With markets falling on fears that political brinkmanship in the US may result in an embarrassing default on the country’s extraordinary debt obligations (not to mention a reputationally damaging event), I wondered whether we could dig anything up with a more-than-slightly different approach to finding value.

With markets falling on fears that political brinkmanship in the US may result in an embarrassing default on the country’s extraordinary debt obligations (not to mention a reputationally damaging event), I wondered whether we could dig anything up with a more-than-slightly different approach to finding value.

As you would know from reading Value.able, I am not a fan of the Price to Earnings Ratio. Nothing has changed on that front. Nevertheless, value may just be in the eye of the beholder and not only is the P/E Ratio common in literature about investing and in market commentary, it is, whether rightly or wrongly, in wide use.

Indeed, if you are like many Baby Boomers now on the cusp of selling your business, you will be spending a great deal of time in negotiations and assisting in due diligence to arrive at a simple multiple of earnings.

The humble P/E Ratio may be misused, misunderstood and relied on far too heavily, but popular it remains.

One version of the earnings multiple that is adopted for comparison purposes by private equity buyers is the enterprise model. The enterprise model takes the market value of the equity (market cap) and debt, less cash, and divides the whole lot by the EBITDA (earnings before interest tax depreciation and amortisation). Of course, if you have a company with high operating margins but lots of property, plant and equipment (PP&E) to maintain, you may find the results a little optimistic.

Simply take a standard price to earnings approach, but subtract the cash the company has in the bank.

If you were to buy a business outright, you may take into account the cash the company has in its bank accounts. After buying the business you may be able to access this cash and withdraw it to lower the purchase price. Alternatively, if you are selling a business, in an IPO for example, you may be just as keen to take the cash out before selling it to maximise the return to you and reduce the return available to otherwise anonymous share market investors (this latter strategy is very popular).

The arithmetic result of taking out the cash is a lower P/E multiple. And that is what I thought you may be interested to discuss.

Are there any companies listed in Australia that are trading on very low multiples of earnings once their cash is taken into consideration? The broad based market declines have ensured there are indeed a few.

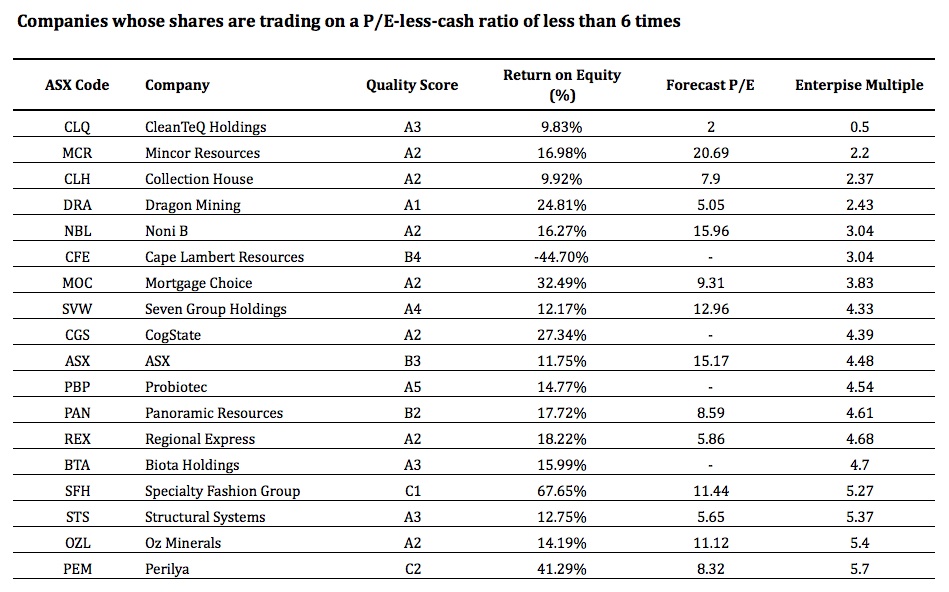

Step 1

My search began by opening our next-generation A1 service (Value.able Graduates – your exclusive invitation to pre-register is not far away). I applied a filter to discover those companies whose shares were trading at a P/E-less-cash ratio of less than 6 times. From the more than 2000 companies reviewed, there are 18 such companies that meet the criteria today. Keeping in mind some businesses have cash on their balance sheet that would NOT be accessible to a buyer (legislated, regulation or simply working capital needs), here are the eighteen:

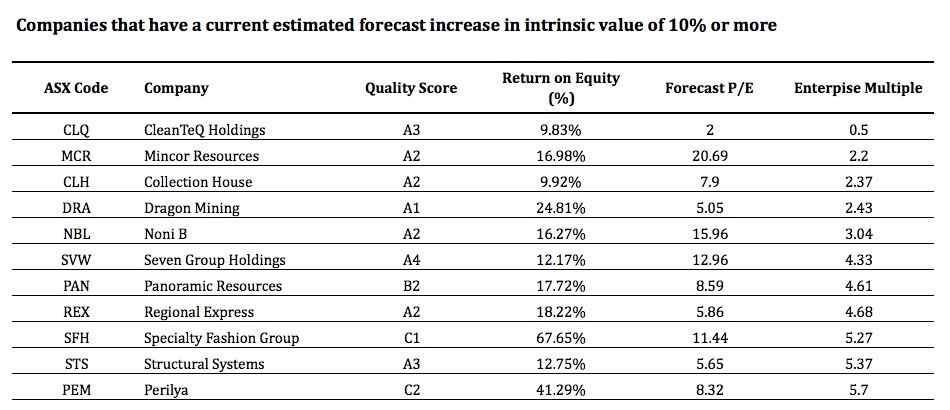

Step 2

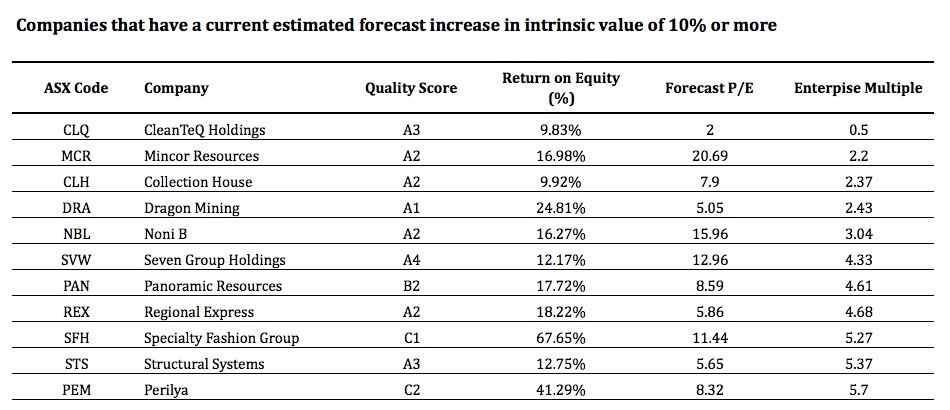

Next, I retained only those companies that have a current estimated forecast increase in intrinsic value of 10% or more. This filter reduced the field to just 11 companies, removing ASX, OZL, CGS, CFE, BTA, PBP AND MOC. Here are the eleven:

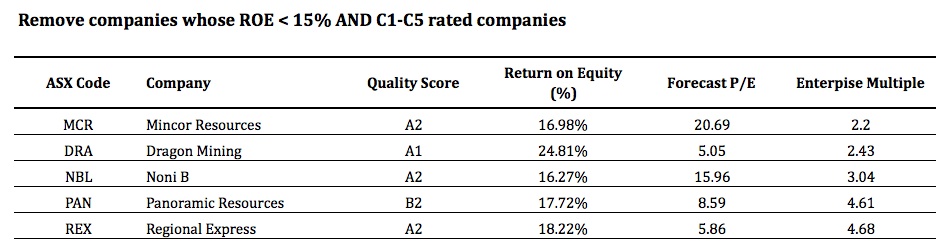

Step 3

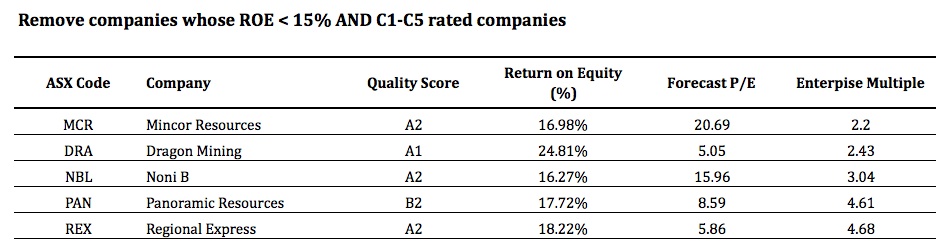

Finally, I removed companies whose previous year’s ROE was less than 15%. I also removed any companies with a C1-C5 Quality Score. Low ROE stocks removed were; CLQ, CLH, SVW AND STS and C-rated companies removed were; SFH AND PEM. That left just five companies. Here they are:

And there you have it, companies trading at enterprise multiples that may be attractive to a buyer who could potentially use the cash on the balance sheet to reduce their purchase price.

Amazing, incredible simple. No manual calculations required (ever again).

Remember, this exercise did not incorporate any of the traditional Value.able investing considerations we usually discuss at the Insights Blog… safety margin, intrinsic value.

For the record, only two of the listed businesses look cheap on the Value.able score today. With reporting season about to begin in ernest, keep in mind the results and cash balances of these companies will all change.

You must do your own research into their prospects and remember to seek and take personal professional advice.

Very soon, finding extraordinary A1 companies offering large safety margins will become simple and even fun. Our next-generation A1 service that my team and I have been tirelessly working on will inspire your investing and re-energise your portfolio.

Value.able Graduates – stay tuned. Your exclusive invitation to pre-register will arrive in your inbox very soon. If you are yet to join the Graduate Class, click here to order your copy of Value.able immediately. Once you have 1. read Value.able and 2. changed some part of the way you think about the stock market, my team and I will be delighted to officially welcome you as a Graduate of the Class of 2011 (and invite you to become a founding member of our soon-to-be-released next-generation A1 service).

Back to the program… this reporting season, who do you think will surprise with better than expected earnings?

Who do you think will struggle?

And what stocks are looking cheap to you right now?

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 29 July 2011.