Insightful Insights

-

Are two lemons better than one?

Roger Montgomery

January 31, 2012

Robert Gottliebsen penned an interesting piece in the Business Spectator today. Using data provided by James Stuart of Ferrier Hodgson that revealed Internet penetration – as a portion of sales for large US retailers – as high as 18% and comparing that to average penetration of online sales from retailers in Australia of 1%, Robert concluded that time is ticking for owners of commercial property.

I agree with Bob’s conclusions. Oroton’s online store is now its biggest store in terms of sales and sagging bricks and mortar retail growth will force many retailers to also move online and embrace the structural change or go the way of the dinosaurs.

Tight margins, expensive staff and exorbitant rents spell trouble for any business that cannot maintain prices in the face of an online and overseas onslaught.

The impact on rents of commercial buildings such as shops will ultimately be negative And on this point I agree with Bob. But we can add one more step to the scenario. Either a new generation of offerings replaces the old school tenants who are departing and rents are maintained or declining rents lead to lower real estate prices which encourages buyers who are both retail operators and store owners rather than tenants.

Incidentally, at Montgomery Investment Management we cannot find a single listed property trust that meets our criteria. If you can find value in the listed property sector do let us know, but we cannot.

I feel for those who bought shops in strips like to Toorak Road, Chapel Street and Oxford Street on capitalisation rates of less than 3% or 4%.

I also feel for fruit and vegetable growers in Australia who are about to find out what grocery suppliers and milk producers have recently experienced. Many farmers have told me of the mere cents per kilo received by them from major supermarkets who in turn sold the same produce at multiples of 10 and 11 times while explaining to farmers that they needed to charge such high multiples to cover the cost of business. The announcement on Today Tonight last night by Coles staffer Greg Davis of 50% cuts in the prices of fruit and vegetables, suggests the real cost of doing business is much lower than what the supermarkets have been telling farmers.

And if they’ve been dishonest with farmers then perhaps it’s a little disingenuous for Greg Davis to say on national television “We’re investing in prices as well, but our growers are working with us to plan our crops, to ensure that we’ve got certain year-round volumes. We buy in such huge volumes, it brings down the cost of the produce, so customers benefit and growers benefit, because we can move stock really quickly”. Do we reallyt need ore food to be produced? It seems Coles would like us to forget just how many thousands of tonnes of fruit and veg is thrown out by each of the supermarkets each year. According to the National Waste Report 2010, food waste constituted 4.5 million tonnes or 35% of municipal waste. When Coles talks about moving more products at lower prices are obviously not referring to us eating it!

Bruno writes in the comments below:

“Hi Roger,

Just a comment on what farmers are getting for their produce. Being a farmer I can tell you that the very most we have received for citrus is 40c per kg, but on average we get about 20c then we must pay 10c of that just to have them picked. My next door neighbor grew onions this year and also received 20c per kg. pumpkins are the same price. Rice is being sold by farmers for 18c per kg. wine grapes are being harvested right now for an average price of about 24c per kg (1kg is the amount of grapes needed for one bottle of wine) most if not all these crops cost about 10c per kg just to harvest! Of course farming is a cyclical business, and sooner or later what us farmers are paid will have to come up, otherwise there won’t be any farmers left. Where I live we are starting to see banks foreclose on farms, the irony is that no one is willing to buy a business that makes no money. So banks are forced to either lend more money, or spend their own cash to run the farms so the property value isn’t destroyed as fruit trees die. While we worry about the Europe crisis effect on the banks balance sheets we have a very big problem much closer to home which, if farmers don’t start to make a profit soon, will most defiantly effect the share values of the banks as bad debts get written off. if my wide went to work at woollies and at the end of the day she was given a bill from her boss for a days work, there’d be outrage. But when farmers are left in that exact situation, politicians and the like tell us “there’s healthy competition in the market place which benefit consumers” maybe in the short term but as more farmers abandon their farms which is happening, the price of all fruit and vege will definitely go up in the medium term as more and more farmers leave their land.”Further, the wholesale buying of arable agricultural land by foreign interests, the decimation of profitable agricultural enterprises due to irrational competition of the major supermarkets and the replacement of their product by foreign alternatives will not ultimately produce the best outcome for Australia.Australians cannot buy freehold land in China and foreigners are banned from owning the ground floor apartment in any building in Singapore so one does wonder whether our generosity is well placed all in the name of pursuing lower prices for short sighted consumers.

Posted by Roger Montgomery, Value.ableauthor and Fund Manager, 31 January 2012.

by Roger Montgomery Posted in Insightful Insights.

- 47 Comments

- save this article

- POSTED IN Insightful Insights

-

Are investors giving up?

Roger Montgomery

December 20, 2011

We have talked here at the blog about hypothecation, re-hypotecation and hyper-hypothecation, about credit default swaps about a Chinese property bubble bursting, about lower iron ore prices, slower economic growth, increased savings and declining rates of credit expansion and a European sovereign default. Always the value investor, we are on the look out for anything that can impact the values of companies and those things that might offer the prospect of picking up a few bargains.

We have talked here at the blog about hypothecation, re-hypotecation and hyper-hypothecation, about credit default swaps about a Chinese property bubble bursting, about lower iron ore prices, slower economic growth, increased savings and declining rates of credit expansion and a European sovereign default. Always the value investor, we are on the look out for anything that can impact the values of companies and those things that might offer the prospect of picking up a few bargains.If your portfolio still has some rubbish in it, then being able to identify it is a key part of preparing for cheaper prices if they eventuate.

I recently wrote a column for the ASX and pondered the possibility of a climactic event coinciding with a complete throwing in of the towel by equity investors who are simply fed up with poor medium term returns and increased volatility recently.

The ASX200 hasn’t generated a positive capital return since 2005 but quality companies have. The ASX200 contains stocks that are rubbish so it is no wonder that an index based on that rubbish has gone nowhere. Step 1 then is to clean up the portfolio and step 2 is to be ready for quality bargains when they arise.

This is just one of many scenarios and frameworks I am operating with and I wonder what would transpire if the poor returns or the recent heightened volatility continues for a little longer? Will investors simply throw in the towel, leave equities and believe all those advisors offering their own brand of ‘safe’, ‘secure’ and stable investments? On the one hand, I hope so. It would mean certain bargains.

Here’s the Column:

As global sharemarkets decline, remain volatile and produce poor historical returns compared to other asset classes, it will be easy to be swayed by the latest investment trend – to move out of shares. I believe the trend away from shares will gather pace soon as more and more “experts” use the rear-view mirror to demonstrate why sharemarket investors would have been better off somewhere else.

In 1974 US investors had just endured the worst two-year market decline since the early 1930s, the economy entered its second recessionary year and inflation hit 11 per cent as a result of an oil embargo, which drove crude oil prices to record levels. Interest rates on mortgages were in double digits, unemployment was rising, consumer confidence did not exist and many forecasters were talking of a depression.

By August 1979, US magazine BusinessWeek ran a cover story entitled ‘The Death of Equities’ and its experts concluded shares were no longer a good long-term investment.

The article stated: “At least 7 million shareholders have defected from the stockmarket since 1970, leaving equities more than ever the province of giant institutional investors. And now the institutions have been given the go-ahead to shift more of their money from stocks – and bonds – into other investments.”

But be warned. The time to get interested in share investing and make good returns is precisely when everyone else isn’t.

Your own once or twice-in-a-lifetime opportunity may not be that far away and Labor’s promised tax cut on interest earnings may sway even more to give up shares and put their money in a bank, providing the opportunity to obtain even cheaper share prices.

If prices do fall further – and they could – you will need to be ready and will need some cash. The very best returns are made shortly after a capitulation. Cleaning up your portfolio becomes crucial and this article looks at how to do that.

Rule one: Don’t lose money

The key to slowly and successfully building wealth in the sharemarket is to avoid losing money permanently. Sure, good companies will see their shares swing but the poor companies see the downswings more frequently.

Therefore, the easiest way to avoid losing money is to avoid buying weak companies or expensive shares. One of the simplest ways I have avoided losing money this year in The Montgomery [Private] Fund has been to steer clear of low-quality businesses that have announced big writedowns.

These are easy to spot using Skaffold.

Not-so-goodwill

I have often seen companies make large and expensive acquisitions that are followed by writedowns a couple of years later. Writedowns are an admission by the company that they paid too much for an asset.

When Foster’s purchased the Southcorp wine business in 2005 for $3.1 billion, or $4.17 per share, my own valuation of Southcorp was less than a quarter of that amount. Then in 2008 Foster’s wrote down its investment by about $480 million, and then again by another $700 million in January 2009 and a final $1.3 billion in 2010.

When too much is paid for an acquisition, equity goes up but profits do not and you can see that too much was paid because that ratio I have worked so hard to make popular, return on equity (ROE), is low.

These low rates of return are often less than you can get in a bank account, and bank accounts have much lower risk. Over time, if the resultant low rates of return do not improve, it suggests the price the company paid for the acquisition was well and truly on the enthusiastic side and the business’s equity valuation should now be questioned. If return on equity does not improve meaningfully, a large writedown could be in the offing. This will result in losses if you are a shareholder, and you have also paid too much.

Just remember one of the equations I like to share:

Capital raised + acquisition + low rate of return on equity = writedown.When return on equity is very low it suggests the business’s assets are overvalued on the balance sheet. That, in turn, suggests the company has not amortised, written down or depreciated its assets fast enough, which in turn means the historical profits reported by the company could have been overstated.

Scoring bad companies: B4, B5, C4 and below…

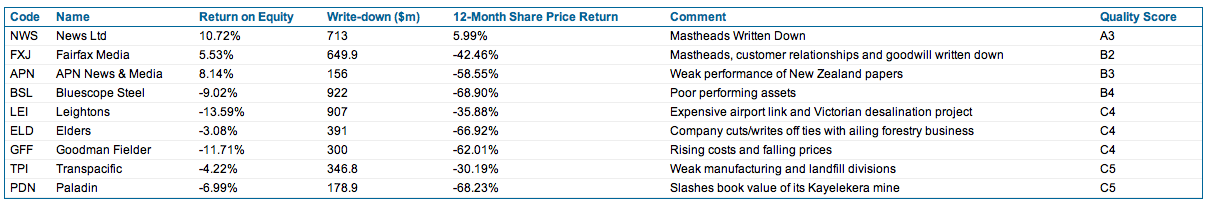

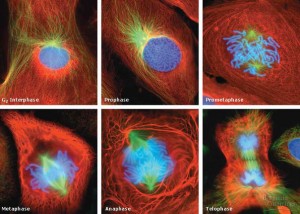

These sorts of companies tend to have very low-quality scores and often appear down at the poor end of the market – the left side of the screen shot in Figure 1 below.

Figure 1. The sharemarket in aerial view (Source; Skaffold.com)

Each sphere in Figure 1. represents a listed Australian company and there are more than 2000 of them. The diagram is taken from Skaffold. Their position on the screen can change daily as the price, intrinsic value and quality changes. The best quality companies and those with positive estimated margins of safety (the difference between the company’s intrinsic value and its share price) appear as spheres at the top right.

Companies that are poor quality (I call them B4, C4 and C5 companies, for example) are found on the left of the screen and if they have an estimated negative margin of safety, they are estimated to be expensive and will be located towards the bottom of the screen.

Highlighted with blue rings in Figure 1 are eight of the companies that announced this year’s biggest writedowns. Notice they tend to be at the lower left of the Australian sharemarket, according to my analysis.

If your portfolio contains shares that are red spheres and on the lower left, you could also be at risk because these companies tend to have low-quality ratings and are also possibly very expensive compared to their intrinsic value.

As is clear from Figure 1, this year’s biggest writedown culprits were all already located in the area to avoid.

The impact of owning such a business outright would be horrendous. Table 1 below reveals the size and details of these writedowns and as you can see, collectively the losses to shareholders amount to $4.6 billion.

Table 1. Predictable losses?

Warren Buffett once said that if you were not prepared to own the whole business for 10 years, you should not own a piece of it for 10 minutes.

Clearly you would not want to own businesses that pay too much for acquisitions and subsequently write down those assets. If you are not willing to own the whole business, don’t own the shares. Although in the short run the market is a voting machine and share prices can rise and fall based on popularity, in the long run the market is a weighing machine and share prices will reflect the performance of the business. Time is not the friend of a poor company, and companies Skaffold rates C4 or C5 are best avoided if you want the best chance of avoiding permanent losses.

Look at Figure 2 below. Those big writedown companies not only performed poorly but so did their shares. These companies (shown collectively as an index in the blue line below) produced bigger losses for investors than the poorly performing indices of which they are part. And that’s just over one year.

Figure 2. The biggest writedowns compared to the market

Take a look at the companies in your portfolio. Do they have large amounts of accounting goodwill on their balance sheet as a portion of their equity? Have they issued lots of shares to make acquisitions and are they producing low and single-digit returns on equity? If the answer to all these questions is yes, you may have a C5 company.

Cleaning up your portfolio not only lowers its risk but will produce cash that may just prove handy in coming months.

If you have made it this far then here’s evidence of the giving up I referred to in the column: http://www.smh.com.au/business/investors-turn-to-term-deposits-in-shift-away-from-equities-20111219-1p2ir.html

Posted by Roger Montgomery, Value.able author and Fund Manager, 20 December 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Market Valuation, Skaffold, Value.able.

-

Is the bubble bursting?

Roger Montgomery

December 8, 2011

In 2010 here at the Insights Blog I wrote:

In 2010 here at the Insights Blog I wrote:“a bubble guaranteed to burst is debt fuelled asset inflation; buyers debt fund most or all of the purchase price of an asset whose cash flows are unable to support the interest and debt obligations. Equity speculation alone is different to a bubble that an investor can short sell with high confidence of making money.

The bubbles to short are those where monthly repayments have to be made. While this is NOT the case in the acquisitions and sales being made in the coal space right now, it IS the case in the macroeconomic environment that is the justification for the purchases in the coal space.

China.

If you are not already aware, China runs its economy a little differently to us. They set themselves a GDP target – say 8% or 9%, and then they determine to reach it and as proved last week, exceed it. They do it with a range of incentives and central or command planning of infrastructure spending.

Fixed asset investment (infrastructure) amounts to more than 55% of GDP in China and is projected to hit 60%. Compare this to the spending in developed economies, which typically amounts to circa 15%. The money is going into roads, shopping malls and even entire towns. Check out the city of Ordos in Mongolia – an entire town or suburb has been constructed, fully complete down to the last detail. But it’s empty. Not a single person lives there. And this is not an isolated example. Skyscrapers and shopping malls lie idle and roads have been built for journeys that nobody takes.

The ‘world’s economic growth engine’ has been putting our resources into projects for which a rational economic argument cannot be made.

Historically, one is able to observe two phases of growth in a country’s development. The first phase is the early growth and command economies such as China have been very good at this – arguably better than western economies, simply because they are able to marshal resources perhaps using techniques that democracies are loath to employ. China’s employment of capital, its education and migration policies reflect this early phase growth. This early phase of growth is characterised by expansion of inputs. The next stage however only occurs when people start to work smarter and innovate, becoming more productive. Think Germany or Japan. This is growth fuelled by outputs and China has not yet reached this stage.

China’s economic growth is thus based on the expansion of inputs rather than the growth of outputs, and as Paul Krugman wrote in his 1994 essay ‘The Myth of Asia’s Miracle’, such growth is subject to diminishing returns.

So how sustainable is it? The short answer; it is not.

Overlay the input-driven economic growth of China with a debt-fuelled property mania, and you have sown the seeds of a correction in the resource stocks of the West that the earnings per share projections of resource analysts simply cannot factor in.

In the last year and a half, property speculation has reached epic proportions in China and much like Australia in the early part of this decade, the most popular shows on TV are related to property investing and speculation. I was told that a program about the hardships the property bubble has provoked was the single most popular, but has been pulled.

Middle and upper middle class people are buying two, three and four apartments at a time. And unlike Australia, these investments are not tenanted. The culture in China is to keep them new. I saw this first hand when I traveled to China a while back. Row upon row of apartment block. Empty. Zero return and purchased on nothing other than the hope that prices will continue to climb.

It was John Kenneth Galbraith who, in his book The Great Crash, wrote that it is when all aspects of asset ownership such as income, future value and enjoyment of its use are thrown out the window and replaced with the base expectation that prices will rise next week and next month, as they did last week and last month, that the final stage of a bubble is reached.

On top of that, there is, as I have written previously, 30 billion square feet of commercial real estate under debt-funded construction, on top of what already exists. To put that into perspective, that’s 23 square feet of office space for every man, woman and child in China. Commercial vacancy rates are already at 20% and there’s another 30 billion square feet to be supplied! Additionally, 2009 has already seen rents fall 26% in Shanghai and 22% in Beijing.

Everywhere you turn, China’s miracle is based on investing in assets that cannot be justified on economic grounds. As James Chanos referred to the situation; ‘zombie towns and zombie buildings’. Backing it all – the six largest banks increased their loan book by 50% in 2009. ‘Zombie banks’.

Conventional wisdom amongst my peers in funds management and the analyst fraternity is that China’s foreign currency reserves are an indication of how rich it is and will smooth over any short term hiccups. This confidence is also fuelled by economic hubris eminating from China as the western world stumbles. But pride does indeed always come before a fall. Conventional wisdom also says that China’s problems and bubbles are limited to real estate, not the wider economy. It seems the flat earth society is alive and well! As I observed in Malaysia in 1996, Japan almost a decade before that, Dubai and Florida more recently, never have the problems been contained to one sector. Drop a pebble in a pond and its ripples eventually impact the entire pond.

The problem is that China’s banking system is subject to growing bad and doubtful debts as returns diminish from investments made at increasing prices in assets that produce no income. These bad debts may overwhelm the foreign currency reserves China now has.”

I now wonder whether we are seeing the bubble slip over the precipice? Falling property prices (10 per cent of the Chinese economy) leads to lower construction activity, leads to declining demand for Australian commodities, leads to falling commodity prices, leads to bigs drops in margins for a sizeable portion of the market index…

Watch this video and decide for yourself.

Posted by Roger Montgomery, Value.able author and Fund Manager, 8 December 2011.

by Roger Montgomery Posted in Energy / Resources, Insightful Insights, Market Valuation, Property, Value.able.

-

Drunk from binge borrowing?

Roger Montgomery

November 25, 2011

A good friend who lives and works in the UK recently sent me an allegory that succinctly describes, for those who haven’t read Michael Lewis, the growth of sub-prime loans, the collateralised debt obligations into which they were securitised and the credit default swaps which were the tradable insurance contracts on the CDO’s. It then goes on to neatly leave us with the consequences.

A good friend who lives and works in the UK recently sent me an allegory that succinctly describes, for those who haven’t read Michael Lewis, the growth of sub-prime loans, the collateralised debt obligations into which they were securitised and the credit default swaps which were the tradable insurance contracts on the CDO’s. It then goes on to neatly leave us with the consequences.If you have seen it before or believe you have a solid understanding of the events, you are many steps ahead of most. For the rest of us,

Heidi provides an explanation;

Heidi is the proprietor of a bar … She realises that virtually all of her customers are unemployed alcoholics and, as such, can no longer afford to patronise her bar. To solve this problem, she comes up with a new marketing plan that allows her customers to drink now, but pay later.

Heidi keeps track of the drinks consumed on a ledger (thereby granting the customers loans). Word gets around about Heidi’s “drink now, pay later” marketing strategy and, as a result, increasing numbers of customers flood into Heidi’s bar. Soon she has the largest sales volume for any bar in Manchester…

By providing her customers freedom from immediate payment demands, Heidi gets no resistance when, at regular intervals, she substantially increases her prices for wine and beer, the most consumed beverages. Consequently, Heidi’s gross sales volume increases massively.

A young and dynamic manager at the local bank recognizes that these customer debts constitute valuable future assets and increases Heidi’s borrowing limit. He sees no reason for any undue concern because he has the debts of the unemployed alcoholics as collateral!

At the bank’s corporate headquarters, expert traders figure a way to make huge commissions, and transform these customer loans into DRINKBONDS. These “securities” then are bundled and traded on international securities markets.

Naive investors don’t really understand that the securities being sold to them as ‘AAA Secured Bonds’ really are debts of unemployed alcoholics. Nevertheless, the bond prices continuously climb – and the securities soon become the hottest-selling items for some of the nation’s leading brokerage houses.

One day, even though the bond prices still are climbing, a risk manager at the original local bank decides that the time has come to demand payment on the debts incurred by the drinkers at Heidi’s bar. He so informs Heidi. Heidi then demands payment from her alcoholic patrons. But, being unemployed alcoholics they cannot pay back their drinking debts. Since Heidi cannot fulfil her loan obligations she is forced into bankruptcy. The bar closes and Heidi’s 11 employees lose their jobs.

Overnight, DRINKBOND prices drop by 90%. The collapsed bond asset value destroys the bank’s liquidity and prevents it from issuing new loans, thus freezing credit and economic activity in the community. The suppliers of Heidi’s bar had granted her generous payment extensions and had invested their firms’ pension funds in the BOND securities. They find they are now faced with having to write off her bad debt and with losing over 90% of the presumed value of the bonds. Her wine supplier also claims bankruptcy, closing the doors on a family business that had endured for three generations, her beer supplier is taken over by a competitor, who immediately closes the local plant and lays off 150 workers.

Fortunately though, the bank, the brokerage houses and their respective executives are saved and bailed out by a multibillion dollar no-strings attached cash infusion from the government. The funds required for this bailout are obtained by new taxes levied on employed, middle-class, non-drinkers who have never been in Heidi’s bar.

Its nicely articulated don’t you think? Fortunately the problem is contained to…Earth. But where too next?

Postscript: This week, China’s vice-premier and head of finance, Wang Qishan, predicted that the global economy has commenced a long-term recession. He observed: “Now the global economic situation is extremely serious and in such a time of uncertainty the only thing we can be sure of is that the world economic recession caused by the international crisis will last a long time.”

Posted by Roger Montgomery, Value.able author and Fund Manager, 25 November 2011.

by Roger Montgomery Posted in Insightful Insights.

- 104 Comments

- save this article

- POSTED IN Insightful Insights

-

What on earth is a covered bond?

Roger Montgomery

November 18, 2011

When Sean Connery played James Bond in the 1967 hit, You Only Live Twice one doubts he had this week’s billion dollar covered bond issue of ANZ in mind. Asking the question “what is a covered bond?” reveals an extra life has been given to borrowers at the expense of prudent savers. Its Australia’s own little moral hazard.

moral hazard n.- a situation in which a party insulated from risk behaves differently from how it would behave if it were fully exposed to the risk.

According to the Treasurer, Wayne Swan, legislation the government passed last month will strengthen the local financial system, increase the supply of credit, and provide cheaper, more stable and longer-term funding.

ANZ this week issued $US1.25 billion of five-year covered bonds. CBA is looking to Europe for its issue while Westpac and NAB are said to be eyeing the US debt markets for theirs ahead of increases in wholesale funding costs on their upcoming refinancing.

When banks issue covered bond they pay a lower rate on their funding than if they issued senior unsecured debt. And if as some commentators suggest the banks in aggregate issue $100 billion of this stuff in coming years the savings can amount to more than half a billion in interest expenses.

The lower rate that banks enjoy on covered bonds is partly due to the AAA rating they receive. This AAA rating (which is higher than the AA rating the banks themselves enjoy) is derived from the fact that banks can use their assets (loans presumably) as collateral for issuing the bonds. If the bank goes bust, the bond holder as recourse to those assets.

Interestingly (and here’s why they just might be Triple A), if the assets are worthless the bondholder has recourse to the bank itself. In other words those bond holders get access to your deposit money and those bond holders rank BEFORE you in terms of their right to your money.

Unsurprisingly, the size of the covered bond market is therefore capped. Banks can only issue covered bonds backed by up to 8 per cent of their assets. Based on the majors’ full year results, the ANZ, CBA, WBC and NAB have a collective $2.686 trillion in assets. Eight percent of those assets amounts to $214.9 billion.

Many believe that the issues in Europe are contained to Europe. Someone wriley observed recently however that debt crises are only contained to planet earth. Investors like central banks who are limited to investing in AAA rated securities will no doubt be interested in the paper because our banks are perceived as safe. But what is that assumption based on? We’ll leave that discussion for your comments below.

What I am most interested in is the unilateral decision to allow that which has previously not been permitted; To rank a bond holder ahead of you in terms of rights to your deposits.

On the flip side, the banks argue that the cheaper funding means you can borrow from them more cheaply – assuming they pass it on of course. But like the ladies in James Bond’s bath, its all part of the policy drive in this country to make things cheap. Cheaper cars at the expense of local manufacturing, cheaper flights at the expense of local jobs, cheaper food at the expense of local farmers and cheaper bonds at the expense of your entitlement to your deposit.

Keep prices down and there won’t be an uprising. Have a good weekend.

Posted by Roger Montgomery, Value.able author and Fund Manager, 18 November 2011.

by Roger Montgomery Posted in Financial Services, Insightful Insights.

-

Are bargains available at Woolworths?

Roger Montgomery

November 17, 2011

On Wednesday November 2 Woolworths held a strategy briefing for professional investors. Woolworth’s effectively asked us to adopt a longer time frame before judging its performance and revealed four strategic priorities that I will describe in a moment.

Prior to the strategy day, the company updated the stock market with a growth outlook that was the lowest in a decade. The market responded negatively to the change and it entrenched previous sentiment by professional investors to switch from Woolworths to Coles.

But Woolworths remains a superior business from a business economics perspective, with high return on equity and it also remains cheaper than its competitor as measured by the larger discount to an estimate of its intrinsic value.

The wider sentiment towards Woolworths Supermarkets is that the period of strong growth is over, and the other businesses, such as Big W, the New Zealand supermarkets, the Masters hardware venture and a possible acquisition of The Warehouse group could be the focus of earnings growth for the company. Gambling pre-committments would not be.

Meanwhile, the Woolworths-owned Dick Smith electronics business appears to have failed to excite consumers and has certainly failed to excite investment professionals. Dick Smith is a relatively weak offering in a market that has been hit particularly hard by the empowerment of the consumer through high Australian dollar.

Moreover, in many ways these businesses are peripheral since the Australian Food & Liquor division accounts for 80% of earnings before interest and tax.

The impact of the company’s lower growth profile on intrinsic value, particularly intrinsic values over the next two years, has been negative and intrinsic value does not appear to be going anywhere in a great hurry (see Skaffold chart below).

This combination of circumstances, in my experience, set Woolworths shares up to be vulnerable to any negative shocks.

Estimating intrinsic value is not the same as predicting price direction, however the above circumstances are not unique historically in putting a lead on price appreciation.

On top of the above combination of factors, there is also the continuing debate in Parliament about the introduction of preset loss limits for poker machines, which, if introduced, would negatively impact Woolworths’ gaming business. Though it is most closely associated with supermarkets, Woolworths is actually the largest poker machine owner in the country, with more than 10,700 pokies.

And a few weeks ago, The Economic Times of India also reported that Woolworths appears to have been dumped by its Indian partner, Tata Group. Woolworths enjoyed a five-year partnership with Tata, introducing Dick Smith-style electronics stores to India under the Infiniti Retail brand. Even though foreign retailers are not permitted to have a direct presence in India, Woolworths partnership offered the hope of growth – albeit with a partner – if the rules were ever relaxed.

Nonetheless, despite these accumulative negative factors, Woolworths is regarded by conventional analysts and investors as a defensive’ company. Its strong cash flows and its status as a major retailer of food makes it an ideal investment in a recessionary or slow or low growth environment. The company also enjoys entrenched competitive advantages over smaller rivals that, until now, the ACCC has done little about. One example of this are the new EFTPOS charges.

From the first of this month, the new Eftpos Payments Australia Limited (EPAL) fees mean retailers incur a 5¢ fee for every transaction over $15 (75% of all EFTPOS transactions). Previously there was no fee and that will still be the case for transactions under $15, which means 25% of transactions.

The retailer’s bank will charge the retailers, some of whom are describing the charges as an “EFTPOS tax”, and they will have no choice but to pass on to the consumer.

Unsurprisingly, EPAL’s members include the major banks, Coles and Woolworths and, because they manage their own terminals, they can opt out of the new charges.

But despite these entrenched advantages, Woolworths has been hit – or so it says – by the state of the economy, noting in its annual report: “Consumer confidence remained historically low as customers reacted adversely to rising utility costs, interest rate hikes in the first half of the year and general global uncertainty, and opted to save rather than spend their money”.

From an investment perspective it is worth noting that retail investors now have a choice of supermarkets, with Coles improving its offering to consumers and taking market share from the incumbent Woolworths.

The investment community is not convinced that further changes to private-label offerings or more innovation around the supply chain will make a dramatic difference to the growth prospects for Woolworths, which set below forecast growth in household income, population and the economy.

One other source of earnings growth is cost-cutting, but the reality is that gains from such strategies are one-offs and again unlikely to excite investors.

Having presented the negatives – which have caused the share price to fall 12% since July, one positive was the strategy briefing’s opportunity to showcase new CEO Grant O’Brien, who replaces Michael Luscombe. The company announced that it planned to extend and defend its leadership in food and liquor, act on the “portfolio” to maximise shareholder value, maintain its track record of building new growth businesses (we’ll ignore Dick Smith) and finally, put in place the enablers for a new era of growth.

In the supermarkets business WOW hopes to grow fresh produce from 28% market share to 36% market share. If achieved this would be an additional $2.5b in sales. Woolies also wants to target a doubling of home brand sales and this aim flies in the face of the ACCC’s stated concerns.

The company will also open 35 new BIG W stores in next 5 years reaching 200 by 2016.

In a reflection of the massive structural shift online, BIG W’s 85,000 in-store SKUs will be expanded and all put online.

And the topic on the tip of everyone’s tongue; Masters. There are now five stores open, another two are due to open in December/January, there are 16 under construction another 100 in the pipeline and the company reported the venture is well ahead of budget.

I also note the advertised sale of $900 million of property ($380 million of which was sold last financial year); and, most recently, the oversubscribed $500 million hybrid note raising that substantially extend the balance sheet strength of the company.

Below we examine the intrinsic value track record and prospects for Woolworths based on current expectations for earnings growth and returns on equity using Skaffold.com

Woolworths (MQR: B2) is currently trading at the same price it was in December 2006 and February 2007, despite the fact profits have risen 11.1% pa, from $1.3 billion to a forecast $2.2 billion in 2012. This growth in profit however is offset by having 16 million more shares on issue; by increased borrowings – up $1.8 billion to $4.8 billion; and by retained earnings, which have risen by $2 billion. The increase in shares on issue and retained earnings have offset the positive impact on return on equity rising profit would normally have.

The latest estimate of its intrinsic value, of $23.23, is forecast to rise modestly over the next two years. For investors looking at opportunities to investigate only when a meaningful discount to intrinsic value is presented, a price of $19 or less for Woolworths would represent at least 20 per cent.

Posted by Roger Montgomery, Value.able author and Fund Manager, 17 November 2011.

by Roger Montgomery Posted in Companies, Consumer discretionary, Insightful Insights, Investing Education, Skaffold.

-

Is it just Harvey Norman or bricks & mortar retailing generally?

Roger Montgomery

November 17, 2011

You don’t normally expect to get investment tips from a mothers’ group get-together, but that’s what happened to me recently when the conversation turned to retail operations.

Relaxing with a glass of pinot gris the women, who have met regularly for a decade, were explaining why they spend less time in Harvey Norman stores than they used to. Why? Tired stores, tired layouts and uncompetitive prices have served the retailer only with the need to revamp its entire offering. And that, it hasn’t done.

Retailing in Australia has been in the eye of a perfect storm for some time. As I’ve written previously, the strong Australian dollar has encouraged overseas travel and online purchases from overseas businesses; and the two-speed economy has ensured that credit growth (the borrowing of more money to buy stuff) is muted.

I’ve always been suspicious of a company that issues a report to the market after the close of trade. On Monday 31 October, a major retail business in Australia did just that. After closing time, Harvey Norman released its sales and earnings for the first quarter of the 2012 financial year. Given its timing, the announcement was almost certain to be negative. Indeed, the stock fell 4% the next day.

Instead of focusing on the retailing offer, refreshing store designs and improving range, company representatives focus on property, horse racing (Gerry Harvey is one of the country’s biggest bloodstock owners), goading the Reserve Bank of Australia to cut rates in “the national interest” and campaigning to have Australians pay GST on items they buy overseas for less than $1000.

Harvey Norman’s first-quarter sales were down 3.8%, as were like-for-like sales. In Australia, like-for-like sales were down 2.8%, in New Zealand down 10.6%, down 8.9% in Slovenia and down 11.1% in Northern Ireland. A stronger currency against the New Zealand dollar, the Euro and the pound has exacerbated the results. Profit before tax – a very important measure to us when estimating intrinsic value – was down by … wait for it, 19.3%!

Harvey Norman claims the strong Australian dollar and the closure of 34 Clive Peeters stores contributed to the poor result. I would argue that a failure to reinvent the offering also contributed. More worryingly, this latter factor is unlikely to go away any time soon.

Compounding this problem is the very likely scenario that the declining iron ore price – recently at about $115 a tonne – will seriously crimp margins for the only sector that has been running at full capacity in this country. Australia’s stock market has become the tail that wags the dog. Its wealth-effect on Australians and the impact on sentiment are important determinants of activity and in particular, retail activity.

With the All Ordinaries index dominated by resource companies and financial services companies it is possible, if not probable, that a declining iron ore price leads to lower stock prices and lower economic activity. I am no economist, but I can understand some experts’ calls for further rate cuts.

Back to Harvey Norman, and like-for-like sales declines of 2.8% compares favourably with JB Hi-Fi’s decline of 3.5%. Indeed, if it became a trend, one would argue Harvey Norman is winning back market share from JB Hi-Fi.

But before you get too excited about this comparison, you have to realise JB Hi-Fi’s profits are higher than they were last year and last year’s profits were higher than the year before that. In Harvey Norman’s case, profits before tax are down 19.3% compared to the same time last year, and last year first-half profits were down 16.5% from the year before that! One retail analyst I know and respect made the point that at this rate Harvey Norman will produce an average profit slightly ahead of the first-half profit made back in 2004, when it generated sales revenue of 62% of today’s sales.

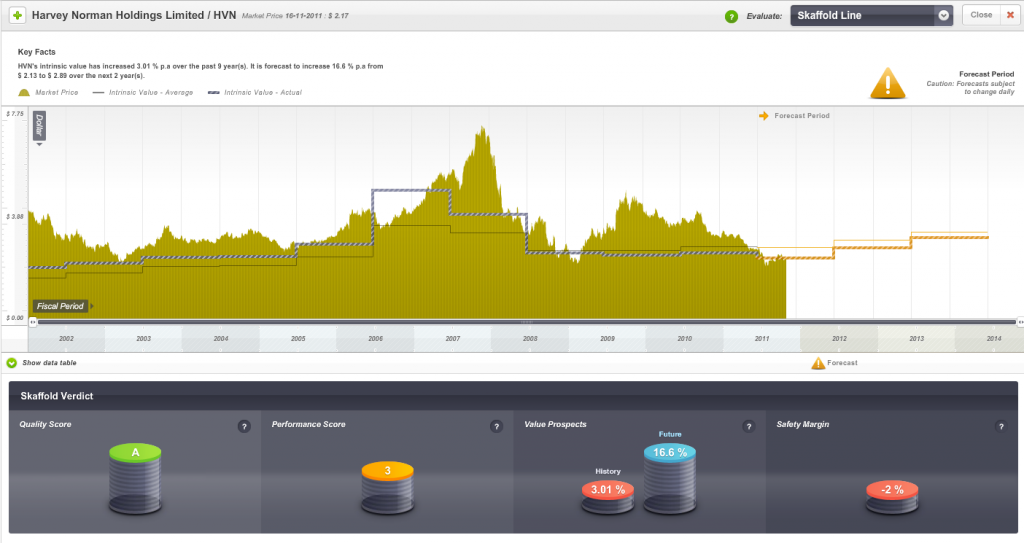

My intrinsic value estimate for Harvey Norman is about $2.00 a share against today’s share price of $2.17. However this is based on earnings per share of 23¢ for 2012 and that is, quite possibly, optimistic. Over the next few weeks, analysts will bring their earnings after tax estimates down for 2012 materially. This will have a negative impact on intrinsic values and I suspect we will discover a price above $2 is a premium to intrinsic value. Most interestingly, for followers of any rational approach to calculating intrinsic value, Harvey Norman’s updated intrinsic value is no higher today than it was nine years ago, in 2003.

This can be seen in the following chart, which plots the share price of Harvey Norman against its estimated intrinsic value. Generally, we look for companies that have a demonstrated track record of rising intrinsic values and are available at a large discount to the current year’s intrinsic value (see 2006 in the graph).

The lack of any real change in intrinsic value and prices (which follow intrinsic value in the long run) reflects the maturation of the business. You can see that in the short run (in 2007 and again in 2009-2011) prices can get ahead of themselves thanks to many factors including irrational exuberance.

In the long run, however, the market’s weighing machine will do its thing and prices generally revert to intrinsic value. That’s why having a rational method for estimating intrinsic value is so important!

The forecast change in intrinsic value may also decline now that Harvey Norman has provided lower guidance. And it’s not unusual for analyst forecasts to be “hockey-stick” optimistic at the commencement of the financial year.

But long-term, Harvey Norman is a mature business in a small country and it continues to swim upstream against the online retailing avalanche. This is a structural shift rather than a short-term trend and Harvey Norman will need to respond by convincing Australian women in mothers’ groups all round the country that it is fresh, new and competitive.

Posted by Roger Montgomery, Value.able author and Fund Manager, 17 November 2011.

by Roger Montgomery Posted in Consumer discretionary, Insightful Insights, Investing Education, Skaffold.

-

Is Australian manufacturing dead, or just in need of a cuddle?

Roger Montgomery

October 13, 2011

With high salaries, higher rents, a strong Aussie dollar and ‘level-playing-field’ policies, are Australian manufacturers being unwillingly and inexorably dragged to doormat status?

We are in a race to the bottom and run the risk of ultimately being chewed up and spat out when our commodities are no longer required with such urgency.

Driven by a belief that economists are right and the way to measure happiness is by the consumption of “stuff”, government policy in Australia is set to keep the masses happy by making that “stuff” as cheap as possible.

Our way of life, and the quality of that life for our kids, is at risk if we continue to be apathetic. Driving around Sydney’s Eastern Suburbs and Lower North Shore, its apparent there isn’t a communal approach to the solution. Instead there is an individual race to accumulate more “stuff” to protect oneself. “Forget about the neighbours”. “Look after number one”. “If I have plenty in the bank, the kids and grandkids will be set up. What do I care if the rest of Australia goes to pot?”

It’s like watching seagulls fighting over a Twistie.

When competing against a country with an ethos that puts ‘the people’ first, what hope does a country whose constituents are clambering over each other for the next short-term dollar have?

Manufacturing in Australia needs help. I am not suggesting protection or a hand out. I am suggesting a leg-up.

Singapore rolls out the red carpet for new businesses with tax-free holidays for the first few hundred thousand in profits. What does the Australian government do for new businesses in Australia? A TAFE course? R&D tax breaks are a start, but helping big business roll out classrooms at $5000 per square metre helped who exactly?

Unemployment in Australia’s wealthiest suburbs is creeping up because we don’t need so many bankers and Merger & Acquisition experts when there aren’t any businesses left to merge and acquire.

Can our current way of life survive without manufacturing? It seems we may just find out. What will we do without manufacturing?

The commodity boom will end one day and we are selling large tracts of arable land to foreign investors. Without manufacturing, will we be running around serving each other lattes? Is that it?

Australia is still the home of ingenuity. Just look at programs like the ABC’s New Inventors. The best and brightest should be receiving generous awards and access to incubator programs that ensure the international success and that the commercial benefits flow back to Australia.

One American recently lamented “10 years ago we had Steve Jobs, Bob Hope and Johnny Cash. Now we have no jobs, no hope and no cash”. If we don’t want to end up in the same place, Australia needs to do more to help incubate, nurture, commercialise and protect our best ideas.

And what are we doing bringing the brightest foreign students into Australia, giving them some of the world’s best education and sharing our IP and then, when they graduate, telling them they cannot work here and sending them home to compete with us?

“Go Australia”? Or “Go, Get Out of Australia”?

We also have some amazing established manufacturing businesses – paint, water heaters, bull bars, truck tippers, caravans, mattresses, wine, beer, pharmaceuticals, chemicals, anoraks, toilets.

The list of those producing attractive products and results is nothing short of A1.

A company that…

1) Has built a brand and or reputation for quality, value or innovation;

2) Is vertically integrated – owning the distribution channel;

3) Is manufacturing a highly specialised or customised product and not competing solely on price;…has a chance to succeed in manufacturing in Australia. And while it’s a shame our government has gradually allowed manufacturing to ‘die’, there are pockets within which Value.able Gradutes can find extraordinary businesses, especially when the market’s manic phase turns to depression.

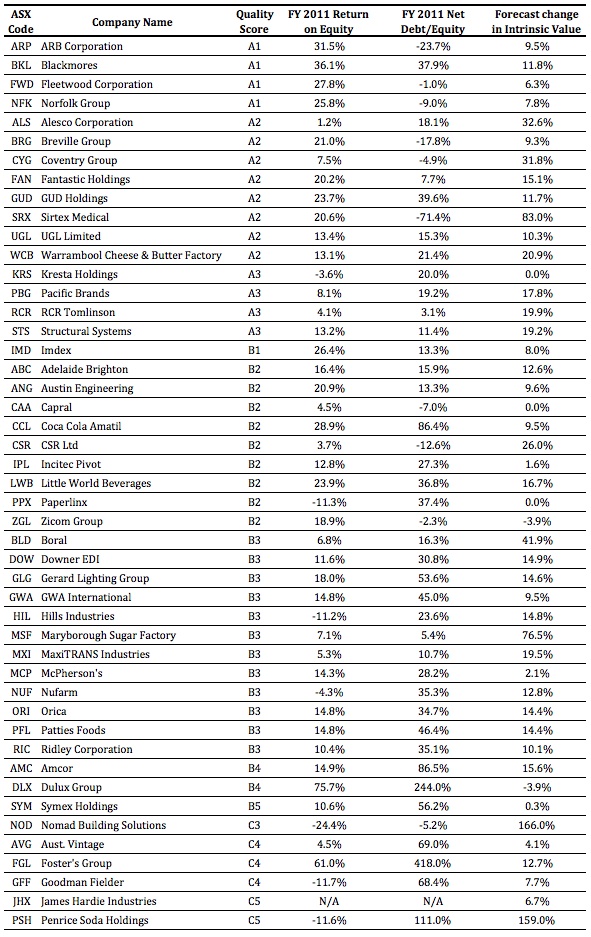

Many of the manufacturers listed in the following table have a long history of operating through a variety of economic conditions. They are ranked from A1 down to C5 – you can immediately see the broad spread of quality. I find looking at the ‘tails’ to be particularly insightful.

While declining in volume, manufacturing in Australia is not dead. Indeed some businesses are positively ‘raking it in’.

Manufacturing is tough and because inflation is always running against a business with a high proportion of fixed assets, smart managerial decisions are constantly required.

Ironically, with so many winds against manufacturers, those that have little or no debt, high rates of return on equity, bright prospects for future growth in intrinsic value and are trading at substantial discounts to current intrinsic value, may just prove to be Value.ablely positioned to leverage a broader economic recovery, locally and globally.

Who’s your top pick for Australia’s best manufacturer? I also want to hear your stories about manufacturing here. Are you a business owner that makes something we should be proud of? How is government policy or a monopoly customer affecting you? What changes need to be made to give Australia a fighting chance?

The universe of great businesses to invest in will inevitably decline unless something is done.

I look forward to your stories. They will be read by the who’s who in banking, management and government, so jot down your thoughts and share your Value.able experiences.

Posted by Roger Montgomery and his A1 team (courtesy of Vocus Communications), fund managers and creators of the next-generation A1 stock market service, 13 October 2011.

by Roger Montgomery Posted in Insightful Insights, Manufacturing, Value.able.

- save this article

- POSTED IN Insightful Insights, Manufacturing, Value.able

-

Which A1 twin is outperforming?

Roger Montgomery

October 6, 2011

This journey began with the simple question Will David beat Goliath?

This journey began with the simple question Will David beat Goliath?Value.able Graduate Scott T resolved to take up a fight with conventional investing, by tracking the performance of a typical and published ‘institutional-style’ portfolio against a portfolio of companies that receive my highest Montgomery Quality Ratings.

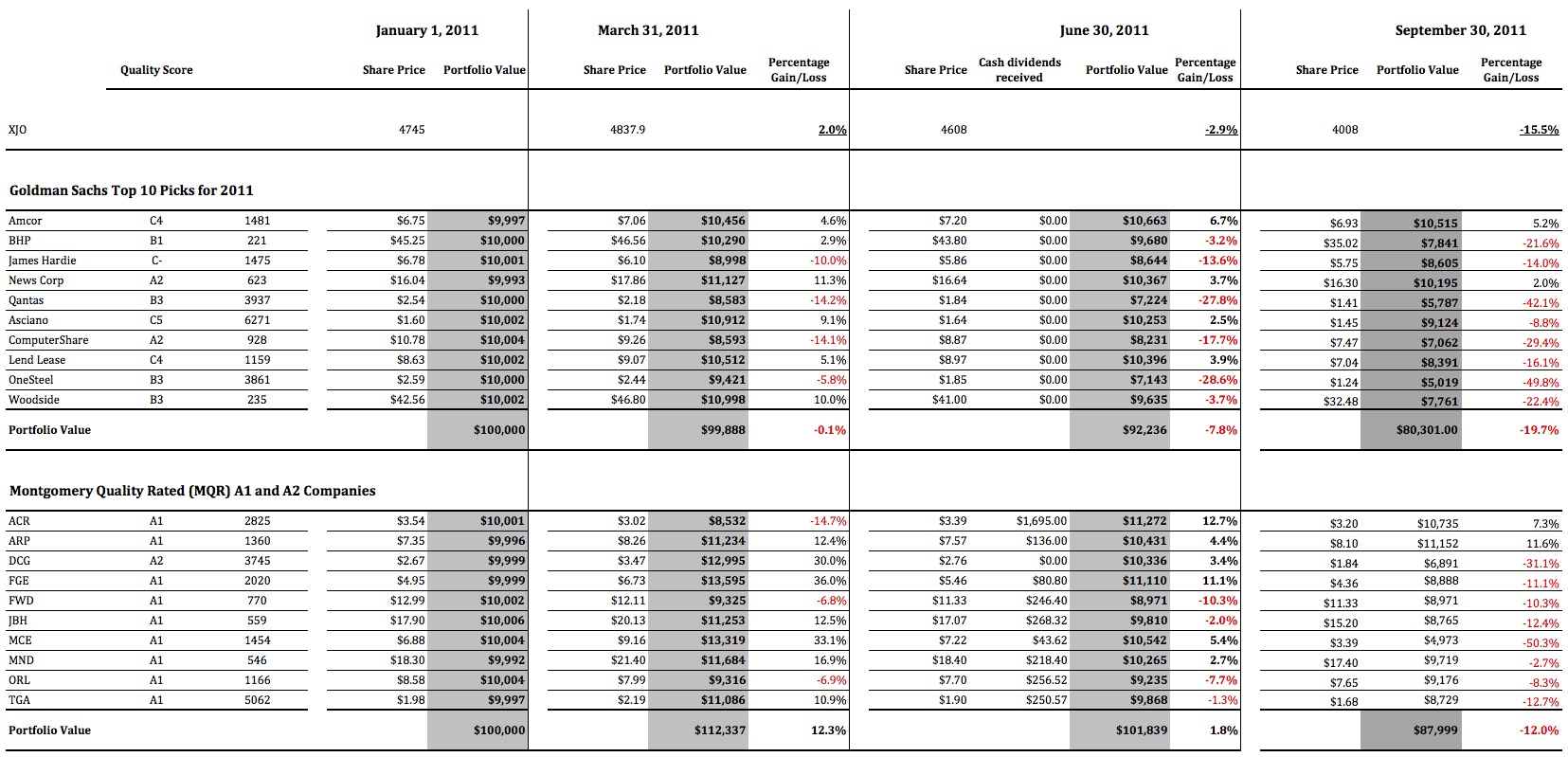

By 30 June 2011 the A1 portfolio was up 1.8 per cent compared to the XJO, which was down 2.9 per cent. As for the conventional ‘institutional’ portfolio, the bankers were down 6.2 per cent.

Over to Scott T for his third quarter update…

“For new readers to Roger Montgomery’s Insights Blog, welcome. Here at Roger’s blog we are conducting a 12-month exercise measuring the performance of a basket of 10 stocks recommended by Goldman Sachs, against a basket of 10 A1 or A2 businesses that were selling for as big a discount to Intrinsic Value as we could find.

“Nine months have now passed since our twin brothers each invested their $100 000 inheritance, and it has been a very turbulent time in the market.

“Our Queensland regional accountant has had his head down at the office for the entire quarter. The end of the financial year had come and gone and hundreds of clients where sending in their tax documentation, calling with questions and chasing their refunds. Time flew by in the office, and he hardly had time to try to attract new clients, let alone watch the daily gyrations of the global equities markets. By the end of September when he was finally able to take a breath and look at the performance of his portfolio.

“He was surprised at how poorly his portfolio of A1 and A2 companies, acquired at prices less than they were worth, had faired. But he quickly realised the overall market had done even worse. Loosing 12 per cent, or $12 000, YTD was bad. But it could have been worse, much worse.

“His twin brother was in a world of pain. The federal department he worked for felt like it was under attack. The mood in the department was that the media seemed hell bent on criticising everything the government did. No initiative was well received and every announcement was instantly compared to last months failure. To top it all off, every night he would check his portfolio, to see how much more of his inheritance had vanished. The red negative number on his spreadsheet just seemed to steadily increase. With little information to go on, and a feeling of helplessness washing over him, he thought seriously about visiting his financial advisors, desperately seeking reassurance, and perhaps changing the mix of the stocks held. He resounded, “Buying what they advised would be good for 2012”.

“As per the first half of the year, dividends will be picked up in the fourth quarter, when shares have finished going ex-dividend and the dividends have actually been received.

“In summary for the nine months to 30 September 2011:

The XJO is DOWN 15.5 per cent

The Goldman Sachs Portfoliois DOWN 19.7 per cent

The A1 and A2 Portfolio is DOWN 12.0 per cent

The A1 and A2 Portfolio has achieved an OUTPERFORMANCE of 3.5 per cent over the XJO and 7.7 per cent over the Goldman Sachs portfolio.“Here are the portfolios in detail, including cash dividends received in the first half (click the image to enlarge)

“We will visit the brothers again at the end of December for a final wrap up of their first year, and discuss their strategies for 2012

“All the Best

Scott T”Thank you Scott.

How is your A1 portfolio performing?

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 stock market service, 6 October 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

Are your profits recurring?

Roger Montgomery

September 30, 2011

With school holidays well and truly underway, plenty of my peers are also taking a few days off here and there to take their kids to the football finals, duck up to the beach or entertain. That offers plenty of time to review your portfolio with recurring profits in mind.

With school holidays well and truly underway, plenty of my peers are also taking a few days off here and there to take their kids to the football finals, duck up to the beach or entertain. That offers plenty of time to review your portfolio with recurring profits in mind.Stability and predictability are two key words that many investors are unlikely to have heard in recent times and two important components of the ‘toolkit’ that may have gone astray. But at all junctures of the business cycle, stability and predictability are helpful investment partners.

Irrespective of whether you are building a portfolio from the ground up or are reviewing your current holdings, it is vital that you ensure your portfolio is always pointed in the right direction. Few, if any are able to reliably and predictability predict short-term share prices so there is relevance, if not necessity, in ensuring the very best opportunity is given to your portfolio. When a recovery transpires and investors are willing to accept risk again, the portfolio constructed from businesses with some stability and predictability to their revenues and earnings streams will have an excellent chance of outperformance.

While there are many definitions of what constitutes ‘stable’ and ‘predictable’, in terms of business analysis, recurring revenue would be the one I would use. And if you built a portfolio of such businesses, would it matter if this week a country defaulted on its debt or another had its credit rating downgraded? These issues are both temporary in nature and only likely to impact share prices, not the economics of the business.

Long-term contracts are the best form of recurring revenues and these contracts take many forms; There are of course the obvious long-term contracts, such as a mobile phone plan, internet or TV subscription, a car lease or a property tenancy, but less obvious are the long-term contracts we have with our own bodies to feed them, clean them and take out the waste. We have a long-term contract with our teeth, our cutlery and our toilets and these contracts ensure Coles and Woolworths, Kelloggs, Procter & Gamble and Kimberley Clark have millions of customers buying their consumables frequently and with monotonous regularity. In other words – recurring revenue.

Knowing that a percentage of revenue can be relied upon to come in the door each year allows a business to budget, rewarded staff consistently and plan expansions with fewer surprises.

And if you are buying a small piece of such a business, you can sleep more comfortably at night ‘knowing’ that your share will always have value even if the share price halves or worse.

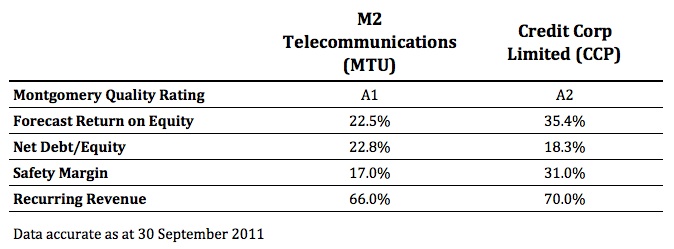

The following two businesses are examples of companies we hold in The Montgomery [Private] Fund, and that we believe display the characteristic discussed.

M2 Telecommunications is a reseller of telecommunications equipment and services into the $6 billion SMB Telecommunications market. While dominated by Telstra (ASX:TLS) with 80 per cent market share, M2 is the seventh largest Telco in Australia with a 4.5 per cent share.

Two thirds of the business’s revenue is recurring via traditional fixed voice services, mobile (phone and broadband) and wholesaling services. Typically, contracted revenue is on 2-4 year terms giving management a significant amount of predictability.

It is due to this predictability that management have forecast 15 per cent earnings growth for FY12 and have the ability to self-fund a couple of large acquisitions, which Vaughn Bowen has moved aside from day-to-day duties to focus on.

Credit Corp – With new management installed and a demonstrated focus on transparency and sustainable growth, 70 per cent of collections are now on recurring payment arrangements.

This frees up collection staff to focus on those clients that are finding it harder to repay their liabilities and drives efficiencies across the group. Not only this, but the degree of certainty has allowed management to invest in even more self-funded ledger purchases and forecast earnings of $21m-$23m in FY12.

Additionally, the businesses offer the following financial metrics:

High Montgomery Quality Ratings (MQR), high forecast ROE’s, low debt levels, a Safety margin and high, recurring revenues have attracted us. After conducting your own research and seeking and taking personal professional advice, I’d be interested to know whether these companies or any others meet your recurring revenue test.

Go ahead and use this blog post as the beginning of a thread listing companies with solid recurring revenue and earnings.

Given the time to be interested in stocks is when no one else is, now is the time to go through your portfolio and determine those holdings that have a component of revenues that are recurring.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 stock market service, 30 September 2011.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Value.able.