Global markets

-

Australia’s worst equity performance day since the GFC – some observations

Scott Phillips

March 10, 2020

Yesterday saw the ASX 200 Index sell off a whopping 7.3 per cent in what was the most brutal fall in our Australian equity market since 10 October, 2008, which was in the height of the GFC. continue…

by Scott Phillips Posted in Global markets, Market commentary.

- save this article

- POSTED IN Global markets, Market commentary

-

How investors could benefit from the coronavirus

Roger Montgomery

March 4, 2020

Looking purely from an investing perspective, the global sell-off caused by the coronavirus pandemic could be manna from heaven for cashed-up value investors. I think we’re about to see some wonderful buying opportunities. continue…

by Roger Montgomery Posted in Editor's Pick, Global markets, Market commentary.

-

What’s really infecting markets?

Roger Montgomery

March 2, 2020

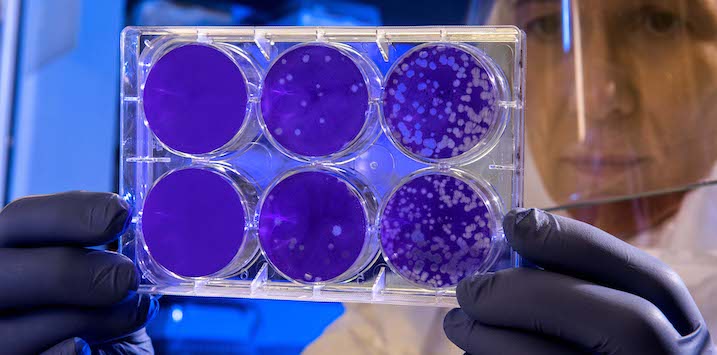

Can you see how coronavirus can be contained? Let’s think practically about this, especially in light of the revelation that the incubation period may be longer than two weeks and is infectious before symptoms present. continue…

by Roger Montgomery Posted in Global markets, Market commentary.

-

How the Coronavirus is infecting China’s activity

Roger Montgomery

February 27, 2020

Humans often take their cues from the news and their assessment of risk often coincides with the subject’s prominence in the media. However, to be a successful investor you need to see through the noise. continue…

by Roger Montgomery Posted in Global markets.

- save this article

- POSTED IN Global markets

-

Chinese supply chain impacts from tariffs and coronavirus

Andreas Lundberg

February 26, 2020

A lot has been written in media on the current impact of the coronavirus on both the Chinese citizens and the Chinese economy. Although most of what I read is concerned with the short-term and not on the potential longer-term implications. To that extent, I wanted to relay a small snippet of information that came out of a company meeting I recently attended. continue…

by Andreas Lundberg Posted in Companies, Global markets.

- 2 Comments

- save this article

- POSTED IN Companies, Global markets

-

Two reasons this bull market is set to continue

Roger Montgomery

February 7, 2020

Since early 2009, soaring global markets have made shares an extremely rewarding place to invest. With profits likely to keep recovering, and interest rates and inflation likely to stay low, I see no reason why this bull market will not continue. continue…

by Roger Montgomery Posted in Economics, Global markets, Market commentary.

-

Observations of equity markets from previous viral outbreaks

Scott Phillips

January 28, 2020

Investors in Australia and around the world are understandably worried about the onset of a new disease (Wuhan Coronavirus – known as nCoV) and the implications for their investments, particularly as the medical profession develops their understanding of the disease. While the number of confirmed cases has increased from 282 to 4,474 in the past 7 days it is a moving tally. continue…

by Scott Phillips Posted in Editor's Pick, Global markets, Health Care, Market commentary.

-

Are we seeing a dissonance between credit markets & broader equity indices?

Roger Montgomery

December 12, 2019

UK Macroeconomic Strategist Michael Wilson has penned an interesting piece entitled “Involution” which came across my desk. It was interesting enough that I thought it worth sharing in its entirety. continue…

by Roger Montgomery Posted in Global markets, Market commentary.

-

US equities will head higher in 2020, says Credit Suisse

David Buckland

December 5, 2019

Our friends at Credit Suisse have fished out the crystal ball to give us a snapshot of the likely year ahead for US equities. The good news is that next year should deliver more solid returns for investors. continue…

by David Buckland Posted in Global markets, Market commentary.

- save this article

- POSTED IN Global markets, Market commentary

-

All Eyes on the US Government Ten-Year Bond Yield

David Buckland

November 15, 2019

There are many factors which have driven the US Government Ten-Year Bond Yield down over the 35-year period from 15.85 per cent in the September Quarter of 1981 to 1.35 per cent in the September Quarter of 2016. While I will discuss these factors in more detail in an upcoming blog, what has struck me is that over recent weeks we have seen the US Government Ten-Year Bond Yield jump by nearly 0.5 per cent from close to a record low of 1.45 per cent to the current 1.93 per cent. continue…

by David Buckland Posted in Global markets, Market commentary.

- save this article

- POSTED IN Global markets, Market commentary