Atlas Arteria profits from negative rates

One of Shakespeare’s most famous quotes is “Neither a borrower nor a lender be.” But toll road operator, Atlas Arteria (ASX: ALX), may beg to differ. It’s just been paid to borrow €500 million in bonds. It makes you wonder: has there ever been a better time to borrow?

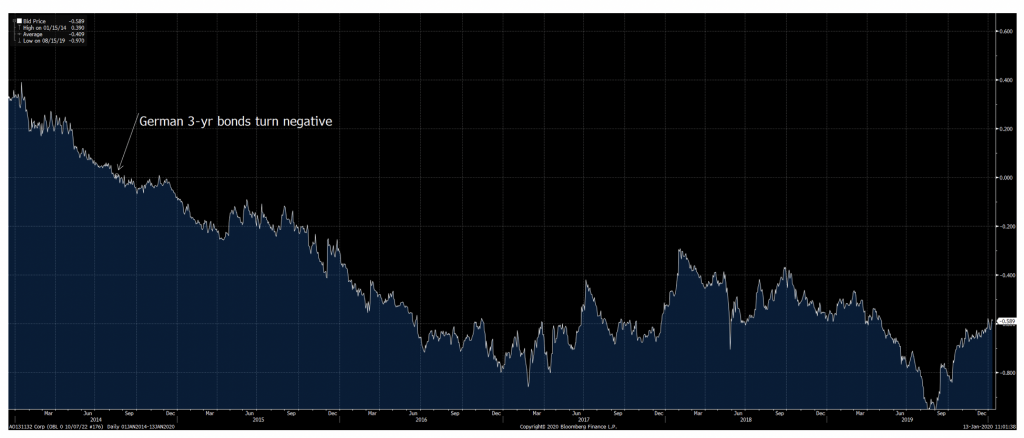

We often hear about European government bonds trading at negative implied yields – ie financial institutions are forced to pay money for the privilege to lend money to the European Central Bank. While negative rates have been around for some time now (German 3-year bonds first went negative in 2014 and have been there since), the notion of paying to lend remains conceptually foreign for most Australians despite the march down Australian bond rates have seen over the past 12 months.

Germany 3-year bonds yield to maturity – 2014 to present

Source: Bloomberg

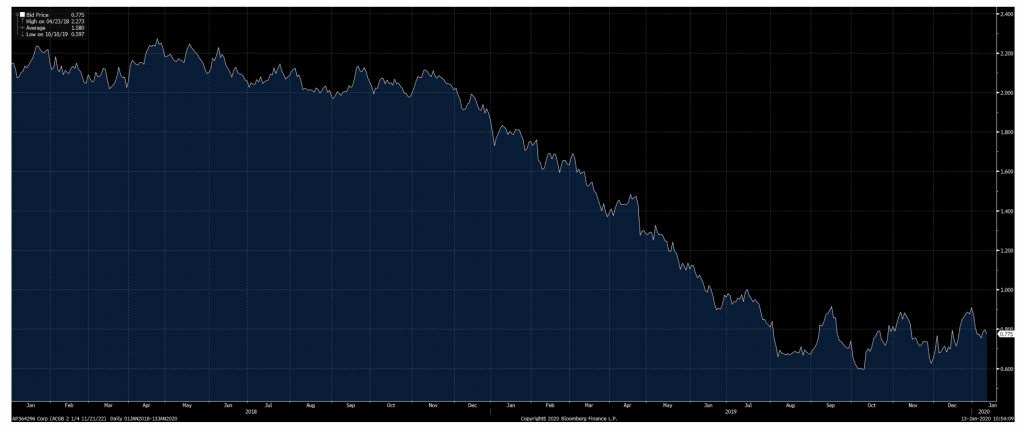

Australian 3-year bonds yield to maturity – 2018 to present

Source: Bloomberg

Without going into the sensibility of current monetary policy settings (which we can debate ad nauseum), one of the most remarkable ASX announcements I have seen over my investment career was released by Atlas Arteria – one of The Montgomery Fund’s investments – on 12 January 2020.

“Atlas Arteria (ASX:ALX) announces that APRR has successfully priced €500 million of bonds under its Euro Medium Term Note Programme.

The Bonds have a term of 3 years and will mature on 20 January 2023…… The Bonds were priced at 100.231% of par with a zero coupon. This represents a margin of 18 basis points over mid-rate swaps and a negative yield to maturity of minus 7.7 basis points.”

From an APRR / Atlas Arteria perspective, the company has just been paid to borrow money (although post fees this will likely be negative). The shorter-term nature of the debt is interesting to note given current credit market conditions, but this is explainable by the fact there is a hole in the 2023 debt repayment cycle for the asset (ie there are no other bonds maturing in 2023).

Theoretically, the issuance means incremental better returns for APRR equity holders given interest costs and “borrowing from the future”, although in practice APRR is unable to pay 100 per cent of its free cash flow to Atlas Arteria at present given the limitation on paying dividends in excess of net profit.

While the announcement doesn’t have any significance for either our investment thesis or the share price of ALX, it does highlight the challenge European financial institutions have in parking excess reserves.

The Montgomery Fund and Montgomery [Private] Fund own shares in Atlas Arteria. This article was prepared 14 January with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Atlas Arteria you should seek financial advice.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY