articles by Scott Shuttleworth

-

What’s going on in Greece? (30/06/2015)

Scott Shuttleworth

June 30, 2015

by Scott Shuttleworth Posted in Video Insights.

- watch video

- save this article

- POSTED IN Video Insights.

-

Should you buy CSL?

Scott Shuttleworth

June 26, 2015

CSL Limited’s (ASX: CSL) share price has strengthened in recent years (appreciating from below $30 to over $90), supported by the firm’s consistent approach to dividend policy and a steady commitment to share buybacks.

by Scott Shuttleworth Posted in Companies, Insightful Insights.

- 2 Comments

- save this article

- 2

- POSTED IN Companies, Insightful Insights.

-

Australia’s demand for data is off the charts!

Scott Shuttleworth

June 24, 2015

As we have previously noted, the demand for data in Australia (and the world) is growing at an exponential rate and the statistics are staggering. IBM notes here that “Every day, we create 2.5 quintillion bytes of data — so much that 90% of the data in the world today has been created in the last two years alone.”

by Scott Shuttleworth Posted in Insightful Insights, Technology & Telecommunications.

-

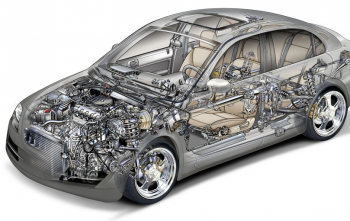

Burson revs up its engine

Scott Shuttleworth

June 18, 2015

On Monday it was announced that Burson Group Limited (ASX: BAP) had agreed to acquire the automotive division of Metcash Limited (ASX: MTS). Below we’ve included some of our notes on the transaction as a summary. Continue…

by Scott Shuttleworth Posted in Insightful Insights, Technology & Telecommunications.

-

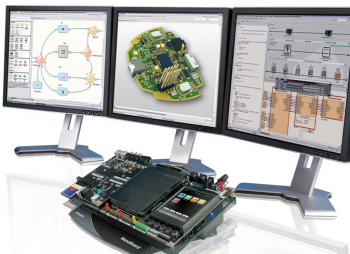

What’s the outlook for Altium?

Scott Shuttleworth

June 16, 2015

The share price of Altium (ASX: ALU) soared past our position entry price of $2.87 back in late January over the coming months. We were then surprised (and delighted), to see the share price fly north of $5 in such a short time.

by Scott Shuttleworth Posted in Companies, Insightful Insights.

- save this article

- POSTED IN Companies, Insightful Insights.

-

Consolidation in the corporate telecom space

Scott Shuttleworth

June 9, 2015

As many readers will know, Vocus Communications Limited (ASX: VOC) has been the potential acquirer of Amcom Telecommunications Limited (ASX: AMM) for quite some time. This has been speculated since Vocus’ October 2014 10 per cent acquisition of the shares outstanding in Amcom. We thought it may be worthwhile to review the timeline of events up to now and consider what this means for the future. Continue…

by Scott Shuttleworth Posted in Insightful Insights, Takeovers, Technology & Telecommunications.

-

No bundles of joy

Scott Shuttleworth

June 3, 2015

You may recall that almost a year ago now we commented briefly on our decision regarding the Monash Group Limited (ASX: MVF) IPO in relation to odd trading behaviour we had seen at that time. Continue…

by Scott Shuttleworth Posted in Health Care, Insightful Insights.

- save this article

- POSTED IN Health Care, Insightful Insights.

-

Farming for returns

Scott Shuttleworth

May 28, 2015

We were recently asked by a reader why our portfolio currently contains no investments in the Australian food/agricultural sector and we noted internally that this was a very good question to ask. Continue…

by Scott Shuttleworth Posted in Energy / Resources, Insightful Insights.

-

Supporting the exabyte

Scott Shuttleworth

May 26, 2015

Back in November we noted the exponential growth in data demand from the Australian population. One question that sprung to mind is whether Australia has the infrastructure to support such high demand growth and this needs to be answered on several levels. Continue…

by Scott Shuttleworth Posted in Insightful Insights.

- save this article

- POSTED IN Insightful Insights.

-

3 things to look for in corporate capital policy

Scott Shuttleworth

May 20, 2015

As Australians we tend to have a strong attraction to the humble dividend. If our current markets are anything to go by, some investors may have chased yield whilst having thrown caution to the wind. Continue…

by Scott Shuttleworth Posted in Investing Education.

- 3 Comments

- save this article

- 3

- POSTED IN Investing Education.