Investing Education

-

Montgomery Funds’ Performance to 15 November 2012

Roger Montgomery

November 21, 2012

Recently you may have received a copy of the first bi-monthly Investment report for The Montgomery Fund along with a copy of Tim Kelley’s White Paper “What’s Under the Bonnet?”. We are of course enormously proud of the very early results The Montgomery Fund has achieved and we won’t be resting here. For those who missed out however and are interested in the latest performance numbers, please find them below.

To invest $25,000 or more in The Montgomery Fund, you will need to click here and request a copy of the Product Disclosure Statement, which includes the Application Form. Don’t invest in any security that is not appropriate for you of course and to determine that you must seek and take personal professional advice.

by Roger Montgomery Posted in Insightful Insights, Investing Education.

-

Hybrid Securities – Equity Downside for Fixed Interest Returns

Tim Kelley

November 16, 2012

We often hold a material amount of cash in our funds management operation and, with deposit rates at painfully low levels, we have been considering ways we might work the cash a bit harder. Like many investors, we have focused attention on hybrid securities as one possibility.

Having studied this possibility for a short time we are now focusing elsewhere. Analysis of the terms of some of the recent offerings reveals highly complex instruments with concealed downside risks and an interest rate that falls well short of compensating investors for the hidden downside. A cynical observer might think that some of these products are designed to exploit retail investors who are unable to fully assess the downside risks they are taking on.

by Tim Kelley Posted in Insightful Insights, Investing Education.

-

MEDIA

What are Tim Kelley’s insights on Exchange Traded Funds?

Roger Montgomery

November 15, 2012

Do Energy Action (EAX), Central Petroleum (CTP), Perseus (PRU), Iluka Resources (ILU), AGL (AGK), Matrix (MCE), Reward Minerals (RWD), FKP Property (FKP), Rio Tinto (RIO), Telecom NZ (TEL), Hills Holdings (HIL), Aurora (AUT), DWS (DWS) Cash Converters (CCV) or NAB (NAB) achieve the coveted A1 grade? Watch this edition of Sky Business’ Your Money Your Call 15 November 2012 program now to find out, and also learn Tim’s insights on Exchange Traded Funds. Watch here.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, TV Appearances.

-

MEDIA

Three cliches that cost you money

Roger Montgomery

November 10, 2012

In this Australian article published 10 November 2012 Roger discusses why listening to share market cliches is likely to result in poor portfolio returns. Read here.

by Roger Montgomery Posted in In the Press, Insightful Insights, Investing Education.

-

New Car Anyone?

Roger Montgomery

November 8, 2012

By Russell Muldoon & Roger Montgomery

We like to keep an eye on monthly new car sales statistics produced by the Federal Chamber of Automotive Industries. For a number of businesses we are interested in, including Carsales and ARB Corporation, they are both beneficiaries of a high level of new vehicle turnover.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Manufacturing.

-

RBA favours ‘riskier’ investments?

Tim Kelley

November 7, 2012

In the wake of the RBA’s decision to leave interest rates unchanged it’s interesting to see some of the commentary on the attractiveness of fixed interest versus ‘riskier’ investments, including property and shares. RBA governor Glenn Stevens is reported to favour investors moving into these asset classes away from low-yielding term deposits.

We have recently been doing some interesting analysis to better understand the long-term value proposition currently offered by the Australian equity markets. We will share the results of the analysis here when completed, but the emerging view – for those with a long-term perspective – is that governor Stevens has a valid point.

by Tim Kelley Posted in Insightful Insights, Investing Education.

-

Know your Options

Tim Kelley

November 1, 2012

From time to time we are asked about option strategies. There are many different types of option strategy, and the merits of any given one depends very much on the particular strategy and the circumstances, but there are a few general principles that are worth keeping in mind. These include:-

– Buying or writing options is a zero sum game. This means that when one person sells an option to another, one of them will win and the other will lose. This is in contrast to ordinary shares where it’s reasonable for all long-term investors to expect a positive return

continue…by Tim Kelley Posted in Insightful Insights, Investing Education.

-

MEDIA

Go against the flow and thrive

Roger Montgomery

October 27, 2012

In this Australian article published 27 October 2012 Roger discusses how behaving counterintuitively may result in better performance for your portfolio. Read here.

by Roger Montgomery Posted in In the Press, Insightful Insights, Investing Education, Market Valuation.

-

WHITEPAPERS

Why the Stock Market Doesn’t Work (White Paper)

Roger Montgomery

October 19, 2012

What is ailing the stock market and why have investors deserted it in droves?

Founder of Montgomery Investment Management and author of value-investing bestseller Value.able reveals the steps he is taking to ensure investor returns and investors return.

This white paper is exclusively for Roger Montgomery.com subscribers.

by Roger Montgomery Posted in Investing Education, Whitepapers.

-

What is your best performing stock pick for the next 9 months?

Roger Montgomery

October 5, 2012

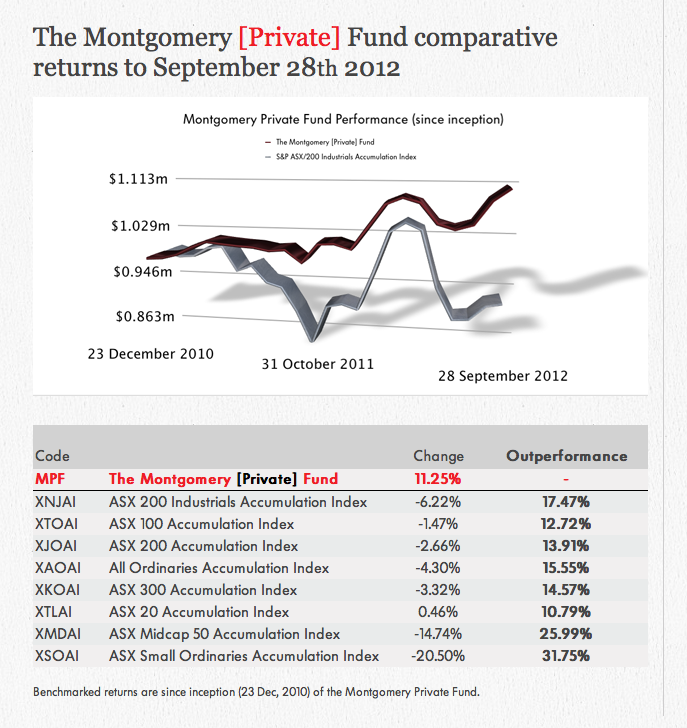

September was a challenging month for investors but Montgomery chalked up another outperformance in both The Montgomery [Private] Fund and The Montgomery Fund (see figure 1).

Of course in the short term the performance of share prices can be attributed to noise and randomness and so the bigger question is always; which businesses will be worth substantially more in the future?

What is your suggestion for the best performing stock for the next nine months to June 30, 2012?

Pick the best performing stock in the next nine months and gain fame and notoriety, kudos and credit.

Each month we’ll track the list and present the table until June 30, 2012.

All the best and stay tuned.

by Roger Montgomery Posted in Companies, Intrinsic Value, Investing Education.