Investing Education

-

MEDIA

The Market is sliding, but have we reached the bottom?

Roger Montgomery

June 4, 2012

Roger Montgomery discusses his Value.able Insights into the the recent losses in the Australian share market, and what the short term future may hold for investors. Watch here.

This interview was broadcast on ABC News 24 on 4 June 2012.

by Roger Montgomery Posted in Investing Education, TV Appearances, Value.able.

- save this article

- POSTED IN Investing Education, TV Appearances, Value.able

-

MEDIA

The Market is pegging back, but is it time to start buying?

Roger Montgomery

June 3, 2012

In this edition of ABC1’s Inside Business Roger Montgomery discusses his insights into the causes of the recent market losses and how Value Investors should be interpreting the changes – Roger appears commencing 3:27. Watch here.

This program was broadcast on 3 June 2012.

by Roger Montgomery Posted in Companies, Investing Education, TV Appearances, Value.able.

-

MEDIA

Should online lottery firms be in your investment portfolio?

Roger Montgomery

June 1, 2012

Roger Montgomery discusses the expansion of Jumbo Interactive (JIN) and the implications of further developments in the online lottery ticket industry in this Money Magazine article published in June 2012. Read here.

by Roger Montgomery Posted in Investing Education, On the Internet, Value.able.

-

MEDIA

What does Roger Montgomery think of Gina Rinehart’s Fairfax shareholding?

Roger Montgomery

May 30, 2012

Learn Roger’s insights into the near-term future for Fairfax Media (FXJ) as Gina Rinehart increases her shareholding in this discussion with 2GB’s Ross Greenwood broadcast 30 May 2012. Listen here.

by Roger Montgomery Posted in Companies, Investing Education, Market Valuation, Radio.

- save this article

- POSTED IN Companies, Investing Education, Market Valuation, Radio

-

Were investors hasty?

Roger Montgomery

May 28, 2012

It’s true that many Australian businesses are on their own path and even amid the financial tempest raging in Europe there will be companies that succeed.

It’s true that many Australian businesses are on their own path and even amid the financial tempest raging in Europe there will be companies that succeed.Conversely there will many that fail.

I have maintained that beating the market can be made simpler by sticking to high quality issues.

Skaffold’s A1’s, I believe, have the lowest probability of ‘catastrophe’ within a year or two of receiving their score. Of course, you have to realise that business is dynamic and Skaffold’s quality scores will change with new information.

Furthermore, having the lowest probability of catastrophe is not to say there is zero chance of catastrophe. A 100-to-1 nag at Moonee Valley might still win the race.

Nevertheless, I would however rather have a diversified portfolio of A1s and A2s than a portfolio of C5s.

And this brings me to today’s announcement that Hastie Group has voluntarily appointed Administrators, just three days after the company announced accounting irregularities would result in a charge to profits of $20 million.

Hastie Group Limited (HST) has today announced that it has been placed into voluntary administration. Many investors will lose any and all the money they had invested in the company. If you are retired or about to retire, you can least afford such a permanent impairment to your capital.

I get so frustrated when I hear young advisers telling people on air to ‘only use money they can afford to lose’. I don’t know about you, but I cannot afford to lose any!

And that’s were quality comes into its own. Skaffold was designed to mitigate the risk of investing in those companies where the risk of events like the appointment of administrators is highest.

Skaffold’s quality scoring is based on decades of international academic research into forecasting collapses. And for us it just works.

At Montgomery Investment Management the Quality of a company is our first filter. A high Quality Score is the cornerstone to our investment strategy as well as the core of our investment decision-making. The second step is value. We reduce risk even further when we buy high quality companies only when they are at sharp discounts to intrinsic value.

Hastie listed on the ASX in 2005 and enthusiasm for its shares once pushed the market value of the company to $500 million and to a share price – just before the GFC – of more than $40.

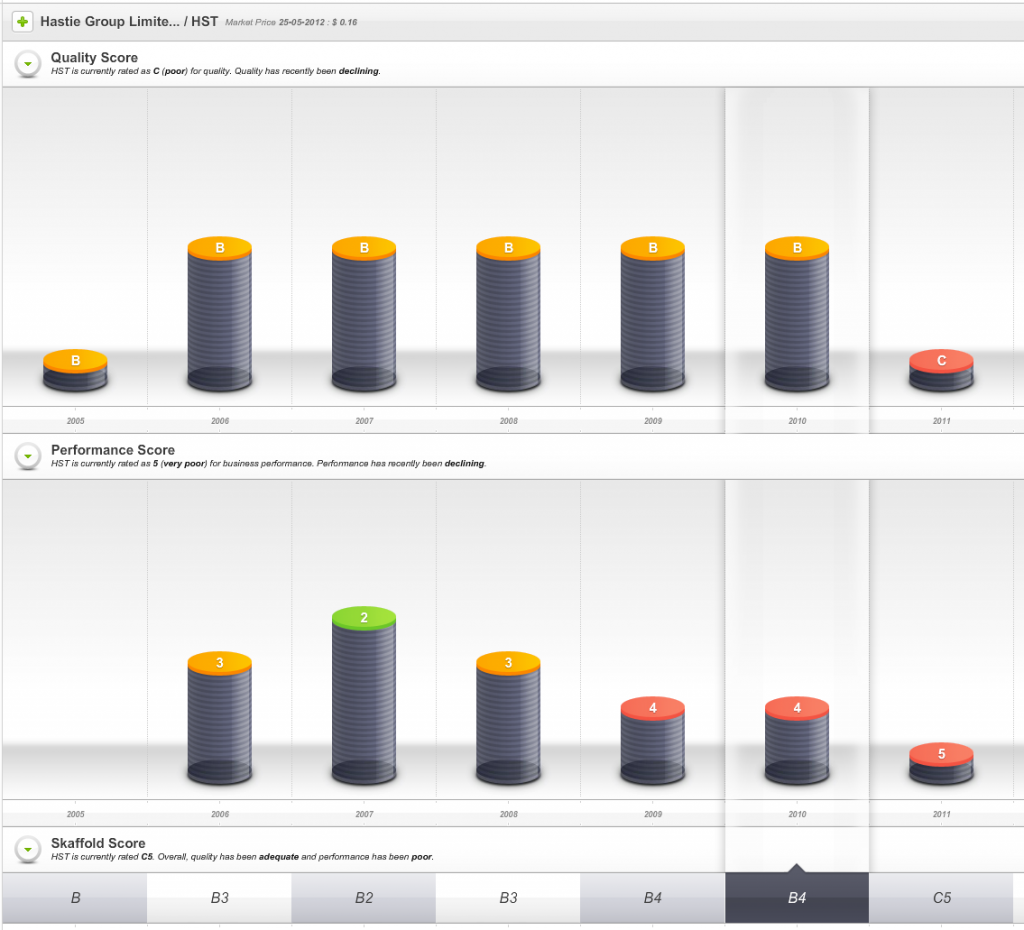

So, one sign of impending danger was that from 2009 onwards the company’s Quality Score dropped well below investment grade.

Fig 1. Skaffold Quality Score History since listing. (International Patents Pending). Hastie Group

The second warning was that the company’s shares, when they were at the height of their popularity were trading well above intrinsic value and intrinsic value was not rising at a satisfactory rate.

Fig 2. Skaffold Line. Hastie Group. (International Patents Pending). Expensive in 2006-2008 and flat and declining intrinsic value from 2007.

For many investors Figs 1 and 2 might be enough to turn the page and look to invest elsewhere. For those with more than a cursory interest however, Skaffold opens a window to the performance of the company.

As Fig 3 reveals, the company was reporting profits but even rising levels of debt failed to stem declining returns on equity.

Fig 3. Skaffold Capital History (International Patents Pending). Hastie Group. Note declining blue line (ROE) despite rising red columns (debt) and rising green line (profits)).

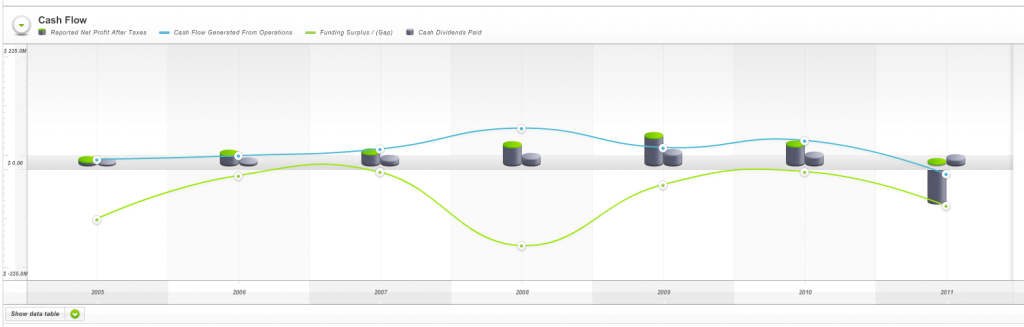

And weak cash flows (Fig 4.) as measured by Skaffold’s Funding Gap (the green line was below zero every year since listing) ensured the company would never meet all of our investment criteria.

Fig 4. Skaffold Cash Flow (International Patents Pending). Hastie Group. (note the green line (Funding Gap/Surplus) is almost always negative – biting off more than it can chew?

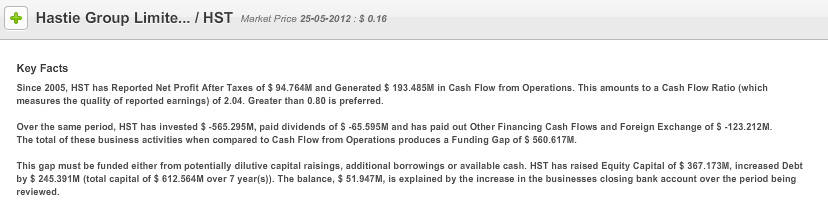

Finally, I note that Skaffold does something I reckon is positively spectacular. Using the Cash Flow Evaluate Screen in Fig 4. above as an example, Skaffold’s computing engine converts the chart to plain and natural English! Its a simple paragraph that explains in easy-to-understand terms precisely what you are looking at. Imagine that being updated live for every screen and for every listed stock! Have a read…

Fig 5. Skaffold’s Auto-generated plain language Cash Flow Screen description. (International Patents Pending)

Avoid potential disasters with Skaffold’s Quality Scores.

Skaffold consistently identified HST as expensive or poor quality or both.

For investors who seek to give themselves every opportunity to avoid the landmines, Skaffold’s timely assessment of HST’s poor investment quality represents the kind of early warning signal you need.

Decades of academic research into the study of corporate failure are the backbone of Skaffold. Isn’t it time you made Skaffold your portfolio’s most important investment?

To find out more about how Skaffold can help you avoid potential disasters such as Hastie Group Limited and best protect your portfolio in preparation for the future contact Donna at Skaffold on (02) 9692 5750 or register to attend the next Skaffold online webinars from the complete comfort of your own home, office or combine harvester.

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 28 May 2012.

by Roger Montgomery Posted in Investing Education, Skaffold.

- 11 Comments

- save this article

- POSTED IN Investing Education, Skaffold

-

MEDIA

Why is BHP less than a sure-fire thing?

Roger Montgomery

May 26, 2012

In The Australian Roger Montgomery discusses why the laws of supply and demand suggest demanding times ahead for mining companies. Read here.

by Roger Montgomery Posted in Energy / Resources, In the Press, Investing Education.

-

MEDIA

Why does Roger Montgomery think Qantas’ accountants are so creative?

Roger Montgomery

May 23, 2012

Learn Roger’s Value.able insights into the recent Qantas corporate restructure in this discussion with Radio 2GB’s Ross Greenwoood broadcast on 23rd May 2012. Listen here.

by Roger Montgomery Posted in Investing Education, Radio, Value.able.

- save this article

- POSTED IN Investing Education, Radio, Value.able

-

MEDIA

What are Russell Muldoon’s Value.able Insights into Seven West Media and Qantas?

Roger Montgomery

May 22, 2012

Do Jumbo Interactive (JIN), Seven West Media (SWM), Matrix Composites (MCE), Toll Holdings (TOL), Blackmores (BKL), Seek (SEK), Silverlake resources (SLR), Paladin Energy (PDN) and Qantas (QAN) make Roger’s coveted A1 grade? Watch this edition of Sky Business’ Your Money Your Call broadcast 22 May 2012 to find out. Watch here.

by Roger Montgomery Posted in Airlines, Companies, Investing Education, TV Appearances, Value.able.

-

Is this what they mean?

Roger Montgomery

May 16, 2012

When pundits talk of blood in the streets, is this what they mean?

When pundits talk of blood in the streets, is this what they mean?The chart above is a Market Heat Map for the All Ordinaries. The brightest green is a move up of more than 6% on the day. Not many fit that bill today. The brightest red is a move down of more than 6%. The size of each box is related to market capitalisation. You can see the four big boxes in the lower middle of the heat map – thats the big four banks.

And if you are wondering what the little bright green stock is at the lower right of the Heat Map, that’s Industrea (ASX: IDL, Skaffold Quality Score A3). A year ago IDL was trading at $1.57 but its intrinsic value in Skaffold was just $1.13. Based on expected 2012 results Skaffold’s intrinsic value was just 83 cents and on May 9 this the share price fell to 80 cents. So it a took a year to get there but the price traded at a 4% discount to intrinsic value – admittedly not a very wide discount. And today IDL is bright green in a sea of red ink because it received a takeover offer from GE at $1.27.

Turning back to the Heat Map and the red appearing everywhere (it could all be very bright green tomorrow – we are not in the business of predicting prices) the fact is that it’s not common for us to look at prices with this much interest unless things are indeed getting interesting. We know the companies we’d like to own and the prices we’d like to pay – all that’s left to do is to turn the market on and see if anyone is prepared to do something silly today.

Today might just have been one of those days. Only time will tell and of course never bet the farm on one throw of the dice. So are we looking at a market on the precipice (the same precipice many of you have indicated you believe house prices are sitting on)? Or if you are reading this after the close, have you missed the boat? WHat are your advisers telling you?

There are some incredibly learned and articulate readers that regularly visit and I’d be delighted to hear your thoughts.

Posted by Roger Montgomery, Value.ableauthor, SkaffoldChairman and Fund Manager, 16 May 2012.

by Roger Montgomery Posted in Investing Education, Value.able.

-

MEDIA

Can you really be surprised at the slump in Mining Services?

Roger Montgomery

May 15, 2012

Roger Montgomery is not surprised by the slump in Mining Services share prices – here he discusses with Ticky Fullerton on ABC’s The Business how the growth in supply and the limits to Chinese demand have allowed value investors to anticipate the current share price levels. Watch the video.

This interview was broadcast on ABC1’s The Business on 15 May 2012.

by Roger Montgomery Posted in Companies, Energy / Resources, Investing Education, TV Appearances.