Editor’s Pick

-

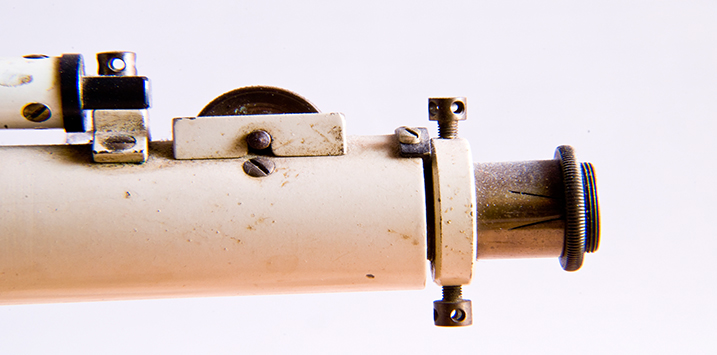

Through my telescope, I see a property bubble forming

Roger Montgomery

September 1, 2016

Another week, another set of entertaining quotes from the auction rooms as a fresh wave of investors bids over the reserve for a piece of Sydney real estate. Oh, yes, you gotta love asset bubbles. They produce quotes that, when told on the other side of the crash, seem so ridiculous they’re unbelievable. continue…

by Roger Montgomery Posted in Editor's Pick, Property.

- 25 Comments

- save this article

- POSTED IN Editor's Pick, Property

-

Has GEM learnt lessons from ABC?

Roger Montgomery

August 26, 2016

Childcare operator, G8 Education (ASX: GEM), recently reported its first half 2016 results, and they were not inspiring. EBIT margins are deteriorating under the weight of rising wages and corporate overheads. We don’t yet see it as a repeat of the ABC Learning disaster, but we are keeping our eyes peeled. continue…

by Roger Montgomery Posted in Companies, Editor's Pick.

- 9 Comments

- save this article

- POSTED IN Companies, Editor's Pick

-

How good a guide is guidance?

Roger Montgomery

August 22, 2016

How often have we read or heard that a listed company has missed guidance? Ahead of the upcoming 2016 reporting season, I have been thinking about whether guidance is helpful or not and have been encouraged by recent developments. continue…

by Roger Montgomery Posted in Editor's Pick, Market commentary.

- save this article

- POSTED IN Editor's Pick, Market commentary

-

Why you should stick with quality businesses

Tim Kelley

August 17, 2016

So far, 2016 hasn’t been an easy time for quality-oriented investors. If you look at returns across the ASX, low quality companies, like many in the Materials and Energy sectors, have provided stellar returns, while high quality companies have delivered comparatively boring returns. Despite this, we don’t believe it’s time to abandon quality businesses. continue…

by Tim Kelley Posted in Editor's Pick, Market commentary.

-

Is this another signal that a bubble is forming?

Roger Montgomery

August 16, 2016

From skirt lengths, to magazine covers to public protests and the rise of ant-establishment voting, signals are everywhere. And, as investors, we need to pay attention to them. Which is why the imminent sale of the long-held Soul Pattinson building in Sydney’s Pitt Street Mall caught our eye. To us, it’s yet another signal that asset prices are over-stretched. continue…

by Roger Montgomery Posted in Editor's Pick, Market commentary.

-

Don’t bet on rates staying lower for longer

Roger Montgomery

August 10, 2016

Australians are getting used to super-low interest rates, and eye-watering loan amounts, particularly for property purchases. Along the way, the household debt burden as a percentage of disposable income has ballooned out from 170% to 185% since 2008. This is nosebleed territory. Is it time to be concerned? We think so. continue…

by Roger Montgomery Posted in Economics, Editor's Pick, Property.

- 32 Comments

- save this article

- POSTED IN Economics, Editor's Pick, Property

-

Stand by for a big correction in apartment prices

Roger Montgomery

August 4, 2016

Are you worried about housing affordability? Anxious that your kids can’t even get onto the property ladder, never mind climb it? Well, an oversupply of apartments, plus an increasing number of failed settlements, means all that is about to change. Cheaper apartments are on the way. continue…

by Roger Montgomery Posted in Editor's Pick, Property.

- 30 Comments

- save this article

- POSTED IN Editor's Pick, Property

-

The headwinds affecting Australia’s Free to Air Television are strengthening

David Buckland

August 3, 2016

Name the Company which has been Australia’s number one player in its field for ten consecutive years, has recorded $2.54 billion of “Significant Losses” in the past four financial years and will likely see its Earnings Before Interest and Tax (EBIT) (excluding Significant Items) decline by 45 per cent over the five years to June 2017? continue…

by David Buckland Posted in Editor's Pick, Media Companies, Technology & Telecommunications.

-

Sorry is the hardest word

Stuart Jackson

July 22, 2016

As we head into another reporting season, we have taken a quick look at recent trading updates from companies and what this might tell us about what to expect from results. continue…

by Stuart Jackson Posted in Editor's Pick, Market commentary.

- save this article

- POSTED IN Editor's Pick, Market commentary

-

What’s the Go with Pokemon?

Ben MacNevin

July 15, 2016

You may be wondering why Pokemon is suddenly everywhere. Wasn’t that a fad 20 years ago? The popularity of the Pokemon Go app has not only turbo-charged Nintendo’s share price. It has also shown us, yet again, the significance of the ‘network effect’ – where a good or service becomes more valuable when more people use it. continue…

by Ben MacNevin Posted in Companies, Editor's Pick, Technology & Telecommunications.