Insightful Insights

-

MEDIA

What are the ongoing prospects for Queensland Mining?

Roger Montgomery

September 12, 2012

Roger Montgomery discusses the new Qld Government levies on mining, and the likely impact on mining stocks with Ross Greenwood on Radio 2GB. Listen here.

This program was broadcast on 12 September 2012.

by Roger Montgomery Posted in Companies, Insightful Insights, Radio, Value.able.

- save this article

- POSTED IN Companies, Insightful Insights, Radio, Value.able

-

MEDIA

Where does Roger see the best opportunities?

Roger Montgomery

September 12, 2012

Do Regis Resources (RRL), Silverlake Resources (SLR), Decmil Group (DCG), BC Iron (BCI), Corporate Travel Management (CTD), Sirius Resources (SIR), Sirtex Medical, SRX), Rio Tinto (RIO), Energy Action (EAX), ASG Group (ASZ), Seek (SEK) and Eastland Medical (EMS) makeRoger’s coveted A1 grade? Watch this edition of Sky Business’ Your Money Your Call broadcast 12 September 2012 to find out, and also learn Roger’s insights into the best opportunities. Watch here.

by Roger Montgomery Posted in Insightful Insights, TV Appearances.

- save this article

- POSTED IN Insightful Insights, TV Appearances

-

Big Apple?

Roger Montgomery

September 12, 2012

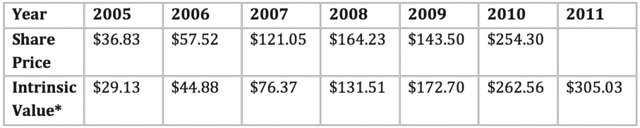

Did you know that the market capitalisation of Apple Inc. is now more than the entire equity markets of Spain, Portugal, Ireland and Greece combined? Its stunning. Surely Forrest Gump from Greenbow Alabama would be writing to Jenny with much enthusiasm. But what about its intrinsic value? Back in 2010 (http://rogermontgomery.com/is-apple-an-a1/) I wrote that Apple’s intrinsic value was higher than the share price at the time. The table below first published in July 2010 reveals the company’s pattern of rising intrinsic values. back then the price was indeed showing a small margin of safety.

A couple of blog readers have subsequently told me they purchased Apple shares and obviously they have done nicely. But what about today?

Only last year, when the share price hit $600 I wrote that I thought price had run ahead of intrinsic value (but not forecast intrinsic value) and the share price subsequently fell slightly. We also noted declining margins and market shares losses. But improving quarterly results and rising forecasts means revisions have resulted in IV estimates continuing their stellar rise so a revisit of our assumptions might be worth our time.

The graph below reveals that our ‘revised’ back-of-the-envelope intrinsic value estimate for Apple is forging ahead. If you are confident that Apple’s pipeline of products will usurp the competition, take back market share and fill Apple’s coffers towards 1000 billion dollars and that the iPhone 5 – expected to be revealed this week – will knock everyone’s socks off, then the massive rises in intrinsic value, might not seem so extreme.

Of course all intrinsic values are just estimates and while our haven’t done too badly for us – we’ve been spot on with BHP at $30 and done well on others – the reality is they can change dramatically as new information comes to hand.

So lets keep an eye on whether Apple impresses this week with its new release.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Market Valuation, Value.able.

-

MEDIA

Round 1: Value Investing vs the “new” paradigm – you be the judge……

Roger Montgomery

September 10, 2012

One of the constants of the last 10 years is market commentators saying that “this time is different” – we believe that the principles of of value investing never change, and Roger articulates the reasons why in this interview with Ticky Fullerton (and Marcus Padley!) on ABC1’s The Business, broadcast 7 September 2012. Watch here.

by Roger Montgomery Posted in Insightful Insights, Intrinsic Value, Investing Education, TV Appearances.

-

MEDIA

Bright prospects for Computershare?

Roger Montgomery

September 10, 2012

Computershare’s court victory allows it to proceed with its digital post business – and Roger Montgomery discusses its potential in this edition of ABC1’s Inside Business broadcast 2 September 2012 . Watch here.

by Roger Montgomery Posted in Insightful Insights, TV Appearances, Value.able.

- save this article

- POSTED IN Insightful Insights, TV Appearances, Value.able

-

MEDIA

CEO tenures – ever shorter?

Roger Montgomery

September 10, 2012

Roger Montogmery provides some advice for Chief Executives looking for new roles in this discussion on ABC1’s Inside Business broadcast 2 September 2012. Watch here.

by Roger Montgomery Posted in Insightful Insights, TV Appearances.

- save this article

- POSTED IN Insightful Insights, TV Appearances

-

MEDIA

2012 Results Season Wrap Up

Roger Montgomery

September 10, 2012

Learn Roger Montgomery’s insights into the latest 2012 results announcements in this discussion on ABC1’s Inside Business broadcast 2 September 2012. Watch here.

by Roger Montgomery Posted in Insightful Insights, TV Appearances.

- save this article

- POSTED IN Insightful Insights, TV Appearances

-

Is it all FUN and Games?

Harley Grosser

September 9, 2012

The following article was contributed by Harley, and gives a very detailed account of Funtastic as a possible turnaround story. If you have the skill to identify them, turnarounds can be very profitable investments, although its not an area of focus for us at Montgomery Investment Management. In 2006, Funtastic fell to a B5 on our quality and performance ratings, and since that time has been outside the range that we would normally consider “investment grade”. However, as Harley points out, Funtastic may enjoy better times ahead if its portfolio of toys appears on enough Christmas shopping lists.

Funtastic is in the business of fun. As a leading toy distributor with domestic and international operations, as well an entertainment arm, Funtastic (ASX:FUN) make money by selling products that make us happy. The question is, would an investment in Funtastic at today’s prices set us up for pleasant future returns or is this one turnaround story that is worth avoiding?

by Harley Grosser Posted in Companies, Insightful Insights, Manufacturing.

-

From the Coal Face – pardon the pun

Roger Montgomery

September 8, 2012

We have just written our monthly report to investors of The Montgomery Private Fund and the outlook for the large Materials stocks is not expected, in our view, to improve in the short term. Chinese steel mills don’t see demand picking up. Daily steel production falling 5% every two weeks. While blast furnaces are slowing down, capacity is high and shut downs not happening. We have noted already that inventory remains double that of 2007.

WHat does this mean? Prices can, and we expect will, continue to go down. Not is straight line of course but the outlook appears to be deteriorating even further for the widely held Materials stocks.

In China, steel prices are already hitting 2008 lows.Observers say Iron ore inventory levels at ports is still quite high

Our reading on Steel demand and after breaky with a member of the team at one of the the worlds largest short selling fund is that steel demand will continue to be weak into 2013. I think expectations for a recovery in the short term simply represent wishful thinking by those in denial.

by Roger Montgomery Posted in Energy / Resources, Insightful Insights.

-

Mining swings from profit to loss quickly and without fear or favour. Its always been this way.

Roger Montgomery

September 6, 2012

You might recall back in December (Dec 8, 2011) with FMG trading at $4.84 (now $2.94), BHP at $37.00 ($31.36 today) and RIO at $66.09 ($50.19 today) we warned

“I now wonder whether we are seeing the bubble slip over the precipice? Falling property prices (10 per cent of the Chinese economy) leads to lower construction activity, leads to declining demand for Australian commodities, leads to falling commodity prices, leads to big drops in margins for a sizeable portion of the [Australian stock] market index…”

Since the start of 2012, commodities have, on average, fallen more than 20%, and in some cases much more. This is a pace of decline matched only by that experienced during the financial crisis of 2008.

At current prices many mining companies will now be making losses. As analysts we question the viability of some companies and Atlas Iron for example, one of the largest Iron Ore producers outside of BHP and RIO, may not be without outside help – should prices remain at or below present levels.

by Roger Montgomery Posted in Companies, Energy / Resources, Insightful Insights.