How soon will another property construction boom emerge?

The Australian bureau of statistics’ (ABS) building approvals data paints a sorry picture for the supply of apartments today but also points to a much brighter future.

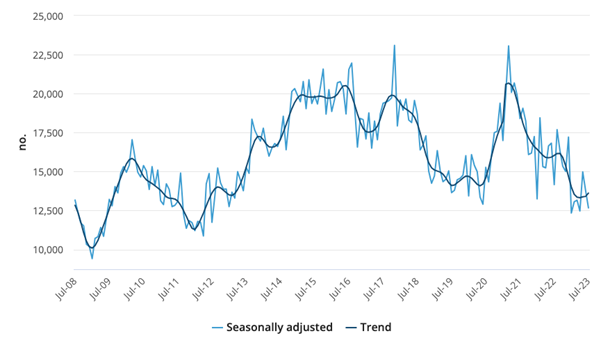

Figure 1., reveals apartment approvals are at levels last seen in 2012/13, suggesting near near-term construction of apartments will be insufficient to alleviate any of the rental issues befalling many Australians.

Figure 1. Dwelling unit approvals

Source: Australian Bureau of Statistics

Figure 1., however also demonstrates cyclicality in the approval, therefore construction and supply, of apartments in Australia. One does not need to be too imaginative to see the supply of apartments swings from undersupply to oversupply and back again.

Today, an undersupply exists but this will change. Low levels of completions coincide with a growing population, and less than two per cent rental vacancies. Despite higher interest rates, these factors could serve to support apartment prices. It is also the case apartment prices have lagged free standing house prices.

These factors will serve to incentivise developers to seek approvals to build more apartments and before you know it another development boom will be underway. Some say the issue for alleviating the supply constraints impacting medium and high-density construction is red tape and bureaucracy, however I would point out those handbrakes existed during the previous boom.

Indeed, a recovery in demand for housing was one of the strongest themes that emerged from real estate exposed companies during reporting season. While the previous financial year posed challenges due to rate hikes and cost inflation, the housing sector’s outlook remains promising. A majority of developers and property companies anticipate a rebound. Despite the slowdown leading up to June, a consistent theme emerging from the recent reporting season is the expectation of a housing demand surge.

Interest rates: A short term factor

It’s called sticker shock. When prices change rapidly, consumption pulls back and can sometimes stop. That’s affecting the property market to some extent. The price of money, interest rates, has risen rapidly and so property buyers haven’t had time to recalibrate. So, even if rates don’t decline, demand for property and therefore turnover will start to pick up again. Why? Because buyers will adjust to the new regime. The shock associated with the interest rate (price) rises will dissipate.

Sales are sluggish today, but even if interest rates aren’t cut, the outlook will improve for demand.

Developer optimism well placed

Leaders in the property industry point to the acute shortage of homes, described in the ABS data, and the consistent underlying demand I noted above, attributed to a shortage of rental properties and a rising population. They believe these factors position the sector well for the future, especially as the country grapples with an undersupply of housing to cater to returning students, immigrants, and the general populace.

Cedar Woods’ managing director noted “The rapid rise in interest rates impacted buyer sentiment during the first three quarters of the financial year, resulting in sales figures substantially lower than the prior two years. However, sales rebounded strongly in the final quarter, leaping 58 per cent on the prior quarter and up 10 per cent on the corresponding fourth quarter of the financial year 2022.”

Already that sticker shock I describe is beginning to wane.

Back in February, builder AV Jennings said the reserve bank of Australia’s (RBA) rapid rate hikes had halved inquiry levels compared to 2021. More recently in the company’s 2023 annual report, Chairman Simon Cheong noted, “Despite the ongoing risks presented by rising interest rates and inflationary pressures, our optimism for the business is unwavering. This confidence is underpinned by the ongoing scarcity of affordable housing (forecast by the national housing finance and investment corporation to be 175,000 homes by 2027), high levels of immigration and overall growth in population, which undoubtedly presents a significant opportunity for AV Jennings.”

AV Jennings chief executive officer (CEO) Phil Kearns added, “We are confident about the medium-term prospects for the residential housing sector driven by the growing structural imbalance between population growth and housing supply.”

Conversely, the housing industry association’s recent report has a more cautious tone, predicting a decade-low in-home construction next year due to weak sales and numerous cancellations. Challenges like inclement weather, inflation, and labor shortages certainly remain and some companies have called out the need for higher-density development in cities and the amplification of demand from the HomeBuilder COVID-19 stimulus package.

Last financial year saw significant challenges for the building sector due to rate hikes and cost inflation, but the housing sector’s outlook remains promising.

The consistent theme from builders in reporting season is hope, anticipation of increased demand, and an eventual equilibrium in the market. The ABS chart of approvals shows a clear cyclicality that will be repeated. Another property construction boom will eventually emerge. All else is a noisy distraction.