WBC: 1, NAB: 0. 100% out-performance in 10 years

Westpac’s results for the year to September 2012 reinforced the ongoing challenges National Australia Bank is suffering from its Clydesdale and Yorkshire banking subsidiaries. In terms of cash earnings, Westpac’s $6.6b is 21% higher than NAB’s $5.443b. Both companies had average shareholders’ funds of $43b in the year to September 2012 however Westpac’s cash earnings to average shareholders’ funds ratio was 2.7% higher than NAB’s at 15.35%.

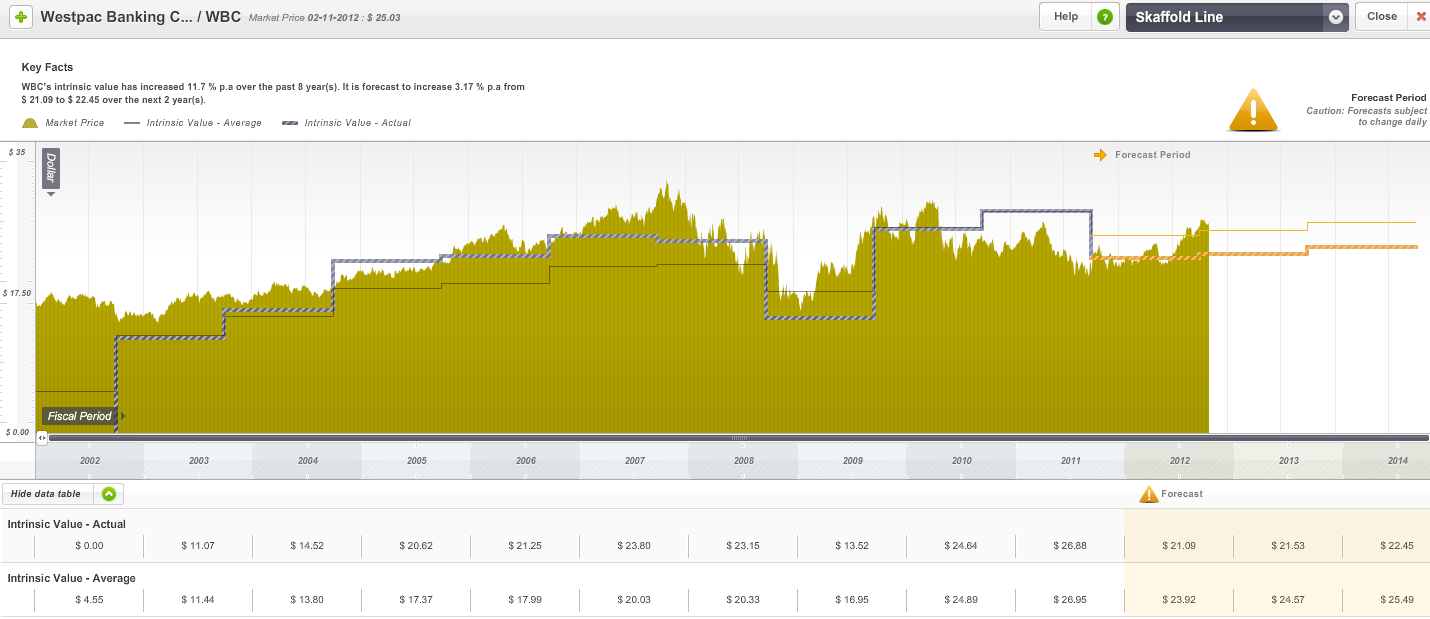

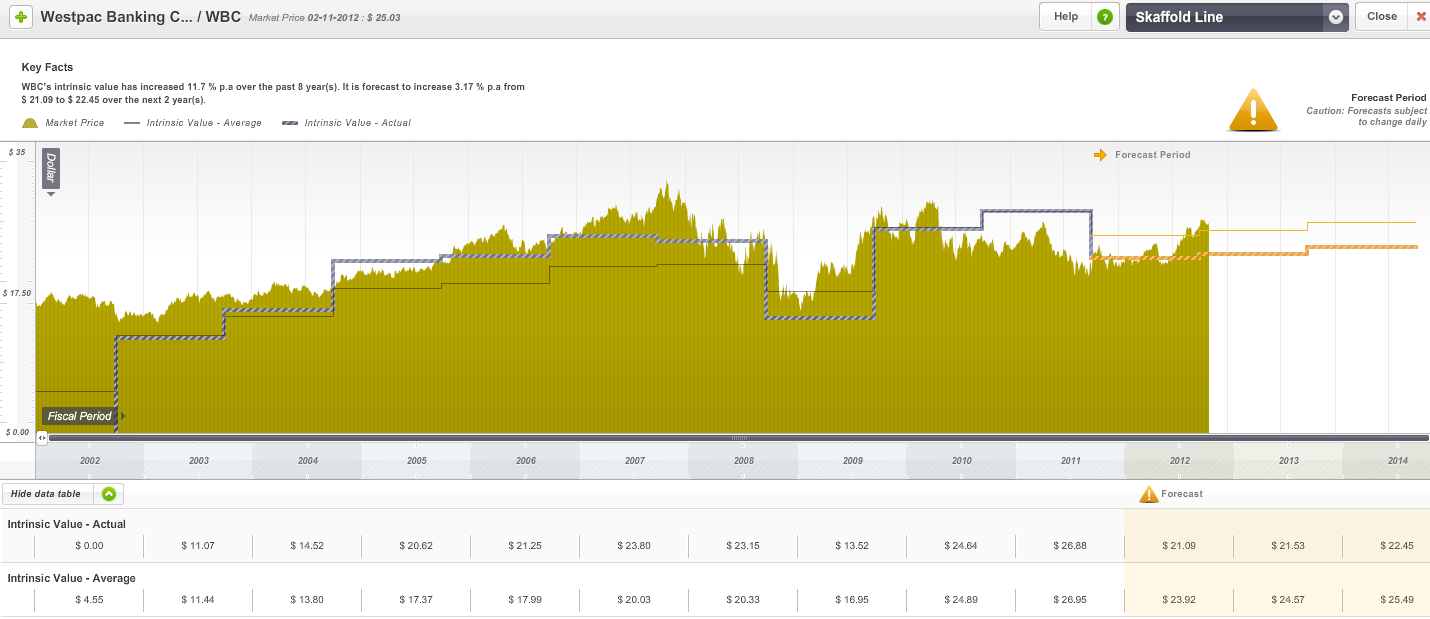

It is interesting to compare Westpac’s share price movement over the past decade (below) with that of the National Australia Bank (see post at 1 November 2012). Westpac’s share price is up 78% (from $14 to $25), while NAB’s share price is down 22% (from $32 to $25), emphasising that what matters in the long run is a company’s actual underlying business performance. As Benjamin Graham said, “in the long run, the market is like a weighing machine”.

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking.

Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

DON STEWART

:

Chaney was a stella performer when CEO at WES. I would have thought he, although only Chairman, would have turned NAB around by now. He has certainly blotted his copybook!