Investing Education

-

MEDIA

What future prospects does Roger see for Seek, Bluescope Steel and BHP Billiton?

Roger Montgomery

February 29, 2012

Do BHP Billiton (BHP), Fortescue Metals (FMG), Seek (SEK), Bluescope Steel (BSL), GR Engineering (GNG), CSL (CSL), Peak Resources (PEK), Harvey Norman, (HNN), Buru Energy (BRU), The Reject Shop (TRS), ASG Group (ASZ), Tatts Group (TTS) and Webject (WEB) make Roger’s coveted A1 grade? Watch this edition of Sky Business’ Your Money Your Call broadcast 29 February 2012 to find out. Watch here.

by Roger Montgomery Posted in Companies, Energy / Resources, Investing Education, TV Appearances, Value.able.

-

Another strong result from small Co.

Roger Montgomery

February 26, 2012

We have been delighted with the reports coming out from the smaller industrial companies and note again the growing divergence in the performance of the XJO versus the XNJ (ASX 200 versus All Industrials). We attribute this to a declining enthusiasm for the ‘resource story’ and the fact that many of the industrial companies we like (and own, including MTU) are producing such fantastic results despite evidence of a terrible domestic economic backdrop.

Headline revenue was down 14% as a result of the reduction of unprofitable EDirect business activity. Thats good. Underlying revenue (excluding the zero margin Edirect business) rose 8% and the dividend was up 29%. Business cash flow was $17.5mln compared to reported profit of $16.7mln. The impact on valuations should be positive again but ultimately will be determined by the returns generated on the $21.8mln paid for the two acquisitions made in the current half.

Since 2003 (the year before MTU listed) the company has increased profits by more than 91% per annum and is forecast to grow profits again to $36 mln in 2012. To generate the increase in profits (of $27mln to 2011) $60 million has been raised and $30 million borrowed. The return on incremental equity is about 50% suggesting the acquisitions made thus far have reflected an astute allocation of capital. We’ll be keeping an eye on the debt but reckon a recovery in the local economy (as interest rates are lowered and hopefully passed on by the banks) will give MTU another boost.

According to one of our brokers who has a buy recommendation on the stock, the following stocks are at risk of reducing their dividends: Examining for factors…”forecast earnings revisions, payout ratios, stock price stability and free operating cashflows, the companies that are most at risk of further dividend cuts are SWM, GWA, TTS, HVN, QBE and MYR. Those that have reduced dividends but continue to pose a risk include BBG, CSR, DJS, GFF, HIL, MQG, OST, PPT, PBG, PTM, TAH, and TEN.”

Not a recommendation of course. Seek and take personal professional advice before engaging in ANY securities transactions.

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 27 February 2012.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Skaffold.

-

MEDIA

Buying opportunities

Roger Montgomery

February 21, 2012

In his ASX Investor Hour presentation of 21 February 2012, Roger argues that whether you invest on the basis of fundamentals or technical analysis, your buying and selling decisions should always be made in the light of your valuation of the company. Roger explains the factors he takes into account in assessing the value of companies, the systems he uses to do those valuations and talks about some of the companies that he currently regards as good value. Watch video here and view the slides here.

by Roger Montgomery Posted in Insightful Insights, Investing Education, TV Appearances, Value.able.

-

Vale

Roger Montgomery

February 20, 2012

Bloomberg:

“Walter Schloss, the money manager who earned accolades from Warren Buffett for the steady returns he achieved by applying lessons learned directly from the father of value investing, Benjamin Graham, has died. He was 95.

He died yesterday at his home in Manhattan, according to his son, Edwin. The cause was leukemia.

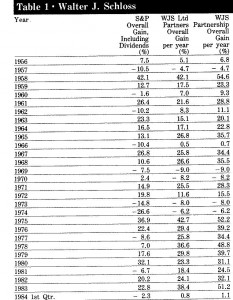

From 1955 to 2002, by Schloss’s estimate, his investments returned 16 percent annually on average after fees, compared with 10 percent for the Standard & Poor’s 500 Index. (SPX) His firm, Walter J. Schloss Associates, became a partnership, Walter & Edwin Schloss Associates, when his son joined him in 1973.

“He was a true fundamentalist,” Edwin Schloss, now retired, said today in an interview. “He did his fundamental analysis and was very concerned that he was buying something at a discount. Margin of safety was always essential.”

Buffett, another Graham disciple, called Schloss a “superinvestor” in a 1984 speech at Columbia Business School. He again saluted Schloss as “one of the good guys of Wall Street” in his 2006 letter to shareholders of his Berkshire Hathaway Inc.

“Following a strategy that involved no real risk — defined as permanent loss of capital — Walter produced results over his 47 partnership years that dramatically surpassed those of the S&P 500,” wrote Buffett (BRK/A), whose stewardship of Berkshire Hathaway (BRK) has made him one of the world’s richest men and most emulated investors. “It’s particularly noteworthy that he built this record by investing in about 1,000 securities, mostly of a lackluster type. A few big winners did not account for his success.”

Biography: While Walter Schloss’s name is not nearly as ubiquitous as Warren Buffett, Schloss was arguably one of the best investors ever. Like Buffett, Schloss was a student of Ben Graham, worked at Graham’s firm with Buffett , and is one of ” Super Investors” mentioned by Buffett in his famous essay The Super Investors of Graham-And-Doddsville.

Here’s a table of Schloss’s returns to 1984.

Walter Schloss was born in 1916. At 18 years old he worked as a Wall Street runner for on Wall Street. While he didn’t attend college he enrolled in several classes given by legendary investor Benjamin Graham. Schloss eventually went to work for the Graham-Newton Partnership. In 1955 Schloss launched his own value fund. He ran the fund until 2000.

Walter Schloss was born in 1916. At 18 years old he worked as a Wall Street runner for on Wall Street. While he didn’t attend college he enrolled in several classes given by legendary investor Benjamin Graham. Schloss eventually went to work for the Graham-Newton Partnership. In 1955 Schloss launched his own value fund. He ran the fund until 2000.Schloss was reportedly very frugal. In one year, legend has it that his total office expense was $11,000 while his partnership generated a net profit of $19,000,000.

Schloss stopped actively managing other people’s money in 2003 and was a treasurer for the Freedom House a non-profit group devoted to furthering democracy, and human rights.

Over the 45 years Schloss managed his fund he trounced the S&P 500 by producing returns of 15.3% versus 10% for the S&P 500. A $10,000 initial investment in Schloss’s fund would have grown to $12,344,268, compared to an initial investment of $10,000 in the S&P 500 which would have produced $1,173,909.

Farewell and Thank You.

Posted by Roger Montgomery, Value.able and Skaffoldauthor and Fund Manager, 21 February 2012.

by Roger Montgomery Posted in Investing Education.

- 4 Comments

- save this article

- POSTED IN Investing Education

-

Is your portfolio filled with quality and margins of safety?

Roger Montgomery

February 20, 2012

Click on the image at left to see a close up of the stocks we like.

Click on the image at left to see a close up of the stocks we like.I reckon 2012 will be the year to get set and fill your portfolio with high quality businesses, demonstrating bright prospects for intrinsic value growth and a margin of safety. That will be the topic of my talk today as I kick off the ASX’s 2012 Investor Hour series. Here are the details:

Topic: Buying opportunity

When: Tuesday 21 February

Where: Wesley Conference Centre, 220 Pitt Street, Sydney (venue location)

Time: 12 noon – 1pm. Please arrive by 12.00 noon for start

Details:The time to get interested in share investing and make good returns is precisely when everyone else isn’t. But know that the key to slowly and successfully building wealth in the sharemarket is to avoid losing money permanently.

At this event Roger will set out his principles for stock selection.

Roger Montgomery is a highly-regarded value investor, analyst and author and a regular contributor and commentator across the media. Roger is an analyst at Montgomery Investment Management Pty Ltd.

Presenter(s): Roger Montgomery, www.Skaffold.com, www.Montinvest.com

Posted by Roger Montgomery, Value.able and Skaffoldauthor and Fund Manager, 21 February 2012.

by Roger Montgomery Posted in Companies, Investing Education, Market Valuation.

-

MEDIA

Are the Big Miner’s really good value investments?

Roger Montgomery

February 7, 2012

Roger Montgomery thinks not, and discusses why in this article published in The Sydney Morning Herald on 7th February 2012. Read here.

by Roger Montgomery Posted in Energy / Resources, In the Press, Intrinsic Value, Investing Education.

-

How to analyse a new float or IPO.

Roger Montgomery

February 6, 2012

There has been a bit of action on the IPO front over the past few months. Sixteen stocks have been added to the main board of the ASX, as set out below with their actual listing date.

There has been a bit of action on the IPO front over the past few months. Sixteen stocks have been added to the main board of the ASX, as set out below with their actual listing date.I thought it might be a worthwhile task to run the ruler over them and see if any are potential investment candidates among the newcomers.

Let’s start our exercise at the more speculative end of the investment spectrum. I don’t gamble with money, so let’s eliminate those that are involved in exploration activities given their high risk/high reward dynamics. There are 12 exploration businesses among this group. I will leave these to others who are more suitably qualified in working out whether any opportunities exist here and whether they will find something before their cash runs out.

Of those remaining, well-known NZ website Trade Me and RXP Services are involved broadly in the IT space, Alliance Aviation is involved in mining services and finally Chorus, another NZ company, specialises in Telecommunications. These are the four businesses we will focus on. A brief review of these follows.

Alliance Airlines (AQZ)

I will start with a sector I know well – airlines. A capital intensive industry with lots of competition rarely makes for wonderful business economics (Qantas, Virgin) and despite Alliance operating in a niche market of fly-in, fly-out operations for the mining sector, my view remains the same: I will never invest a dollar into this sector.

Alliance has grown quickly since its formation in late 2002. From nothing, to a fleet of 20 Fokker 100 and Fokker 70LR jets as well as five Fokker 50 turboprops with established, long-term, profitable blue-chip relationships with BHP Billiton, Santos, Incitec Pivot, and Newcrest. That’s an outstanding achievement by management. A distinguishing feature is that approximately 75% of Alliance’s 2010-11 revenue was subject to medium to long-term contracts – recurring revenues.

No matter. Any airline cannot escape competition or its high level of ongoing capital requirements. And for a niche space, four other competitors (Cobham, Network aviation, Qantaslink, Skywest) appear to be a handful in terms of the prices they can charge, competition for future contracts (especially when 44% of 2010-11 revenue was from one client, BHP), ongoing operating margins and future market share gains.

A total 47.6% of Alliance’s forecast for 2011-12 EBITDA will be consumed on refurbishments, maintenance, rotables, new aircraft and property, plant and equipment. This leaves just over 50% to pay taxes, interest and for working capital requirements. And once all is paid for, only a little will be left over for future dividends, buybacks, etc. It is not surprising, therefore, that the prospectus does not forecast a dividend to be paid in 2012.

Despite a pro-forma forecast of $18.1 million NPAT, or 20.1¢ earnings per share, and the shares trading below what the business may be worth, if you ever see me buying an airline, please put me in a straitjacket.

RXP Services (RXP)

Unfortunately, this business has a very, very short history and no real track record. It was formed in October 2010, just 15 months ago, with the purpose of establishing an information & communications technology (ICT) business with a focus on medium/large enterprises and the government.

The founders have done this, but with one drawback. Rather than building a business organically, the purpose of the float was mainly to raise funds to acquire two unlisted businesses in Vanguard and Indigo Pacific. The rollup of these has seen RXP service capabilities expand overnight from nothing into a broad range of management, business and ICT consulting, delivery and support services.

With a number of already listed ICT businesses already competing for market share – SMX, CSG, OKN, many of which have had a chequered operating history as listed entities – the space appears to be a little crowded. I can’t see how RXP will differentiate a commodity product offering.

And turning to its financials, despite the consolidated accounts in the prospectus showing how the businesses may have looked had Vanguard and Indigo been owned in the past, they weren’t; what we see is what would have been a profitable little businesses. But as we have little to go on as to how they will actually function together going forward under new stewardship, we will watch this one from the sidelines for now.

Chorus (CNU)

Chorus is a spin-out from Telecom New Zealand. It is New Zealand’s largest telecommunications utility company, a technical way to describe a business that builds, maintains and repairs existing phone and broadband lines.

Following the demerger, Chorus is a business whose sole focus is on bringing fibre within reach to as many New Zealanders as possible – kind of like our own NBN Co., but not run by the government, even if it has been chosen by the Crown to build NZ’s ultra-fast broadband (UFB) network to 830,000 urban premises, as well as extend fibre further into rural New Zealand through the Rural Broadband Initiative (RBI) by the end of 2019.

Having so far deployed some 2500 kilometres of fibre optic cable, upgraded hundreds of local telephone exchanges with new broadband equipment and installed or upgraded about 3600 roadside cabinets, a target of 20,000 kilometres of fibre optic cable to deliver ultra-fast broadband will probably be met. Management’s recent experience in rolling-out ADSL2+ broadband is coming in very handy and helping to build New Zealand’s fibre future.

There are some obvious tailwinds here, with the long-term nature of this contract and ratings agency Moody’s has assigned Chorus a Baa2, stable issuer and senior unsecured rating. A rating similar to Bulgaria and Kraft foods.

Look under the hood, however, and you can see that about $NZ1.7 billion of net interest bearing debt was outstanding as at December 2011, all current. On just $NZ422 million of equity, it appears that Telecom New Zealand may have also let go of some unwanted baggage in the de-merger.

While 2011 cash flows appear to be well managed and interest payments well covered, I can’t help but be reminded of another infrastructure asset in Asiano when it was demerged from Toll holdings in 2007. It too was saddled with a large debt burden and at the end of its first trading day; Asciano had a market capitalisation of $7 billion. Today it is $4.5 billion.

Trade Me (TME)

Last but not least is the well-known NZ website Trade Me. Similar to eBay international, Trade Me is now dual-listed on both the New Zealand and Australian Stock Exchange.

While this is another spin-off, Fairfax Media Limited (ASX:FFX, SQR B3) has retained a shareholding of 66% – generally a good sign.

On one reading this might be the pick of the recent floats. The business has an moderately geared balance sheet, produces a significant amount of free cash with low levels of ongoing capital expenditure now that the website is mature and has a history of earnings growth which any shareholder, and that includes Fairfax, would be truly happy with. On top of this, with Fairfax retaining a material level of ownership in the business, they are still highly incentivised to continue promoting the website via its vast media network.

On another reading Fairfax paid $750mill for Trade Me (TME) and have just sold 34% of it for $363.5 mill or a total ‘value’ of $1.07Bln. This will help them justify the carrying value on their own balance sheet. Further, since 2007 TradeMe has made net profits totalling $276mill, the bulk of which has been taken out as dividends. So FFX have made an IRR of about 17% per annum. Given FFX have set up the company with market cap of about $1 billion, equity of $631 mill ($721 mill goodwill and therefore negative NTA) and debt of $164 mill, the expected return on equity is just over 10 per cent means FFX have got a return that you might not.

As “Rainsford” wrote here at the blog: “Seems to me it’s a great deal for Fairfax but not so great for other investors”. If analysts are projecting 18.2¢ for 2013, which equates to 5% growth, and with the shares trading at $2.31, they appear to be fully valued given current expectations. Patience will be need to be exercised on this one.Posted by Roger Montgomery, Value.able and Skaffold author and Fund Manager, 6 February 2012.

by Roger Montgomery Posted in Investing Education.

- 11 Comments

- save this article

- POSTED IN Investing Education

-

An upgrade amid the malaise!

Roger Montgomery

February 2, 2012

Reporting season has begun in ernest and a few companies we have been watching (and some of which we own in the Montgomery Private Fund) have reported. Today it was Credit Corp’s turn (ASX: CCP, SQR* A2). You can find the presentation here (be sure to read and agree to the ASX and our disclaimer).

Reporting season has begun in ernest and a few companies we have been watching (and some of which we own in the Montgomery Private Fund) have reported. Today it was Credit Corp’s turn (ASX: CCP, SQR* A2). You can find the presentation here (be sure to read and agree to the ASX and our disclaimer).Skaffold members are likely to have already seen CCP on the Aerial Viewer with an A2 rating and a discount to Skaffold’s estimate of Intrinsic Value. In the Montgomery Private Fund, we have owned the stock for some time now and I have mentioned it as a stock to investigate on many TV and Radio programs. Today’s 10 per cent gain is certainly a welcome boost to the gains already registered.

The highlights from the announcement of the half year results for us were 1) that earnings were at the top end of guidance, 2) a 12% increase in revenue translated to a 23% increase in NPAT, 3) a welcome reduction in debt to its lowest level since listing and 4) strong free cash flow after an increase in dividends and finally a conditional settlement of a “distracting” class action. This final point is particularly important for many investors who will now feel vindicated that it was not the investor who erred. The impact of the settlement on earnings will be immaterial thanks to insurances. At current rates of cash flow generation, debt could be extinguished completely by the end of the financial year.

Grant Duggan – a regular blog poster here – was kind enough to make the following comments below: “If i recall on YMYC a caller asked for one xmas stock to put under the tree for 2012, and much to your dislike [Roger] to only be able to pick one it was CCP, and i know two months don’t make a market but to me this is another indicator of value able investing starting to prove its worth. Thanks to Roger and all blog posts once again.”

I know I am harping on about it but if you have not joined as a member of Skaffold, how are you planning to find the best opportunities during reporting season? Join Skaffold who have done all the hard valuation and quality assessments for every single listed company so you don’t have to.

Posted by Roger Montgomery, Value.able and Skaffold author and Fund Manager, 2 February 2012.

by Roger Montgomery Posted in Companies, Investing Education, Skaffold, Value.able.

-

Will Facebook’s IPO be a one day Circus?

Roger Montgomery

February 2, 2012

Unless you live under a waterfall in the rainforests of South America, you will have heard that Facebook has lodged its S-1 (Prospectus) for a probably May 2012 IPO. Skaffold members can look forward to Facebook being available to view in Skaffold when the team loads up all the international stocks.

To become a Skaffold member today and discover how we have been investing click here

Back to our regular programming…

Hyped by the media around the world as the biggest internet IPO in history and asked whether we would ‘invest’ in Facebook, we note the following:

The company already has 500 shareholders and would have been required by the SEC to lodge financials in April.

Facebook Stock Code: FB

Maximum aggregate offering price: $5Bn

as yet, there is not sufficient valuation information listed in the S-1 filing with the SEC nor how many shares are being offered.

According to the S-1 cover:

845 million monthly active users (MAU)

483 million daily active users (DAU)

Users generated on average 2.7 billion Likes and Comments per day in Q4 2011.

100 billion friendships

250 million photos uploaded per day

Our observation: Not a mention of any dollars yet! “likes”, “friends” and ‘uploaded photos’ are today what ‘page impressions’ and ‘visitors’ where in the tech boom of 1999/2000.

FB generated $3.7 billion in Revenue in 2011, up from $2 billion in 2010. 12 percent of Facebook’s revenue in 2011 was linked to its relationship with online gaming giant Zynga.

FB generated $1 billion in net income in 2011, up from $606 billion in 2010, a 40% growth rate, compared to the 165% growth rate from 2009’s $229m.

EBIT margin peaked at 52.3% in 2010 ($1m in EBIT on $2 billion in revenue), has since declined to 47.3% or $1.756Bn on $3.711Bn in Revenue, still incredible.

$3.9 billion in cash and marketable securities

Western world user growth is slowing but thats the law of large numbers. Facebook says: “We believe that our rates of user and revenue growth will decline over time. For example, our annual revenue grew 154% from 2009 to 2010 and 88% from 2010 to 2011. Historically, our user growth has been a primary driver of growth in our revenue. Our user growth and revenue growth rates will inevitably slow as we achieve higher market penetration rates, as our revenue increases to higher levels, and as we experience increased competition.”

The company still reported +60% earnings growth rates in 2011. The key is whether users stay and whether they can be ‘monetized’ further. MAU additions peaked in 2010 when FB added 248m to a total of 608m; in 2011 it added 237MM to 845m.

On the subject of dividends FB says: “We do not intend to pay dividends for the foreseeable future. We have never declared or paid cash dividends on our capital stock. We currently intend to retain any future earnings to finance the operation and expansion of our business, and we do not expect to declare or pay any dividends in the foreseeable future. As a result, you may only receive a return on your investment in our Class A common stock if the market price of our Class A common stock increases. In addition, our credit facility contains restrictions on our ability to pay dividends.”

Here’s access to the S-1: http://www.sec.gov/Archives/edgar/data/1326801/000119312512034517/d287954ds1.htm

The map of the world connected by facebook users is intriguing. What are those pirates on the west coats of Africa doing on Facebook?

I have previously written about the forthcoming floats of internet and social media sites here: http://rogermontgomery.com/which-ipos-are-you-watching/

‘Paradigm changers’ (remember Yahoo?) have come and gone so it is essential you don’t get caught up in the hype and instead stick to the valuation approach that is the bedrock of our approach. If you don’t know it, buy a copy of Value.able today for just $49.95. Or to save yourself reading the last ten annual reports for every listed company, try Skaffold.

There were eight large and highly media-promoted IPOs in the last year or two (GRPN, ZNGA, LNKD, P, YOKU, DANG, AWAY, and FFN). One analyst reported that if you could get stock in the IPO (forget it if you weren’t a major client of the lead broker or a ‘friend’ of the company) there was an average gain of 50%. If you bought each IPO in the market on Day 1 you now have an average loss of 54% with incredibly only 1 of the 8 names (ZNGA) still holding on to gains (+11%) thanks to a rally of 15% in the last week.

We would like to go through the numbers for Facebook today and try to come up with a valuation for you. You can do it yourself if you have a copy of Value.able.

There’s about $5.2 billion in equity, including $1bln of retained earnings. There’s 4.1bln Class A shares and the same number of class B’s. The preferred’s will be converted and only Class A’s sold. We cannot calculate equity per share because the S-1 does not disclose how many shares will be issued. ROE is about 26 per cent. No dividends will be paid. The company states in its S-1 that it will continue to grow by acquisition as well as organically. But the company will takeover Earth if it continues to retain profits and generates 26% returns on the incremental equity. Assuming earnings grow at 40% and faster than the rate of return on equity, then you can expect ROE to rise. Using these favourable metrics we reckon Facebook is worth $26-$28bln in 2012 rising to $57-$63bln in 2014. If the IPO ‘values’ the company at $100bln as many media outlets suggest, watch out.

This paragraph from the S-1 is important:

“If you purchase shares of our Class A common stock in our initial public offering, you will experience substantial and immediate dilution.

If you purchase shares of our Class A common stock in our initial public offering, you will experience substantial and immediate dilution in the pro forma net tangible book value per share of $ per share as of December 31, 2011, based on an assumed initial public offering price of our Class A common stock of $ per share, the midpoint of the price range on the cover page of this prospectus, because the price that you pay will be substantially greater than the pro forma net tangible book value per share of the Class A common stock that you acquire. This dilution is due in large part to the fact that our earlier investors paid substantially less than the initial public offering price when they purchased their shares of our capital stock. You will experience additional dilution upon exercise of options to purchase common stock under our equity incentive plans, upon vesting of RSUs, if we issue restricted stock to our employees under our equity incentive plans, or if we otherwise issue additional shares of our common stock. For more information, see “Dilution”.

Note the blanks, which makes FB impossible to value on a per share basis, yet.

We’ll have to wait until the final days of the capital raising before we can come up with a firm valuation on a per share basis but for now, the circa $27bln valuation stands.

Posted by Roger Montgomery, Value.able and Skaffold author and Fund Manager, 2 February 2012.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

MEDIA

What are Roger’s Value.able Insights into the float of Facebook?

Roger Montgomery

February 1, 2012

Do David Jones (DJS), Myer (MYR), ARB Corporation (ARP), Oroton (ORL), Billabong (BBG), JB Hi-Fi (JBH), Harvery Norman (HVN) or Campbell Brothers (CPB) make Roger’s coveted A1 grade? Watch this edition of Sky Business’ Switzer program broadcast 1 February 2012 to find out and also learn Roger’s views on the pricing of the upcoming Facebook IPO. Watch here.

by Roger Montgomery Posted in Intrinsic Value, Investing Education, Skaffold, TV Appearances, Value.able.