Burson revs up its engine

On Monday it was announced that Burson Group Limited (ASX: BAP) had agreed to acquire the automotive division of Metcash Limited (ASX: MTS). Below we’ve included some of our notes on the transaction as a summary.

- Rights issue of 76 million shares at a price of $2.85 (discounted 16 per cent to Friday’s close at $3.40).

- Funds to be used to acquire Metcash Automotive Holdings for $275 million. A subsidiary of Metcash Limited (ASX: MTS), the firm has the following summary statistics: Financial year 2015 Revenue/Earnings Before Interest Taxes Depreciation Amortization / Net Profit After Tax: $261 million/ $33.2 million/ $17.2 million respectively.

- The deal will be 23 per cent funded by an expansion in debt facilities, the remainder in equity.

- Expected Net Debt/EBITDA of the merged firm to be 1.75x.

- The firm expects the deal to be 20 per cent earnings per share accretive on financial year 2015 numbers. However, benefits of the transaction won’t be shown until at least the first half of 2016.

- Burson also reported numbers in line to beat prospectus expectations, circa $22/23 million Net Profit After Tax.

Metcash Automotive Holdings (MAH), summary:

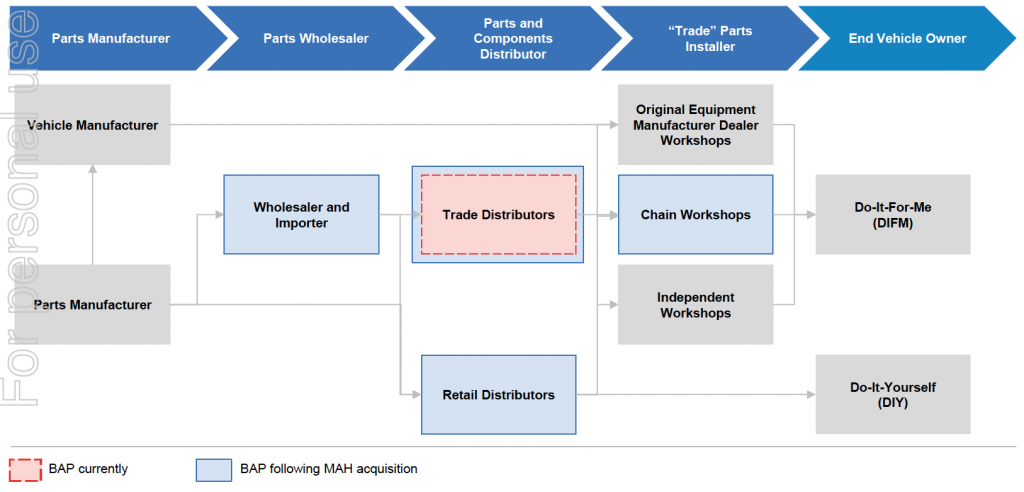

- MAH is comprised of a collection of businesses and warehouses which operate in the retail accessories and spare parts automotive market. $180 million (69 per cent of revenues) are sourced from the firm’s wholesale and distribution operations with approximately 3000 customers Australia wide and 10 distribution centres (130 000 Stock Keeping Units).

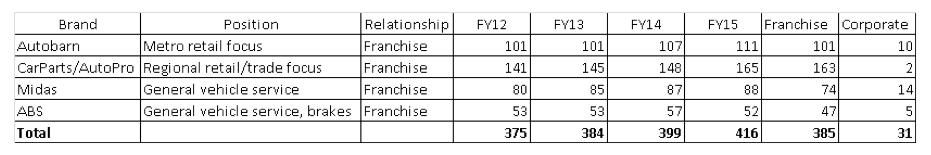

- The remainder of revenues is generated through the firm’s retailing operators, i.e. retail part, accessory sales and vehicle servicing. A summary is below, along with store growth over the past several years (averaging 13 new stores per annum, 140 of the stores are servicing workshops):

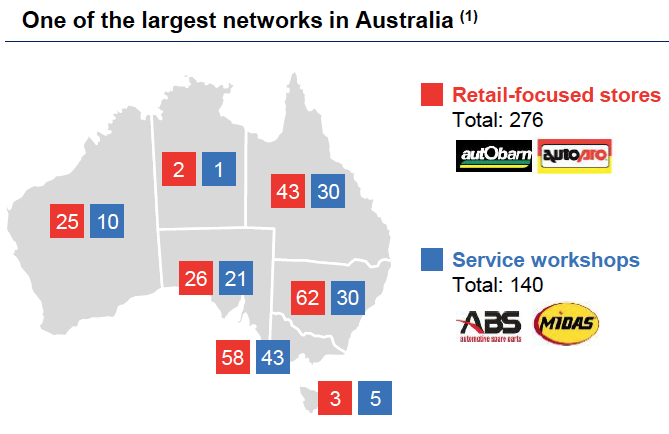

As noted, most of the stores are operated as a franchise model. Franchisees pay up front costs, royalties on sales, marketing levies and are also responsible for growth capital expenditure of their individual stores. The store network is well placed throughout Australia as per the below.

As noted, most of the stores are operated as a franchise model. Franchisees pay up front costs, royalties on sales, marketing levies and are also responsible for growth capital expenditure of their individual stores. The store network is well placed throughout Australia as per the below.

Prospects & Valuation:

- MAH appears to have been growing at 7 per cent organically over the past few years supported by growth in the stock of cars and a slight amount of market share gains. Statutory accounts state higher, however this includes several acquisitions.

- On this basis, we believe the firm is fairly valued at its last closing price of $3.40 per share. The rights are however being offered at a price of $2.85 (a 15-20 per cent discount to intrinsic value).

- Further upside may be realised from synergies. Burson Group management states that quantifying the upside is currently difficult. Notably, the synergies would need be fairly large (circa $10 million) before our valuation would change materially.

- Whilst it is difficult to price on current information, we believe further upside could be achieved if Burson Group expands further downstream into vehicle servicing centres. This part of the market appears ripe for consolidation similar to that seen in trade accessories and parts over the past few years (which Burson is currently consolidating). The opportunity is twofold in that the firm will earn revenues organically through workshop services as well as providing further avenues for Burson’s current trade products (more than 50 per cent of workshop equipment supply is currently from Repco). Burson management noted that this strategy would be part of a review over the coming months.

Source: Burson Group Limited

Source: Burson Group Limited

It’s the intention of both funds at Montgomery to participate in this rights issue.

The Montgomery funds own shares in Burson Group Limited.

Scott Shuttleworth is an analyst at Montgomery Investment Management. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Lucas Hainsworth

:

Do you think that BAP is looking at becoming a wholly vertically integrated car fix it shop?

Scott Shuttleworth

:

Hi Lucas

Technically this transaction does make them vertically integrated. We will need to wait for Bursons to review their new assets and decide on whether it’s worth pursuing the strategy more aggressively.

They’ve taken their first steps into a $15B market..could be lucrative for a capable player.