Financial Services

-

Are the banks robbing sensible investment returns?

Roger Montgomery

November 15, 2011

Amid all the talk of GFC II and the Eurozone unravelling, Warren Buffett’s Berkshire Hathaway Inc. (BRK/A) has been increasing its stake in US bank, Wells Fargo & Co (WFC – 420 Montgomery Street San Francisco).

Amid all the talk of GFC II and the Eurozone unravelling, Warren Buffett’s Berkshire Hathaway Inc. (BRK/A) has been increasing its stake in US bank, Wells Fargo & Co (WFC – 420 Montgomery Street San Francisco).Buffett (or was it Todd Combs?) topped up Berkshire’s holdings in the world’s 24th biggest bank by 9.7 million shares in the three months to June 2011 (we don’t have more recent information because Berkshire requested and was granted permission to withhold stock specific information). Between 1 March and 30 June – the three months during which the stake was increased – Wells Fargo traded as high as $33 and as low as $27.

WFC currently trades at $25.65 and its book value is $26.10 per share. Paying a small discount to book value for a bank that earns a return of 11.86 per cent on that book value doesn’t seem like a fantastic bargain and paying a premium to book value is perhaps less so. But the fact remains one of the best investors of our generation, reckons it is ok to be selectively buying US banks. Is Buffett going to make off with a bank fortune the way Butch Cassidy did or will he be caught red handed this time? Should you be doing the same as Buffett with Australian Banks?

Wells Fargo is the biggest U.S. home lender (think Commonwealth Bank) and Berkshire is its biggest shareholder. Given Berkshire’s interest in Wells Fargo and Bank of America should be taking a look at our own Banks?

I know there are conflicting and well-articulated opinions here at the blog about the banks, so feel free to add your own thoughts.

Here are mine.

Broadly, the local banking system is in a relatively strong position compared to peers globally. The funding, capital and liquidity position of the major banks has been strengthened and those who fear a housing collapse in Australia should be mindful that such an event would impact consumer confidence and credit growth more than the immediate profits of the banks, who have insured their exposure.

From a funding perspective, bank deposit growth has outstripped lending growth and while further increases in wholesale funding costs could reasonably be expected, the banks are ahead of schedule in raising term wholesale funding that is said to provide 6 months grace. Of course if deposits continue to grow faster than loans, the gap that is funded from overseas wholesale markets diminishes.

As I have previously noted, high levels of leverage at the consumer, company and country level simply take time to pay off. You just don’t go off spending aggressively again until you feel your debt is under control. As a result, it is reasonable to expect bank balance sheet expansion will be muted over the next year or two at least. Some of you may think even longer or permanently…

Globally, the banking picture is at the very least, interesting to watch. The five biggest US banks excluding bank of America posted 8 per cent profit growth, while in the UK the five majors posted H1’11 profits that were half of those reported the year before. Predictably this has resulted in announcements of an intended five billion Sterling cost cutting drive by 2014. In Europe, the largest ten banks saw profits fall less than 8 per cent. Curiously some observers suggest that the present problems befalling sovereigns will have less of an impact on banks than the GFC because sovereign debt is less complex than credit default swaps on collateralized debt obligations and stress testing has been completed and widely reported. With little exposure to European debt and strong growth domestically, Asian banks (with the exception of Japan) are the one bright spot.

Globally, banks are targeting cost to income ratios of less than 40 per cent despite the higher costs associated with reengineering systems and procedures to meet a heightened regulatory environment.

Locally, our major banks have posted more than acceptable profits considering global financial conditions and local consumer and business sentiment, which has remained muted

Growth has been achieved at least partly by the reduction in the provision for bad and doubtful debts. Additionally, the reduction in the aggregate loan impairment charge was 37%; from $8.4 billion to $5.3 billion.

While significant reductions in loan impairment charges can be seen as a positive, future growth in profits – in the absence of a recovery in consumer and business confidence – will have to come from cost cutting.

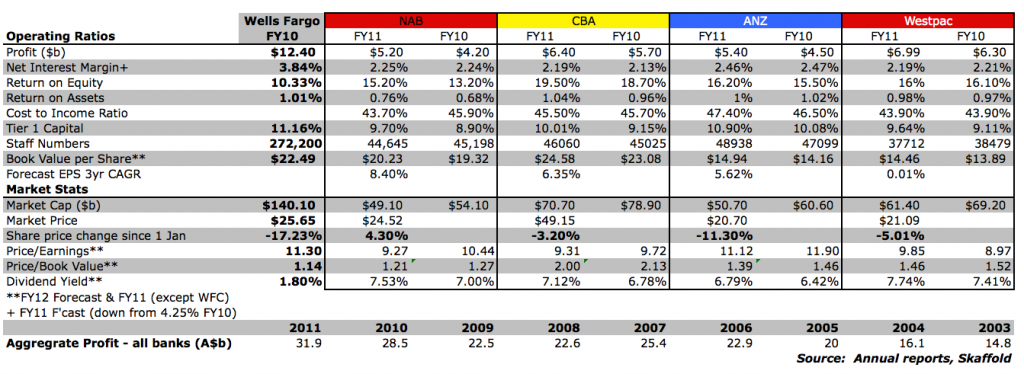

Collectively, cost cutting is being reflected in some results – cost to income ratios improved for the CBA and NAB and less so for the ANZ and Westpac. Further improvements should be expected and I have been reliably informed to expect significant retrenchments – in the thousands – in the financial services sector, even though full time employees increased at the ANZ and CBA last year. The changes in cost to income ratios should also be seen in the light of the dramatic reductions achieved since the early nineties when cost to income ratios were; ANZ 74%, WBC 68%, CBA 67% and NAB 57%.

Net interest margins – the net margin earned or the difference between interest paid on deposits and interest earned on loans – were broadly unchanged and while the CBA recorded an improvement, this has not been widely reported elsewhere as being materially due to an accounting reclassification of net swap costs. Competition for retail deposits and higher-cost, post-GFC funding as well as regulatory changes forcing an increase in liquid assets put pressure on margins. A broad maintenance of margins is therefore laudable.

The banking industry’s preferred measure of profit is Cash Profit (after tax), which removes the impact of discontinued operations, adjustments for acquisitions, Treasury shares and fair value adjustments.

On this measure, all the banks posted healthy increases.

The ANZ increased profits from $5.1 to $5.6, the CBA $6.1 to $6.8, NAB $4.6 to $5.5 and Westpac from $5.9 to $6.3.

Non-interest income, which includes trading, fees & commissions and Wealth management & insurance (which includes life insurance, superannuation and investment management products), declined in aggregate. Fees & commissions across the major banks were largely steady at just under $12 billion due to a drop in lending offset by an increase in corporate M&A. Wealth management profits fell for all the banks bar Westpac (BT). Profits here are largely a function of equity market performance given the big brand’s focus on index hugging and fund inflows/outflows. Funds under management and administration grew only for the CBA.

The outlook for Australian banks will remain mired by the general ‘funk’ Australian consumers and business are in. Our one-cylinder economy is not going to spur rapid balance sheet expansion (read credit growth) for the banks in the near term. With property prices and volumes in some areas also depressed the number of mortgages and the size of a loan on any individual property is necessarily lower. Banks love mortgages the most because their perceived lower risk means the banks have to provision less for each one they write. You are welcome to discuss your views about the direction of property in Australia in the comments below and I would welcome your thoughts. I think that we shouldn’t expect any immediate recovery in property activity to spur bank balance sheet expansion.

With the details broadly out of the way what are the current estimated valuations and prospects for intrinsic value growth for each of the banks? Keep in mind the intrinsic value expectations for the next three years are based on earnings growth and equity figures as stated in the table included with this column.

Skaffold’s (www.Skaffold.com) current estimated intrinsic values for the banks are: WBC $22.12, ANZ $24.49, CBA $51.54 and NAB $27.69. Of course these will change over the next weeks and months as estimates are updated and the banks make announcements about prospects, acquisitions or capital raisings etc. and I may not update those details here at the Insights Blog.

The bank displaying the greatest estimated margin of safety currently is ANZ, which at the current price, is displaying an estimated safety margin of 16%. Of the others NAB appears to be next, with an estimated margin of safety of 11%, WBC 5% and CBA 3%.

Despite being second on this list, the NAB has produced the lowest returns on equity and assets but also the lowest cost to income ratio, second highest Net interest margin and the highest forecast earnings per share growth for the next three years.

In aggregate the opportunity to buy at either very large discounts or smaller discounts but with solid growth potential does not appear to be available. An investor requiring meaningful margins of safety, would demand lower prices before being seriously interested. I will leave that decision to you after taking personal professional advice of course – from Buffett or your advisor. Growth doesn’t have to be sensational to make attractive returns but in such cases, one should require a large margin of safety to be more certain of a reasonable return.

What are you thoughts about the banks? Have I missed an angle that you would like to add? For example do you think the economic growth prospects are bright for the US compared to Australia? What are your estimates for earnings growth and what are your expectations for the residential, agricultural or commercial property market? I would be delighted to facilitate a discussion on these subjects.

Posted by Roger Montgomery, Value.able author and Fund Manager, 16 November 2011.

by Roger Montgomery Posted in Financial Services.

- 48 Comments

- save this article

- POSTED IN Financial Services

-

Which bank?

Roger Montgomery

November 11, 2010

Everyone from the media, to politicians and litigation funders have been busy bashing our banks over the head. Led by a possibly tipped-off/advised Joe Hockey, this particular attack seems to have legs. Have you been distracted by the noise?

Not me, I have been busy looking at the latest set of financial results from ANZ, NAB and WBC and comparing them to my CBA benchmark.

I have spent many hours and analysed many industries and their KPI’s and for the banks I will simply say that CBA and WBC are currently my two highest quality banks (based on the Montgomery Quality Rating). WBC gets an A1 MQR (up from an A5!), CBA is an A2 (up from an A4). They’re also the biggest.

My salient facts for the big four are shown below.

While ANZ appears to be the cheapest and the most tempting, I continue focusing on the goal of filling the portfolio with only the best businesses. So it may prove a better option to exercise patience and wait for wider safety margins. With the latest round of bank bashing and China announcing further tightening measures, I may not have to wait long.

Between now and then you will read many views about the size of each bank’s reported profits, why they have too much power, why they should cut this fee or stop doing this and that. But keep in perspective that no matter what is written or said, they provide many services and functions that are vital to capitalism.

Another important couple of things to remember is that they collectively have 92% market share and don’t provide all (or any!) of their services for free. ATM Fees… Debit Card Transaction Fees… Annual account-maintenance fees… Monthly Account keeping Fees… Minimum Balance Fees… Wire Transfer Fees… Overdraft Protection Fees… Overdrawn fees… Dishonour Fees… Clearance Fees… Statement Fees… Voucher Fees… Periodical Payments or transfer fees… Stop payment fees… Recent Transaction List Fee… Overseas transaction fees… Electronic banking fees… Interest fees… Establishment Fees… Deferred establishment fees… Over the limit fees… Currency conversion fees… Annual Fees… Deposit Fees… Withdrawal Fees… Online-banking fees… Teller fees… the list goes on, there’s even “late” payments fees for paying your credit card too early.

As you might know there are four basic sources of competitive advantage – something Buffett is primarily focused on – they are: economies of scale, the network effect, intellectual property rights and high switching costs. The four biggest banks enjoy both economies of scale and the benefits of high switching costs. It is personally more taxing for a client to change banks than the benefits that inhere from switching. And so very few people switch. As I have often said, if you live on an island with a long swim to anywhere else, then owning a bank is not a bad idea. They can charge you to put your money in, charge you to take your money out and even charge you to find out how much money you have.

For me, being active in the share market can bring on-line brokerage fees, telephone order fees, custody fees, software fees, transfer fees, late settlement fees, margin lending fees etc…

No matter where you turn, the banks are entrenched in my daily life.

And where do all of these fees, along with net interest income and trading profits go? Into wafer thin 1% margins. Yes, our banks rely on massive volumes. WBC has $620b of assets. A 1% return on those assets equates to a profit of $6.2b – roughly what they reported in their full year result.

They are also some of Australia’s highest leveraged businesses shouldering enormous risks (albeit controlled) to generate that return. If you have ever heard that ‘X’ bank has a tier 1 risk weighted capital ratio of 8%, generally this means that the bank is holding only $8 for every $100 that a customer has borrowed. Being highly geared, it is therefore in the bank’s interest to ensure that everything in our economy ticks along.

By far the biggest variable expenses for banks are bad debts. During the GFC when bad debts increased dramatically, do you remember what happened when things turned ugly? Those wafer thin profit margins disappeared like the last Mars Polar Lander. The impact on NAB’s profits, for example, was dramatic with profit in 2009, $2 billion lower than the year before.

With these risks in mind it seems a tad irrational to quibble over the enormous profits being earned, particularly when they are largely returned to Australians. Shareholders receive 70%-80% of profits in fully franked dividends and the Australian public receive 30% of pre-tax profits via tax payments to the government.

On the other side of the coin is the very real fact that these are mature businesses. As Value.able Graduate Richard Quadrio mentioned in his comment here on the blog yesterday, banks can only increase their profit by either lending us more or charging us more. The former depends on our appetite, which may be slowing. That leaves the latter.

In my mind, they have the power to keep increasing prices but the legislators now need to be convinced that they should be allowed to in return for wanting to continue lending and perpetuating the GDP growth dream. Paralysed by these competing forces, I go back to what I know – investing, and ask; which bank is the best? For me that’s the only question – which bank?

Posted by Roger Montgomery, 11 November 2011.

by Roger Montgomery Posted in Financial Services.

- 114 Comments

- save this article

- POSTED IN Financial Services

-

Where are my valuations Roger?

Roger Montgomery

July 22, 2010

Bipolar markets appear to be the anticipated outcome for the next few years. Investors seem to be in the middle of a tug-o-war between inflation and deflation, recovery or double dip recession.

Bipolar markets appear to be the anticipated outcome for the next few years. Investors seem to be in the middle of a tug-o-war between inflation and deflation, recovery or double dip recession.Pimco’s Bill Gross says we have entered the era of the “new normal’ – expect low aggregate returns. Jeremy Grantham at GMO says that attributing the chance of recovery at 25% is “generous” and the US will be lucky to achieve 2% economic growth over the next seven years. And David Rosenberg at Gluskin Sheff says deflation is more likely than inflation, describing the stock market as meat grinder – “No return for a decade and yet plenty of sleepless nights on this roller-coaster ride.” Keep in mind David is a perennial bear. I remember during my days as trader being told; listen to the bears but don’t sell until they turn bullish!

Over at the bullish camp PuruSaxena says “the ongoing range trading should conclude with a bullish resolution” and cites Intel’s best quarter ever and JP Morgan’s analyst estimates-beating performance as justification.

At Montgomery Inc. ‘we’ don’t claim to know how the world’s debt issues will be resolved. What we do know is that you cannot solve them with more borrowing.

In Australia many ‘analysts’ are pointing to the fact that the recent rally has not been accompanied by much volume. Indeed, one of my friends who is a broker said they can “hear pins drop” in their office. But before you rush out and sell in anticipation of some imminent correction (I am not forecasting anything), have a look at the volume that accompanied the beginning of the bounce from the March 2009 lows. They were relatively light too. Perhaps that means the whole thing will indeed end in a massive correction that will see even lower lows! (I am not forecasting anything).

Stock market investing however need not be so mysterious and confusing. Instead of focusing on stocks, focus on businesses. Instead of focusing on prices, focus on values. When bargains are available it is obvious. When the banks were at their lows, there was no justification and large discounts to intrinsic value were evident for three of the big four. Their prices were following the pattern of their global peers that were each losing billions and being bailed out or nationalised. While their prices were on their knees, their values were being driven by the fact they were reporting multibillion-dollar profits. Focus on the business – don’t take your cues from share prices.

More importantly, when bargains are available you are writing to me with requests to value high quality companies. “What is the value of CBA Roger?” “What do you think of CSL and Cochlear at these prices?” “They’re pricing QBE like it is going out of business, that’s just crazy.”

Today, value is not so obvious and once again that is reflected in the general quality of the companies that you are asking me to value for you. While you have requested a few decent businesses, there have been a few raised eyebrows at Montgomery Global.

With those thoughts in mind, I offer another Value.able update from Montgomery Inc, along with the relevant MQRs – “Montgomery Quality Ratings”. At some point I will publish, somehow, the entire universe with the A1, A2, A3, to C3 C4 and C5 MQRs.

Don’t forget that the valuations you are seeing here are based on inputs that include analyst estimates. As some of you have indicated, analysts are notoriously bullish and particularly at the beginning of a reporting period tend to have estimates for earnings that need subsequent downward revision. I will discuss this and my observations and insights in a future post.

For now, know that the studies conducted by McKinsey, for example, into the persistent excess bullishness among analysts, aggregate and average the data which can produce a result that does not reflect any particular year. Stick your head in an oven and your feet in the freezer and your ‘average’ temperature will be about right, but of course you won’t be feeling so good!

The point I should make however is that my valuations for CBA, WBC, NAB, ANZ, QTM, CAB, HZL, FLT, SOL, MMS, CPU, AXA, BLD, CFU, DYE, DMX, ISF, VLA, QHL and CLQ (especially the 2011 estimates) will be revised over time. They will change. And having just been calculated they may also have changed from any previously published valuation and supersede them.

WARNING: Not recommendations or advice. Didactic exercise only. Seek personal professional advice before doing anything!

* Quality Score shown for last full year results. May change dramatically. May have been one good year – a flash in the pan. There is more to know. If for example, a company makes a debt-funded acquisition, its quality score could change.

++ 2009 Valuation. No forecast information available

+++ No forecast information available

^ US Company listed in the USYour copy of Value.able will be delivered soon. I’m looking forward to comparing you’re valuations here on my blog.

Posted by Roger Montgomery, 22 July 2010.

by Roger Montgomery Posted in Companies, Financial Services, Insightful Insights, Investing Education.

-

Which Bank do you own?

rogermontgomeryinsights

December 24, 2009

Half of all shareholders in Australia own at least one major bank in their share portfolios. The economics for banks in the last two years have changed dramatically and on several fronts.

First, they are believed to have largely dodged the impact of the GFC. This was predictable, as was the second change – the substantial gain in market share the banks enjoyed as their mortgage origination peers fell like dominoes relying, as they were, on short term wholesale funding and with no deposit base.

For both reasons I mentioned at the end of 2008 and the beginning of 2009 on CNBC that bank prices represented a rare opportunity to own the best businesses you can on an island – a legislated oligopoly that charges people to get their own money in and out. You can see the video from December 16 here.

There was also another major change that kept analysts on our toes. Dilutionary capital raisings wreaked havoc on the returns on equity and the equity per share for all four majors. Then Westpac, previously the bank with the best business performance, bought St George, and CBA bought ING. NAB has since bid for Axa (at arguably a price that is double the intrinsic value of the Axa) and ANZ…well who knows (read more here)

The effect of all this activity has not changed the fundamental attraction of owning a big four bank on an island of 22 million people who don’t care what you charge them because they cannot be bothered moving to another bank; “they’re all the same”. What has changed however is the future returns on equity for each of the banks and therefore, their intrinsic values.

Here’s my take on each banks’ forecast return on equity range for the next few years and valuation. I have ordered them by profitability in ascending order (ROE range, Intrinsic value):

NAB (11%-15%, $22.08)

ANZ (12.6%-16%, $18.10)

WBC (14.5%-18%, $19.19)

CBA (17.5% – 20.7%, $53.53)

In every case, current prices are well ahead of the current valuation however, I should add that the valuations are based on 2010 estimates and for all four banks, the valuations rise significantly in future years as ROE heads towards the top of each of the ranges given. Given the time frames that I can see, you will be waiting for values to catch up to current prices. NAB and ANZ are the cheapest, but you are buying the new 2nd tier banks. WBC is a better performing bank than ANZ and NAB but its price reflects it and you will be waiting twice as long as the others to catch up.

Many of you have told me you want to keep this blog a little bit of a secret, but let me tell you we will all benefit if we receive contributions and insights from those closer to the coal face of various industries. So let me encourage you to post your own thoughts and insights and invite anyone else you know (that owns bank shares for example or works in a company that is a competitor to any of those I mention) to do likewise. Do you think you know anyone that owns bank shares and would benefit from this insight? Spread the link.

http://rogermontgomeryinsights.wordpress.com/

Posted by Roger Montgomery, 23 December 2009

by rogermontgomeryinsights Posted in Companies, Financial Services, Insightful Insights.

-

Is AMP getting good value for Axa and could ANZ really pay that much for AMP?

rogermontgomeryinsights

November 23, 2009

Corporate Australia has a rich history of overpaying for the right to be big, bigger, the biggest. While size may help fatten the wallet of the steward steering the ship, it is often the case that investors, particularly those late to the party, see their wallets lose weight.

When ABC Learning bought all those centres and Wesfarmers bought Coles, it was obvious that the prices being paid were much higher than a rational and patient value investor would pay. Justified with promised synergies however, many acquisitions can be made to look good, disguising the real he’s-got-one-so-I-want-one-too motivation.

Turning to the AMP/Axa deal I should first point out that I am not suggesting either company is in the same boat as ABC Learning. What I will say though is that ultimately a business is worth some multiple of its equity and that multiple must be related to its profitability. Talk surrounds the possibility that Axa could be the recipient of another bid – although none has been forthcoming and with wealth management being a key growth strategy for the banks, there is also talk that ANZ might bid for AMP. The hunter becomes the hunted. Ignoring the cliches, the rumours and share price gyrations, we can value Axa and decide whether we like AMP management’s capital allocation strategy. We can also value AMP and decide, if ANZ make a bid, what we think of them.

Turning first to Axa; AMP has, with cash and shares, bid about $5.40 per share. Unsurprisingly Axa shareholders want a higher bid. Well of course they do. I would rather receive a few million more for my house too. But Axa’s performance doesn’t justify a higher bid and AMP needs to be prudent. According to analyst estimates of EPS, Axa will generate a return on equity of about 13 percent over the next two years. With the exception of the 2008 loss, the return on equity for the last ten years has ranged between 6.8% in 1999 and 27% in 2003. Based on the forecast ROE and a payout ratio of between 61% and 67%, Axa’s 2010 equity of $2.58 per share is worth a little more than $3.00 per share. The market believes AMP will bid more and so the shares are trading at $5.84.

With AMP at $6.35 – up from its lows earlier this year of $3.52 – the price does not reflect the actual value of the business which is between $4.53 and $5.24. Should ANZ bid even more than the already optimistic price, it would reflect a genuine me-too strategy over at ANZ.

Nothing gets the blood racing more than a takeover and when blood leaves the head for other regions, common sense usually follows.

By Roger Montgomery, 23 November 2009

by rogermontgomeryinsights Posted in Financial Services, Insurance.

- 4 Comments

- save this article

- POSTED IN Financial Services, Insurance

-

A clear leader emerges among Aussie banks

rogermontgomeryinsights

September 9, 2009

Nothing beats living on an island and nothing beats living on an island and owning the only bank. The cozy banking oligopoly that exists on the island of Australia as well as high switching costs for customers has produced all the benefits associated with a wide competitive advantage.

Are you going to bother moving if your bank charges you a few cents more for each ATM withdrawal, EFTPOS transaction or EFTPOS cash-out? With 70 million ATM transactions per month, 150 million EFTPOS and EFTPOS cash out transactions per month and 30 million debit card accounts, a few extra cents charged per transaction and account is a valuable revenue generator for banks with very little additional work or cost and virtually no risk of customer loss.

In the past the banks were all the same from an investors perspective too, but there’s a change in the air. The recent capital raisings have done significant damage to the value of three of the major four banks in Australia.

When ANZ, NAB and WBC were raising capital to shore up their balance sheets, CBA was raising capital to take advantage of opportunities in a distressed market, and acquired BankWest. It shored up its profitability in the process and now has the highest ROE of all the banks at 19% and based on consensus estimates will return 21% on its equity for the next 2 years. This compares favourably with the ANZ (11%), NAB (12%) and WBC (13%).

After two decades, a clear leader for investors has emerged in Australian banking.

By Roger Montgomery, 9 September 2009

by rogermontgomeryinsights Posted in Financial Services.

- 2 Comments

- save this article

- POSTED IN Financial Services