articles by Joseph Kim

-

Freedom Foods shows why it pays to check a firm’s cash-flow

Joseph Kim

July 2, 2020

Ignoring a firm’s operating cash-flow conversion for a period of time can be very risky. Particularly during a period of business stress, like we have right now. The most recent example of this is with Freedom Foods (ASX: FNP), which was recently put in a trading halt pending an investigation into its financial position – but not before its share price dived 14 per cent.

Continue…by Joseph Kim Posted in Companies, Investing Education.

- save this article

- POSTED IN Companies, Investing Education.

-

Day traders betting on Hertz could be in for a world of pain

Joseph Kim

June 12, 2020

COVID-19 stay-at-home orders have led to a surge in share trading, due to the lure of seemingly quick riches. The trouble is, many people are being drawn to extremely risky trades, particularly in the US. And, like moths to a flame, these traders could get badly burnt. Continue…

by Joseph Kim Posted in Companies.

- save this article

- POSTED IN Companies.

-

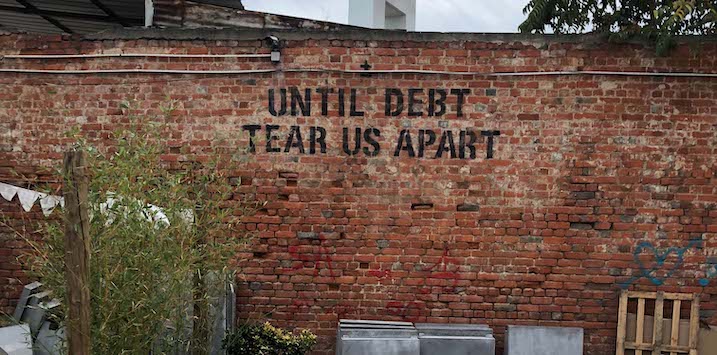

Does debt no longer matter?

Joseph Kim

June 2, 2020

As countries look to re-open their economies, the narrative from financial media circles has been one of re-opening and “V-shaped” recoveries to explain the recent rally in equity markets, despite the significant uncertainty that dominates real world events. Continue…

by Joseph Kim Posted in Investing Education.

- save this article

- POSTED IN Investing Education.

-

Avita Medical – a small cap with big potential

Joseph Kim

May 28, 2020

Around 12 months ago, we noted that Avita Medical (ASX:AVH) – which provides a novel approach to skin regeneration – was a business worth keeping tabs on. Although its share price has felt the effects of the COVID-19 market sell-off, our positive view of the company has not changed. Continue…

by Joseph Kim Posted in Companies, Editor's Pick, Stocks We Like.

- 10 Comments

- save this article

- 10

- POSTED IN Companies, Editor's Pick, Stocks We Like.

-

After raising capital, is Flight Centre now a good investment?

Joseph Kim

April 27, 2020

When governments around the world shut down travel in order to contain the spread of COVID-19, Flight Centre Travel Group (ASX:FLT) suddenly found itself on its knees. Its share price plummeted, from $40 to around $9. Now, post a capital raising, the business can breathe easy for a while. But is it a good investment? Continue…

by Joseph Kim Posted in Companies, Editor's Pick.

- 5 Comments

- save this article

- 5

- POSTED IN Companies, Editor's Pick.

-

Why Flight Centre needed to raise capital – and fast

Joseph Kim

April 20, 2020

With the Australian share market rallying strongly in April off the 25 March low, there has been a spate of capital raisings by cash-strapped companies looking to reduce debt and/or ‘pay the bills’. One of those is travel retailer, Flight Centre (ASX:FLT). In this 2-part blog, I outline our assessment of the business in the face of COVID-19 risks and the likelihood of negative earnings for the foreseeable future. Continue…

by Joseph Kim Posted in Companies.

- save this article

- POSTED IN Companies.

-

Four criteria we are considering before buying shares in this market

Joseph Kim

March 18, 2020

With the Australian market in freefall, readers and clients alike have asked us where we are looking to invest. While we continue to monitor the fluid situation closely, we have established some key criteria that we would look to satisfy in anticipation of a potential recovery. Continue…

by Joseph Kim Posted in Market commentary.

- 2 Comments

- save this article

- 2

- POSTED IN Market commentary.

-

What is happening on the ground in China as a result of Coronavirus?

Joseph Kim

February 20, 2020

It has now been a month since coronavirus entered the global vernacular, with media coverage covering almost every conceivable angle possible, including the potential economic fallout. We monitor new cases and deaths very closely, especially for any signs of contagion outside of Hubei – the epicentre of COVID-19 – and the unfortunate passengers on the Diamond Princess cruise off the coast of Japan. Continue…

by Joseph Kim Posted in Market commentary.

- 2 Comments

- save this article

- 2

- POSTED IN Market commentary.

-

What should we expect from BHP and RIO in 2020?

Joseph Kim

February 4, 2020

In this week’s video insight Joseph takes a look at the outlook for the two major miners, BHP and Rio Tinto. Generally speaking 2019 was a positive year for the miners, BHP posted a total return of 25 per cent, while Rio Tinto’s performance was even more impressive with a total return of 41 per cent. So why have we decided to not hold either company at their current prices?

by Joseph Kim Posted in Companies, Video Insights.

- save this article

- POSTED IN Companies, Video Insights.

-

Atlas Arteria profits from negative rates

Joseph Kim

January 14, 2020

One of Shakespeare’s most famous quotes is “Neither a borrower nor a lender be.” But toll road operator, Atlas Arteria (ASX: ALX), may beg to differ. It’s just been paid to borrow €500 million in bonds. It makes you wonder: has there ever been a better time to borrow? Continue…

by Joseph Kim Posted in Companies, Editor's Pick, Stocks We Like.

- save this article

- POSTED IN Companies, Editor's Pick, Stocks We Like.