Companies

-

Are there really five bargains to research further?

Roger Montgomery

July 29, 2011

With markets falling on fears that political brinkmanship in the US may result in an embarrassing default on the country’s extraordinary debt obligations (not to mention a reputationally damaging event), I wondered whether we could dig anything up with a more-than-slightly different approach to finding value.

With markets falling on fears that political brinkmanship in the US may result in an embarrassing default on the country’s extraordinary debt obligations (not to mention a reputationally damaging event), I wondered whether we could dig anything up with a more-than-slightly different approach to finding value.As you would know from reading Value.able, I am not a fan of the Price to Earnings Ratio. Nothing has changed on that front. Nevertheless, value may just be in the eye of the beholder and not only is the P/E Ratio common in literature about investing and in market commentary, it is, whether rightly or wrongly, in wide use.

Indeed, if you are like many Baby Boomers now on the cusp of selling your business, you will be spending a great deal of time in negotiations and assisting in due diligence to arrive at a simple multiple of earnings.

The humble P/E Ratio may be misused, misunderstood and relied on far too heavily, but popular it remains.

One version of the earnings multiple that is adopted for comparison purposes by private equity buyers is the enterprise model. The enterprise model takes the market value of the equity (market cap) and debt, less cash, and divides the whole lot by the EBITDA (earnings before interest tax depreciation and amortisation). Of course, if you have a company with high operating margins but lots of property, plant and equipment (PP&E) to maintain, you may find the results a little optimistic.

Simply take a standard price to earnings approach, but subtract the cash the company has in the bank.

If you were to buy a business outright, you may take into account the cash the company has in its bank accounts. After buying the business you may be able to access this cash and withdraw it to lower the purchase price. Alternatively, if you are selling a business, in an IPO for example, you may be just as keen to take the cash out before selling it to maximise the return to you and reduce the return available to otherwise anonymous share market investors (this latter strategy is very popular).

The arithmetic result of taking out the cash is a lower P/E multiple. And that is what I thought you may be interested to discuss.

Are there any companies listed in Australia that are trading on very low multiples of earnings once their cash is taken into consideration? The broad based market declines have ensured there are indeed a few.

Step 1

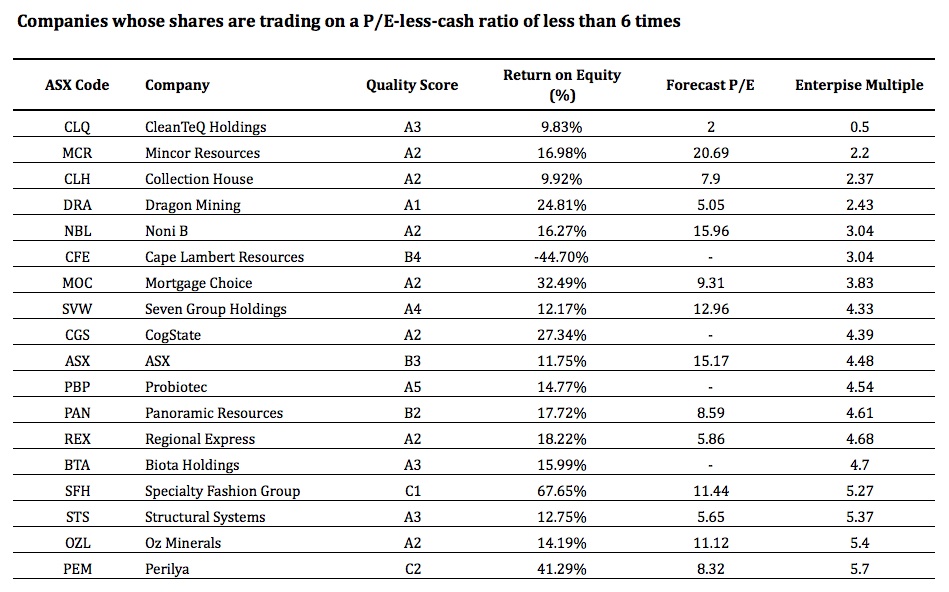

My search began by opening our next-generation A1 service (Value.able Graduates – your exclusive invitation to pre-register is not far away). I applied a filter to discover those companies whose shares were trading at a P/E-less-cash ratio of less than 6 times. From the more than 2000 companies reviewed, there are 18 such companies that meet the criteria today. Keeping in mind some businesses have cash on their balance sheet that would NOT be accessible to a buyer (legislated, regulation or simply working capital needs), here are the eighteen:

Step 2

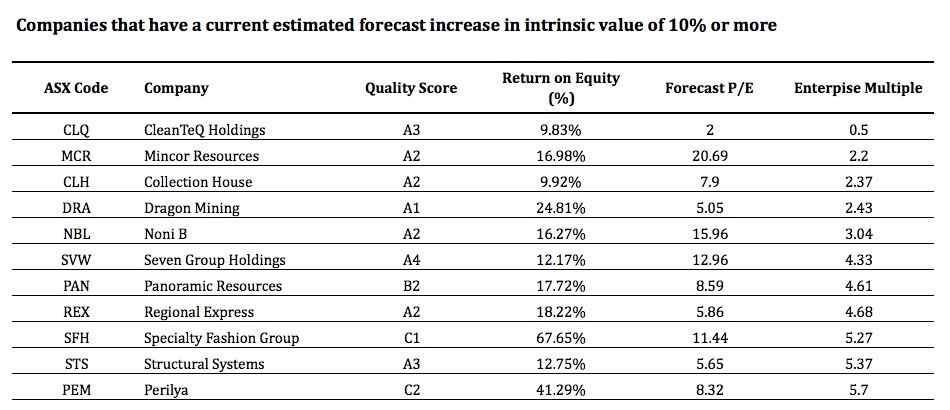

Next, I retained only those companies that have a current estimated forecast increase in intrinsic value of 10% or more. This filter reduced the field to just 11 companies, removing ASX, OZL, CGS, CFE, BTA, PBP AND MOC. Here are the eleven:

Step 3

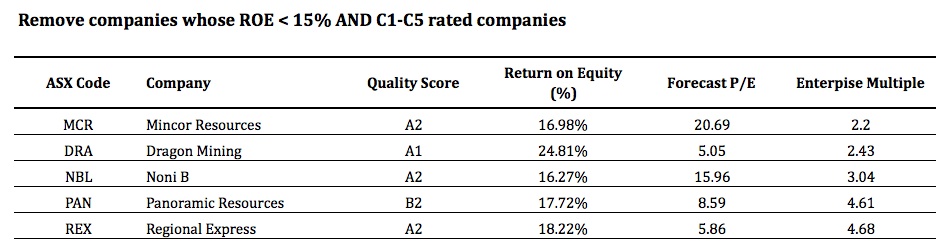

Finally, I removed companies whose previous year’s ROE was less than 15%. I also removed any companies with a C1-C5 Quality Score. Low ROE stocks removed were; CLQ, CLH, SVW AND STS and C-rated companies removed were; SFH AND PEM. That left just five companies. Here they are:

And there you have it, companies trading at enterprise multiples that may be attractive to a buyer who could potentially use the cash on the balance sheet to reduce their purchase price.

Amazing, incredible simple. No manual calculations required (ever again).

Remember, this exercise did not incorporate any of the traditional Value.able investing considerations we usually discuss at the Insights Blog… safety margin, intrinsic value.

For the record, only two of the listed businesses look cheap on the Value.able score today. With reporting season about to begin in ernest, keep in mind the results and cash balances of these companies will all change.

You must do your own research into their prospects and remember to seek and take personal professional advice.

Very soon, finding extraordinary A1 companies offering large safety margins will become simple and even fun. Our next-generation A1 service that my team and I have been tirelessly working on will inspire your investing and re-energise your portfolio.

Value.able Graduates – stay tuned. Your exclusive invitation to pre-register will arrive in your inbox very soon. If you are yet to join the Graduate Class, click here to order your copy of Value.able immediately. Once you have 1. read Value.able and 2. changed some part of the way you think about the stock market, my team and I will be delighted to officially welcome you as a Graduate of the Class of 2011 (and invite you to become a founding member of our soon-to-be-released next-generation A1 service).

Back to the program… this reporting season, who do you think will surprise with better than expected earnings?

Who do you think will struggle?

And what stocks are looking cheap to you right now?

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 29 July 2011.

by Roger Montgomery Posted in Companies, Investing Education.

- 87 Comments

- save this article

- POSTED IN Companies, Investing Education

-

What did Ash and the team talk about?

Roger Montgomery

July 7, 2011

Yesterday we had the pleasure of meeting Ash in person. If you scroll through any of the threads on our blog, you will no doubt find some extraordinary insights from one of Value.able’s founding Graduates.

Indeed, Ash’s generosity and willingness to share his experience and insights with new investors has fostered a spirit of camaraderie that has become integral to the Value.able community.

What did we talk about? It’s been a hot question at the Facebook page!

…Matrix, the recovering Lockyer Valley, cotton, gas explorers, an exciting new float, Lloyd, rugby and the 2GB podcast about a small cap gold stock that resulted in 170 comments and the thought to shut this blog down!

Thanks again Ash. We look forward to catching up with you again when you are next in Sydney.

Now to the photo… can you spot some familiar faces?

The first four of six framed artworks are now featured at the entrance of our office.

It was a proud moment indeed. We will publish some more photographs of the artworks in coming days.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 7 July 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Value.able.

-

Who is being watched this reporting season?

Roger Montgomery

July 1, 2011

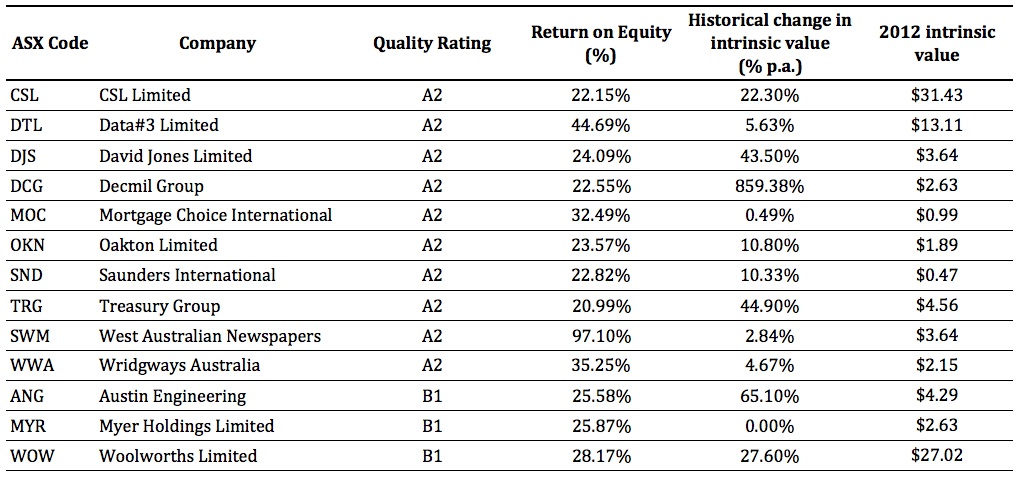

Now on the cusp of reporting season, it is worth reviewing our expectations for Value.able intrinsic valuations and double-checking those that belong to higher quality (MQR: A1, A2, B1, B2) businesses.

Now on the cusp of reporting season, it is worth reviewing our expectations for Value.able intrinsic valuations and double-checking those that belong to higher quality (MQR: A1, A2, B1, B2) businesses.There were more than 107 suggestions! Thank you.

Our new A1 service allows us to whip up all the data required for all your nominated stocks in less than a minute (soon you can too!). For now, let’s put stakes in the ground for those which achieved at least three nominations.

In order of mentions…

Matrix C&E, followed by JB Hi-Fi, Forge, Vocus, BigAir, Credit Corp, Woolworths, Thinksmart, BHP, M2 Telecommunications, Zicom, Oroton, ANZ, CSL, ARB Corporation, Thorn Group and Cash Convertors. The remaining companies received less than 5 mentions each. The companies with only a single mention (and therefore arguably least followed) were: ILU, RFG, SMX, KRS, AMA, LNC, RQL, COU, TBR, CPB, AVM, BDR, REA, AIR, CKL, AJJ, FXL, CTD, STU, MIN, TGR, CXS, CMI, CDA, CGX, DGX, RCO, MND, CIX, MOC, RHD, DLX, RMS, MYE, SEA, DPG, SFR, NCK, SRX, NCM, CLV, NFK, CLX, NOE, CMG, NST, IPP, CDD, WTF, OGC, KNH, DWS, FRI and KCN.

Well without further delay, here’s the list with our 2012 forecast Value.able intrinsic valuations.

<Temporarily removed for updating and additional stocks and data columns>

Over the next few weeks we will build on the list, include some additional useful information and data and generally prepare you for reporting season.

Stay tuned. This is a period when even developed markets can be inefficient.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 1 July 2011.

by Roger Montgomery Posted in Companies, Market commentary.

- 179 Comments

- save this article

- POSTED IN Companies, Market commentary

-

What are you cooking up Roger and team?

Roger Montgomery

June 23, 2011

I am working tirelessly to generate superior returns for the Montgomery [Private] Fund. That is the number #1 goal. But stay tuned, because I am also writing a post for next week that will list some of the companies you should be seriously watching this reporting season (and there may be a few gems). Stay tuned and keep checking in.

I am working tirelessly to generate superior returns for the Montgomery [Private] Fund. That is the number #1 goal. But stay tuned, because I am also writing a post for next week that will list some of the companies you should be seriously watching this reporting season (and there may be a few gems). Stay tuned and keep checking in.Today’s earlier post (What if the sell off is just a Flash?) lists some out-of-favour A1 companies.

If you have a company that you believe investors should be watching this reporting season, please start posting them here. Check in next week to see if they’re on our list too.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 23 June 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

What if the sell-off is just a Flash?

Roger Montgomery

June 23, 2011

Did you overhear a prominent investment commentator (not a Value.able Graduate, of course) recently express how upset/annoyed they were that the market for big companies’ shares was deteriorating?

Did you overhear a prominent investment commentator (not a Value.able Graduate, of course) recently express how upset/annoyed they were that the market for big companies’ shares was deteriorating?In the short run prices move independently of the underlying business, so let’s encourage the market to decline further!

For those truly concerned about Australia’s prosperity, relax. Be comfortable in the knowledge that short-term share price moves are unlikely to impact the employment policies of Australia’s largest listed businesses.

Looking over the financials of fifty-six A1 companies, little has changed. While Telstra and Fosters share prices are beating to the drum of hoped-for franked dividends and a takeover, the fundamentals of many other companies, particularly A1s (and indeed A2 and B1), are resolute. Are these businesses worth 10% to 26% less than they were worth before? No chance. The Value.able intrinsic valuations of companies that were cheap before haven’t changed.

So what has changed?

Only investors’ perceptions. Perceptions about the global economic outlook; perceptions about a US slowdown becoming a recession; perception about a Chinese slowdown causing a global rout the world cannot afford; and hope that Australian house prices will fall to levels people can actually afford.

Think about that for a moment. Baby boomers own $1m + homes that they will be forced to liquidate to fund their retirements and health care. Meanwhile, Generation Y is struggling to afford a property. Something has to give. Economics 101 suggests price declines.

Investors have simply been reducing their appetite for risk.

Armageddonists are spouting scenarios similar to those that followed Britain’s exit from the gold standard in 1931.

But this fear may be unfounded. It’s most certainly not a cause for permanent worry. Even if a recession does transpire, it will not be permanent.

Our job as Value.able Graduates is not to guess the gyrations of the economy – while they are vital in determining the sustainability of a given return on equity, many of the world’s very best investors do not even employ economists (they employ former US Federal Chairmen).

Your mantra is to simply put together a list of ten extraordinary businesses that you believe will be much more valuable in five, ten or twenty years time.

Of course trying to fit all this into your daily life can be a challenge. Completely eliminating the drudgery, and making it simple and fun, is something my team and I have been working on for you. We created our A1 service because we wanted to make finding extraordinary companies offering large safety margins easy. And, of course we love investing. We have worked really hard to create our next-generation service because its what we all want to use. We are its first members! Soon, you will be able to make your investing life simpler too (remember, Value.able Graduates will be invited first – have you secured your copy?). It’s an A1 service that is like nothing you have ever seen before.

You may sense our excitement…

… back to the regular program.

So, here it is. Our list of out-of-favour-but-extraordinary businesses. WARNING: out-of-favour does not always mean ‘bargain’.

Steve Jobs once said; “People think focus means saying yes to the thing you’ve got to focus on. But that’s not what it means at all. It means saying no to the hundred other good ideas that there are. You have to pick carefully.”

With that in mind, here are my thoughts on ten businesses we have discussed over the past few months with a back-of-the-business card reason for interest…

JB Hi-Fi (ASX: JBH, MQR: A1) – Bad news across the board in retail may get worse, but it will turn around and JB Hi-Fi is not Harvey Norman. The buyback has increased intrinsic value at the same time the price slides below.

Cochlear (ASX: COH, MQR: A1) – The shining star amongst A1s (COH is one of this country’s best export successes), yet the worst performer on the share market amongst its peers. Rational, anyone? Australian dollar fluctuations doesn’t change the quality of COH’s business, only the nature or shape of its earnings. Aussie dollar appreciation may last a while, but is not permanent.

CSL Limited (ASX:CSL, MQR: A1) – Another A1 amongst A1s. Like COH, earnings are affected by currency fluctuations.

Woolworths (ASX: WOW, MQR: B1) – Trading at a premium to current Value.able intrinsic value, but a small discount to 2012. Intrinsic value has taken five years to catch up to the price and the price has complied by waiting. In the absence of further downgrades, intrinsic value for future years now rises beyond the price at a good clip.

Reece (ASX: REH, MQR: A2) – Great quality business. Wait for weaker prices or intrinsic value to catch up.

Platinum Asset Management (ASX: PTM, MQR: A1) – Whilst few businesses can compete with Platinum on an ROE and low capital intensity basis, patience is required before acquiring.

Matrix C&E (ASX: MCE, MQR: A1) – Matrix is unique amongst its small capitalisation peers also servicing the resources sector. Watch the full year results closely.

ANZ (ASX: ANZ, MQR: A3) – Short of swimming off the island, we don’t have much choice when it comes to choosing a banking partner. Thanks to fears of an ineffectual Asia roll-out, ANZ is the cheapest of Australia’s big four at the present time.

Vocus Communications (ASX: VOC, MQR: A1) – Run by some of the best in the business, the intrinsic value of Vocus has the potential to be much, much higher in five years time.

Zicom Group (ASX: ZGL, MQR: B2) – Like Matrix, Zicom is exposed to both small-cap and resource sector engineering negativity. And like Vocus, the intrinsic value could rise much higher on the back of further rises in the price of oil and demand for gas.

What’s on your list?

This market, with an increasing number of companies hitting 52-week lows, is demanding your attention!

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 23 June 2011.

by Roger Montgomery Posted in Companies, Insightful Insights.

-

Tech Wreck MkII Continued: Signs of a bubble?

Roger Montgomery

June 20, 2011

Irrational exuberance and tech stocks are old bedfellows. In my previous post, Is this time different?, I wrote “I never ever allow myself to believe this time is different to the last”.

With that in mind, approach the following list of upcoming IPOs with the same trepidation as a Value.able Graduate would the P/E ratio. Don’t get too distracted.

Facebook, Groupon, Kayak, HomeAway, Milennial Media, Trulia and Zillow Inc are expected to float in the near future. I’ll be watching them for signs of irrational exuberance. Why? Because locally, James Packer is buying into similar companies (Scoopon.com.au, catchoftheday.com.au and groceryrun.com.au), one suspects to subsequently spin them off, through an IPO, to you.

If you would like to keep this list updated, go right ahead.

On behalf of Value.able Graduates and every other investor who reads my Insights blog, I would be delighted to see you expand this list.

In your comments, feel free to add any upcoming floats or recent floats that I have left out (Zipcar, for example). Stay tuned for MQR’s and intrinsic valuations for these companies too! (they’re just a small part of our new A1 service – my team will invite all Value.able Graduates to pre-register soon).

Facebook: If floated, as many expect, in April 2012, Facebook could be valued at $100 billion. You can imagine the float price will be a bit silly… the company will tell 700 million users about it and will attract many first time Gen Y ‘investors’. Facebook is currently valued around $70 billion on the private market.

Groupon: One of the very first deal-of-the-day websites set up all the way back in 2009, Groupon has already filed to go public. The company estimated sales of $2 billion and is expected to float at $30 billion but that sales figure is based on the revenue from selling coupons. A significant percentage of that must go to the business that offers the goods/service in the first place. If ebay reported its sales revenue as the total value of all goods sold, it would amount to $61 billion rather than the $9 billion they did report. The correct sales number for Groupon is about $530 million. The valuation compares to $135 million funding in April 2010 that gave the company a $1.35 billion valuation, Google’s offer in November 2010 of $6 billion, and a $590 million raising in January 2011 that valued the company at 15 billion. At $30 billion the price-to-sales ratio is 51 times. This compares to Google at 6 times, Microsoft at 3.5 times, Apple at 5 times, and Amazon and Yahoo at 3 times.

Kayak: The leader in travel search filed for an IPO in November 2010. It generated $53 million in revenue for the quarter ending March 31, up 43 per cent from pcp (previous corresponding period). The company processed 214 million queries in the quarter, up 48 per cent from pcp and there were more than one million downloads of its mobile applications in the quarter, up 226 per cent from pcp. Kayak had a net loss of $6.9 million in the quarter, up from $854,000 in the year-ago period. But the company took a $15 million charge for dropping its Sidestep.com URL. The company stated:

“During the first three months of 2011 we determined that we would no longer support two brand names and URLs in the United States and decided to migrate all traffic from www.sidestep.com to www.kayak.com, resulting in the impairment charge.”

Kayak sources 56 per cent of content for the Kayak flight queries from a company called ITA Software. Google has acquired ITA software and is expected to build a competing product. On this development, Kayak has said that it received 7.8 per cent of total advertising from Google in the most recent quarter. It notes that a consent decree requires Google to renew Kayak’s contract with ITA. If, however, Google limits Kayak’s access to ITA or develops replacement software, Kayak could be hurt.

HomeAway: The vacation rental site filed for a $230 million IPO in March 2011, hoping to sell 9.2 million shares at $24 to $27 each. HomeAway will list this week. Last week the company raised the goal for its initial stock offering to $248.4 million giving it a proposed value of $2 billion. 2010 revenue was $167.9 and net profit was $16.9 million. HomeAway makes more than 91 per cent of its cash annual subscription fees. Most property managers/owners pay $329 per listing per year to be featured on HomeAway.com, HolidayRentals (UK) and HomeAway FeWo-direkt (Germany). It’s a subscription fee business model that doesn’t rely on ad dollars, but according to the company, is “highly predictable and profitable”. Last year, more than 75 per cent of HomeAway’s clients renewed their existing listings. But $2 billion for a profit of $16 million in profits? Fairfax got a steal when they bought OzStayz! The auditors can relax about the valuation of goodwill on the company’s balance sheet.

Milennial Media: The third-largest mobile-advertising company in the US is talking to bankers about a potential initial public offering. The IPO is expected late this year or in early 2012, values the company at $700 million to $1 billion. Milennial Media helps advertisers find space on mobile devices, such as smartphones. It’s increasing its market share in the industry, but its competitors include global dominators Google and Apple. According to research firm IDC, Millennial accounted for 6.8 percent of mobile-ad revenue last year, up from 5.4 percent in 2009. Also according to IDC, total US mobile-ad market, however, generated just $877 million in 2010.

Trulia: Real estate search engine Trulia hired former Yahoo CEO Paul Levine in February. Trulia won’t say when it plans to float, but Chief Executive Pete Flint recently told Reuters that an offering is part of the company’s longer-term plans. “Building an IPO-ready management team is our focus, but we’re certainly in no rush, and as we announced, we’re profitable, so we’re not in need of external capital.” Its main competitor is Zillow.com (see below).

Zillow Inc: Filed on April 18 to raise $51.8 million, the company is backed by venture capital firms Accel Partners and Sequoia Capital . Zillow has hired Citigroup Inc. to handle the IPO. In three years its revenue mix has gone from being advertising-based, to fees and subscriptions from its Zillow Mortgage Marketplace, which connects borrowers with lenders. In 2009, Zillow earned 22 percent of its revenues from the marketplace, and 78 per cent from display advertising.

In 2010 display advertising dropped to 57 per cent of the total pool, while marketplace revenues more than doubled. Display advertising revenues however grew by 27 percent this year. In total, Zillow earned $30.4 million last year, and made a loss of $14.1 million in 2010 after a loss of $12.9 million in 2009. Its venture capital investors have sunk $87 million into the company.

So there’s the list and I would be delighted to see you expand it. Irrational exuberance in the US can spread like a virus here. James Packer’s investment in the founders of catchoftheday, dealsdirect and groceryrun values the coupon business at $200 million. What valuation will be given when they are dressed up for a float here? Watch this space…

What upcoming or recent floats are you watching? Feel free to submit the new Aussie floats that you are watching and I’ll add the Montgomery Quality Ratings and Value.able intrinsic valuations to them over the coming weeks.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 20 June 2011.

by Roger Montgomery Posted in Companies, Technology & Telecommunications.

-

…You can’t touch this?

Roger Montgomery

June 13, 2011

“Yet you do not know about what may happen tomorrow. What is the nature of your life? You are but a wisp of vapor that is visible for a little while and then disappears“. James 4:14

“Suddenly a mist fell from my eyes and I knew the way I had to take.” Edvard Grieg

“Fog and smog should not be confused and are easily separated by color.” Chuck Jones

With apologies to 90’s rapper M.C Hammer, today I plan to lift the lid, ever so slightly, on a misconception about the value of tangible assets. I’ll throw in a few Value.able intrinsic valuations for you too.

Were you as fascinated recently, as I was, to read Harvey Norman suggesting that the price premium to book value of JB Hi-Fi compared to that of itself was unjustified? The company pointed out – and allow me to paraphrase – that the market capitalisation of JB Hi-Fi ($1.9 billion) against just $365 million of book value is high, when Harvey Norman’s market capitalisation is $2.7 billion and its book value is expected to be $2.2 billion at the end of this financial year.

The attachment to physical assets held by many is not unusual, nor is the belief that intangible assets are akin to a puff of smoke. Premiums to book value however are justified when that ‘book’ generates above average rates of return. And it is assets of the intangible variety – the economic goodwill (rather than the accounting variety) – that are more valuable anyway. Physical assets can be replaced, imitated and replicated. Any competitor (with deep enough pockets) can purchase almost all of them. Ultimately, any unusual returns these generate will be competed away as competitors secure the same machines, tools, equipment etc. Many in the printing game experience this phenomenon. A new machine gives them a marginal advantage only for as long as it takes their competitor to make the same investment.

Assets of an intangible nature are less easily copied and so high rates of return can be sustained longer, and are therefore worth more.

A company’s book value is the net worth of its assets. Book value is made up of both tangible assets and intangible assets. Tangible assets are physical and financial and include property, plant & equipment, inventory, cash, receivables and investments. Intangible assets aren’t physical or financial and may include trademarks, franchises and patents.

To demonstrate the difference in value between intangible and tangible, have a look at Google; That company’s market capitalisation is US$165.5 billion and yet its book value is just US$48.6 billion. Its price to book value is 3.42 times. JB Hi-Fi’s price to book value is 5.2 times and Harvey Norman’s is 1.22 times. But Google’s ‘book’ generates returns of 19.16%, JB Hi-Fi; 41.5% and Harvey Norman; 11.6%. There is indeed a relationship between the price premium to ‘book’ and the profitability of that ‘book’ (‘ROE’). A business is worth much more than its net tangible assets when it produces profits well in excess of market-wide rates of return.

I wrote about the capital intensity of airlines in Value.able (re-read Pages 60-63, 122, 164, 172-3), so you should know my thoughts about this already (You can also read any of these articles and transcripts for a refresher: Taking-off or crash-landing?, Qantas cuts costs to stay in profit, Qantas cuts staff, flights to counter fuel price hit and Flights reduced, jobs cut at Qantas).

When it comes to physical assets, less is more. For a business to double sales and profits, there is frequently the requirement to increase the level of physical assets. The higher the proportion of physical assets compared to sales that are required, the less cash flow available to the owner. This is the antithesis of the intangible-heavy business that continually produces profits without the need to spend money on maintenance, upgrades or replacements.

Let me demonstrate with an admittedly rudimentary example. Take two companies Rich Pty Limited and Poor Pty Limited. Both companies earn a profit of $100,000. Rich Pty Limited has net assets of $1 million. Intangible assets, such as patents and a brand, represent six hundred thousand dollars while physical assets, including machinery running at full capacity and inventory, represent $400,000. Poor Pty Limited also has a net worth of $1 million, but this time the intangible/intangible mix is reversed and eight hundred thousand dollars represents tangible assets and $200,000 is intangible.

Rich P/L is earning $100,000 from tangible assets of $400,000 and Poor P/L is earning $100,000 from tangible assets of $800,000.

If both companies sought to double earnings, they may also have to double their investment in tangible assets. Rich P/L would have to invest another $400,000 to increase earnings by $100,000. Poor P/L would have to spend another $800,000.

For many investors a large proportion of physical assets – also reflected in a high NTA – is seen as a solid backstop in the event something catastrophic should befall a company. I would suggest that the opposite may just be true. A high level of physical assets may be a drag on your returns.

Physical assets are only worth more if they can generate a higher rate of earnings. Any hope that they are worth more than their book value is based on the ability to sell them for more, and that, in turn, is dependent on either finding a ‘sucker’ to buy them or a buyer who can generate a much higher return and therefore justify the higher price.

With these ideas in mind, its worth looking at a list of companies that further investigation may show have very high levels of tangible assets compared to their profits. Let’s also throw in those companies that have highly valued intangible assets too. If they are generating low returns on these, the auditors should arguably take a knife to their stated ‘book’ values.

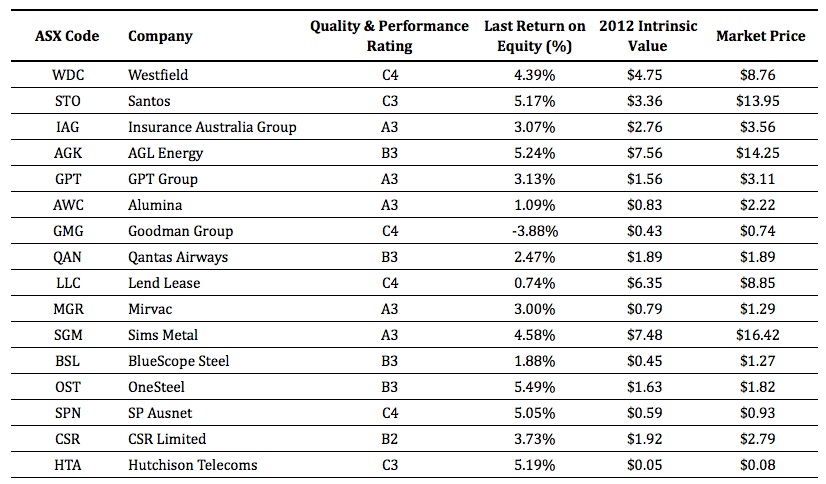

Starting with those companies whose market captitalisation is more than $1 billion (156), I then ranked them by return on equity (return on book value) in ascending order. 49 (31 per cent) companies generate returns less than your bank term deposit. The 16 largest (based on market capitalisation) companies with low ROE, possibly indicating either high levels of tangible assets or possibly overstated intangible assets carried on the balance sheet, are:

I have excluded resource companies. For while there are plenty that qualify, their returns are dependent on commodity prices.

Something to remember about the Quality & Performance Rating…

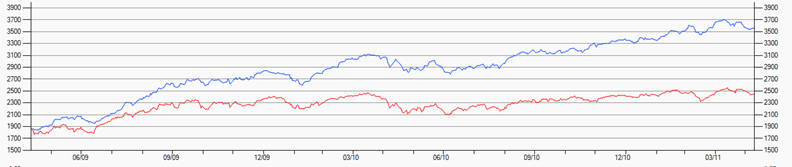

Rated A1 to A5, B1 to B5 and C1 to C5, every listed company is rated based on a series of over 30 discrete metrics, measured at both a point in time and over time. Most importantly, the Quality and Performance Rating is applied without any subjectivity. All companies are judged according to the metrics they generate. A1s have the lowest probability of a liquidation event. “Lowest probability” however doesn’t mean a liquidity event won’t occur. It just means far fewer A1s will have a liquidity event imposed on them compared to C5s. A liquidity event includes a capital raising, debt default or renegotiation, administration, receivership etc. An A1 company could of course raise capital if it needs to fast track construction of a new factory. MCE is an example of a high quality company whose cash flow has needed supplementation for this reason. Sticking to A1s and avoiding C5s should, over time, produce better returns. I demonstrate in the following chart:

The above chart shows the performance of a portfolio of the 20 biggest companies listed on the ASX rated ‘A1’. The red line is the poor old ASX 200.

There is merit with sticking to A1s (just as those who like the taste of Coca-Cola don’t settle for Pepsi). My team and I are fine-tuning something that will make the identification of A1s extraordinarily simple. So ignore those ‘Beat-the-tax-man’ pre-June 30 ‘special’ offers from various investing experts and other ‘helpers’. Avoid the temptation of an extra one, two or three month ‘subscription’, a show bag full of tips, a free magazine, DVD, or even a set of free steak knives.Wait for an A1 opportunity instead. Your patience will be rewarded.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 13 June 2011.

by Roger Montgomery Posted in Airlines, Companies, Insightful Insights, Value.able.

-

Is The Price Now Right?

Roger Montgomery

June 9, 2011

There’s a lot in this post. So sit back and relax. Put up your feet, pull down the blinds and get comfortable.

There’s a lot in this post. So sit back and relax. Put up your feet, pull down the blinds and get comfortable.Billionaire Oilman J. Paul Getty famously advised; “Buy when everyone is Selling and Hold until everyone is Buying”. Knowing what price to pay most certainly helps to enhance returns in the long run.

An investor without the knowledge to estimate Value.able intrinsic valuations is surely blind to the opportunities presented by a sea of red ink. Without it, one cannot see beyond today. And without intrinsic values one sees only falling prices and fears further declines – frozen in the spotlight of a market collapse.

Even though they told themselves they would buy if prices dropped, now they can’t. Tomorrow, they reassure themselves, will be a better day.

Focus instead on business quality. Seek out those whose prospects are bright and whose Value.able intrinsic values you expect to rise 10, 15, 20 per cent over the years. Identify those whose returns on equity puts your term deposit to shame and whose balance sheet can survive the next GFC, should it occur.

With the downturn in the US’s business cycle triggering fears of recession, I would like to share with you a list. It’s not a list of A1s, and it’s not a list of all companies trading at prices less than they’re ‘worth’.

It is instead a Value.able watchlist of companies that achieve some of our higher quality and performance ratings – A2 or B1 (I shared a list of A1s here a couple of weeks ago) and includes CSL, Data#3, David Jones, Decmil, Mortgage Choice, Oakton, Saunders International, Treasury Group, West Australian Newspapers, Wridgways Australia, Austin Engineering, Myer and Woolworths.

Each business reported return on equity greater than 20 per cent last year and may or may not be demonstrating a safety margin. Some have a track record of extraordinary performance; whilst others, well, won’t (p.s. that’s a clue)

Your Long Weekend Study Guide

The watchlist forms part of your Value.able education. Like the Insights blog itself, it is for educational purposes only. If you haven’t reviewed Value.able lately, I encourage you to spend some time over the long weekend (between periods of relaxation of course) reviewing Part Two – Identifying Extraordinary Businesses, then research your answers to the following questions for each company.

1. Extraordinary prospects: Does the future look bright? Or, if you don’t believe the future will be as extraordinary as the past, why not?

2. Competitive Advantage: What sets this business apart from its competitors?

3. Debt/Equity: How has management managed capital? What is the evidence?

4. Cashflow: Track record of cash flow? Use my quick back-of-the-envelope calculation to asses the true cash power of the business.

5. Which three are going straight to the top of your Value.able watchlist, and why?

Lets build a body of ideas under this post that adds value. If you complete the questions for one or all the companies listed, or if you have identified another company you would like included, go ahead and add it in. Please try and keep your comments under this post consistent with the above, five-part format.

And if all that seems like too much work, keep calm. My team and I are fine-tuning something that will knock your value investing socks off.

Those who have already had a private screening don’t want to be without it, and some Graduates are happy to pre-pay for it, sight unseen!

So ignore those ‘Beat-the-tax-man’ pre-June 30 ‘special’ offers from various investing experts and other ‘helpers’. Avoid the temptation of an extra one, two or three month ‘subscription’, a show bag full of tips, a free magazine, DVD, or even a set of free steak knives.

Wait for an A1 opportunity instead. Your patience will be rewarded.

If you like the taste of Coca Cola, you don’t settle for Pepsi. Even if Pepsi throws in more – an extra 300ml, an extra can or bottle, or even a free holiday – it’s just not the real thing.

Nothing matches what we are putting the finishing touches on for you.

We have been told it is the ‘next-generation’. Actually, its five generations ahead of anything else we have seen. It is A1, it is world leading with global plans and soon it could be yours.

So save your pennies because it won’t be discounted and we won’t need to fill a show bag full of other stuff to convince you.

If Value.able is the menu, then our next-generation A1 is the entire fine-dining kitchen.

Value.able Graduates will be offered first priority, followed by the loyal Facebook community.

So if you haven’t yet ordered your copy of Value.able, now is not the time to procrastinate. Remember, Value.able Graduates will be offered first priority.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 9 June 2011.

by Roger Montgomery Posted in Companies, Value.able.

- 130 Comments

- save this article

- POSTED IN Companies, Value.able

-

Have you submitted your photograph to the Value.able Graduate Album?

Roger Montgomery

June 9, 2011

Jesse, Michael, Young Les, Justin, Matt, Rad, John, Ron, Young Max, Gary, Dan’s mum, Gary, George, Steven, JohnM, Paul, Steven and Sophie, Michael, Alya, Martin, Bernie, Amit, RBS Morgans Gosford, Jim Rogers, Daniel, Keith, Gavin, Graeme, Nick, Gelato Messina, Chris, Rodger, Phil, Vikki, Mark, Hien, Kenneth, Greg, Peter, Bernie, Paul, John, Bill, Bryan, Di and Lesley, Craig, Scotty, Chris, Main Amigo Stan, Charles, Fred, David, Mark, Collin, Nevada Cody and Winston, Peter, John, Nathan, Mal, John, Tony, Les, William Grant, Greg, Mike, Paul, Roger, Mike, David, Paul, Sinaway, Anders, Frank, Jake, Johan, Mark, Rob, Ian, Joan, Claude, Toni, Richard, Matt Jnr, Indrash, Sara, Garry, Jonathan, Ganesh, James, Kevin, Jim, Peter, Greg, Stuart, Craig, Eric, Robert, Ermin, Mike, Syed, Wilma, John, Alf, Tony, Phillip, Robyn, James, Carolyn, Roy, Peter, Jack, Kevin, Howard, Leo, Jonathan, Carole, Eileen, James, John, Martin, Ordan, Warren, Andrew, Liz, Jim, Anthony, Bob, Douglas, Christine, Frank, Martyn, Michael, John, Dave, Peter, Darrell, Jeffrey, David, Joof, Tom, Leigh, Mervin, Paul M, Paul K, Noel, Bob, George, Leigh, Bob, Steve, Monica, Richard, Frank, Brett, Steven, Colin, Wayne, Joanne, Dan, Garry, Lin, Judi, Allan, Stephen, Garth, John, Joab, Phillip, Kevin, John, Robert, Tweety and Bert, Peter, Mike, Patrick, Eugene, Brian, Harold, Russell, Brad, Rajest, Tim, Gemma, William, Bill, Robert, Geoff, Gary, Emily, Kent, Lucas, Neil, Peter, Rowley, Jason, Simon, Charles, Russell, Grahame, Lester, David, John, Richard, Mitra, John, Dave, Peter, Geoff, Paul, Derek and Rod have already submitted their photographs for inclusion in the Graduate album. My team – Russell, Vanessa, Rachel and Chris, will add theirs shortly.

Jesse, Michael, Young Les, Justin, Matt, Rad, John, Ron, Young Max, Gary, Dan’s mum, Gary, George, Steven, JohnM, Paul, Steven and Sophie, Michael, Alya, Martin, Bernie, Amit, RBS Morgans Gosford, Jim Rogers, Daniel, Keith, Gavin, Graeme, Nick, Gelato Messina, Chris, Rodger, Phil, Vikki, Mark, Hien, Kenneth, Greg, Peter, Bernie, Paul, John, Bill, Bryan, Di and Lesley, Craig, Scotty, Chris, Main Amigo Stan, Charles, Fred, David, Mark, Collin, Nevada Cody and Winston, Peter, John, Nathan, Mal, John, Tony, Les, William Grant, Greg, Mike, Paul, Roger, Mike, David, Paul, Sinaway, Anders, Frank, Jake, Johan, Mark, Rob, Ian, Joan, Claude, Toni, Richard, Matt Jnr, Indrash, Sara, Garry, Jonathan, Ganesh, James, Kevin, Jim, Peter, Greg, Stuart, Craig, Eric, Robert, Ermin, Mike, Syed, Wilma, John, Alf, Tony, Phillip, Robyn, James, Carolyn, Roy, Peter, Jack, Kevin, Howard, Leo, Jonathan, Carole, Eileen, James, John, Martin, Ordan, Warren, Andrew, Liz, Jim, Anthony, Bob, Douglas, Christine, Frank, Martyn, Michael, John, Dave, Peter, Darrell, Jeffrey, David, Joof, Tom, Leigh, Mervin, Paul M, Paul K, Noel, Bob, George, Leigh, Bob, Steve, Monica, Richard, Frank, Brett, Steven, Colin, Wayne, Joanne, Dan, Garry, Lin, Judi, Allan, Stephen, Garth, John, Joab, Phillip, Kevin, John, Robert, Tweety and Bert, Peter, Mike, Patrick, Eugene, Brian, Harold, Russell, Brad, Rajest, Tim, Gemma, William, Bill, Robert, Geoff, Gary, Emily, Kent, Lucas, Neil, Peter, Rowley, Jason, Simon, Charles, Russell, Grahame, Lester, David, John, Richard, Mitra, John, Dave, Peter, Geoff, Paul, Derek and Rod have already submitted their photographs for inclusion in the Graduate album. My team – Russell, Vanessa, Rachel and Chris, will add theirs shortly.Have you emailed yours?

We plan to frame the album and hang it at the entrance of our office, next to another invaluable piece – Stay Calm and Carry On.

Posted by Roger Montgomery and his A1 team, fund managers and Value.able Graduates, 9 June 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

Where to next?

Roger Montgomery

May 18, 2011

You may have noticed my recent posts are not filled with stock ideas. Don’t worry. The drought will end, once the market resumes serving up mouthwatering opportunities

For many businesses, Australia may not seem like the ‘lucky country’ right now. A litany of evidence suggests the economy is cool. Recent bank results reveal credit growth is slowing, if not stalling. Significantly fewer homes are being put to auction and of those that are, clearance rates are not inspiring.

Australia’s savings rate has risen and thanks to rising fuel costs and utility bills, we haven’t got as much to spend as we used to. Then there’s the prospect of rising interest rates. I wonder, given all anecdotal evidence of weakness, whether an interest rate cut would be more justified?

Some of Australia’s ‘blue chips’ have reported weakness or downgrades. Seven West Media reported a softer advertising market, which has also affected Fairfax and APN. OneSteel cited a strong Aussie dollar, as did BlueScope. And you can almost guarantee food manufacturers are going to complain about higher commodity input prices.

Indeed higher input prices, combined with pressure on consumers to pay more for daily essentials – gas, electricity and petrol – means many companies have lost their ability to pass on rising costs. Naturally, this leads me to think that this is precisely the combination of influences that will reveal which companies have a true competitive advantage?

The Value.able community has spent a great of time exploring, discussing and naming competitive advantages – retailers, Apple, your insights. The current economic headwind will reveal who actually has one.

Take a look at the companies in your portfolio. Can they pass on rising costs in the form of higher prices, without a detrimental impact on unit sales? Can they grab market share from competitors whose margins are slimmer, by cutting prices? Is your portfolio overflowing with A1 businesses, or are there some C5s in there that may struggle through post-reporting season?

Now despite current pressures, which of course you must refrain from believing is permanent (and indeed cease focusing on), analysts haven’t brought down their earnings expectations.

Macquarie’s equity analysts are forecasting aggregate profit growth of 19 per cent and according to JP Morgan, non-resource companies are expected to grow profits by 13 per cent this year. These growth rates are a significant revision down from 6 months ago. Are more downgrades to come? Thirteen to nineteen per cent does seem more appropriate for a rosier economic environment…

Lower profits have a real impact on intrinsic values. For companies generating attractive rates of return on equity (at last count, 187 listed on the ASX generate a ROE greater than 20 per cent. Of those 103 are A1/A2), lower profits reduce the quantum of that return, as well as the amount of retained earnings and therefore the rate of growth in equity. All of those changes are negative. If Ben Graham was right and in the long run, price does follow value, that means either lower prices or prices that cannot justifiably rise much more. And this is where Value.able Graduates’ attention should be focused, not on the bailout of Greece or Portugal.

What does this all mean?

I don’t have a crystal ball, so I simply don’t know where the market is headed. Thankfully it isn’t a brake on market-beating returns.

What I do know, is that of approximately 1849 listed entities, 1175 made no money last year. Of the remainder, 56 are A1s and of those, just 13 are trading at a discount to our estimate of intrinsic value. Six are trading at a discount of more than 20 per cent and of those six, The Montgomery [Private] Fund owns two. We have been decidedly slothful in buying and, as a result, while the market has been falling, the Fund’s value hasn’t.

Steven wrote on my Facebook page yesterday “Who cares? this market is… only ugly!” It’s only natural to want to throw up your hands in dismay, but this is where the rubber hist the road – Keep Calm and Carry On Value.able graduates. Look for extraordinary businesses at prices far less than they’re worth.

Just under 11 per cent of The Montgomery [Private] Fund is invested in extraordinary businesses. Even with 89 per cent of the Fund in cash, we are outperforming the S&P ASX/200 Industrials Accumulation Index by 5.29 per cent since inception.

My team and I continue to be inspired by the 1939 poster in which England advised its citizens to “Keep Calm and Carry On”.

Low prices should not bring consternation, but salivation. As sure as the sun rises, low prices for A1 companies will not be permanent.

Beating the market does not mean positive performance every week, every month or even every year. I have no doubt that some investments I will make for myself and the clients we work for will not perform as expected. Not every A1 at a discount will prove spectacular. We can however mitigate some of the risks of course. Sticking to a diversified basket of the highest quality companies (A1s perhaps?) purchased at big discounts to intrinsic value, won’t prevent the market value of the portfolio declining in the short term, but it can help to generate an early, eventual and more satisfying recovery.

With a falling market (and falling prices for A1 companies too) the daggers will come out, so also be prepared for those of weak resolve. They may try to discredit our Value.able way of investing.

A contest isn’t won by watching the score board, looking in the rear view mirror or mimicking those with a demonstrated track record of success. You have to play. And play your own game. Over long periods of time, sticking to good quality A1 companies works. Given that returns are dependent on the price you pay, lower prices (and greater value) works even better!

The issue of course is not the reliability of the Value.able approach, but the patience required to execute it. Remember the ‘fat pitch’? Irrespective of the turmoil that impacts markets, we must Keep Calm and Carry On.

So what do you think? Where do you think the market is headed? What are the factors you are watching? Have you picked up something in your research that you’d like to share? Go for it!

Posted by Roger Montgomery, author and fund manager, 18 May 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Market Valuation, Value.able.