What’s the outlook for Altium?

The share price of Altium (ASX: ALU) soared past our position entry price of $2.87 back in late January over the coming months. We were then surprised (and delighted), to see the share price fly north of $5 in such a short time.

Recently, the share price has pulled back to the mid $4 range and some may wonder if our view has changed since January. Whilst both funds lightened their positions around $5, overall our view on the long term prospects of the company still holds. We believe that the shares are trading at approximately fair value at the current price.

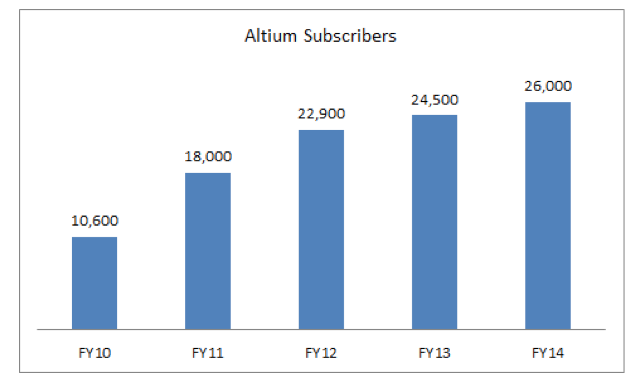

More detailed information has come out regarding their historic subscriber numbers which demonstrate a pleasing trend. For financial year 2015 we expect the subscriber base will have grown to approximately 28,000 to 29,000 subscribers. Further upside is apparent should churn continue to improve – churn reduced from 27.13 per cent in financial year 2014 to 23.58 per cent over the first half of financial year 2015. Churn improvements become increasingly value accretive as the firm’s subscriber base continues to grow.

The Montgomery Fund and the Montgomery [Private] Fund hold positions in Altium Limited (ASX: ALU).

Scott Shuttleworth is an analyst at Montgomery Investment Management. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY