Market commentary

-

The rise of uranium and the opportunity for small cap investors

Michael Gollagher

September 28, 2023

Australian small companies can provide investors with opportunities to tap into global themes that we believe will drive investment returns in the future. One of these is what is the most effective solution for achieving decarbonisation in electricity production. continue…

by Michael Gollagher Posted in Energy / Resources, Market commentary, Stocks We Like.

-

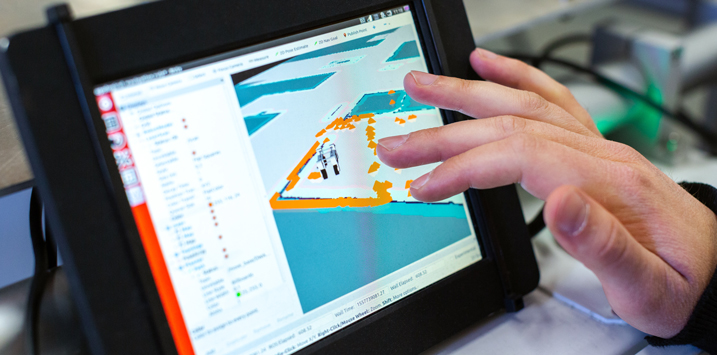

Generative AI’s growing impact on businesses

Roger Montgomery

September 25, 2023

Over recent years, artificial intelligence (AI) has gained considerable traction. And on the back of the resultant excitement, price-earnings (P/E) ratios for stocks even remotely related have soared. Is the excitement premature? continue…

by Roger Montgomery Posted in Market commentary.

- save this article

- POSTED IN Market commentary

-

The OECD says core inflation remains persistent in many countries

David Buckland

September 22, 2023

With forecasters failing to predict the acceleration of inflation from 2021, and its subsequent persistence, it is unsurprising that the U.S. ten-year treasury bonds now exceeds 4.4 per cent, the highest yield recorded in 16 years. continue…

by David Buckland Posted in Economics, Market commentary.

- save this article

- POSTED IN Economics, Market commentary

-

Who will emerge as the winners and losers of AI?

Roger Montgomery

September 21, 2023

In the ever-evolving landscape of technology, the rise of artificial intelligence (AI) has become an undeniable force of change. Amidst the hype and speculation, one question stands out: who will emerge as winners and losers as AI adoption accelerates among consumers? While many uncertainties remain, it is increasingly clear that AI has the potential to revolutionise the way we interact with the digital world. continue…

by Roger Montgomery Posted in Market commentary, Polen Capital.

-

Revving up: Australian auto market hits historic high in August

Roger Montgomery

September 20, 2023

In a remarkable surge, the Australian automotive market witnessed a historic high in August with 109,966 new vehicles sold. This momentous spike has been attributed to an upsurge in pent-up demand and a resurgence in supply. Notably, this August performance broke previous records, following on the heels of similarly ground-breaking sales in May and July this year. continue…

by Roger Montgomery Posted in Editor's Pick, Market commentary.

- save this article

- POSTED IN Editor's Pick, Market commentary

-

Economic insights from reporting season

Roger Montgomery

September 18, 2023

In this week’s video insight, I review the question of whether a recession is imminent. There has been no shortage of talks of a recession lately, although if we dive deeper into what we have seen in markets over August and September a compelling counterpoint to this narrative is visible. continue…

by Roger Montgomery Posted in Economics, Market commentary, Video Insights.

-

Navigating the FY23 reporting season: Tech and retail sector highlights

Roger Montgomery

September 13, 2023

In this weeks’ video insight, I wanted to highlight some key takeaways from the reporting season, especially in the tech and retail sector. Retail’s results were mixed, with earnings per share declining in the second half of 2023. Predictions for fiscal year 24 and 25 estimates saw a slight downturn. In the tech sector, performance met expectations, with a noticeable focus on tech companies’ downgrading due to depreciation and amortisation, and capex concerns with a focus on cash flow and the underestimation of rising interest rates. continue…

by Roger Montgomery Posted in Editor's Pick, Market commentary, Video Insights.

-

Streaming TV ain’t what it used to be

Roger Montgomery

September 12, 2023

In 1999, I was working at an investment bank. It was a terrible year to be advising investors to invest in high-quality companies making a profit and to take profit on the technology-related initial public offerings (IPO) listed at massive first-day premiums despite being unprofitable businesses. It was the year of the first technology boom, now known as the Dotcom boom and subsequent bubble. continue…

by Roger Montgomery Posted in Market commentary, Technology & Telecommunications.

-

The themed ETF trap

Roger Montgomery

September 11, 2023

At the outset, let me be clear: This is a blog post about a very narrow band of specialised or thematic exchange-traded funds (ETF), not broader ETFs that track major stock market indices. continue…

by Roger Montgomery Posted in Market commentary.

- save this article

- POSTED IN Market commentary

-

How soon will another property construction boom emerge?

Roger Montgomery

September 8, 2023

The Australian bureau of statistics’ (ABS) building approvals data paints a sorry picture for the supply of apartments today but also points to a much brighter future. continue…

by Roger Montgomery Posted in Market commentary, Property.

- save this article

- POSTED IN Market commentary, Property