Were investors hasty?

It’s true that many Australian businesses are on their own path and even amid the financial tempest raging in Europe there will be companies that succeed.

It’s true that many Australian businesses are on their own path and even amid the financial tempest raging in Europe there will be companies that succeed.

Conversely there will many that fail.

I have maintained that beating the market can be made simpler by sticking to high quality issues.

Skaffold’s A1’s, I believe, have the lowest probability of ‘catastrophe’ within a year or two of receiving their score. Of course, you have to realise that business is dynamic and Skaffold’s quality scores will change with new information.

Furthermore, having the lowest probability of catastrophe is not to say there is zero chance of catastrophe. A 100-to-1 nag at Moonee Valley might still win the race.

Nevertheless, I would however rather have a diversified portfolio of A1s and A2s than a portfolio of C5s.

And this brings me to today’s announcement that Hastie Group has voluntarily appointed Administrators, just three days after the company announced accounting irregularities would result in a charge to profits of $20 million.

Hastie Group Limited (HST) has today announced that it has been placed into voluntary administration. Many investors will lose any and all the money they had invested in the company. If you are retired or about to retire, you can least afford such a permanent impairment to your capital.

I get so frustrated when I hear young advisers telling people on air to ‘only use money they can afford to lose’. I don’t know about you, but I cannot afford to lose any!

And that’s were quality comes into its own. Skaffold was designed to mitigate the risk of investing in those companies where the risk of events like the appointment of administrators is highest.

Skaffold’s quality scoring is based on decades of international academic research into forecasting collapses. And for us it just works.

At Montgomery Investment Management the Quality of a company is our first filter. A high Quality Score is the cornerstone to our investment strategy as well as the core of our investment decision-making. The second step is value. We reduce risk even further when we buy high quality companies only when they are at sharp discounts to intrinsic value.

Hastie listed on the ASX in 2005 and enthusiasm for its shares once pushed the market value of the company to $500 million and to a share price – just before the GFC – of more than $40.

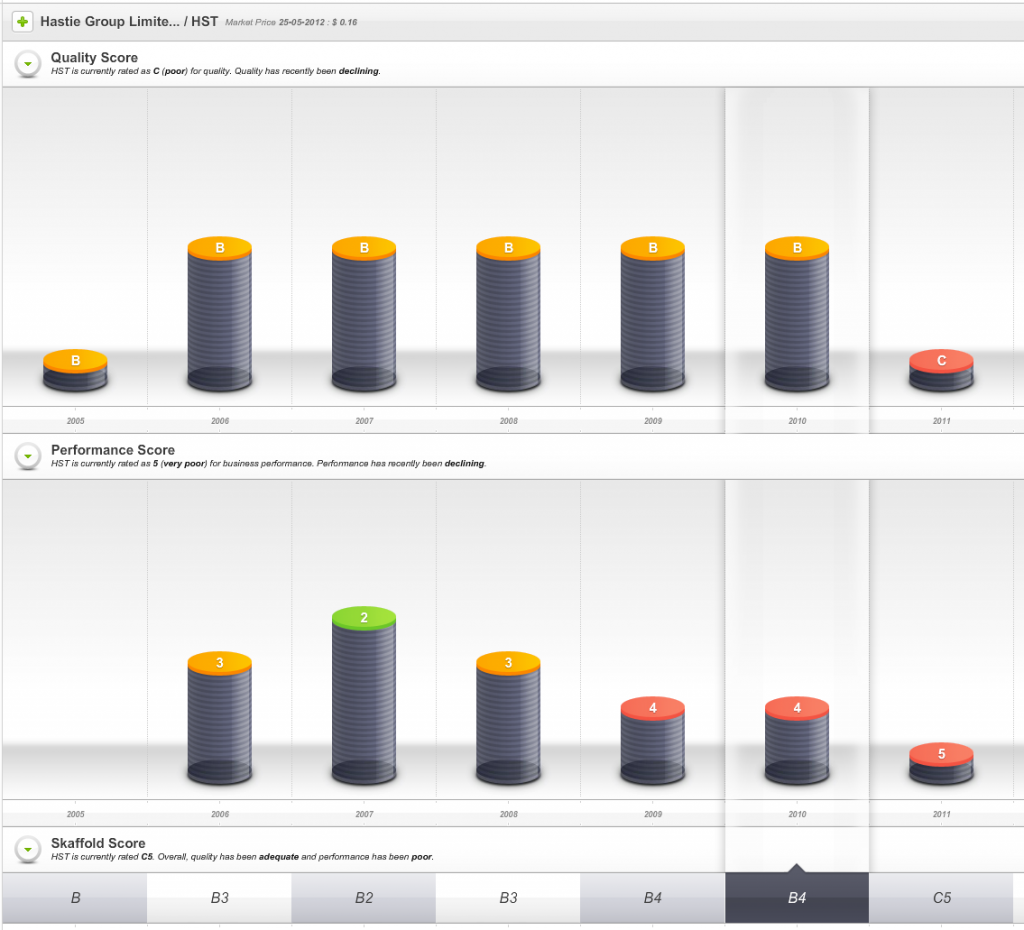

So, one sign of impending danger was that from 2009 onwards the company’s Quality Score dropped well below investment grade.

Fig 1. Skaffold Quality Score History since listing. (International Patents Pending). Hastie Group

The second warning was that the company’s shares, when they were at the height of their popularity were trading well above intrinsic value and intrinsic value was not rising at a satisfactory rate.

Fig 2. Skaffold Line. Hastie Group. (International Patents Pending). Expensive in 2006-2008 and flat and declining intrinsic value from 2007.

For many investors Figs 1 and 2 might be enough to turn the page and look to invest elsewhere. For those with more than a cursory interest however, Skaffold opens a window to the performance of the company.

As Fig 3 reveals, the company was reporting profits but even rising levels of debt failed to stem declining returns on equity.

Fig 3. Skaffold Capital History (International Patents Pending). Hastie Group. Note declining blue line (ROE) despite rising red columns (debt) and rising green line (profits)).

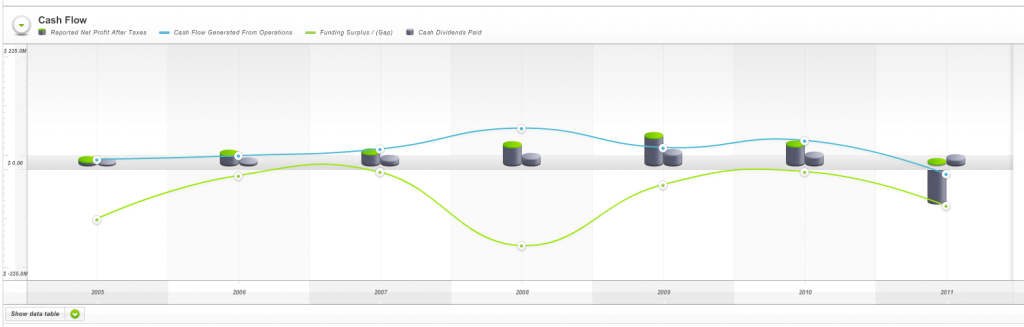

And weak cash flows (Fig 4.) as measured by Skaffold’s Funding Gap (the green line was below zero every year since listing) ensured the company would never meet all of our investment criteria.

Fig 4. Skaffold Cash Flow (International Patents Pending). Hastie Group. (note the green line (Funding Gap/Surplus) is almost always negative – biting off more than it can chew?

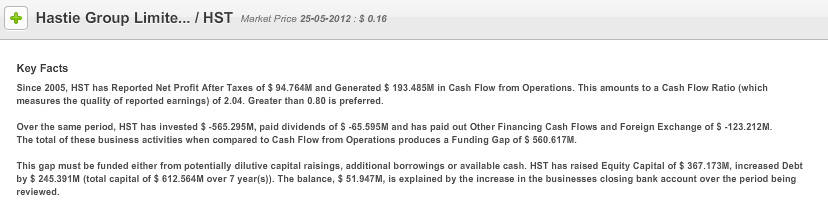

Finally, I note that Skaffold does something I reckon is positively spectacular. Using the Cash Flow Evaluate Screen in Fig 4. above as an example, Skaffold’s computing engine converts the chart to plain and natural English! Its a simple paragraph that explains in easy-to-understand terms precisely what you are looking at. Imagine that being updated live for every screen and for every listed stock! Have a read…

Fig 5. Skaffold’s Auto-generated plain language Cash Flow Screen description. (International Patents Pending)

Avoid potential disasters with Skaffold’s Quality Scores.

Skaffold consistently identified HST as expensive or poor quality or both.

For investors who seek to give themselves every opportunity to avoid the landmines, Skaffold’s timely assessment of HST’s poor investment quality represents the kind of early warning signal you need.

Decades of academic research into the study of corporate failure are the backbone of Skaffold. Isn’t it time you made Skaffold your portfolio’s most important investment?

To find out more about how Skaffold can help you avoid potential disasters such as Hastie Group Limited and best protect your portfolio in preparation for the future contact Donna at Skaffold on (02) 9692 5750 or register to attend the next Skaffold online webinars from the complete comfort of your own home, office or combine harvester.

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 28 May 2012.

Mark Ab

:

Roger,

the ‘multi-million dollar’ question I have is:

Given the above reports on this company and it’s track record, how could it be that 2 well known Investment ‘houses’, 1 of which contains 2 highly ranked well connected ex-politicians commit approx. $75m into the above company less than 12 months ago. The only answers I can conclude are the following:

a. their egos are punching well above their IQ’

b. they are speculators (not ‘Investment’ houses) and have taken 1 almighty punt

c. they have been profoundly misled and this is another “Enron’ style collapse

If you picked c, then it still is hard to comprehend why these particular ‘Investors’ would commit such equity into this company given the ‘picture’ that Skaffold provides and importantly the conclusions that can be drawn from the results, over a prolonged period.

Roger Montgomery

:

Hi Mark,

There are many investment styles and I believe the investors are indeed some of the brightest. What they were backing was a change of management and that management appeared to be doing all the right things. So an additional point D on your list might be to ask whether the banks lost patience? Perhaps the banks were in control and not the company?

One may never know and of course the above is pure speculation.

Rainsford

:

Thanks Roger. That brings me to the question of Norfolk Group NFK. A while back it was mooted that NFK may be interested in some parts of Hastie. Maybe not now. NFK is an A1 company trading at an MOS of 37%. However since I invested in them the share price has fallen some 30% !! To date not one of my better moves . They have just announced their full year results. 5% increase in NPAT, eps up, no debt, good forward orders. But ROE down. I also like the way they are diversifying away from Resources eg into the Heath sector. Roger, any thoughts on the company and why the share price has fallen so much?

thanks, Rainsford

Roger Montgomery

:

Hey Rainsford,

As value investors we aren’t in the business of explaining every move up and down in short term share prices, but I appreciate that doesn’t provide any comfort. You might remember I wrote here at the blog about my concerns regarding China and the impact it could have on resources. if you take a look at the share price of many mining services stocks they have fallen substantially following those comments (entirely coincidental of course). Slowing Europe = slowing China = less resource demand = lower commodity prices = lower margins = less money to spend on capex AND opex.

Rainsford

:

Thanks Roger.

I’m not ruling out buying some more NFK at current price.

How are you going getting those NZ stocks up on Skaffold?

Rainsford

Roger Montgomery

:

Close Rainsford. I have already seen it working but now its time for testing.

Steve

:

Hi Rainsford, NFK is a “Business/Corporate Services Company” as opposed to a “Mining Services” company. Norfolk does have some exposure to the Resources Boom but substantial amounts of its current and future revenue sit outside of “Mining Services/Resource Sector” which offers strong resilience and defensive qualities in this current market. The quality and size of NFK’s current “Order Book” at $1.05 Billion with $1.1 billion of Tenders Submitted and in Negotiation with $277 Million in Tenders being prepared paints a very strong forward view. Norfolk Management are conservative and experienced and not given to over estimate and have a track record in place to give confidence to this view.

Looking forward;

1.EBIT projected at 20%

2. NPAT projected at 10% “at least”

3. Net cash position continues to strengthen (-16.1)%

4. New 3 year Debt facility has just been renewed by existing Bankers

5. ROE is down due largely to the 75% retention of earnings strengthening of the balance sheet as per their stated objectives and also enhanced by the announcement of having received a one off $16 million tax refund which has not been passed on to shareholders.

6. Dividend Policy of 25% maintained

Re Hastie, in my view NFK have not been interested in making bolt on acquisitions or securing any of Hastie’s assets as this does not fit within their Strategic Objectives and Hastie assets in particular would be viewed as complicated at best and the Norfolk Management team would more than likely steer clear. However in light of Hastie’s recent demise Haden/Norfolk maybe presented with some Revenue opportunities and at the very least, Hastie’s failure and now the former number 1 player in HVAC market will offer Haden (Norfolk’s HVAC division) the opportunity of margin expansion and a greater slice of the revenue pie.

Other considerations you can apply to your Norfolk research when looking forward is the outlook of future opportunities in the Rail Network expansion in most states of Australia which are currently struggling to meet demand and sits front of mind with most major city’s current and future capital expenditure. O’Donnell Griffin are a very powerful division within Norfolk and are number 1 in their field and will continue to strengthen, underpinning Norfolk’s future earnings growth.

Norfolk is also strongly positioned to benefit from the ever developing “Carbon Omission World” revenues. (Green Rated) Government expenditure takes the lead to ensure that the “Tax Payer’s” Assets comply with the new “Green Carbon Friendly World” both in existing and the new “Tax Payer/Government” Assets. Also as the Comercial Property world recovers, this will only enhance the opportunity, with HVAC revenues improving steadily off the industry’s current low revenue base. This will certainly add more spice to Norfolks revenues going forward, particularly when considering Hastie’s demise and it’s reputation-al damage/fallout over what remnants survive.

My view is that Norfolk has a very High Quality Order Book, their Pipeline of work ($1.1 Billion) paints a high quality current and future earnings base, plus as I have referred to above Norfolk offers a very bright future. Norfolk have developed a highly skilled work force that is not easily replicated, particularly in this current skills shortage environment which offers a realistic defendable/moat like quality.

Recent price falls along with the market has been on low volume (no run for the exit) and highlighted by very small volume deliberate offers often positioned well below the (at market) offers and have managed to exaggerate the price to the down side. Their was nothing in the latest FY12 result to spook or negatively surprise investors, quite the contrary the latest result was inline and has confirmed that the company is on track and performing very well. More importantly NFK management have continued to earn the trust of it’s Investors who have entrusted their money with them.

Hope this view helps with your research & yes I own shares in Norfolk.

http://clients.weblink.com.au/clients/norfolk/article.asp?asx=NFK&view=2679873

Mick

:

Hi Roger I must agree with your comment

“I get so frustrated when I hear young advisers telling people on air to ‘only use money they can afford to lose’. I don’t know about you, but I cannot afford to lose any!”

In my view it is dangerous to have the mentality to even think of losing money on shares.You have worked hard for your money so why would you want to lose it.Buffett’s rule 1 is never lose money and the next rule 2 is to review rule 1.

Roger Montgomery

:

So true Mick. Thanks.

Andrew

:

I agree, i believe a big problem with many retail investors is the mental approach to investing. I don’t think this really gets talked about as much as it should and instead we tend to only give retail investors half the information (the actual investing side and even that can be questionable).

Luckily we all have here a great body of knowledge in different areas and a really experienced host in Roger where we share information and help eachother out but i think we would agree that such generosity is an exception in investing rather than the rule. Throught this we have learned and unlearned a lot of good and bad traits and are now much better for it.

In my opinion, a belief that you should only invest what you can afford to lose breeds a speculator as they are considering losing money as an option. This leads people to believing that the stock market is simply a variation of the roulette wheel and that the result of whether you make or lose money to be beyond your control.

We here at the value.able lounge know that’s not true and that by limiting our purchasing decisions to companies who meet a strict criteria and then only when their price is at a large discount to what they are worth we can make sure we dramatically reduce our risk of losing money.

Craig

:

Thanks for this Roger. It’s a good post to help reinforce what a poor business looks like in the various Skaffold screens.