Insightful Insights

-

MEDIA

How should you view a takeover offer on a company in your portfolio?

Roger Montgomery

September 19, 2012

Roger Montgomery discusses his insights into how to view takeover offers, and in particular he discusses the Sundance Resources (SDL) takeover bid with Ross Greenwood on Radio 2GB. Listen here.

This program was broadcast 19 September 2012.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Radio.

- save this article

- POSTED IN Insightful Insights, Investing Education, Radio

-

China growth fears (continued)

David Buckland

September 19, 2012

Yesterday’s Australian Financial Review highlighted comments from Mark Williams, Shell’s global downstream director.

“The global economy seems weaker to me than the numbers indicate”, said Mr Williams. “I still expected more suction out of China than we’re getting. I’m just a bit uneasy with what we are seeing in terms of fuel demand and chemical demand”.

by David Buckland Posted in Companies, Insightful Insights.

- save this article

- POSTED IN Companies, Insightful Insights

-

It’s a Bear Trap! Be fearful when others are greedy

Roger Montgomery

September 17, 2012

Its no news we have been warning investors about the risk of declining iron ore prices since late calendar 2011. Most recently we have been warning of a bear trap – the risk associated with buying stocks when they appear to be ‘cheap’ because they have fallen a long way but poor fundamentals are likely to see prices even lower.

Figure 1 outlines how The Montgomery Funds have been thinking about China, Iron Ore and our big miners.

by Roger Montgomery Posted in Energy / Resources, Insightful Insights, Market Valuation.

-

MEDIA

Thinking Of A Gamble? Don’t.

Roger Montgomery

September 15, 2012

Roger Montgomery discusses why investing in heavily leveraged companies is a risky pursuit in this Australian article published 15 September 2012. Read here.

by Roger Montgomery Posted in Energy / Resources, In the Press, Insightful Insights.

-

New ASX Investment Talk – Beating the Index

Roger Montgomery

September 14, 2012

Join Roger as he explains how the long-standing principles of value investing can be applied so that you too can identify A1 businesses for your portfolio and beat the index. Watch here.

by Roger Montgomery Posted in Insightful Insights, Intrinsic Value, Investing Education, Market Valuation.

-

The pebble drops

Roger Montgomery

September 13, 2012

There is an old chinese proverb that says “a pebble cast into a pond causes ripples that spread in all directions” – as Michael’s email over the weekend (below) displays, there’s a shift going on which is rippling its way through the market.by Roger Montgomery Posted in Energy / Resources, Insightful Insights.

-

MEDIA

What are the ongoing prospects for Queensland Mining?

Roger Montgomery

September 12, 2012

Roger Montgomery discusses the new Qld Government levies on mining, and the likely impact on mining stocks with Ross Greenwood on Radio 2GB. Listen here.

This program was broadcast on 12 September 2012.

by Roger Montgomery Posted in Companies, Insightful Insights, Radio, Value.able.

- save this article

- POSTED IN Companies, Insightful Insights, Radio, Value.able

-

MEDIA

Where does Roger see the best opportunities?

Roger Montgomery

September 12, 2012

Do Regis Resources (RRL), Silverlake Resources (SLR), Decmil Group (DCG), BC Iron (BCI), Corporate Travel Management (CTD), Sirius Resources (SIR), Sirtex Medical, SRX), Rio Tinto (RIO), Energy Action (EAX), ASG Group (ASZ), Seek (SEK) and Eastland Medical (EMS) makeRoger’s coveted A1 grade? Watch this edition of Sky Business’ Your Money Your Call broadcast 12 September 2012 to find out, and also learn Roger’s insights into the best opportunities. Watch here.

by Roger Montgomery Posted in Insightful Insights, TV Appearances.

- save this article

- POSTED IN Insightful Insights, TV Appearances

-

Big Apple?

Roger Montgomery

September 12, 2012

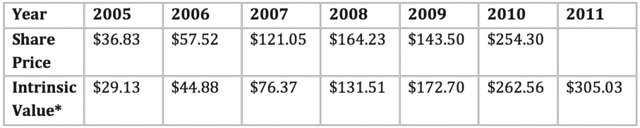

Did you know that the market capitalisation of Apple Inc. is now more than the entire equity markets of Spain, Portugal, Ireland and Greece combined? Its stunning. Surely Forrest Gump from Greenbow Alabama would be writing to Jenny with much enthusiasm. But what about its intrinsic value? Back in 2010 (http://rogermontgomery.com/is-apple-an-a1/) I wrote that Apple’s intrinsic value was higher than the share price at the time. The table below first published in July 2010 reveals the company’s pattern of rising intrinsic values. back then the price was indeed showing a small margin of safety.

A couple of blog readers have subsequently told me they purchased Apple shares and obviously they have done nicely. But what about today?

Only last year, when the share price hit $600 I wrote that I thought price had run ahead of intrinsic value (but not forecast intrinsic value) and the share price subsequently fell slightly. We also noted declining margins and market shares losses. But improving quarterly results and rising forecasts means revisions have resulted in IV estimates continuing their stellar rise so a revisit of our assumptions might be worth our time.

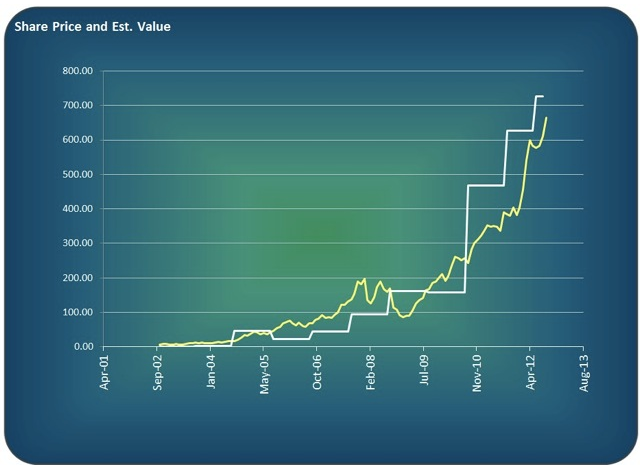

The graph below reveals that our ‘revised’ back-of-the-envelope intrinsic value estimate for Apple is forging ahead. If you are confident that Apple’s pipeline of products will usurp the competition, take back market share and fill Apple’s coffers towards 1000 billion dollars and that the iPhone 5 – expected to be revealed this week – will knock everyone’s socks off, then the massive rises in intrinsic value, might not seem so extreme.

Of course all intrinsic values are just estimates and while our haven’t done too badly for us – we’ve been spot on with BHP at $30 and done well on others – the reality is they can change dramatically as new information comes to hand.

So lets keep an eye on whether Apple impresses this week with its new release.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Market Valuation, Value.able.

-

MEDIA

Round 1: Value Investing vs the “new” paradigm – you be the judge……

Roger Montgomery

September 10, 2012

One of the constants of the last 10 years is market commentators saying that “this time is different” – we believe that the principles of of value investing never change, and Roger articulates the reasons why in this interview with Ticky Fullerton (and Marcus Padley!) on ABC1’s The Business, broadcast 7 September 2012. Watch here.

by Roger Montgomery Posted in Insightful Insights, Intrinsic Value, Investing Education, TV Appearances.