Insightful Insights

-

Is China exporting inflation now? Did the RBA know? What’s going on at RIO?

Roger Montgomery

February 10, 2012

Following on from our comment yesterday about BHP and comments in the media explaining why we weren’t buyers of BHP or RIO (falling Iron Ore prices and a contracted customer (28% of RIO’s revenue last year) who won’t honor contracts), we are interested in the flow of information through the week.

Following on from our comment yesterday about BHP and comments in the media explaining why we weren’t buyers of BHP or RIO (falling Iron Ore prices and a contracted customer (28% of RIO’s revenue last year) who won’t honor contracts), we are interested in the flow of information through the week.First the RBA held off cutting rates. Did they know that China would soon be exporting inflation (cost pressures there)? Then the next day China reported…guess what….the biggest jump in inflation…so forget about rate cuts there to help out US and Euro exports?

And now we are hearing that over at RIO a freeze has been placed on contractors and recruitment. Read; “massive overspend / cost inflation”.

Today Bloomberg quoted an analyst on China: “Domestic demand was genuinely weak in January, while exports remained on a gradual downward trend,” said Yao Wei, a Hong Kong-based economist for Societe Generale SA. And “Tom Albanese, chief executive officer of Rio Tinto Group, said yesterday he remains confident of a so-called soft landing in China… Inflation (CNCPIYOY) accelerated last month for the first time since July as food prices climbed before the holiday that started Jan. 22, a statistics bureau report showed yesterday. An index of export orders in the agency’s survey of manufacturing purchasing managers released last week showed a contraction for the fourth straight month. The IMF said in a Feb. 6 report that China’s economic expansion may be cut almost in half from its 8.2 percent estimate this year if Europe’s debt crisis worsens, a scenario that would warrant “significant” fiscal stimulus from the government.(See my postscript).

17/2/2012 PostScript: An analyst we regard highly wrote this to us today:

“On this recent visit, our wise counselor forecast China’s growth rate will be in therange of 8 to 9% in 2012—assuming no major external shocks. Inflationary pressurewill be lower this year than last, especially in the first half of the year. The inflation ratein China for the entire year will be lower than 4%. Low inflation will allow thegovernment to deregulate prices—water, natural gas, and power.Our trusted counselor believes that export markets cannot be counted on to deliver thegrowth that China needs in 2012. Likewise, domestic consumption, while on the rise as apercentage of GDP, is hard to stimulate quickly. Therefore, the only remaining option to preventChinese economic growth from slowing is for the government to use investment as a stimulus.”“On this recent visit, our wise counselor forecast China’s growth rate will be in therange of 8 to 9% in 2012—assuming no major external shocks. Inflationary pressurewill be lower this year than last, especially in the first half of the year. The inflation ratein China for the entire year will be lower than 4%. Low inflation will allow thegovernment to deregulate prices—water, natural gas, and power.Our trusted counselor believes that export markets cannot be counted on to deliver thegrowth that China needs in 2012. Likewise, domestic consumption, while on the rise as apercentage of GDP, is hard to stimulate quickly. Therefore, the only remaining option to preventChinese economic growth from slowing is for the government to use investment as a stimulus.”

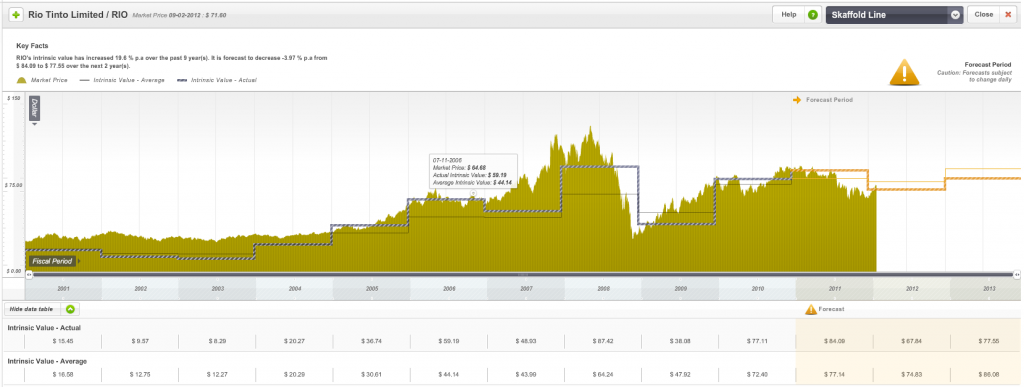

Here’s a quick view from Skaffold of RIO. To become a Skaffold member and enjoy having every stock in the Australian market quality rated and valued and all valuations and data automatically updated for every company every day CLICK HERE

Posted by Roger Montgomery, Value.able and Skaffoldauthor and Fund Manager, 10 February 2012.

by Roger Montgomery Posted in Energy / Resources, Insightful Insights, Manufacturing.

-

The colour of money?

Roger Montgomery

February 9, 2012

It’s been a lackluster start to this year’s company confession session. Only a few companies have so far bucked the stable / downward trend in revenues and profits.

It’s been a lackluster start to this year’s company confession session. Only a few companies have so far bucked the stable / downward trend in revenues and profits.At the top of this list, reporting what I would consider to be quality results are CCP (SQR A2) – so far the clear standout and a business we own in the Montgomery Private Fund. This is followed by WEB (SQR A2) a business whose Total Transaction Value (TTV) is growing at rates 4x the industry average but is a little expensive in terms of its future prospects for now.

And that’s about it at the quality end of the investment spectrum (with the exception of Breville, Forge and Decmil’s updates). Remember that we rate every single listed company from A1 (the best) to C5 (the worst) so we follow them all. If you want to find opportunities such as CCP before everyone else, take a look at Skaffold.com

There have been a number of other businesses which have reported so far and on face value, while LGD (SQR B2) experienced strong revenue and profit growth; a large proportion of its growth was driven by several recent acquisitions. Organic growth is less than 50% of that being reported currently; something to watch in future reporting seasons.

Now to our friends long Telstra:

(SQR B3) the half year was a little sobering for those who have bought the stock for its dividend yield. Whilst reported Free Cash Flow was $1,795b and dividends paid amounted to $1,738b, one would assume the yield was fully covered. Not so. The free Cash number reported did not include $559m in interest repayments on almost $15b debt. $500m additional debt was borrowed to fund dividends and CAPEX – debt to equity thus increased and is currently 104%. While dividends are being paid, and will probably continue being paid, its just worth noting how they are being funded…

Over at the Big Australian – BHP:

Staying at the big end of town and global diversified mineral and petroleum producer BHP (SQR B1) reported a HY NPAT $9.9b NPAT down on last year’s. The lower results was despite very attractive Iron Ore, Bulks and Petroleum margins – prices which declined in the latter part of 2012 and which may impact profits further in the 2nd half. The acquisition of Petrohawk for $13b (which pushed gearing to 34%) contributed to earnings but couldnt arrest the decline. Industry-wide cost pressures with consumable, labour and contractor costs added $400m to cost inflation! On a more positive note, the project pipeline of $27b and $5b in actual committed projects. In the half total CAPEX (investment) projects + exploration spend was $9b – this continues to support EPC / EPCM engineers, drillers, mud suppliers (Decmil, Forge, Maca, Fleetwood et. al.) which are all operating at full capacity and expanding like there is no tomorrow. However for BHP investors, because the company continuously has to invest in greenfield projects to offset natural production decline, this results in a capital intensive investment program – something investors in BHP 20 years ago might be acutely aware of. Although they have long-life, world class assets and significant cash flows that are able to meet the demands currently, over the past three months profits have been downgraded from circa $25b to circa $19b. Indicative of an economic slowdown and slowing demand for resources. So something to be watchful of is the fact that declining profits = declining cashflows = declining future investment. Albeit the investment future and plans looks like its all boom time right now.

Posted by Russell Muldoon per Montgomery Investment Management, Value.able and Skaffoldauthor and Fund Manager, 9 February 2012.

by Roger Montgomery Posted in Companies, Insightful Insights, Skaffold.

- 5 Comments

- save this article

- POSTED IN Companies, Insightful Insights, Skaffold

-

Does your adviser agree with these stocks?

Roger Montgomery

February 9, 2012

The ability to pick stocks that never go down, is NOT one of our skills. Plenty of you can attest to that. Value investing using the method we advocate in Value.able and using Skaffold.com cannot prevent losses, it is about minimising the cases of permanent impariment.

The ability to pick stocks that never go down, is NOT one of our skills. Plenty of you can attest to that. Value investing using the method we advocate in Value.able and using Skaffold.com cannot prevent losses, it is about minimising the cases of permanent impariment.Asked by BRW’s Tony Featherstone which small caps we liked we nominated a few. Here’s the list and if you cannot read it properly or would like to also read about the TOP 10 Start Ups of 2011, grab this week’s copy of the BRW.

Remember to seek and take personal professional advice before engaging in any security transactions.

Posted by Roger Montgomery, Value.able and Skaffold author and Fund Manager, 9 February 2012.

by Roger Montgomery Posted in Companies, Energy / Resources, Insightful Insights, Skaffold.

-

First base.

Roger Montgomery

February 6, 2012

US jobs data was stronger than expected and resulted in global equity markets following the US reaction higher. But is all as it seems?

US jobs data was stronger than expected and resulted in global equity markets following the US reaction higher. But is all as it seems?The increase in jobs was 243,000 but 490,000 were said to be temporary jobs. The employment number is now the same as a decade ago but a decade ago there were 30 million fewer people living in the US!

Charles Biderman notes that “Either there is something massively changed in the income tax collection world, or there is something very, very suspicious about today’s BLS hugely positive number,” adding, “Actual jobs, not seasonally adjusted, are down 2.9 million over the past two months. It is only after seasonal adjustments – made at the sole discretion of the Bureau of Labor Statistics economists – that 2.9 million fewer jobs gets translated into 446,000 new seasonally adjusted jobs.” A 3.3 million “adjustment” solely at the discretion of the BLS? And this from the agency that just admitted it was underestimating the so very critical labor participation rate over the past year? Perhaps with a hint of conspiracy theorist (all hints of which we run from as fast as possible) Biderman wonders whether the BLS is being pressured by the Obama administration during an election year to paint an overly optimistic picture. Hmmmmm…

The BLS however constantly ‘adjust’ its numbers and an January overadjustment occurs annually. Without the BLS smoothing calculation, the real economy lost 2,689,000 jobs, while net of the adjustment, it actually gained 243,000. So are conditions really getting better in the US or only in the adjustment column on an analyst’s spreadsheet?For those of you who have seen the amazing Abbott and Costello skit ‘Who’s on first’, here’s another take on it:

COSTELLO: I want to talk about the unemployment rate in America.

ABBOTT: Good Subject. Terrible Times. It’s 8.3%.

COSTELLO: That many people are out of work?

ABBOTT: No, that’s 16%.

COSTELLO: You just said 8.3%.

ABBOTT: 8.3% Unemployed.

COSTELLO: Right 8.3% out of work.

ABBOTT: No, that’s 16%.

COSTELLO: Okay, so it’s 16% unemployed.

ABBOTT: No, that’s 8.3%…

COSTELLO: WAIT A MINUTE. Is it 8.3% or 16%?

ABBOTT: 8.3% are unemployed. 16% are out of work.

COSTELLO: IF you are out of work you are unemployed.

ABBOTT: No, you can’t count the “Out of Work” as the unemployed. You have to look for work to be unemployed.

COSTELLO: BUT THEY ARE OUT OF WORK!!!

ABBOTT: No, you miss my point.

COSTELLO: What point?

ABBOTT: Someone who doesn’t look for work, can’t be counted with those who look for work. It wouldn’t be fair.

COSTELLO: To who?

ABBOTT: The unemployed.

COSTELLO: But they are ALL out of work.

ABBOTT: No, the unemployed are actively looking for work… Those who are out of work stopped looking.

They gave up and if you give up, you are no longer in the ranks of the unemployed.

COSTELLO: So if you’re off the unemployment rolls, that would count as less unemployment?

ABBOTT: Unemployment would go down. Absolutely!

COSTELLO: The unemployment just goes down because you don’t look for work?

ABBOTT: Absolutely it goes down. That’s how you get to 8.3%. Otherwise it would be 16%. You don’t want to read about 16% unemployment do ya?

COSTELLO: That would be frightening.

ABBOTT: Absolutely.

COSTELLO: Wait, I got a question for you. That means there are two ways to bring down the unemployment number?

ABBOTT: Two ways is correct.

COSTELLO: Unemployment can go down if someone gets a job?

ABBOTT: Correct.

COSTELLO: And unemployment can also go down if you stop looking for a job?

ABBOTT: Bingo.

COSTELLO: So there are two ways to bring unemployment down, and the easier of the two is to just stop looking for work.

ABBOTT: Now you’re thinking like an economist.

COSTELLO: I don’t even know what the I just said!While we are not waiting around for the swallows to sing – then spring will be over – we are buying stocks in a slow and measured way. We haven’t added any new stocks to our portfolio so we are adding to existing holdings.

In Australia, the situation may not be much better. Last year here at the blog we discussed the impending job losses at banks, manufacturers and retailers and all of that appears to be rolling along as predicted. But as my friend Bob Gottliebsen noted today; “At the weekend, Roy Morgan Research reported a big jump in unemployment during January. Almost certainly that will be reflected in the official figures when they are released later this month. Morgan uses a different method to calculate unemployment to the statisticians and Morgan’s December unemployment was 8.6 per cent, compared with the statisticians’ 5.2 per cent. But now Morgan estimates that January unemployment has skyrocketed from 8.6 to 10.3 per cent – the highest level since Morgan began calculating unemployment.”

“There is no doubt there are seasonal issues as those leaving tertiary education try to join the labour force. They are usually not employed until February or later months. A rise of the proportion shown by Morgan reflects much greater forces than seasonal influences and in 2012 it will be much harder for students to gain employment than in 2011.”

“There is no doubt there are seasonal issues as those leaving tertiary education try to join the labour force. They are usually not employed until February or later months. A rise of the proportion shown by Morgan reflects much greater forces than seasonal influences and in 2012 it will be much harder for students to gain employment than in 2011.”What does it all mean for value investors – remember, we are not economists and macro economics is not part of the value.able bottom-up approach to investing? The implications are that we should be seeking deeper discounts to intrinsic value estimates and those estimates could decline further.

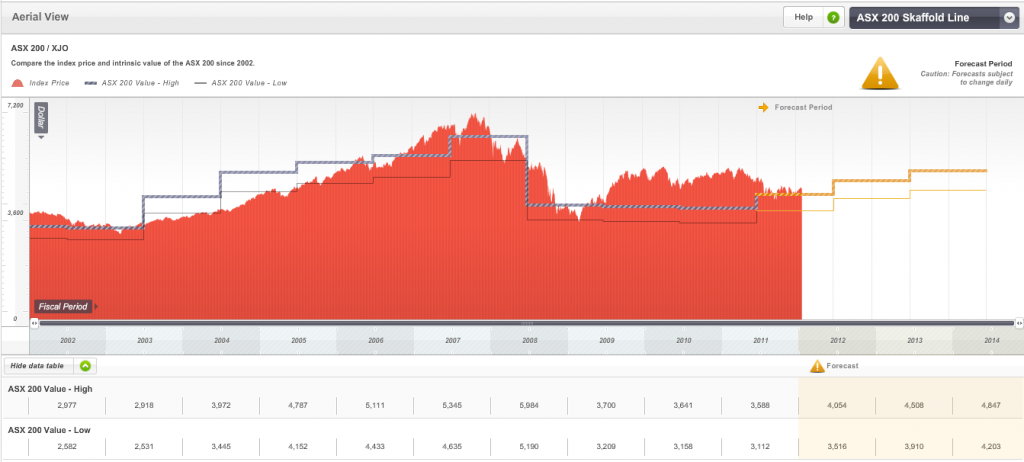

Given Skaffold (click here to Join) is currently suggesting the ASX200 is not cheap, we tend to be cautious even though my learned peers are betting with the world’s central banks that their printing of money and associated reduction in interest rates will force the world out of being defensively cash weighted and into equities and commodities.

We reckon gold makes sense in these times of destabilised fiat money. As you know we own a number of gold stocks (some of which have returned nearly 100%) and I bought more gold (physical) before Christmas.

Here is the latest chart of the ASX200 plotted against Skaffold’s estimates of intrinsic value. You can see that the market is trading a little higher than the estimated intrinsic value for the index. That doesn’t mean it can’t go a lot higher, just that if you are a genuine bargain hunter, you may need to be patient. In light of the unemployment situation noted above and the painfully strong Australian dollar, that makes sense.

Here is the latest chart of the ASX200 plotted against Skaffold’s estimates of intrinsic value. You can see that the market is trading a little higher than the estimated intrinsic value for the index. That doesn’t mean it can’t go a lot higher, just that if you are a genuine bargain hunter, you may need to be patient. In light of the unemployment situation noted above and the painfully strong Australian dollar, that makes sense.In addition to the powerful benefit of such a chart as the ASX 200 Skaffold line, which by the way, is automatically keeping you up-to-date daily for changes in analysts estimates of earnings and dividends for each of the 200 indices’ constituents, Skaffold members will enjoy an unprecedented level of interactivity in upcoming updates. By the way, I trust you are enjoying the enhanced search functionality the team delivered last week.

My team noted a few wanna-be competitors trying to plagiarise little aspects of Skaffold recently and I explained that they and you should “be flattered” and I told the team; “if you can see the competition, you aren’t at the front of the race”. Concentrate on staying in front by looking ahead and not at those trying to catch up. They respect Skaffold members too much to insult them by delivering second-hand ideas or technology. Skaffold keeps you in front with world beating ideas – remember the team that works on Skaffold works for Nike, Porsche, EA Games and Google. What possible hope do the competitors have? We’ve retained one of the world’s decorated design and development teams so Skaffold is.

Posted by Roger Montgomery, Value.able and Skaffold author and Fund Manager, 6 February 2012.

by Roger Montgomery Posted in Insightful Insights, Market Valuation, Skaffold.

-

Will Facebook’s IPO be a one day Circus?

Roger Montgomery

February 2, 2012

Unless you live under a waterfall in the rainforests of South America, you will have heard that Facebook has lodged its S-1 (Prospectus) for a probably May 2012 IPO. Skaffold members can look forward to Facebook being available to view in Skaffold when the team loads up all the international stocks.

To become a Skaffold member today and discover how we have been investing click here

Back to our regular programming…

Hyped by the media around the world as the biggest internet IPO in history and asked whether we would ‘invest’ in Facebook, we note the following:

The company already has 500 shareholders and would have been required by the SEC to lodge financials in April.

Facebook Stock Code: FB

Maximum aggregate offering price: $5Bn

as yet, there is not sufficient valuation information listed in the S-1 filing with the SEC nor how many shares are being offered.

According to the S-1 cover:

845 million monthly active users (MAU)

483 million daily active users (DAU)

Users generated on average 2.7 billion Likes and Comments per day in Q4 2011.

100 billion friendships

250 million photos uploaded per day

Our observation: Not a mention of any dollars yet! “likes”, “friends” and ‘uploaded photos’ are today what ‘page impressions’ and ‘visitors’ where in the tech boom of 1999/2000.

FB generated $3.7 billion in Revenue in 2011, up from $2 billion in 2010. 12 percent of Facebook’s revenue in 2011 was linked to its relationship with online gaming giant Zynga.

FB generated $1 billion in net income in 2011, up from $606 billion in 2010, a 40% growth rate, compared to the 165% growth rate from 2009’s $229m.

EBIT margin peaked at 52.3% in 2010 ($1m in EBIT on $2 billion in revenue), has since declined to 47.3% or $1.756Bn on $3.711Bn in Revenue, still incredible.

$3.9 billion in cash and marketable securities

Western world user growth is slowing but thats the law of large numbers. Facebook says: “We believe that our rates of user and revenue growth will decline over time. For example, our annual revenue grew 154% from 2009 to 2010 and 88% from 2010 to 2011. Historically, our user growth has been a primary driver of growth in our revenue. Our user growth and revenue growth rates will inevitably slow as we achieve higher market penetration rates, as our revenue increases to higher levels, and as we experience increased competition.”

The company still reported +60% earnings growth rates in 2011. The key is whether users stay and whether they can be ‘monetized’ further. MAU additions peaked in 2010 when FB added 248m to a total of 608m; in 2011 it added 237MM to 845m.

On the subject of dividends FB says: “We do not intend to pay dividends for the foreseeable future. We have never declared or paid cash dividends on our capital stock. We currently intend to retain any future earnings to finance the operation and expansion of our business, and we do not expect to declare or pay any dividends in the foreseeable future. As a result, you may only receive a return on your investment in our Class A common stock if the market price of our Class A common stock increases. In addition, our credit facility contains restrictions on our ability to pay dividends.”

Here’s access to the S-1: http://www.sec.gov/Archives/edgar/data/1326801/000119312512034517/d287954ds1.htm

The map of the world connected by facebook users is intriguing. What are those pirates on the west coats of Africa doing on Facebook?

I have previously written about the forthcoming floats of internet and social media sites here: http://rogermontgomery.com/which-ipos-are-you-watching/

‘Paradigm changers’ (remember Yahoo?) have come and gone so it is essential you don’t get caught up in the hype and instead stick to the valuation approach that is the bedrock of our approach. If you don’t know it, buy a copy of Value.able today for just $49.95. Or to save yourself reading the last ten annual reports for every listed company, try Skaffold.

There were eight large and highly media-promoted IPOs in the last year or two (GRPN, ZNGA, LNKD, P, YOKU, DANG, AWAY, and FFN). One analyst reported that if you could get stock in the IPO (forget it if you weren’t a major client of the lead broker or a ‘friend’ of the company) there was an average gain of 50%. If you bought each IPO in the market on Day 1 you now have an average loss of 54% with incredibly only 1 of the 8 names (ZNGA) still holding on to gains (+11%) thanks to a rally of 15% in the last week.

We would like to go through the numbers for Facebook today and try to come up with a valuation for you. You can do it yourself if you have a copy of Value.able.

There’s about $5.2 billion in equity, including $1bln of retained earnings. There’s 4.1bln Class A shares and the same number of class B’s. The preferred’s will be converted and only Class A’s sold. We cannot calculate equity per share because the S-1 does not disclose how many shares will be issued. ROE is about 26 per cent. No dividends will be paid. The company states in its S-1 that it will continue to grow by acquisition as well as organically. But the company will takeover Earth if it continues to retain profits and generates 26% returns on the incremental equity. Assuming earnings grow at 40% and faster than the rate of return on equity, then you can expect ROE to rise. Using these favourable metrics we reckon Facebook is worth $26-$28bln in 2012 rising to $57-$63bln in 2014. If the IPO ‘values’ the company at $100bln as many media outlets suggest, watch out.

This paragraph from the S-1 is important:

“If you purchase shares of our Class A common stock in our initial public offering, you will experience substantial and immediate dilution.

If you purchase shares of our Class A common stock in our initial public offering, you will experience substantial and immediate dilution in the pro forma net tangible book value per share of $ per share as of December 31, 2011, based on an assumed initial public offering price of our Class A common stock of $ per share, the midpoint of the price range on the cover page of this prospectus, because the price that you pay will be substantially greater than the pro forma net tangible book value per share of the Class A common stock that you acquire. This dilution is due in large part to the fact that our earlier investors paid substantially less than the initial public offering price when they purchased their shares of our capital stock. You will experience additional dilution upon exercise of options to purchase common stock under our equity incentive plans, upon vesting of RSUs, if we issue restricted stock to our employees under our equity incentive plans, or if we otherwise issue additional shares of our common stock. For more information, see “Dilution”.

Note the blanks, which makes FB impossible to value on a per share basis, yet.

We’ll have to wait until the final days of the capital raising before we can come up with a firm valuation on a per share basis but for now, the circa $27bln valuation stands.

Posted by Roger Montgomery, Value.able and Skaffold author and Fund Manager, 2 February 2012.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

MEDIA

Why does Roger Montgomery think 2012 may be our toughest year yet?

Roger Montgomery

February 1, 2012

Roger Montgomery discusses why the global investing outlook for 2012 will be impacted by a variety of negative influences in this Money Magazine article published February 2012. Read here.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Market Valuation, On the Internet, Value.able.

-

Are two lemons better than one?

Roger Montgomery

January 31, 2012

Robert Gottliebsen penned an interesting piece in the Business Spectator today. Using data provided by James Stuart of Ferrier Hodgson that revealed Internet penetration – as a portion of sales for large US retailers – as high as 18% and comparing that to average penetration of online sales from retailers in Australia of 1%, Robert concluded that time is ticking for owners of commercial property.

I agree with Bob’s conclusions. Oroton’s online store is now its biggest store in terms of sales and sagging bricks and mortar retail growth will force many retailers to also move online and embrace the structural change or go the way of the dinosaurs.

Tight margins, expensive staff and exorbitant rents spell trouble for any business that cannot maintain prices in the face of an online and overseas onslaught.

The impact on rents of commercial buildings such as shops will ultimately be negative And on this point I agree with Bob. But we can add one more step to the scenario. Either a new generation of offerings replaces the old school tenants who are departing and rents are maintained or declining rents lead to lower real estate prices which encourages buyers who are both retail operators and store owners rather than tenants.

Incidentally, at Montgomery Investment Management we cannot find a single listed property trust that meets our criteria. If you can find value in the listed property sector do let us know, but we cannot.

I feel for those who bought shops in strips like to Toorak Road, Chapel Street and Oxford Street on capitalisation rates of less than 3% or 4%.

I also feel for fruit and vegetable growers in Australia who are about to find out what grocery suppliers and milk producers have recently experienced. Many farmers have told me of the mere cents per kilo received by them from major supermarkets who in turn sold the same produce at multiples of 10 and 11 times while explaining to farmers that they needed to charge such high multiples to cover the cost of business. The announcement on Today Tonight last night by Coles staffer Greg Davis of 50% cuts in the prices of fruit and vegetables, suggests the real cost of doing business is much lower than what the supermarkets have been telling farmers.

And if they’ve been dishonest with farmers then perhaps it’s a little disingenuous for Greg Davis to say on national television “We’re investing in prices as well, but our growers are working with us to plan our crops, to ensure that we’ve got certain year-round volumes. We buy in such huge volumes, it brings down the cost of the produce, so customers benefit and growers benefit, because we can move stock really quickly”. Do we reallyt need ore food to be produced? It seems Coles would like us to forget just how many thousands of tonnes of fruit and veg is thrown out by each of the supermarkets each year. According to the National Waste Report 2010, food waste constituted 4.5 million tonnes or 35% of municipal waste. When Coles talks about moving more products at lower prices are obviously not referring to us eating it!

Bruno writes in the comments below:

“Hi Roger,

Just a comment on what farmers are getting for their produce. Being a farmer I can tell you that the very most we have received for citrus is 40c per kg, but on average we get about 20c then we must pay 10c of that just to have them picked. My next door neighbor grew onions this year and also received 20c per kg. pumpkins are the same price. Rice is being sold by farmers for 18c per kg. wine grapes are being harvested right now for an average price of about 24c per kg (1kg is the amount of grapes needed for one bottle of wine) most if not all these crops cost about 10c per kg just to harvest! Of course farming is a cyclical business, and sooner or later what us farmers are paid will have to come up, otherwise there won’t be any farmers left. Where I live we are starting to see banks foreclose on farms, the irony is that no one is willing to buy a business that makes no money. So banks are forced to either lend more money, or spend their own cash to run the farms so the property value isn’t destroyed as fruit trees die. While we worry about the Europe crisis effect on the banks balance sheets we have a very big problem much closer to home which, if farmers don’t start to make a profit soon, will most defiantly effect the share values of the banks as bad debts get written off. if my wide went to work at woollies and at the end of the day she was given a bill from her boss for a days work, there’d be outrage. But when farmers are left in that exact situation, politicians and the like tell us “there’s healthy competition in the market place which benefit consumers” maybe in the short term but as more farmers abandon their farms which is happening, the price of all fruit and vege will definitely go up in the medium term as more and more farmers leave their land.”Further, the wholesale buying of arable agricultural land by foreign interests, the decimation of profitable agricultural enterprises due to irrational competition of the major supermarkets and the replacement of their product by foreign alternatives will not ultimately produce the best outcome for Australia.Australians cannot buy freehold land in China and foreigners are banned from owning the ground floor apartment in any building in Singapore so one does wonder whether our generosity is well placed all in the name of pursuing lower prices for short sighted consumers.

Posted by Roger Montgomery, Value.ableauthor and Fund Manager, 31 January 2012.

by Roger Montgomery Posted in Insightful Insights.

- 47 Comments

- save this article

- POSTED IN Insightful Insights

-

Are investors giving up?

Roger Montgomery

December 20, 2011

We have talked here at the blog about hypothecation, re-hypotecation and hyper-hypothecation, about credit default swaps about a Chinese property bubble bursting, about lower iron ore prices, slower economic growth, increased savings and declining rates of credit expansion and a European sovereign default. Always the value investor, we are on the look out for anything that can impact the values of companies and those things that might offer the prospect of picking up a few bargains.

We have talked here at the blog about hypothecation, re-hypotecation and hyper-hypothecation, about credit default swaps about a Chinese property bubble bursting, about lower iron ore prices, slower economic growth, increased savings and declining rates of credit expansion and a European sovereign default. Always the value investor, we are on the look out for anything that can impact the values of companies and those things that might offer the prospect of picking up a few bargains.If your portfolio still has some rubbish in it, then being able to identify it is a key part of preparing for cheaper prices if they eventuate.

I recently wrote a column for the ASX and pondered the possibility of a climactic event coinciding with a complete throwing in of the towel by equity investors who are simply fed up with poor medium term returns and increased volatility recently.

The ASX200 hasn’t generated a positive capital return since 2005 but quality companies have. The ASX200 contains stocks that are rubbish so it is no wonder that an index based on that rubbish has gone nowhere. Step 1 then is to clean up the portfolio and step 2 is to be ready for quality bargains when they arise.

This is just one of many scenarios and frameworks I am operating with and I wonder what would transpire if the poor returns or the recent heightened volatility continues for a little longer? Will investors simply throw in the towel, leave equities and believe all those advisors offering their own brand of ‘safe’, ‘secure’ and stable investments? On the one hand, I hope so. It would mean certain bargains.

Here’s the Column:

As global sharemarkets decline, remain volatile and produce poor historical returns compared to other asset classes, it will be easy to be swayed by the latest investment trend – to move out of shares. I believe the trend away from shares will gather pace soon as more and more “experts” use the rear-view mirror to demonstrate why sharemarket investors would have been better off somewhere else.

In 1974 US investors had just endured the worst two-year market decline since the early 1930s, the economy entered its second recessionary year and inflation hit 11 per cent as a result of an oil embargo, which drove crude oil prices to record levels. Interest rates on mortgages were in double digits, unemployment was rising, consumer confidence did not exist and many forecasters were talking of a depression.

By August 1979, US magazine BusinessWeek ran a cover story entitled ‘The Death of Equities’ and its experts concluded shares were no longer a good long-term investment.

The article stated: “At least 7 million shareholders have defected from the stockmarket since 1970, leaving equities more than ever the province of giant institutional investors. And now the institutions have been given the go-ahead to shift more of their money from stocks – and bonds – into other investments.”

But be warned. The time to get interested in share investing and make good returns is precisely when everyone else isn’t.

Your own once or twice-in-a-lifetime opportunity may not be that far away and Labor’s promised tax cut on interest earnings may sway even more to give up shares and put their money in a bank, providing the opportunity to obtain even cheaper share prices.

If prices do fall further – and they could – you will need to be ready and will need some cash. The very best returns are made shortly after a capitulation. Cleaning up your portfolio becomes crucial and this article looks at how to do that.

Rule one: Don’t lose money

The key to slowly and successfully building wealth in the sharemarket is to avoid losing money permanently. Sure, good companies will see their shares swing but the poor companies see the downswings more frequently.

Therefore, the easiest way to avoid losing money is to avoid buying weak companies or expensive shares. One of the simplest ways I have avoided losing money this year in The Montgomery [Private] Fund has been to steer clear of low-quality businesses that have announced big writedowns.

These are easy to spot using Skaffold.

Not-so-goodwill

I have often seen companies make large and expensive acquisitions that are followed by writedowns a couple of years later. Writedowns are an admission by the company that they paid too much for an asset.

When Foster’s purchased the Southcorp wine business in 2005 for $3.1 billion, or $4.17 per share, my own valuation of Southcorp was less than a quarter of that amount. Then in 2008 Foster’s wrote down its investment by about $480 million, and then again by another $700 million in January 2009 and a final $1.3 billion in 2010.

When too much is paid for an acquisition, equity goes up but profits do not and you can see that too much was paid because that ratio I have worked so hard to make popular, return on equity (ROE), is low.

These low rates of return are often less than you can get in a bank account, and bank accounts have much lower risk. Over time, if the resultant low rates of return do not improve, it suggests the price the company paid for the acquisition was well and truly on the enthusiastic side and the business’s equity valuation should now be questioned. If return on equity does not improve meaningfully, a large writedown could be in the offing. This will result in losses if you are a shareholder, and you have also paid too much.

Just remember one of the equations I like to share:

Capital raised + acquisition + low rate of return on equity = writedown.When return on equity is very low it suggests the business’s assets are overvalued on the balance sheet. That, in turn, suggests the company has not amortised, written down or depreciated its assets fast enough, which in turn means the historical profits reported by the company could have been overstated.

Scoring bad companies: B4, B5, C4 and below…

These sorts of companies tend to have very low-quality scores and often appear down at the poor end of the market – the left side of the screen shot in Figure 1 below.

Figure 1. The sharemarket in aerial view (Source; Skaffold.com)

Each sphere in Figure 1. represents a listed Australian company and there are more than 2000 of them. The diagram is taken from Skaffold. Their position on the screen can change daily as the price, intrinsic value and quality changes. The best quality companies and those with positive estimated margins of safety (the difference between the company’s intrinsic value and its share price) appear as spheres at the top right.

Companies that are poor quality (I call them B4, C4 and C5 companies, for example) are found on the left of the screen and if they have an estimated negative margin of safety, they are estimated to be expensive and will be located towards the bottom of the screen.

Highlighted with blue rings in Figure 1 are eight of the companies that announced this year’s biggest writedowns. Notice they tend to be at the lower left of the Australian sharemarket, according to my analysis.

If your portfolio contains shares that are red spheres and on the lower left, you could also be at risk because these companies tend to have low-quality ratings and are also possibly very expensive compared to their intrinsic value.

As is clear from Figure 1, this year’s biggest writedown culprits were all already located in the area to avoid.

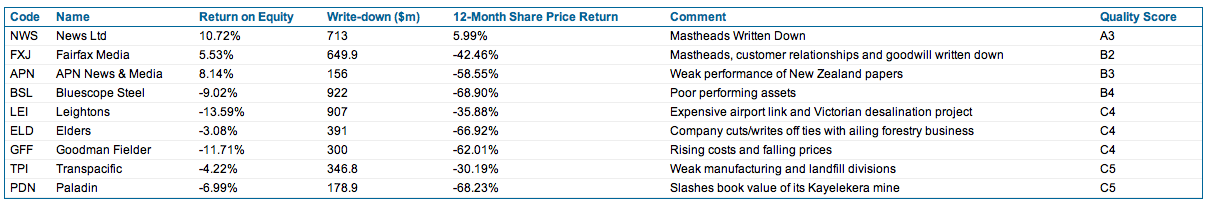

The impact of owning such a business outright would be horrendous. Table 1 below reveals the size and details of these writedowns and as you can see, collectively the losses to shareholders amount to $4.6 billion.

Table 1. Predictable losses?

Warren Buffett once said that if you were not prepared to own the whole business for 10 years, you should not own a piece of it for 10 minutes.

Clearly you would not want to own businesses that pay too much for acquisitions and subsequently write down those assets. If you are not willing to own the whole business, don’t own the shares. Although in the short run the market is a voting machine and share prices can rise and fall based on popularity, in the long run the market is a weighing machine and share prices will reflect the performance of the business. Time is not the friend of a poor company, and companies Skaffold rates C4 or C5 are best avoided if you want the best chance of avoiding permanent losses.

Look at Figure 2 below. Those big writedown companies not only performed poorly but so did their shares. These companies (shown collectively as an index in the blue line below) produced bigger losses for investors than the poorly performing indices of which they are part. And that’s just over one year.

Figure 2. The biggest writedowns compared to the market

Take a look at the companies in your portfolio. Do they have large amounts of accounting goodwill on their balance sheet as a portion of their equity? Have they issued lots of shares to make acquisitions and are they producing low and single-digit returns on equity? If the answer to all these questions is yes, you may have a C5 company.

Cleaning up your portfolio not only lowers its risk but will produce cash that may just prove handy in coming months.

If you have made it this far then here’s evidence of the giving up I referred to in the column: http://www.smh.com.au/business/investors-turn-to-term-deposits-in-shift-away-from-equities-20111219-1p2ir.html

Posted by Roger Montgomery, Value.able author and Fund Manager, 20 December 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Market Valuation, Skaffold, Value.able.

-

Is the bubble bursting?

Roger Montgomery

December 8, 2011

In 2010 here at the Insights Blog I wrote:

In 2010 here at the Insights Blog I wrote:“a bubble guaranteed to burst is debt fuelled asset inflation; buyers debt fund most or all of the purchase price of an asset whose cash flows are unable to support the interest and debt obligations. Equity speculation alone is different to a bubble that an investor can short sell with high confidence of making money.

The bubbles to short are those where monthly repayments have to be made. While this is NOT the case in the acquisitions and sales being made in the coal space right now, it IS the case in the macroeconomic environment that is the justification for the purchases in the coal space.

China.

If you are not already aware, China runs its economy a little differently to us. They set themselves a GDP target – say 8% or 9%, and then they determine to reach it and as proved last week, exceed it. They do it with a range of incentives and central or command planning of infrastructure spending.

Fixed asset investment (infrastructure) amounts to more than 55% of GDP in China and is projected to hit 60%. Compare this to the spending in developed economies, which typically amounts to circa 15%. The money is going into roads, shopping malls and even entire towns. Check out the city of Ordos in Mongolia – an entire town or suburb has been constructed, fully complete down to the last detail. But it’s empty. Not a single person lives there. And this is not an isolated example. Skyscrapers and shopping malls lie idle and roads have been built for journeys that nobody takes.

The ‘world’s economic growth engine’ has been putting our resources into projects for which a rational economic argument cannot be made.

Historically, one is able to observe two phases of growth in a country’s development. The first phase is the early growth and command economies such as China have been very good at this – arguably better than western economies, simply because they are able to marshal resources perhaps using techniques that democracies are loath to employ. China’s employment of capital, its education and migration policies reflect this early phase growth. This early phase of growth is characterised by expansion of inputs. The next stage however only occurs when people start to work smarter and innovate, becoming more productive. Think Germany or Japan. This is growth fuelled by outputs and China has not yet reached this stage.

China’s economic growth is thus based on the expansion of inputs rather than the growth of outputs, and as Paul Krugman wrote in his 1994 essay ‘The Myth of Asia’s Miracle’, such growth is subject to diminishing returns.

So how sustainable is it? The short answer; it is not.

Overlay the input-driven economic growth of China with a debt-fuelled property mania, and you have sown the seeds of a correction in the resource stocks of the West that the earnings per share projections of resource analysts simply cannot factor in.

In the last year and a half, property speculation has reached epic proportions in China and much like Australia in the early part of this decade, the most popular shows on TV are related to property investing and speculation. I was told that a program about the hardships the property bubble has provoked was the single most popular, but has been pulled.

Middle and upper middle class people are buying two, three and four apartments at a time. And unlike Australia, these investments are not tenanted. The culture in China is to keep them new. I saw this first hand when I traveled to China a while back. Row upon row of apartment block. Empty. Zero return and purchased on nothing other than the hope that prices will continue to climb.

It was John Kenneth Galbraith who, in his book The Great Crash, wrote that it is when all aspects of asset ownership such as income, future value and enjoyment of its use are thrown out the window and replaced with the base expectation that prices will rise next week and next month, as they did last week and last month, that the final stage of a bubble is reached.

On top of that, there is, as I have written previously, 30 billion square feet of commercial real estate under debt-funded construction, on top of what already exists. To put that into perspective, that’s 23 square feet of office space for every man, woman and child in China. Commercial vacancy rates are already at 20% and there’s another 30 billion square feet to be supplied! Additionally, 2009 has already seen rents fall 26% in Shanghai and 22% in Beijing.

Everywhere you turn, China’s miracle is based on investing in assets that cannot be justified on economic grounds. As James Chanos referred to the situation; ‘zombie towns and zombie buildings’. Backing it all – the six largest banks increased their loan book by 50% in 2009. ‘Zombie banks’.

Conventional wisdom amongst my peers in funds management and the analyst fraternity is that China’s foreign currency reserves are an indication of how rich it is and will smooth over any short term hiccups. This confidence is also fuelled by economic hubris eminating from China as the western world stumbles. But pride does indeed always come before a fall. Conventional wisdom also says that China’s problems and bubbles are limited to real estate, not the wider economy. It seems the flat earth society is alive and well! As I observed in Malaysia in 1996, Japan almost a decade before that, Dubai and Florida more recently, never have the problems been contained to one sector. Drop a pebble in a pond and its ripples eventually impact the entire pond.

The problem is that China’s banking system is subject to growing bad and doubtful debts as returns diminish from investments made at increasing prices in assets that produce no income. These bad debts may overwhelm the foreign currency reserves China now has.”

I now wonder whether we are seeing the bubble slip over the precipice? Falling property prices (10 per cent of the Chinese economy) leads to lower construction activity, leads to declining demand for Australian commodities, leads to falling commodity prices, leads to bigs drops in margins for a sizeable portion of the market index…

Watch this video and decide for yourself.

Posted by Roger Montgomery, Value.able author and Fund Manager, 8 December 2011.

by Roger Montgomery Posted in Energy / Resources, Insightful Insights, Market Valuation, Property, Value.able.

-

Drunk from binge borrowing?

Roger Montgomery

November 25, 2011

A good friend who lives and works in the UK recently sent me an allegory that succinctly describes, for those who haven’t read Michael Lewis, the growth of sub-prime loans, the collateralised debt obligations into which they were securitised and the credit default swaps which were the tradable insurance contracts on the CDO’s. It then goes on to neatly leave us with the consequences.

A good friend who lives and works in the UK recently sent me an allegory that succinctly describes, for those who haven’t read Michael Lewis, the growth of sub-prime loans, the collateralised debt obligations into which they were securitised and the credit default swaps which were the tradable insurance contracts on the CDO’s. It then goes on to neatly leave us with the consequences.If you have seen it before or believe you have a solid understanding of the events, you are many steps ahead of most. For the rest of us,

Heidi provides an explanation;

Heidi is the proprietor of a bar … She realises that virtually all of her customers are unemployed alcoholics and, as such, can no longer afford to patronise her bar. To solve this problem, she comes up with a new marketing plan that allows her customers to drink now, but pay later.

Heidi keeps track of the drinks consumed on a ledger (thereby granting the customers loans). Word gets around about Heidi’s “drink now, pay later” marketing strategy and, as a result, increasing numbers of customers flood into Heidi’s bar. Soon she has the largest sales volume for any bar in Manchester…

By providing her customers freedom from immediate payment demands, Heidi gets no resistance when, at regular intervals, she substantially increases her prices for wine and beer, the most consumed beverages. Consequently, Heidi’s gross sales volume increases massively.

A young and dynamic manager at the local bank recognizes that these customer debts constitute valuable future assets and increases Heidi’s borrowing limit. He sees no reason for any undue concern because he has the debts of the unemployed alcoholics as collateral!

At the bank’s corporate headquarters, expert traders figure a way to make huge commissions, and transform these customer loans into DRINKBONDS. These “securities” then are bundled and traded on international securities markets.

Naive investors don’t really understand that the securities being sold to them as ‘AAA Secured Bonds’ really are debts of unemployed alcoholics. Nevertheless, the bond prices continuously climb – and the securities soon become the hottest-selling items for some of the nation’s leading brokerage houses.

One day, even though the bond prices still are climbing, a risk manager at the original local bank decides that the time has come to demand payment on the debts incurred by the drinkers at Heidi’s bar. He so informs Heidi. Heidi then demands payment from her alcoholic patrons. But, being unemployed alcoholics they cannot pay back their drinking debts. Since Heidi cannot fulfil her loan obligations she is forced into bankruptcy. The bar closes and Heidi’s 11 employees lose their jobs.

Overnight, DRINKBOND prices drop by 90%. The collapsed bond asset value destroys the bank’s liquidity and prevents it from issuing new loans, thus freezing credit and economic activity in the community. The suppliers of Heidi’s bar had granted her generous payment extensions and had invested their firms’ pension funds in the BOND securities. They find they are now faced with having to write off her bad debt and with losing over 90% of the presumed value of the bonds. Her wine supplier also claims bankruptcy, closing the doors on a family business that had endured for three generations, her beer supplier is taken over by a competitor, who immediately closes the local plant and lays off 150 workers.

Fortunately though, the bank, the brokerage houses and their respective executives are saved and bailed out by a multibillion dollar no-strings attached cash infusion from the government. The funds required for this bailout are obtained by new taxes levied on employed, middle-class, non-drinkers who have never been in Heidi’s bar.

Its nicely articulated don’t you think? Fortunately the problem is contained to…Earth. But where too next?

Postscript: This week, China’s vice-premier and head of finance, Wang Qishan, predicted that the global economy has commenced a long-term recession. He observed: “Now the global economic situation is extremely serious and in such a time of uncertainty the only thing we can be sure of is that the world economic recession caused by the international crisis will last a long time.”

Posted by Roger Montgomery, Value.able author and Fund Manager, 25 November 2011.

by Roger Montgomery Posted in Insightful Insights.

- 104 Comments

- save this article

- POSTED IN Insightful Insights