Investing Education

-

Know your Options

Tim Kelley

November 1, 2012

From time to time we are asked about option strategies. There are many different types of option strategy, and the merits of any given one depends very much on the particular strategy and the circumstances, but there are a few general principles that are worth keeping in mind. These include:-

– Buying or writing options is a zero sum game. This means that when one person sells an option to another, one of them will win and the other will lose. This is in contrast to ordinary shares where it’s reasonable for all long-term investors to expect a positive return

continue…by Tim Kelley Posted in Insightful Insights, Investing Education.

-

MEDIA

Go against the flow and thrive

Roger Montgomery

October 27, 2012

In this Australian article published 27 October 2012 Roger discusses how behaving counterintuitively may result in better performance for your portfolio. Read here.

by Roger Montgomery Posted in In the Press, Insightful Insights, Investing Education, Market Valuation.

-

WHITEPAPERS

Why the Stock Market Doesn’t Work (White Paper)

Roger Montgomery

October 19, 2012

What is ailing the stock market and why have investors deserted it in droves?

Founder of Montgomery Investment Management and author of value-investing bestseller Value.able reveals the steps he is taking to ensure investor returns and investors return.

This white paper is exclusively for Roger Montgomery.com subscribers.

by Roger Montgomery Posted in Investing Education, Whitepapers.

-

What is your best performing stock pick for the next 9 months?

Roger Montgomery

October 5, 2012

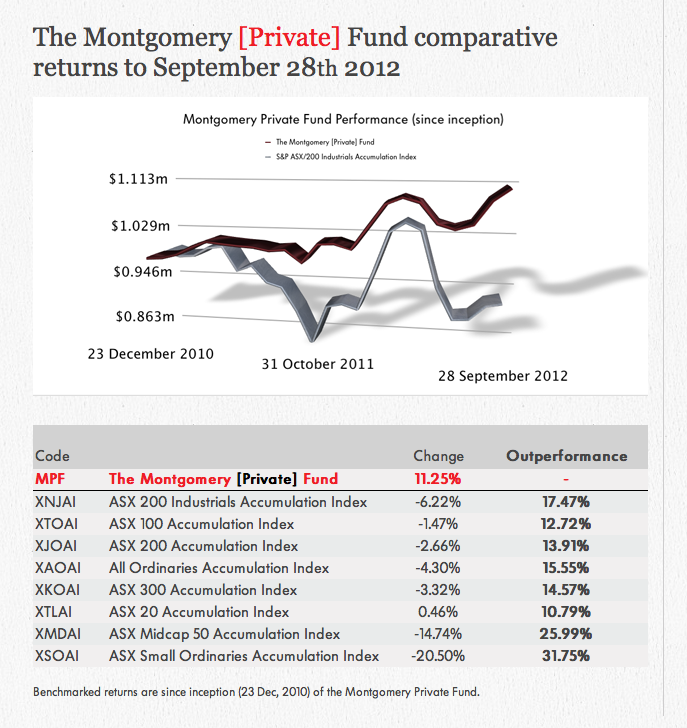

September was a challenging month for investors but Montgomery chalked up another outperformance in both The Montgomery [Private] Fund and The Montgomery Fund (see figure 1).

Of course in the short term the performance of share prices can be attributed to noise and randomness and so the bigger question is always; which businesses will be worth substantially more in the future?

What is your suggestion for the best performing stock for the next nine months to June 30, 2012?

Pick the best performing stock in the next nine months and gain fame and notoriety, kudos and credit.

Each month we’ll track the list and present the table until June 30, 2012.

All the best and stay tuned.

by Roger Montgomery Posted in Companies, Intrinsic Value, Investing Education.

-

A good time to consider allocating to equities ?

Tim Kelley

September 27, 2012

At Montgomery Investment Management we don’t claim any special ability to predict where equity markets will go next, but we do know that buying equities when they are relatively inexpensive is a reliable path to better than average long-term returns. One simple way of gauging relative value is to compare the dividend yield for the market as a whole with its historical average (although we don’t advocate valuing individual companies in this way). It’s worth noting that the current dividend yield on the ASX All Ordinaries is around 4.65%, vs an average of 3.84% for the last 20 years (Source: IRESS).

by Tim Kelley Posted in Insightful Insights, Investing Education.

-

If Only They Had Skaffold

Roger Montgomery

September 20, 2012

Notch up another win for investors who use Skaffold. Back in August last year I was asked by a viewer on Sky Business what I thought of MacMahon Holdings (ASX:MAH).

Notch up another win for investors who use Skaffold. Back in August last year I was asked by a viewer on Sky Business what I thought of MacMahon Holdings (ASX:MAH).You can watch the video here at 5 mins 20 seconds.

When asked the question, I looked at Skaffold.com and noting the very small change in intrinsic value over many years I said “This business is not going to deliver sustainable long-term outperformance”.

Today’s near-40% share price decline, announcement of a cost blowout, a downgrade to previous earnings guidance and the immediate resignation of the CEO Nick Bowen is a blow to those investors who own the shares of MacMahon and do not own Skaffold.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Skaffold.

-

MEDIA

How should you view a takeover offer on a company in your portfolio?

Roger Montgomery

September 19, 2012

Roger Montgomery discusses his insights into how to view takeover offers, and in particular he discusses the Sundance Resources (SDL) takeover bid with Ross Greenwood on Radio 2GB. Listen here.

This program was broadcast 19 September 2012.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Radio.

- save this article

- POSTED IN Insightful Insights, Investing Education, Radio

-

New ASX Investment Talk – Beating the Index

Roger Montgomery

September 14, 2012

Join Roger as he explains how the long-standing principles of value investing can be applied so that you too can identify A1 businesses for your portfolio and beat the index. Watch here.

by Roger Montgomery Posted in Insightful Insights, Intrinsic Value, Investing Education, Market Valuation.

-

Big Apple?

Roger Montgomery

September 12, 2012

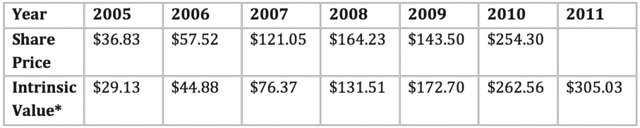

Did you know that the market capitalisation of Apple Inc. is now more than the entire equity markets of Spain, Portugal, Ireland and Greece combined? Its stunning. Surely Forrest Gump from Greenbow Alabama would be writing to Jenny with much enthusiasm. But what about its intrinsic value? Back in 2010 (http://rogermontgomery.com/is-apple-an-a1/) I wrote that Apple’s intrinsic value was higher than the share price at the time. The table below first published in July 2010 reveals the company’s pattern of rising intrinsic values. back then the price was indeed showing a small margin of safety.

A couple of blog readers have subsequently told me they purchased Apple shares and obviously they have done nicely. But what about today?

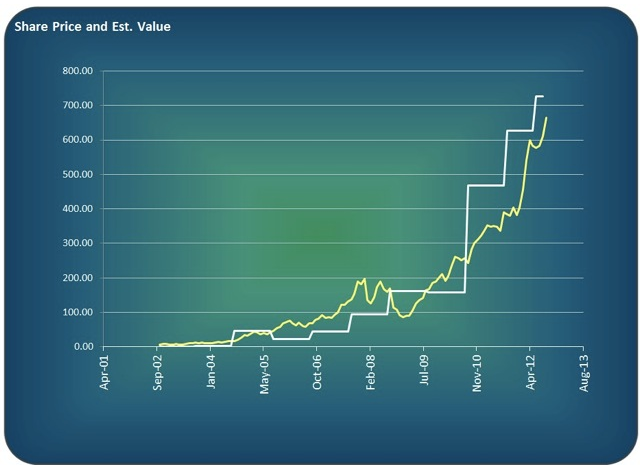

Only last year, when the share price hit $600 I wrote that I thought price had run ahead of intrinsic value (but not forecast intrinsic value) and the share price subsequently fell slightly. We also noted declining margins and market shares losses. But improving quarterly results and rising forecasts means revisions have resulted in IV estimates continuing their stellar rise so a revisit of our assumptions might be worth our time.

The graph below reveals that our ‘revised’ back-of-the-envelope intrinsic value estimate for Apple is forging ahead. If you are confident that Apple’s pipeline of products will usurp the competition, take back market share and fill Apple’s coffers towards 1000 billion dollars and that the iPhone 5 – expected to be revealed this week – will knock everyone’s socks off, then the massive rises in intrinsic value, might not seem so extreme.

Of course all intrinsic values are just estimates and while our haven’t done too badly for us – we’ve been spot on with BHP at $30 and done well on others – the reality is they can change dramatically as new information comes to hand.

So lets keep an eye on whether Apple impresses this week with its new release.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Market Valuation, Value.able.

-

MEDIA

Round 1: Value Investing vs the “new” paradigm – you be the judge……

Roger Montgomery

September 10, 2012

One of the constants of the last 10 years is market commentators saying that “this time is different” – we believe that the principles of of value investing never change, and Roger articulates the reasons why in this interview with Ticky Fullerton (and Marcus Padley!) on ABC1’s The Business, broadcast 7 September 2012. Watch here.

by Roger Montgomery Posted in Insightful Insights, Intrinsic Value, Investing Education, TV Appearances.