net of the adjustment, it actually gained 243,000. So are conditions really getting better in the US or only in the adjustment column on an analyst’s spreadsheet?For those of you who have seen the amazing Abbott and Costello skit ‘Who’s on first’, here’s another take on it:

COSTELLO: I want to talk about the unemployment rate in America.

ABBOTT: Good Subject. Terrible Times. It’s 8.3%.

COSTELLO: That many people are out of work?

ABBOTT: No, that’s 16%.

COSTELLO: You just said 8.3%.

ABBOTT: 8.3% Unemployed.

COSTELLO: Right 8.3% out of work.

ABBOTT: No, that’s 16%.

COSTELLO: Okay, so it’s 16% unemployed.

ABBOTT: No, that’s 8.3%…

COSTELLO: WAIT A MINUTE. Is it 8.3% or 16%?

ABBOTT: 8.3% are unemployed. 16% are out of work.

COSTELLO: IF you are out of work you are unemployed.

ABBOTT: No, you can’t count the “Out of Work” as the unemployed. You have to look for work to be unemployed.

COSTELLO: BUT THEY ARE OUT OF WORK!!!

ABBOTT: No, you miss my point.

COSTELLO: What point?

ABBOTT: Someone who doesn’t look for work, can’t be counted with those who look for work. It wouldn’t be fair.

COSTELLO: To who?

ABBOTT: The unemployed.

COSTELLO: But they are ALL out of work.

ABBOTT: No, the unemployed are actively looking for work… Those who are out of work stopped looking.

They gave up and if you give up, you are no longer in the ranks of the unemployed.

COSTELLO: So if you’re off the unemployment rolls, that would count as less unemployment?

ABBOTT: Unemployment would go down. Absolutely!

COSTELLO: The unemployment just goes down because you don’t look for work?

ABBOTT: Absolutely it goes down. That’s how you get to 8.3%. Otherwise it would be 16%. You don’t want to read about 16% unemployment do ya?

COSTELLO: That would be frightening.

ABBOTT: Absolutely.

COSTELLO: Wait, I got a question for you. That means there are two ways to bring down the unemployment number?

ABBOTT: Two ways is correct.

COSTELLO: Unemployment can go down if someone gets a job?

ABBOTT: Correct.

COSTELLO: And unemployment can also go down if you stop looking for a job?

ABBOTT: Bingo.

COSTELLO: So there are two ways to bring unemployment down, and the easier of the two is to just stop looking for work.

ABBOTT: Now you’re thinking like an economist.

COSTELLO: I don’t even know what the I just said!While we are not waiting around for the swallows to sing – then spring will be over – we are buying stocks in a slow and measured way. We haven’t added any new stocks to our portfolio so we are adding to existing holdings.

In Australia, the situation may not be much better. Last year here at the blog we discussed the impending job losses at banks, manufacturers and retailers and all of that appears to be rolling along as predicted. But as my friend Bob Gottliebsen noted today; “At the weekend, Roy Morgan Research reported a big jump in unemployment during January. Almost certainly that will be reflected in the official figures when they are released later this month. Morgan uses a different method to calculate unemployment to the statisticians and Morgan’s December unemployment was 8.6 per cent, compared with the statisticians’ 5.2 per cent. But now Morgan estimates that January unemployment has skyrocketed from 8.6 to 10.3 per cent – the highest level since Morgan began calculating unemployment.”

“There is no doubt there are seasonal issues as those leaving tertiary education try to join the labour force. They are usually not employed until February or later months. A rise of the proportion shown by Morgan reflects much greater forces than seasonal influences and in 2012 it will be much harder for students to gain employment than in 2011.”

“There is no doubt there are seasonal issues as those leaving tertiary education try to join the labour force. They are usually not employed until February or later months. A rise of the proportion shown by Morgan reflects much greater forces than seasonal influences and in 2012 it will be much harder for students to gain employment than in 2011.”What does it all mean for value investors – remember, we are not economists and macro economics is not part of the value.able bottom-up approach to investing? The implications are that we should be seeking deeper discounts to intrinsic value estimates and those estimates could decline further.

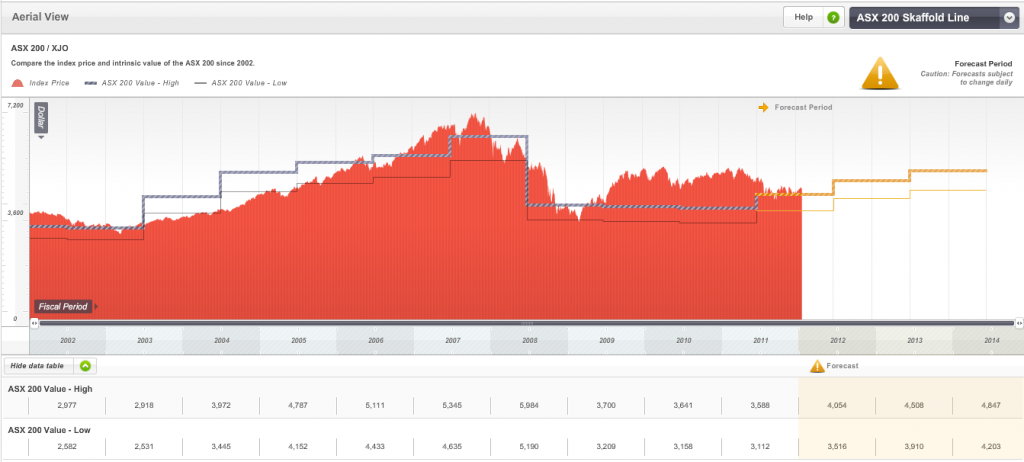

Given Skaffold (click here to Join) is currently suggesting the ASX200 is not cheap, we tend to be cautious even though my learned peers are betting with the world’s central banks that their printing of money and associated reduction in interest rates will force the world out of being defensively cash weighted and into equities and commodities.

We reckon gold makes sense in these times of destabilised fiat money. As you know we own a number of gold stocks (some of which have returned nearly 100%) and I bought more gold (physical) before Christmas.

Here is the latest chart of the ASX200 plotted against Skaffold’s estimates of intrinsic value. You can see that the market is trading a little higher than the estimated intrinsic value for the index. That doesn’t mean it can’t go a lot higher, just that if you are a genuine bargain hunter, you may need to be patient. In light of the unemployment situation noted above and the painfully strong Australian dollar, that makes sense.

Here is the latest chart of the ASX200 plotted against Skaffold’s estimates of intrinsic value. You can see that the market is trading a little higher than the estimated intrinsic value for the index. That doesn’t mean it can’t go a lot higher, just that if you are a genuine bargain hunter, you may need to be patient. In light of the unemployment situation noted above and the painfully strong Australian dollar, that makes sense.In addition to the powerful benefit of such a chart as the ASX 200 Skaffold line, which by the way, is automatically keeping you up-to-date daily for changes in analysts estimates of earnings and dividends for each of the 200 indices’ constituents, Skaffold members will enjoy an unprecedented level of interactivity in upcoming updates. By the way, I trust you are enjoying the enhanced search functionality the team delivered last week.

My team noted a few wanna-be competitors trying to plagiarise little aspects of Skaffold recently and I explained that they and you should “be flattered” and I told the team; “if you can see the competition, you aren’t at the front of the race”. Concentrate on staying in front by looking ahead and not at those trying to catch up. They respect Skaffold members too much to insult them by delivering second-hand ideas or technology. Skaffold keeps you in front with world beating ideas – remember the team that works on Skaffold works for Nike, Porsche, EA Games and Google. What possible hope do the competitors have? We’ve retained one of the world’s decorated design and development teams so Skaffold is.

Posted by Roger Montgomery, Value.able and Skaffold author and Fund Manager, 6 February 2012.

by Roger Montgomery Posted in Insightful Insights, Market Valuation, Skaffold.

-

An upgrade amid the malaise!

Roger Montgomery

February 2, 2012

Reporting season has begun in ernest and a few companies we have been watching (and some of which we own in the Montgomery Private Fund) have reported. Today it was Credit Corp’s turn (ASX: CCP, SQR* A2). You can find the presentation here (be sure to read and agree to the ASX and our disclaimer).

Reporting season has begun in ernest and a few companies we have been watching (and some of which we own in the Montgomery Private Fund) have reported. Today it was Credit Corp’s turn (ASX: CCP, SQR* A2). You can find the presentation here (be sure to read and agree to the ASX and our disclaimer).Skaffold members are likely to have already seen CCP on the Aerial Viewer with an A2 rating and a discount to Skaffold’s estimate of Intrinsic Value. In the Montgomery Private Fund, we have owned the stock for some time now and I have mentioned it as a stock to investigate on many TV and Radio programs. Today’s 10 per cent gain is certainly a welcome boost to the gains already registered.

The highlights from the announcement of the half year results for us were 1) that earnings were at the top end of guidance, 2) a 12% increase in revenue translated to a 23% increase in NPAT, 3) a welcome reduction in debt to its lowest level since listing and 4) strong free cash flow after an increase in dividends and finally a conditional settlement of a “distracting” class action. This final point is particularly important for many investors who will now feel vindicated that it was not the investor who erred. The impact of the settlement on earnings will be immaterial thanks to insurances. At current rates of cash flow generation, debt could be extinguished completely by the end of the financial year.

Grant Duggan – a regular blog poster here – was kind enough to make the following comments below: “If i recall on YMYC a caller asked for one xmas stock to put under the tree for 2012, and much to your dislike [Roger] to only be able to pick one it was CCP, and i know two months don’t make a market but to me this is another indicator of value able investing starting to prove its worth. Thanks to Roger and all blog posts once again.”

I know I am harping on about it but if you have not joined as a member of Skaffold, how are you planning to find the best opportunities during reporting season? Join Skaffold who have done all the hard valuation and quality assessments for every single listed company so you don’t have to.

Posted by Roger Montgomery, Value.able and Skaffold author and Fund Manager, 2 February 2012.

by Roger Montgomery Posted in Companies, Investing Education, Skaffold, Value.able.

-

MEDIA

What are Roger’s Value.able Insights into the float of Facebook?

Roger Montgomery

February 1, 2012

Do David Jones (DJS), Myer (MYR), ARB Corporation (ARP), Oroton (ORL), Billabong (BBG), JB Hi-Fi (JBH), Harvery Norman (HVN) or Campbell Brothers (CPB) make Roger’s coveted A1 grade? Watch this edition of Sky Business’ Switzer program broadcast 1 February 2012 to find out and also learn Roger’s views on the pricing of the upcoming Facebook IPO. Watch here.

by Roger Montgomery Posted in Intrinsic Value, Investing Education, Skaffold, TV Appearances, Value.able.

-

Peace and Joy to all this Christmas.

Roger Montgomery

December 20, 2011

Thank you for your support in 2011 and for all of your wonderful contributions to the knowledge bank.

Thank you for your support in 2011 and for all of your wonderful contributions to the knowledge bank.I am delighted to finish the year on a positive note with Cochlear (see post below) announcing it has identified the source of the malfunction of its Nucleas CI500 cochlear implant. This will also be positive news for many Cochlear implant recipients who put their quality of life in the company’s hands.

I have also published a recent column on the possibility of a convergence of Eurozone default, economic slowdown, a decline in consensus earnings estimates and a throwing in of the towel by investors who are fed up with low returns and heightened volatility (see below).

Hopefully that will stimulate some serious contemplation over the Christmas break.

Next year I am hoping to reconfigure the Insights Blog. My idea is to create and share the publishing role with any number of you who wish to write 300-600 word columns of an investment topic of your choice. I will remain editor and I am looking for twenty six (26) Graduates who can contribute two columns each in 2012. Of course if you wish to contribute more, be my guest.

We also intend to restructure the blog to allow easier searching and viewing of multiple threads. Stay tuned and if you would like to contribute send an email to me at roger@rogermontgomery.com with “CONTRIBUTOR” in the subject heading.

I am delighted that, in 2011, so many investors have found Value.able and Skaffold so useful. Many Graduates have said the Skaffold approach to investing is at once easy to understand and rational. And according to Daman’s feedback, Value.able!

“On Friday the 16th Dec, Bendigo announced a takeover of the Australian arm of a Greek bank at purchase price reflecting a return on equity around the same as a 12 month term deposit with Ubank. Alongside this was a $96M or so write down to its Margin Lending Business (due to the poor economic conditions). Today, its appears upon recommencing trading and Mr Market being nervous in general the share price of BEN has fallen over 6%.

Good news is that I sold my holdings in BEN on the 7th of December. Thanks to your teachings on the importance of ROE I was able to recognise that this business does not have superior performance characteristics, among several other factors. As a result I secured a somewhat reasonable profit of 14% on my holdings and a 2,740% ROB (return on [your] book).”

If you have not already secured your copy of Value.able or become a member of Skaffold and want to kick 2012 off the Skaffold way, go to www.Skaffold.com.

To the Value.able Graduates and Skaffold members (Skaffolders?), thank you for taking the time to share with me just how much you have been impacted by each. I am delighted to hear your amazing stories of investing success and I am pleased we can look forward to 2012 with enthusiasm.

I will return in late January. Our team will continue to publish your comments here at the blog, post new videos to my YouTube channel, reply to your emails and take your calls.

We leave 2011 with one of the world’s most successful billionaire hedge fund managers telling his clients; “Trust has been lost, confidence in the system is being lost, and the ultimate consequence of this break down – sovereign defaults – are imminent.”

In the meantime may your Christmas be filled with the love of family and friends. I look forward to corresponding with you again beginning February 2012. I will always be enthralled by Caravaggio’s work. The Adoration was painted in 1609.

Posted by Roger Montgomery, Value.able author and Fund Manager, 20 December 2011.

by Roger Montgomery Posted in Skaffold, Value.able.

- 39 Comments

- save this article

- POSTED IN Skaffold, Value.able

-

Are investors giving up?

Roger Montgomery

December 20, 2011

We have talked here at the blog about hypothecation, re-hypotecation and hyper-hypothecation, about credit default swaps about a Chinese property bubble bursting, about lower iron ore prices, slower economic growth, increased savings and declining rates of credit expansion and a European sovereign default. Always the value investor, we are on the look out for anything that can impact the values of companies and those things that might offer the prospect of picking up a few bargains.

We have talked here at the blog about hypothecation, re-hypotecation and hyper-hypothecation, about credit default swaps about a Chinese property bubble bursting, about lower iron ore prices, slower economic growth, increased savings and declining rates of credit expansion and a European sovereign default. Always the value investor, we are on the look out for anything that can impact the values of companies and those things that might offer the prospect of picking up a few bargains.If your portfolio still has some rubbish in it, then being able to identify it is a key part of preparing for cheaper prices if they eventuate.

I recently wrote a column for the ASX and pondered the possibility of a climactic event coinciding with a complete throwing in of the towel by equity investors who are simply fed up with poor medium term returns and increased volatility recently.

The ASX200 hasn’t generated a positive capital return since 2005 but quality companies have. The ASX200 contains stocks that are rubbish so it is no wonder that an index based on that rubbish has gone nowhere. Step 1 then is to clean up the portfolio and step 2 is to be ready for quality bargains when they arise.

This is just one of many scenarios and frameworks I am operating with and I wonder what would transpire if the poor returns or the recent heightened volatility continues for a little longer? Will investors simply throw in the towel, leave equities and believe all those advisors offering their own brand of ‘safe’, ‘secure’ and stable investments? On the one hand, I hope so. It would mean certain bargains.

Here’s the Column:

As global sharemarkets decline, remain volatile and produce poor historical returns compared to other asset classes, it will be easy to be swayed by the latest investment trend – to move out of shares. I believe the trend away from shares will gather pace soon as more and more “experts” use the rear-view mirror to demonstrate why sharemarket investors would have been better off somewhere else.

In 1974 US investors had just endured the worst two-year market decline since the early 1930s, the economy entered its second recessionary year and inflation hit 11 per cent as a result of an oil embargo, which drove crude oil prices to record levels. Interest rates on mortgages were in double digits, unemployment was rising, consumer confidence did not exist and many forecasters were talking of a depression.

By August 1979, US magazine BusinessWeek ran a cover story entitled ‘The Death of Equities’ and its experts concluded shares were no longer a good long-term investment.

The article stated: “At least 7 million shareholders have defected from the stockmarket since 1970, leaving equities more than ever the province of giant institutional investors. And now the institutions have been given the go-ahead to shift more of their money from stocks – and bonds – into other investments.”

But be warned. The time to get interested in share investing and make good returns is precisely when everyone else isn’t.

Your own once or twice-in-a-lifetime opportunity may not be that far away and Labor’s promised tax cut on interest earnings may sway even more to give up shares and put their money in a bank, providing the opportunity to obtain even cheaper share prices.

If prices do fall further – and they could – you will need to be ready and will need some cash. The very best returns are made shortly after a capitulation. Cleaning up your portfolio becomes crucial and this article looks at how to do that.

Rule one: Don’t lose money

The key to slowly and successfully building wealth in the sharemarket is to avoid losing money permanently. Sure, good companies will see their shares swing but the poor companies see the downswings more frequently.

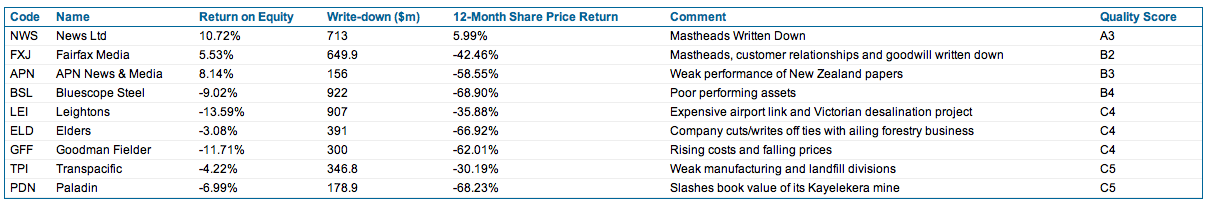

Therefore, the easiest way to avoid losing money is to avoid buying weak companies or expensive shares. One of the simplest ways I have avoided losing money this year in The Montgomery [Private] Fund has been to steer clear of low-quality businesses that have announced big writedowns.

These are easy to spot using Skaffold.

Not-so-goodwill

I have often seen companies make large and expensive acquisitions that are followed by writedowns a couple of years later. Writedowns are an admission by the company that they paid too much for an asset.

When Foster’s purchased the Southcorp wine business in 2005 for $3.1 billion, or $4.17 per share, my own valuation of Southcorp was less than a quarter of that amount. Then in 2008 Foster’s wrote down its investment by about $480 million, and then again by another $700 million in January 2009 and a final $1.3 billion in 2010.

When too much is paid for an acquisition, equity goes up but profits do not and you can see that too much was paid because that ratio I have worked so hard to make popular, return on equity (ROE), is low.

These low rates of return are often less than you can get in a bank account, and bank accounts have much lower risk. Over time, if the resultant low rates of return do not improve, it suggests the price the company paid for the acquisition was well and truly on the enthusiastic side and the business’s equity valuation should now be questioned. If return on equity does not improve meaningfully, a large writedown could be in the offing. This will result in losses if you are a shareholder, and you have also paid too much.

Just remember one of the equations I like to share:

Capital raised + acquisition + low rate of return on equity = writedown.When return on equity is very low it suggests the business’s assets are overvalued on the balance sheet. That, in turn, suggests the company has not amortised, written down or depreciated its assets fast enough, which in turn means the historical profits reported by the company could have been overstated.

Scoring bad companies: B4, B5, C4 and below…

These sorts of companies tend to have very low-quality scores and often appear down at the poor end of the market – the left side of the screen shot in Figure 1 below.

Figure 1. The sharemarket in aerial view (Source; Skaffold.com)

Each sphere in Figure 1. represents a listed Australian company and there are more than 2000 of them. The diagram is taken from Skaffold. Their position on the screen can change daily as the price, intrinsic value and quality changes. The best quality companies and those with positive estimated margins of safety (the difference between the company’s intrinsic value and its share price) appear as spheres at the top right.

Companies that are poor quality (I call them B4, C4 and C5 companies, for example) are found on the left of the screen and if they have an estimated negative margin of safety, they are estimated to be expensive and will be located towards the bottom of the screen.

Highlighted with blue rings in Figure 1 are eight of the companies that announced this year’s biggest writedowns. Notice they tend to be at the lower left of the Australian sharemarket, according to my analysis.

If your portfolio contains shares that are red spheres and on the lower left, you could also be at risk because these companies tend to have low-quality ratings and are also possibly very expensive compared to their intrinsic value.

As is clear from Figure 1, this year’s biggest writedown culprits were all already located in the area to avoid.

The impact of owning such a business outright would be horrendous. Table 1 below reveals the size and details of these writedowns and as you can see, collectively the losses to shareholders amount to $4.6 billion.

Table 1. Predictable losses?

Warren Buffett once said that if you were not prepared to own the whole business for 10 years, you should not own a piece of it for 10 minutes.

Clearly you would not want to own businesses that pay too much for acquisitions and subsequently write down those assets. If you are not willing to own the whole business, don’t own the shares. Although in the short run the market is a voting machine and share prices can rise and fall based on popularity, in the long run the market is a weighing machine and share prices will reflect the performance of the business. Time is not the friend of a poor company, and companies Skaffold rates C4 or C5 are best avoided if you want the best chance of avoiding permanent losses.

Look at Figure 2 below. Those big writedown companies not only performed poorly but so did their shares. These companies (shown collectively as an index in the blue line below) produced bigger losses for investors than the poorly performing indices of which they are part. And that’s just over one year.

Figure 2. The biggest writedowns compared to the market

Take a look at the companies in your portfolio. Do they have large amounts of accounting goodwill on their balance sheet as a portion of their equity? Have they issued lots of shares to make acquisitions and are they producing low and single-digit returns on equity? If the answer to all these questions is yes, you may have a C5 company.

Cleaning up your portfolio not only lowers its risk but will produce cash that may just prove handy in coming months.

If you have made it this far then here’s evidence of the giving up I referred to in the column: http://www.smh.com.au/business/investors-turn-to-term-deposits-in-shift-away-from-equities-20111219-1p2ir.html

Posted by Roger Montgomery, Value.able author and Fund Manager, 20 December 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Market Valuation, Skaffold, Value.able.

-

Not so High at JB Hi-Fi?

Roger Montgomery

December 16, 2011

You will have noticed that since November 16 every post here at the Blog has been a cautionary one. You have not seen me post a ‘here’s possible good value’ story. There is a little method in that, even though we might be unduly conservative. But here goes again…

You will have noticed that since November 16 every post here at the Blog has been a cautionary one. You have not seen me post a ‘here’s possible good value’ story. There is a little method in that, even though we might be unduly conservative. But here goes again…Many of you have heard me discuss JB Hi-Fi and its preferred status among retailers – I believe if JBH is doing it tough everyone else is doing it even tougher. But we sold JBH from our holdings at $15.50 recently and I thought the story of why (ahead of a downgrade as it turns out) would be a good insight into the way we think. Hopefully other investors can gain some insight into the process and fill in the 1) ‘bright prospects’ part of the equation that also requires 2) extraordinary businesses and 3) discounts to intrinsic value.

Starting way back in February 2010 we commented on the impending retirement of JBH’s Richard Uechtritz (now looking as well-timed as other prominent CEO departures, such as the Moss departure from Macquarie and I am sure you can list a few more – go right ahead) and the maturing outlook for the business itself.

“If JB Hi-Fi could re-employ all of its profits at the returns of about 45% it is generating now, its value would be over $38. That’s a pipe dream. The company is generating cash faster than it can ask its employees and contractors and landlords to employ the funds to open new stores. And because the profits also produce taxes and associated franking credits that have no value for the company, shareholders are being handed back the funds, which is a disappointment. However, as chairman Patrick Elliott implied when I spoke with him on radio this week, this is a function of growth and the limited size of the Australian population.

It happens eventually to all retailers and it will happen to JB Hi-Fi in the next five to seven years. The best you can hope for is that once the stores have saturated the market, directors stick to their knitting, and the company continues to generate high returns but pays out all of those earnings out as a dividend (becoming like a bond) rather than make some grand attempt to buy something offshore or diversify too far away from their core expertise (often at the behest of some institutional shareholder) and blow up the returns.

The result of not employing as much retained earnings at 45% is that the intrinsic value declines. It is still going up but not as much.”

In August here at the blog we wrote:

“The big story however is that Terry Smart will need to start looking beyond this organic growth to other strategies if JB Hi-Fi is to avoid developing the profile of another mature Australian retail business like Harvey Norman.”

and

“JB Hi-Fi needs to establish new and emerging business models to try and counter the shift away from physical music unit sales.”

and

“Having said that, the current sales environment is probably not representative of the future. Share market investors generally use the rear view mirror when assessing the future. I have previously discussed the “economics of enough”, which David Bussau from Opportunity International introduced me to many years ago. As it applies to consumers generally, they will get sick of trying to keep up with the latest technology, be happy with their TVs and replace everything less often – opting instead to ‘experience’ travel, food, adventure and other cultures. That of course doesn’t mean JB can’t grow its share-of-wallet. In the face of declining retail sales volume growth over the last five to ten years and deflation, JB is proving it is already the market leader.”

and

“JB Hi-Fi’s quality score dropped from A1 to A3 and interestingly, this was only partly due to the increase in debt. (We really need to know whether it was just timing issues and new stores that contributed to the jump in inventory).”

In addition to these comments I wrote more recently:

“The release of the iPhone 4S seemed to underwhelm technology reviewers when launched and a portion of the population do take their purchasing cues from such quarters.

The 4S is apparently an evolution in the iPhone series, rather than a revolution, and as such, fewer users of the most recent release – the iPhone 4 – will upgrade. Instead, it is likely that they will wait until the iPhone 5 is released next year (owners of the previous model the iPhone 3GS, however, should be coming off their two-year contracts about now and are expected to upgrade). We’ll come back to that shortly.

The iPhone doesn’t contribute anything like a majority profit to JB Hi-Fi’s bottom line. This is because margins on Apple products are slim. But the iPhone does generate foot traffic and phone upgraders also buy protective covers and other accessories on which JB Hi-Fi makes much more significant margins.

So why do we care so much about the iPhone?

It’s because when JB Hi-Fi announced its full-year results the company forecast more than $3 billion in sales and management cited growth from computing, telco, and accessories. They said:

“While we anticipate the market to remain challenging, our diversified product portfolio, particularly the categories of computers, telco and accessories, from which we expect strong growth, will assist JB Hi-Fi in delivering another year of solid sales and earnings in FY12. Assuming trading conditions are comparable with FY11, we expect sales in FY12 to be circa $3.2b, an 8% increase on prior year.”

It’s the lower “telco and accessories” sales that are expected to stem from the iPhone 4S underwhelming so-called early adopters and its most ardent fans that may put pressure on that sales forecast.”

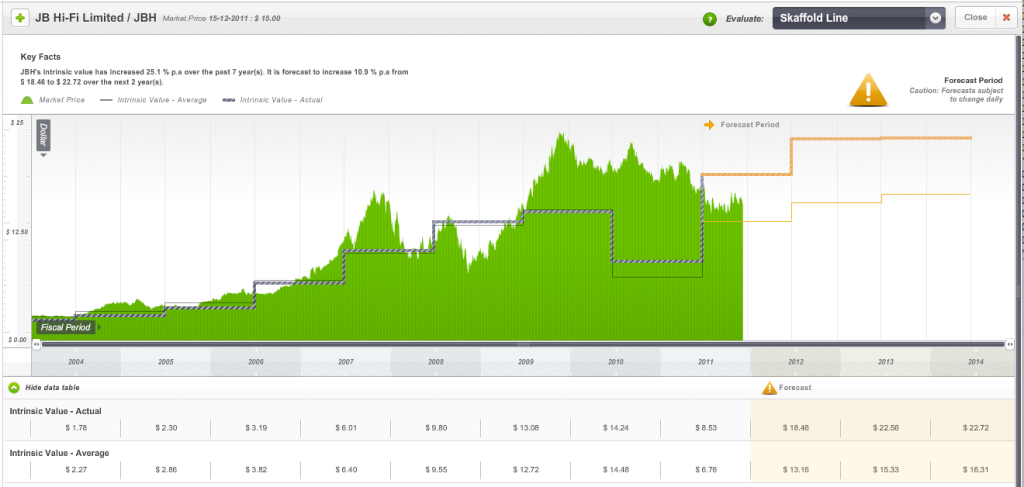

Indeed the only thing that was going for JB Hi-Fi was its discount to intrinsic value. Many investors believe that a stock I mention is below intrinsic value is a “darling’ of mine. It isn’t. A company must meet all of our criteria and it will only be held for as long as it does. Those of you using Skaffold will however have seen JBH was trading only at a discount to one of the intrinsic value estimates – the intrinsic value based on analyst forecasts – but not the more conservative Skaffold Line valuation estimate of $13.16. See Figure 1.

Figure 1.

Both valuations are now likely to decline further in coming days -even the more conservative $13.16 valuation SKaffold has been displaying – and the downgrade may also be reflected in pressure on the company’s cash flow which Skaffold members would have already seen in the 2011 results and which prompted some of the above comments. (See Figure 2. and note the negative funding gap line (international patents pending))

Figure 2. Showing declining operation cash flow and a growing Funding Gap (patents pending).

JB Hi-Fi was 5 per cent of our portfolio however we sold all of our position at $15.50 recently. Our reasoning was simple; Given present circumstances and expectations for retailing (having spoken to many retailers recently) many retailers JB Hi-Fi would have to revise their earlier outlook statements and this would produce lower future valuations. At the same time analyst forecasts are typically optimistic in the first half of the financial year (this year being no exception to that rule) and we should therefore be demanding much larger discounts and JBH was not offering that margin of safety. We also commented to our peers in conversations over the phone and in person that the delfation story – as explained by Gerry Harvey who noted selling plasma TVs for $399 this year means he has to sell three times the volume as last year to make the same money – would put pressure on profits because people already had enough plasma TVs. Finally we also believed that ANZ’s profit growth being dominated by bad debt provisioning writedowns meant that credit growth was non-existant. When you take away growth in credit card purchases – thats got to hurt discretionary retailers.

On November 7 we wrote to our Montgomery [Private] Fund investors thus:

“We aren’t so arrogant to presume we know what will happen next. We have taken earnings expectations for 2012 and beyond (expectations that are typically optimistic in the first half of a financial year) and reduced them to where we believe they could safely be regarded as conservative. The resultant estimations for intrinsic values … are significantly lower and suggest we should require larger margins of safety before committing your funds to many companies…I expect in coming months we may not be as aggressive in purchasing and you might even find our cash levels increase. It’s always preferable to protect capital because we can come back to reinvest at any time. Recovering from losses is much more challenging and demoralising for you.”A prominent media commentator and broker however wrote on December 6

“Our No.1 discretionary retail recommendation remains JB Hi-Fi (JBH). We all know 21% of JBH’s register is currently shorted, a massive short position usually reserved for financial impaired or structurally stuffed stocks. JBH is neither, and that is why we continue to be aggressively recommending buying the stock which generates 25% of its annual profit in December. JBH is trading on 11.2x bottom of the cycle earnings. Nowadays, the P/E’s of cyclical stocks compress with their earnings, meaning that both P/E and E bottom concurrently.”

So, JBH still has long term prospects that surpass many of its peers and I believe it still has a competitive advantage. And if all those short sellers cover their position, the stock could rally. That however would be speculating. On the flip side, changes to accounting reporting standards will give it a lot more liabilities – contingent liabilities such as operating leases will need to come onto the balance sheet. Also, the medium outlook, which includes deflation continuing, will put pressure on JB to sell more volume at precisely the time everyone may just have enough stuff. Finally, the market may now finally catch up to the maturity story we described way back in 2010. Of course consumers will return at some point and spending and credit growth will recover, but given the current weakness and fear among consumers the idea of requiring very, very large discounts to the more conservative estimates of intrinsic value dominates our thinking.

As always be sure to do your own research and seek and take personal professional advice.

Posted by Roger Montgomery, Value.able author and Fund Manager, 16 December 2011.

by Roger Montgomery Posted in Companies, Consumer discretionary, Investing Education, Skaffold.

-

Are bargains available at Woolworths?

Roger Montgomery

November 17, 2011

On Wednesday November 2 Woolworths held a strategy briefing for professional investors. Woolworth’s effectively asked us to adopt a longer time frame before judging its performance and revealed four strategic priorities that I will describe in a moment.

Prior to the strategy day, the company updated the stock market with a growth outlook that was the lowest in a decade. The market responded negatively to the change and it entrenched previous sentiment by professional investors to switch from Woolworths to Coles.

But Woolworths remains a superior business from a business economics perspective, with high return on equity and it also remains cheaper than its competitor as measured by the larger discount to an estimate of its intrinsic value.

The wider sentiment towards Woolworths Supermarkets is that the period of strong growth is over, and the other businesses, such as Big W, the New Zealand supermarkets, the Masters hardware venture and a possible acquisition of The Warehouse group could be the focus of earnings growth for the company. Gambling pre-committments would not be.

Meanwhile, the Woolworths-owned Dick Smith electronics business appears to have failed to excite consumers and has certainly failed to excite investment professionals. Dick Smith is a relatively weak offering in a market that has been hit particularly hard by the empowerment of the consumer through high Australian dollar.

Moreover, in many ways these businesses are peripheral since the Australian Food & Liquor division accounts for 80% of earnings before interest and tax.

The impact of the company’s lower growth profile on intrinsic value, particularly intrinsic values over the next two years, has been negative and intrinsic value does not appear to be going anywhere in a great hurry (see Skaffold chart below).

This combination of circumstances, in my experience, set Woolworths shares up to be vulnerable to any negative shocks.

Estimating intrinsic value is not the same as predicting price direction, however the above circumstances are not unique historically in putting a lead on price appreciation.

On top of the above combination of factors, there is also the continuing debate in Parliament about the introduction of preset loss limits for poker machines, which, if introduced, would negatively impact Woolworths’ gaming business. Though it is most closely associated with supermarkets, Woolworths is actually the largest poker machine owner in the country, with more than 10,700 pokies.

And a few weeks ago, The Economic Times of India also reported that Woolworths appears to have been dumped by its Indian partner, Tata Group. Woolworths enjoyed a five-year partnership with Tata, introducing Dick Smith-style electronics stores to India under the Infiniti Retail brand. Even though foreign retailers are not permitted to have a direct presence in India, Woolworths partnership offered the hope of growth – albeit with a partner – if the rules were ever relaxed.

Nonetheless, despite these accumulative negative factors, Woolworths is regarded by conventional analysts and investors as a defensive’ company. Its strong cash flows and its status as a major retailer of food makes it an ideal investment in a recessionary or slow or low growth environment. The company also enjoys entrenched competitive advantages over smaller rivals that, until now, the ACCC has done little about. One example of this are the new EFTPOS charges.

From the first of this month, the new Eftpos Payments Australia Limited (EPAL) fees mean retailers incur a 5¢ fee for every transaction over $15 (75% of all EFTPOS transactions). Previously there was no fee and that will still be the case for transactions under $15, which means 25% of transactions.

The retailer’s bank will charge the retailers, some of whom are describing the charges as an “EFTPOS tax”, and they will have no choice but to pass on to the consumer.

Unsurprisingly, EPAL’s members include the major banks, Coles and Woolworths and, because they manage their own terminals, they can opt out of the new charges.

But despite these entrenched advantages, Woolworths has been hit – or so it says – by the state of the economy, noting in its annual report: “Consumer confidence remained historically low as customers reacted adversely to rising utility costs, interest rate hikes in the first half of the year and general global uncertainty, and opted to save rather than spend their money”.

From an investment perspective it is worth noting that retail investors now have a choice of supermarkets, with Coles improving its offering to consumers and taking market share from the incumbent Woolworths.

The investment community is not convinced that further changes to private-label offerings or more innovation around the supply chain will make a dramatic difference to the growth prospects for Woolworths, which set below forecast growth in household income, population and the economy.

One other source of earnings growth is cost-cutting, but the reality is that gains from such strategies are one-offs and again unlikely to excite investors.

Having presented the negatives – which have caused the share price to fall 12% since July, one positive was the strategy briefing’s opportunity to showcase new CEO Grant O’Brien, who replaces Michael Luscombe. The company announced that it planned to extend and defend its leadership in food and liquor, act on the “portfolio” to maximise shareholder value, maintain its track record of building new growth businesses (we’ll ignore Dick Smith) and finally, put in place the enablers for a new era of growth.

In the supermarkets business WOW hopes to grow fresh produce from 28% market share to 36% market share. If achieved this would be an additional $2.5b in sales. Woolies also wants to target a doubling of home brand sales and this aim flies in the face of the ACCC’s stated concerns.

The company will also open 35 new BIG W stores in next 5 years reaching 200 by 2016.

In a reflection of the massive structural shift online, BIG W’s 85,000 in-store SKUs will be expanded and all put online.

And the topic on the tip of everyone’s tongue; Masters. There are now five stores open, another two are due to open in December/January, there are 16 under construction another 100 in the pipeline and the company reported the venture is well ahead of budget.

I also note the advertised sale of $900 million of property ($380 million of which was sold last financial year); and, most recently, the oversubscribed $500 million hybrid note raising that substantially extend the balance sheet strength of the company.

Below we examine the intrinsic value track record and prospects for Woolworths based on current expectations for earnings growth and returns on equity using Skaffold.com

Woolworths (MQR: B2) is currently trading at the same price it was in December 2006 and February 2007, despite the fact profits have risen 11.1% pa, from $1.3 billion to a forecast $2.2 billion in 2012. This growth in profit however is offset by having 16 million more shares on issue; by increased borrowings – up $1.8 billion to $4.8 billion; and by retained earnings, which have risen by $2 billion. The increase in shares on issue and retained earnings have offset the positive impact on return on equity rising profit would normally have.

The latest estimate of its intrinsic value, of $23.23, is forecast to rise modestly over the next two years. For investors looking at opportunities to investigate only when a meaningful discount to intrinsic value is presented, a price of $19 or less for Woolworths would represent at least 20 per cent.

Posted by Roger Montgomery, Value.able author and Fund Manager, 17 November 2011.

by Roger Montgomery Posted in Companies, Consumer discretionary, Insightful Insights, Investing Education, Skaffold.

-

Is it just Harvey Norman or bricks & mortar retailing generally?

Roger Montgomery

November 17, 2011

You don’t normally expect to get investment tips from a mothers’ group get-together, but that’s what happened to me recently when the conversation turned to retail operations.

Relaxing with a glass of pinot gris the women, who have met regularly for a decade, were explaining why they spend less time in Harvey Norman stores than they used to. Why? Tired stores, tired layouts and uncompetitive prices have served the retailer only with the need to revamp its entire offering. And that, it hasn’t done.

Retailing in Australia has been in the eye of a perfect storm for some time. As I’ve written previously, the strong Australian dollar has encouraged overseas travel and online purchases from overseas businesses; and the two-speed economy has ensured that credit growth (the borrowing of more money to buy stuff) is muted.

I’ve always been suspicious of a company that issues a report to the market after the close of trade. On Monday 31 October, a major retail business in Australia did just that. After closing time, Harvey Norman released its sales and earnings for the first quarter of the 2012 financial year. Given its timing, the announcement was almost certain to be negative. Indeed, the stock fell 4% the next day.

Instead of focusing on the retailing offer, refreshing store designs and improving range, company representatives focus on property, horse racing (Gerry Harvey is one of the country’s biggest bloodstock owners), goading the Reserve Bank of Australia to cut rates in “the national interest” and campaigning to have Australians pay GST on items they buy overseas for less than $1000.

Harvey Norman’s first-quarter sales were down 3.8%, as were like-for-like sales. In Australia, like-for-like sales were down 2.8%, in New Zealand down 10.6%, down 8.9% in Slovenia and down 11.1% in Northern Ireland. A stronger currency against the New Zealand dollar, the Euro and the pound has exacerbated the results. Profit before tax – a very important measure to us when estimating intrinsic value – was down by … wait for it, 19.3%!

Harvey Norman claims the strong Australian dollar and the closure of 34 Clive Peeters stores contributed to the poor result. I would argue that a failure to reinvent the offering also contributed. More worryingly, this latter factor is unlikely to go away any time soon.

Compounding this problem is the very likely scenario that the declining iron ore price – recently at about $115 a tonne – will seriously crimp margins for the only sector that has been running at full capacity in this country. Australia’s stock market has become the tail that wags the dog. Its wealth-effect on Australians and the impact on sentiment are important determinants of activity and in particular, retail activity.

With the All Ordinaries index dominated by resource companies and financial services companies it is possible, if not probable, that a declining iron ore price leads to lower stock prices and lower economic activity. I am no economist, but I can understand some experts’ calls for further rate cuts.

Back to Harvey Norman, and like-for-like sales declines of 2.8% compares favourably with JB Hi-Fi’s decline of 3.5%. Indeed, if it became a trend, one would argue Harvey Norman is winning back market share from JB Hi-Fi.

But before you get too excited about this comparison, you have to realise JB Hi-Fi’s profits are higher than they were last year and last year’s profits were higher than the year before that. In Harvey Norman’s case, profits before tax are down 19.3% compared to the same time last year, and last year first-half profits were down 16.5% from the year before that! One retail analyst I know and respect made the point that at this rate Harvey Norman will produce an average profit slightly ahead of the first-half profit made back in 2004, when it generated sales revenue of 62% of today’s sales.

My intrinsic value estimate for Harvey Norman is about $2.00 a share against today’s share price of $2.17. However this is based on earnings per share of 23¢ for 2012 and that is, quite possibly, optimistic. Over the next few weeks, analysts will bring their earnings after tax estimates down for 2012 materially. This will have a negative impact on intrinsic values and I suspect we will discover a price above $2 is a premium to intrinsic value. Most interestingly, for followers of any rational approach to calculating intrinsic value, Harvey Norman’s updated intrinsic value is no higher today than it was nine years ago, in 2003.

This can be seen in the following chart, which plots the share price of Harvey Norman against its estimated intrinsic value. Generally, we look for companies that have a demonstrated track record of rising intrinsic values and are available at a large discount to the current year’s intrinsic value (see 2006 in the graph).

The lack of any real change in intrinsic value and prices (which follow intrinsic value in the long run) reflects the maturation of the business. You can see that in the short run (in 2007 and again in 2009-2011) prices can get ahead of themselves thanks to many factors including irrational exuberance.

In the long run, however, the market’s weighing machine will do its thing and prices generally revert to intrinsic value. That’s why having a rational method for estimating intrinsic value is so important!

The forecast change in intrinsic value may also decline now that Harvey Norman has provided lower guidance. And it’s not unusual for analyst forecasts to be “hockey-stick” optimistic at the commencement of the financial year.

But long-term, Harvey Norman is a mature business in a small country and it continues to swim upstream against the online retailing avalanche. This is a structural shift rather than a short-term trend and Harvey Norman will need to respond by convincing Australian women in mothers’ groups all round the country that it is fresh, new and competitive.

Posted by Roger Montgomery, Value.able author and Fund Manager, 17 November 2011.

by Roger Montgomery Posted in Consumer discretionary, Insightful Insights, Investing Education, Skaffold.