Financial Services

-

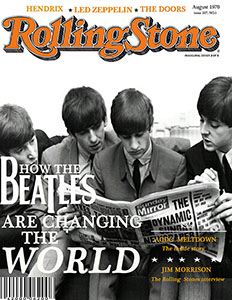

Rolling Stone rolls the stone away from the entrance to reveal…

Roger Montgomery

May 14, 2013

We think you will enjoy spending a few minutes being illuminated by this story from Rolling Stone’s Matt Taibbi.

continue…by Roger Montgomery Posted in Financial Services.

- save this article

- POSTED IN Financial Services

-

MEDIA

What’s the outlook for the Australian economy?

Roger Montgomery

May 10, 2013

In these highlights from Sky Business’ Business View, with James Daggar-Nickson, Roger gives his view on the recent cash rate cut by the RBA and the implications for mortgage holders, as well as the outlook for the resources sector. What’s the outlook for Australia? Find out here.

by Roger Montgomery Posted in Energy / Resources, Financial Services, TV Appearances.

-

MEDIA

Which stocks are good buys right now?

Roger Montgomery

May 2, 2013

In these highlights from the Sky Business Switzer program broadcast on 2 May, Roger gives his view on the intrinsic value of BHP, and whether he thinks that the banks are worth a look. Watch here.

by Roger Montgomery Posted in Energy / Resources, Financial Services, TV Appearances.

-

How Far Can The Big Four Banks Go?

Tim Kelley

May 1, 2013

Strong investor support for stocks with high dividend yields has been one of the defining features of the Australian share market over the last year or two. The big four banks have been particular beneficiaries of this, and with a healthy first half result reported this week by ANZ, the theme has additional momentum.

continue…by Tim Kelley Posted in Financial Services, Insightful Insights.

-

What’s happening at our banks?

Roger Montgomery

April 30, 2013

What’s happening at our banks? ANZ reports.

by Roger Montgomery Posted in Financial Services, Insightful Insights.

-

MEDIA

NAB on the decline

Roger Montgomery

March 13, 2013

In discussion with Ticky Fullerton on ABC1’s The Business, Roger highlights the poor performance of NAB over the past 10 years – and also provides his insights into whether now is a good time to invest, and the unchanging nature of the television market in Australia . Watch here.

This program was broadcast on 13 March 2013.

by Roger Montgomery Posted in Financial Services, Market Valuation, TV Appearances.

-

WHITEPAPERS

FlexiGroup quick out of the blocks

Roger Montgomery

December 22, 2012

But market has factored in too much growth too soon.

Buying a stock that has doubled in a year and become a “market darling” is hard work for value investors. It gets even harder when the company has declining return on equity (ROE), patchy earnings per share (EPS) growth, high debt, and an aggressive growth strategy.

Based on its current valuation, the market seems to think FlexiGroup can do no wrong. The fast-growing provider of consumer and retail point-of-sale finance has done remarkably well after raising $264 million through an Initial Public Offering in 2006.

by Roger Montgomery Posted in Financial Services, Whitepapers.

- 1 Comments

- save this article

- POSTED IN Financial Services, Whitepapers

-

The cold war in accounting oversight heats up

David Buckland

December 12, 2012

Over the past decade many Chinese-based companies have listed in the US. For the larger stocks, such as PetroChina, China Mobile and CNOOC, the American Deposit Receipt (ADR) represents a secondary listing, and often Hong Kong is the primary place of listing.

However for about 200 smaller stocks (with an aggregate market capitalisation of US$84 billion), the US is their primary market.

by David Buckland Posted in Financial Services, Global markets.

- save this article

- POSTED IN Financial Services, Global markets

-

WBC: 1, NAB: 0. 100% out-performance in 10 years

Roger Montgomery

November 7, 2012

Westpac’s results for the year to September 2012 reinforced the ongoing challenges National Australia Bank is suffering from its Clydesdale and Yorkshire banking subsidiaries. In terms of cash earnings, Westpac’s $6.6b is 21% higher than NAB’s $5.443b. Both companies had average shareholders’ funds of $43b in the year to September 2012 however Westpac’s cash earnings to average shareholders’ funds ratio was 2.7% higher than NAB’s at 15.35%.

continue…by Roger Montgomery Posted in Financial Services.

- 1 Comments

- save this article

- POSTED IN Financial Services

-

National Australia Bank – ongoing challenges

David Buckland

November 1, 2012

National Australia Bank continued to suffer ongoing challenges from their Clydesdale and Yorkshire Banking subsidiaries, with reported net cash earnings for the year to 30 September 2012 declining by 0.5% to $5.443b. After contributing GBP183m in the previous year, NAB’s UK operations lost GBP139m. Charges for bad and doubtful debts soared by $793m to $2.6b. While average shareholders’ funds increased 7% to $43b, cash earnings on average shareholders’ funds declined by nearly 1.0% to 12.6%.

While the 7.0% dividend yield is attractive for retail investors, the National Australia Bank share price has been an enormous disappointment over the past decade and shareholders with long memories must be questioning the diversifications strategy which saw the purchase of Clydesdale Bank, Northern Bank (in Northern Ireland), National Irish Bank (in the Republic of Ireland), Yorkshire Bank and the US-based Home Side.

From Montgomery’s viewpoint, National Australia Bank received a B4 quality rating in 2004, and this was reaffirmed in 2007 and 2008. Its current quality rating is A4.

by David Buckland Posted in Financial Services.

- 2 Comments

- save this article

- POSTED IN Financial Services