Monthly Archives: April 2012

Welcome

Roger Montgomery

April 30, 2012

Montgomery Investment Management would like to make the following important announcement.

Montgomery Investment Management would like to make the following important announcement.

Mr David Buckland will be joining Montgomery Investment Management as CEO shortly. David brings a wealth of experience to Montgomery including 11 years as CEO of ethical fund manager Hunter Hall. To view the announcement click on the image at left or click this link: Montgomery Press Release

Montgomery intends to continue to deepen and strengthen its management and investment teams to ensure that clients of the wholesale Montgomery [Private] Fund and its institutional mandates can always rely on impeccable service as we focus on continuing to achieve reliable outperformance.

To register your interest in Montgomery Investment Management or to apply to invest visit www.montinvest.com

Posted by Roger Montgomery, Value.able author, SkaffoldChairman and Fund Manager, 30 April 2012.

by Roger Montgomery Posted in Value.able.

- 15 Comments

- save this article

- 15

- POSTED IN Value.able.

Guest Post: Who’s on the Phone?

Roger Montgomery

April 29, 2012

Harley takes his pen to My Net Fone and impresses even the company’s management with his results.

Harley takes his pen to My Net Fone and impresses even the company’s management with his results.

Take a look at any of the financial media channels or websites and you will likely notice the prevalence of brokers, advisors and commentators claiming that Australian stocks are currently cheap when viewed on a P/E basis. There is no denying that at the present time investors in the Australian stock market are willing to pay considerably less for the earnings of a company than they were just a few years ago. There are a number of possible explanations for this from the risk of external shocks to the increased demand for fixed income securities but there is no doubt that one of the main drivers of the lower market multiple is that investors are pricing in an expectation of lower growth rates in the majority of industries. The earnings of companies in retail, mining, property and construction just to name a few are all expected to experience low to moderate growth, if not stagnation, in the foreseeable future.

In an environment where opportunities for growth are sparse, when a true opportunity presents itself investors have demonstrated their willingness to pay up. There is no better example of this than the substantially higher industry average P/E in the telecommunications sector, where internet growth and new technological developments are driving rates of growth unrivaled elsewhere in the market. As a result investors have their eyes set on discovering the next rising star in the telecommunications world. My Net Fone Ltd may be about to have its turn in the limelight.

My Net Fone (ASX:MNF)

In the words of the company:

“My Net Fone Limited, (ASX:MNF) is Australia’s leading provider of hosted voice and data communications services for residential, business and enterprise users. My Net Fone was first founded in 2004, was listed on the ASX in mid 2006, has 52.5 million shares on issue, has operated profitably since 2009 and has paid dividends to its shareholders every six months since September 2010.

The company has a reputation for quality, value and innovation, having won numerous awards including the Deloitte Technology Fast 50 (2008, 2009, and 2010), PC User Product of the Year (2005), Money Magazine Product of the Year (2007) and many others.

My Net Fone’s wholly owned subsidiary, Symbio, owns and operates Australia’s largest VoIP network, providing wholesale carrier services to the Australian industry, including number porting, cloud‐based hosted PBX services, call termination, call origination and many other infrastructure enabled services. The Symbio network carries over 1.5 Billion minutes of voice per annum.”

What is VoIP? A Look At The Industry

Before looking closer at MNF, it is helpful to have a sound understanding of the industry in which the company operates. Indeed one should first gain a complete and comprehensive understanding of the injdustry and the competitive landscape.

VoIP, or Voice Over Internet Protocol, in its simplest form refers to the group of services that use the internet as a means for communication rather than the standard phone line. A phone call via VoIP involves the call conversation being split into data packets, transmitted over the internet and then reassembled at the other end. The primary benefit as a result is that there is no need for line rental, which provides significant savings to consumers and businesses alike. While cost reduction is generally seen as the most attractive feature of VoIP services the benefits are not limited solely to reduced expenses with a range of other products and services offered by MNF including Virtual PBX, number porting, SIP trunking and hosted services. While their terms may sound complicated they all fit under the catch all term of ‘VoIP.’

The VoIP market is highly competitive and the battle is generally fought over price. For a retail customer, the main reason you would choose VoIP over your traditional provider would of course be the cost savings that occur as a result. But for small and medium businesses, while cost is also of primary importance, other factors come into consideration including product offering, service quality and the ability of the provider to continually innovate and develop new products and services.

VoIP is not new nor is it only just now gaining popularity. If you have ever used Skype or a similar service, you have used VoIP (in fact Skype is a client of MNF’s wholesale division). But there are different VoIP service types and the kind you use when you Skype your family while away on holiday is very different to the kind you would install in your small to medium sized business of 50 full time employees. The two do not directly compete with each other. Sure, businesses may use Skype for video conferencing, but they will still need a communications system, multiple phone numbers, 1300 numbers, fax over IP, remote access to their VoIP number and a host of other services provided by MNF and their competitors. Customers of MNF have reported cost savings on phone bills of up to 50% and in the current business environment it seems likely that businesses will continue to look at ways to reduce costs while still maintaining or even increasing productivity. VoIP services have much to offer small to medium businesses in this regard.

In the early years of VoIP the main restriction was (and at times still is) the issue of low quality broadband. If the broadband connection was weak then the quality of the VoIP service would follow suit, thus making the adoption of VoIP unworthy of the investment for anyone without the highest quality broadband connection. It is no surprise then that in the case of Europe those countries with a high rate of strong broadband connection to homes and businesses (eg France) saw a higher uptake of VoIP than European countries with lower rates of high quality broadband access.

As broadband speeds improve, so too will the quality and available range of VoIP services in Australia. The roll out of the NBN will provide significant opportunities for MNF across all divisions of their business. As more people have access to fast, high quality broadband the potential market for MNF will grow. In the transition period there is likely to be a strong push for new customer acquisition by service providers as retail and business customers alike consider changing from their service type and/or service provider (See MNF’s current marketing program offering significant savings for customers to sign up prior to the roll out of the NBN). While this could result in greater competition in the business and retail markets, as we will see the wholesale division is well positioned to benefit from more service providers setting up shop creating higher demand for wholesale services.

Historic Performance – A Demonstrated Track Record Of Growth

Many investors require a demonstrated track record, which is seen as a way to further reduce the risk one takes in any given investment. As a result there are those who will take one look at the financial reports of MNF, notice the accumulated losses and be frightened away, preferring to wait until MNF has had a few years of strong returns, improving margins and profit growth under its belt. For some, turnaround stories are no go zones.

There is nothing wrong with this method of investing, in fact it can be incredibly successful (witness one W.E. Buffett) but in the case of MNF it is important to understand why the company experienced losses in its early years and why the profits are about to start rolling in.

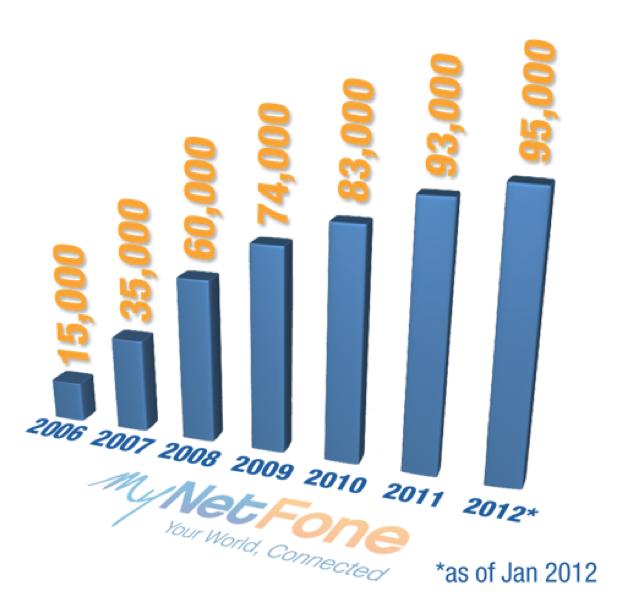

First of all, MNF does possess a proven track record in regards to consistent revenue growth. MNF was started from scratch and has since grown to become a company that currently has 95000 subscribers. Any business owner will know that in the early years of operation profits can take time to come to fruition and a period of investment and cash outflows inevitably precedes growth in scale and subsequent cash inflows. In the case of MNF the company was operating in a brand new industry where the majority of individuals and businesses were still becoming aware of the potential for VoIP services, not to mention the fact that only the tech savvy had the necessary high speed broadband connection to make VoIP worthy of investment in the first place. In 2006, a year that VoIP uptake experienced rapid growth, 19 percent of small to medium businesses in Australia used VoIP services. But of those that didn’t, 35% were completely unaware it existed and another 7% did not understand how it could be implemented into their business.

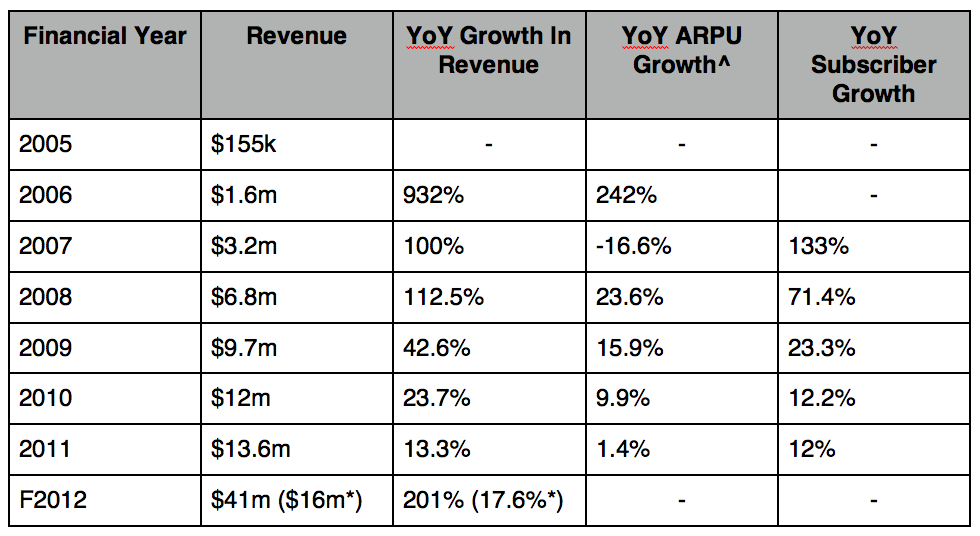

Having said that the growth in revenues (shown in the table below) since MNF listed as a public company is very impressive.

^Provides general summary; figures are not broken down into individual or small to medium business customers

*Minus the contribution of the newly acquired Symbio Networks

Similarly impressive is the year on year growth in MNF’s total customer base, as shown both in the table above and below in a graphic from the company’s website.

Today consumer awareness regarding VoIP is strong and growing. The uptake amongst small and medium businesses is gaining considerable traction due to the significant cost savings and continually developing services on offer. While MNF’s subscriber growth rate is declining from its dizzying heights the company now has access to the potentially lucrative wholesale market through their acquisition of Symbio Networks. And to top things off the government is about to gift MNF with a once in a lifetime opportunity.

NBN – Opportunities Abound For MNF

As previously mentioned, in the past one of the restrictions holding back individuals and businesses from subscribing to VoIP based services was the lack of access to high quality broadband. While broadband penetration in Australia is not particularly low (we were ranked 21st out of OECD countries for fixed broadband penetration and 8th for wireless broadband penetration as at 30 June 2011) the roll out of the National Broadband Network (NBN) will only serve to increase the equality of access to high speed broadband across Australia. What this means is that MNF’s potential market will grow as the NBN roll out progresses.

The capability of MNF’s services are enhanced by any increase in computer power, software/hardware development or internet speeds. Furthermore since product innovation is a demonstrated strength of the company, as technology progresses the range of potential product and service offerings that MNF can deliver to their market will increase. Product and service innovation is a vital differentiating factor in any highly competitive market.

The NBN, in the company’s own words is “a once in a lifetime opportunity” for new customer acquisition as their is a mass transition from the current copper fibre network to the NBN. If the NBN achieves its objectives 93% of Australian households, schools and businesses will have access to broadband services. This will increase the up take potential for residential and SMB VoIP services significantly, and while MNF will likely have to deal with the arrival of many, many new competitors as a result of the expanding market, their wholesale division is likely to benefit from general growth of the VoIP market regardless of which service providers win market share.

(on the flip side, note the higher costs to all competitors/participants after the NBN rolls out and consider the implications of the NBN possibly becoming fibre to the node if Labour loses the next election)

The Importance Of Scale and Differentiation

As an investor it is certainly advantageous to focus on industries experiencing rapid growth. As they say, ‘A rising tide lifts all boats’ and to an extent this will be seen in the performance of internet and VoIP service providers for years to come as the tremendous growth rates are forecast to continue into the foreseeable future. But a market experiencing rapid growth breeds intense competition and if a company cannot differentiate itself from the pack it will be left to fight solely on the basis of being the lowest cost provider, which very rarely ends well for those involved.

There are two things that can separate a company from the pack and ensure it achieves financial performance above the industry average. The first is the presence of scale. MNF’s margins have historically been quite tight, but as revenue grows the margins will naturally improve. The VoIP service industry, while intensely competitive, is such that those who are able to achieve economies of scale have the potential to experience strong margin expansion as each incremental dollar of revenue generates a higher proportion of value to the bottom line. Symbio Networks, the wholesale division of MNF, currently operates at 50% utilisation leaving significant room for margins to be increased at little incremental cost to the company. So while revenue growth will likely taper off to more sustainable growth rates it is highly likely that NPAT growth will outpace revenue growth over the next few years.

In order to reach and sustain a level where economies of scale begin to benefit the bottom line, a company like MNF needs to be able to differentiate itself from competitors. There needs to be a reason why individuals and businesses will choose MNF over other VoIP providers if we, as investors, can be confident that the current high rates of return being generated by the company can be sustained.

The first differentiating factor relates to the vision of MNF management and their focus since the founding of the company. Unlike some of their larger competitors who are being forced to make the transition from older technologies and offer VoIP in addition to their current services, MNF is coming off a lower cost base and with sole focus on New Generation Networks and innovation within the VoIP market. Since the founding of MNF the goal has been “to be the leading VoIP provider in Australia.” The acquisition of the owner of the largest supplier of VoIP wholesale and managed services in Australia also helps separate MNF from the pack.

A quick read through MNF’s past annual reports will give you an idea of the demonstrated ability of the company to come up with new and innovative product offerings. In the past this has no doubt served to enhance the ability of MNF to grab market share, and is reflected in their many industry awards for exceptional products and services. As an investor your job is to determine whether or not MNF will be able to sustain the current high rates of return well in to the future. Start by researching the company’s product offering, read testimonials and compare it with those of MNF’s competitors. Sometimes the best way to form a view over the future of a company is not to approach things as an investor, but to view the business from the perspective of a potential customer.

Perhaps the most attractive feature of MNF’s business model and that which most effectively differentiates MNF from its competitors is the fact that the company is not simply a reseller of VoIP services. A large proportion of VoIP providers are in the business of buying from a wholesaler and reselling the product to the end consumer. Prior to the acquisition of Symbio, this is what it appeared as though MNF was doing when Symbio Networks was external but in actual fact the company was creating these voice services using Symbio’s VoIP technology, adding value through internally developed software and delivering a unique product offering to their customers. The company places a great deal of importance on the development of software and intellectual property to ensure they add value to the services they sell to customers. In the words of the CEO, Rene Sugo, “Today our advantage is largely technical – in terms of scalability, quality, reliability and innovative intellectual property. That is what has driven our growth, and will continue to do so in the medium term.”

Ultimately there is no negating the fact that for a company like MNF (where product development and technological advancement happens faster than most of us can fathom) we are heavily reliant on the competence of management.

The Founders – Interests aligned with shareholders

The two founders, Andy Fung and Rene Sugo, own just over 50% of the company between them. In the first quarter of this year Andy Fung retired from his position as CEO and Rene Sugo took his place. Fung is staying on as a non-executive director and retains his significant holding in the company. Both have strong backgrounds in the telecommunications industry, as well as experience and in depth knowledge in the area of Next Generation Networks. In the ever developing industry of VoIP service providers, experienced and business savvy management is integral to a company’s success.

There is more than just their significant shareholdings in the company that indicates management’s strong desire for MNF to succeed. In the early stages the directors performed services for the company at no or low cost and salaries were kept artificially low as the company dealt with the low capital base nature of a start up business. Similarly, the company was “supported by the low cost provision of services, technology and business support from Symbio Networks Pty Ltd during the start up and early growth phase of the business.” Andy Fung and Rene Sugo were the founders of Symbio Networks, and the company is now wholly owned by My Net Fone after the (related party?) acquisition was finalised earlier this year.

When MNF listed in 2006 they raised $2.5m. Unlike so many of the companies that list on the ASX these funds were not used to repay loans to related parties or to line the pockets of directors, but to fund an expanded marketing program and increase sales and support staff, which was no doubt a raging success evidenced by the growth in total customer numbers of those early years.

Management have also shown their ability to innovate and stay one step ahead of the market. They were the first to remove the pay-for-time model of pricing on international calls and pioneered the move to the now prevalent flat charge for international VoIP calls. The development of ‘On-the-Go’ services which allowed customers to access VoIP services on their mobile in 2007, ‘Meet-Me Conferencing’ in 2010 and the regularly introduced new service plans available to customers are all examples of MNF’s commitment to continually innovating their product offering.

In the process of conducting your research on MNF, do as Roger has suggested frequently here and read each financial report from the prospectus through to the most recent half yearly report. No doubt you will notice the trend of management promising something one year and delivering the next. This is, I believe, exactly what you should be looking for in the management of companies you choose to invest in. In the announcements regarding the Symbio acquisition, and in related articles, the CEO of MNF regularly described the increase in growth that he believed the company was about to experience. On the 23rd of April the company delivered yet again with a profit upgrade that they attributed to the “outstanding performance across the group,” particularly in the March quarter.

The interests of management appear strongly aligned with those of shareholders and as investors our money seems in more than capable hands. Do take the time to read the past annual reports of MNF. Not only will you better understand the growth path that management have in mind for the company but you will most certainly notice the way in which management come across as genuinely interested in the future of the company, its customers and its shareholders, something which is unfortunately rare in many ASX listed companies.

Symbio Networks – A Game Changer For My Net Fone

In September of last year MNF announced they were acquiring Symbio Networks for a maximum consideration of $6m. Symbio Networks is Australia’s largest supplier of VoIP wholesale and managed services. The company was founded by Andy Fung and Rene Sugo, the same founders of My Net Fone. The acquisition of Symbio significantly changes the dynamics of MNF as it means the company is now positioned to benefit from the entry of more VoIP providers.

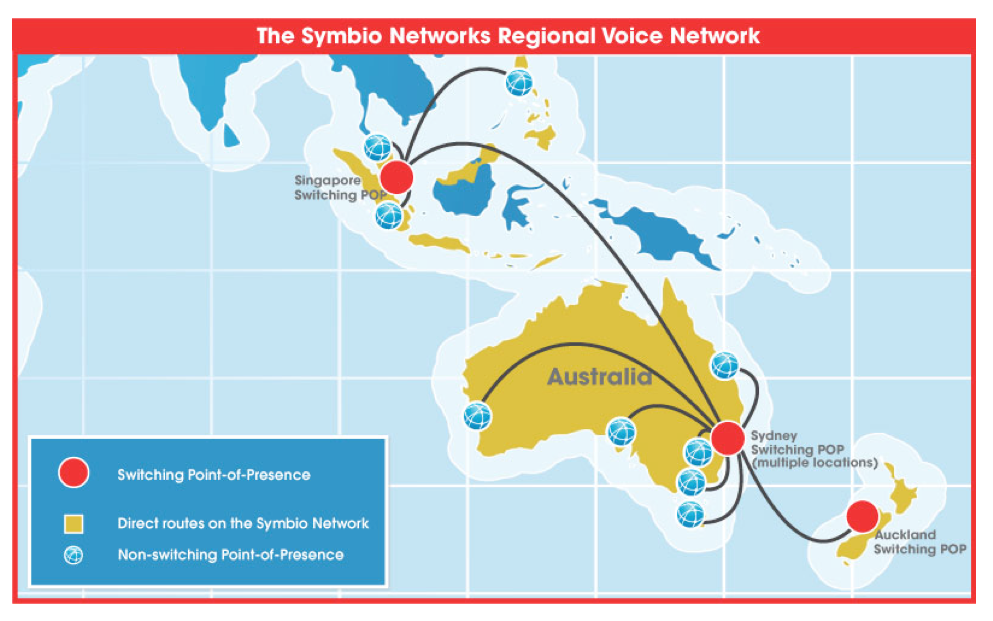

Management plans to run Symbio as a wholly owned subsidiary, separate to the day to day business of My Net Fone. This is important as some of Symbio’s customers are direct competitors with the retail and business division of MNF. Symbio is actually larger than My Net Fone when comparing on the basis of revenues, with $25m of MNF’s FY12 revenue expected to come from Symbio.

The wholesale operations Symbio brings with it is a game changer for MNF. It means that the company is effectively diversified from the inevitable increase in competition that is sure to arise if and when VoIP uptake continues to grow. While the business and retail division benefits only if customers choose MNF over its competitors, Symbio, as the owner and operator of Australia’s largest VoIP network, is positioned to benefit from any overall increase in competition.

Because Symbio has clients across the Asia Pacific the company will not only benefit from the NBN in Australia, but are also positioned to do well from any further increase in broadband penetration or VoIP uptake in Singapore, New Zealand and Malaysia. As such the growth potential for Symbio, and thus MNF, is not limited solely to the Australian market.

The story of both Symbio Networks and My Net Fone are evidence of in my opinion, the visionary skills of the founders of both companies, Andy Fung and Rene Sugo. What we are seeing in the market today with increased uptake of VoIP, new VoIP related products and services being developed and the beginnings of the transition of VoIP to mobile applications, were all envisioned by Fung and Sugo as early as 2002. Today, Rene Sugo is the CEO of the merged entity and Andy Fung will remain as an advisor, consultant and significant shareholder. If their current views on the potential growth in the wholesale, retail and business divisions of their company is half as accurate as their views from ten years ago then it appears MNF is well positioned for the future.

Key Risks (may not be exhaustive)

While the prospects for MNF appear very attractive, like any investment there are risks one needs to consider:

- The NBN: While the NBN is expected to be a fantastic opportunity for MNF there are risks that surround its ultimate effect on the company. These risks include potential increases in costs that favour the larger ISPs, the possibility of substantial changes to the NBN between now and final rollout and of course the fact that the opposition intends to scrap the plan altogether. The first of these risks is reduced by the merger of My Net Fone and Symbio and the fact that MNF’s customer base, while not among the largest, is substantial at around 100,000 customers. The risk of any changes to the details of the NBN that may negatively impact MNF is negated somewhat by management’s active and ongoing correspondence with government and the fact that as the largest VoIP network operator in Australia MNF does indeed have some say in negotiations. And finally if the NBN were to be scrapped, business would go on as usual and if the recent past is anything to go by MNF will continue to grow both revenues and subscribers.

- With the acquisition of Symbio, MNF is liable to pay up to $6m depending on the performance of the now wholly owned subsidiary. The risk here is that if cash flows are impaired for whatever reason the company may need to reduce its dividend payment to fulfill its obligations. With current strong operating cash flows, growing profits and no debt this risk appears minimal.

- External shocks. While MNF is not immune to financial crises occurring in Europe, China or even here in Australia, to some degree their business is defensive in nature. The worse the economic environment becomes the more likely businesses and consumers will decide to cut costs. MNF’s services offer cost reductions in conjunction with improved efficiency and so will benefit from more Australian businesses looking to reduce their overheads.

- VoIP failing to grow and/or the introduction of a new disruptive technology. VoIP itself is a disruptive technology and one that old generation service providers are now finding themselves forced to deal with. But that does not mean a new, more efficient technology won’t come along and steal some of VoIP’s market share, so this risk is certainly one to keep in mind.

- Some other risks may be covered by watching for director’s selling of stock

The Financials

As outlined earlier MNF have grown revenues consistently since listing on the ASX. This year they are forecast to generate $41m in revenue, with $25m coming from the recently acquired Symbio Networks. In their recent earnings upgrade management forecast FY12 NPAT to come in between $2.75m and $3m, with FY13 NPAT guidance for $4m (Note: as a result of past losses the company has tax assets of $930k). If we assume the lower end of guidance then on a fully diluted basis MNF will earn around 5c per share in FY12. In the past the company has paid a dividend around half of the total earnings and with operating cash flows remaining strong there seems no reason why that will stop any time soon. Under these assumptions the company is currently trading on a PE of 7.5 and is paying a respectable dividend. What multiple should the market attribute to a company undergoing strong growth in earnings, paying a healthy dividend and operating in the rapidly expanding internet industry? That is anyone’s guess but there are numerous examples of similar companies currently trading on the ASX that the market has priced on a P/E multiple in the mid-teens, and there is no reason why MNF will not or should not be priced accordingly.

While the company appears to be cheap on a P/E multiple basis the most attractive feature of MNF’s financial performance for me, is its ability to continue to generate fantastic returns on incremental capital for many years to come. The current returns on equity are unsustainably stratospheric – a result of the accumulated losses on the balanced sheet. But even if we calculate return on equity with total contributed capital from shareholders, ignoring the reduction in equity that has resulted from accumulated losses, the company will still generate a return on equity in excess of 50% for FY12 and FY13. The nature of this business is such that provided success continues, high returns on equity can be sustained.

I believe the market is yet to factor in that MNF is now a significant player in the wholesale VoIP market and while its business and retail division will continue to face growing competition, the company has demonstrated its ability to differentiate itself from its competitors. With what seems like highly competent management, bright industry prospects and the ability to sustain current high rates of return My Net Fone currently appears to tick all of my value investing boxes.

Let Harley know what you think of his work and share your own insights. Please note the views of the author are his own and may not represent those of the publisher. It is a must that you conduct your own research and seek and take personal professional advice before undertaking any security transactions. The sources of data Harley relied upon to produce this post may or may not be accurate so readers must investigate and satisfy themselves that are are completely aware of and accept all risks before undertaking any securities transactions they conduct after they have sought advice from a licence adviser familiar with their needs and circumstances.

Authored by Harley and posted by Roger Montgomery, Value.able author, SkaffoldChairman and Fund Manager, 29 April 2012

by Roger Montgomery Posted in Insightful Insights, Technology & Telecommunications.

Why should you look beyond short term share price movements when valuing your investments?

Roger Montgomery

April 28, 2012

In the Weekend Australian, Roger Montgomery discusses how a value investor uses the concept of intrinsic value to determine the attractiveness of investments. Read here.

by Roger Montgomery Posted in In the Press.

- READ

- save this article

- POSTED IN In the Press.

With Sarkozy gone, what future for the Euro?

Roger Montgomery

April 28, 2012

The tumultuous French election result has cast doubt over the European bailout – what does Roger Montgomery think of the result? Read here.

by Roger Montgomery Posted in In the Press.

- READ

- save this article

- POSTED IN In the Press.

Can JBH get its Mojo back?

Roger Montgomery

April 27, 2012

What a difference a high Australian dollar (lots of people travelling and spending their money overseas and not here), a shift to online retailing, deflation, competitors going out of business, higher petrol prices and a more cautious consumer can make in the retail space in just nine months. And few companies are more exposed to all these influences than JB Hi-Fi.

Back in August 2011, the company reported the following in their annual report;

FY11 Sales $2.96b

FY11 NPAT $134.4m

FY11 NPAT Margin 4.5%

Based on these numbers as well as company guidance for sales growth in FY12 of 8% to $3.2b, the consensus analyst view at the time was for 11% FY12 NPAT growth to $150m.

Since that time however, shareholders have suffered three profit downgrades – in mid December, mid February and another this morning.

In this morning’s trading update, management have guided analysts to an estimated NPAT of $100-$105m on sales of $3.1b. Based on this latest announcement, 2012 numbers will look like this (assuming no further downgrades);

FY12 Sales $3.10b

FY12 NPAT $102.5m

FY12 NPAT Margin 3.3%

What’s clear from these numbers is that sales revenue is growing. No immediate issues there. And despite being below the initial 8% forecast, sales are now forecast to grow by 5%. The concern however is that LFL (like-for-like) sales are negative. For the nine months, sales of mature (older established stores) are down 1.3% which means without their current expansion plans, sales targets would not be met. It’s also the main reason their initial 8% sales growth target won’t be met.

But the main issue in forecasting what the business is worth is that despite this incremental sales growth, this is not CURRENTLY being converted to the bottom line. Based on management’s forecasts, NPAT margins will be 3.3% this year vs. 4.5% in the year prior, a 26.7% margin decline in just nine months. No businesses can increase intrinsic value in such an environment.

The tide that’s currently running against JBH is very strong, no plaudits for pointing that out. But when that tide turns, could JB Hi Fi be in an even better position than it was going into the non-resource-recession (a.k.a. the seven cylinder recession of 2012). There’s certainly the possibility and the key is working out when the economy turns and whether the structural changes occurring in retail are enough to adversely impact and offset the benefits of a cyclical turnaround.

Here’s what we are watching:

· Recently management including CEO Terry Smart and Chairman Patrick Elliot have been heavy sellers of their own personal holdings in JBH. What do they know? Why are they selling?

· The retail industry is experiencing a huge shake-up. Many retailers are doing it tough and many more are exciting the space. The Good Guys was being shopped around for a private sale recently with Blackstone rumoured to be the suitor. Later denied by them. Clive Peters (now owned by JBH) and WOW Sight and Sound have gone into receivership and JB’s largest competitor Dick Smith (owned by Woolies) is set to close 100 stores by 2014. Few electronic retailser are investing in growth. The night is darkest just before the dawn so we are looking for evidence that JB Hi Fi is capturing market share in such an environment, either by making acquisitions of distressed sub-scale business or by taking over leases in locations previously unavailable to them. In QLD it appears up to $250m in sales are up for grabs as competitors close. Dick Smiths had $1.5b in sales of which an optimistic analyst would say that JBH could pick up a substantial portion of.

· Currently electronic retailers are on the back foot evidenced by store closures and liquidation sales. These participants are forced sellers of excess stock putting HUGE downward pressure on retail prices and hence profit margins. In March alone, JBH experienced a 200 bps contraction in gross margins. I was silly enough to buy two C3-PO USB keys for my kids at Christmas for $40 each but picked up another two in Brisbane a few weeks ago for $18 at a closing down Dick Smiths (my new book will be called How to Go Broke Saving MoneyTM).

Margin compression of the magnitude reported recently is unprecedented for an operator of JBH’s buying power. So we are looking for signs that the worst is over in terms of competitors closing their doors, a sure sign margins will improve or cease falling precipitously.

· We are also watching closely JBH’s move into the online space. Growth has been excellent in this segment of the business (admittedly off a low base) with an average of 965,000 website visitors each week. That’s 50.2m views per annum – 2.4 times the population of Australia. The trick of course is to convert page views to sales.

· In prior years the business has benefited immensely from positive LFL sales and also an internally funded store-rollout strategy driving new sales and sales as stores matured. This was a tailwind for the business when the number of new stores being added divided by existing stores produced a high ratio. For example when the business only had 50 stores and another 15 were opened, the proportion of stores growing and adding to sales was 30%. At present the business has in excess of 150 stores and is opening 14-15 stores per annum – a ratio of just 10% in new growth. So when you have negative LFL sales in existing and maturing stores, this is a huge drag on business momentum. We are therefore watching for signs that LFL sales stabilise or turn positive so that the business gets its mojo back.

We think it can although we are convinced the very easy money from the store roll out stage of the business along with P/E expansion has been made. Businesses with a leading market position are able to survive traumatic periods in what is a highly cyclical business and are able to absorb the effects of margin compression. Provided they can capture high levels of market share amid the tumult and cement their position as the dominant player JBH might be well positioned for the next economic recovery. One might ask whether ‘Terry and Co’ will be there when that happens.

Skaffold.com Intrinsic Value 13 year chart.

Skaffold’s conservative valuation estimate for JBH is $13.43 for 2013 as can be seen by the thin orange line in the above chart. Whether the share price now approaches that valuation or that valuation instead is revised lower and approaches the price will be determined by whether the company can harness its opportunity and when the irrational pricing associated with collapsing competitors ends. Of course after that, its success will be dependent on the depth of the impact of the structural change represented by the retail shift global and online.

Amid all of your bearishness about housing in Australia, do you think retailing conditions will pick up for JBH and its peers or not? Can you buy goods that JBH sells cheaper online?

Posted by Roger Montgomery, Value.able author, SkaffoldChairman and Fund Manager, 27 April 2012.

by Roger Montgomery Posted in Consumer discretionary, Skaffold.

- 36 Comments

- save this article

- 36

- POSTED IN Consumer discretionary, Skaffold.

How does Roger Montgomery view the desirability of owning airline stocks?

Roger Montgomery

April 26, 2012

Roger Montgomery speaks with Ross Greenwood on Radio 2GB regarding the current state-of-play for Australian airlines, how the global landscape is both pressuring our local players and will also shape their future – and why his in “Value.able” investing strategy highlights why Australian airline stocks are unlikely to represent strong growth investments for some time to come. Listen here.

by Roger Montgomery Posted in Media Room, Radio.

- 4 Comments

- save this article

- 4

- POSTED IN Media Room, Radio.

Sinking like a brick? Are house prices really going to crash?

Roger Montgomery

April 20, 2012

One of the companies that is bound to suffer amid the western world’s slump in house prices, home starts and weak credit growth is Boral.

One of the companies that is bound to suffer amid the western world’s slump in house prices, home starts and weak credit growth is Boral.

Today, Boral (BLD) cut their full year profit guidance by $22m after weak house activity and heavy rain in NSW and QLD have impacted their operations. BLD had forecast profit to be $150m-$175m and now expect $128m-$153m. Boral’s Mark Selway noted that Australia’s residential building sector is “aweful” and the construction and building materials company blamed continued wet weather and slow housing starts for cutting its profit forecast by the $22 million noted. In an interview with Dow Jones today Selways said; “The residential housing market looks tough and, by the way, I think it’s going to get a whole lot tougher,” and 2013 was likely to be “the tough year”.

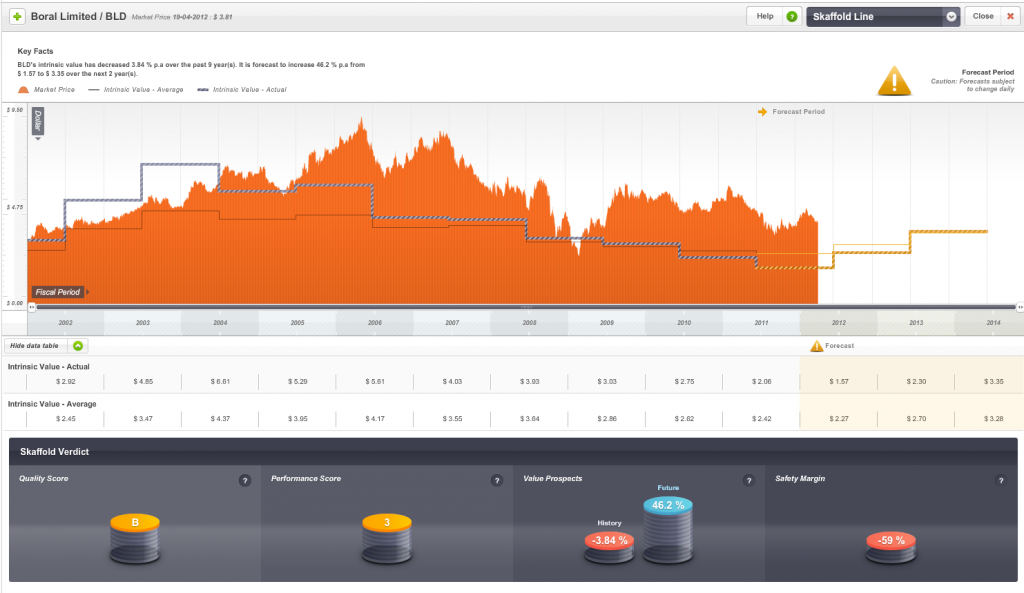

Below: Skaffold.com estimated Intrinsic Value for Boral.

The consensus analysts estimates that produce Skaffold’s current intrinsic value estimate will now decline further as will the estimate of value itself. Since 2003 Boral’s estimated intrinsic value has been in decline as can be seen in the Skaffold Line Evaluate Screen. You should also note the hockey stick – like increase from analysts earnings optimism.

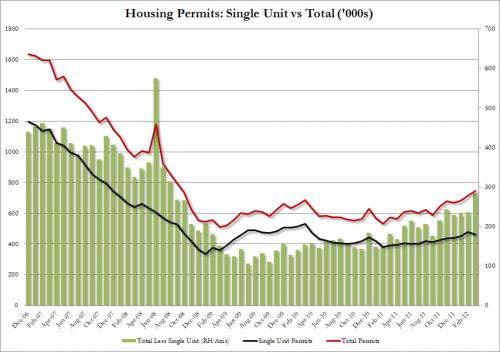

Over in the US the situation isn’t much better. After Warren Buffett noted his 2010/11 prediction of a bottom in housing “was dead wrong” one analyst said “March, housing starts, expected to print at 705K (which is crawling along the bottom as is, so it is all mostly noise anyway, but the algos care), came at a disappointing 654K, the lowest since October 2011, and a third consecutive decline since January. Want proof that the record warm Q1 pulled demand forward? This is it. As the chart below shows, the all important single-unit housing starts have not budged at all since June 2009. So was there any good news in today’s data? Well, housing permits, which means not even $1 dollar has been invested in actually ‘building’ a home soared to 747K, from 715K in February, and well above expectations of 710K – the highest since September 2008. That a permit is largley meaningless if unaccompanied by a start, not to mention an actual completion goes without saying.”

Total starts versus unit starts.

Apparently Harry S. Dent the author of various predictions of impending doom (and someone who’s rpredictions have been wrong as frequently as they have been right, is on Australia and said that we have a real estate bubble that is set to burst. He thinks there’ll be another worldwide economic downturn in 2012, and this will cause Australian real estate values to fall back to where they were 10 years ago.

“People in places like Sydney or Tokyo or Miami say, ‘Hey, real estate can never go down here, we’re a great place, everyone wants to move here, there’s not much land for development’, and what I say is that is exactly the kind of place that bubbles.” “Outside Hong Kong and Shanghai, Australia is the most expensive real estate market in the world compared to income.”

Thanks Harry! My own definition of a bubble is a debt fuelled asset purchasing binge where the income from the asset cannot pay for the interest on the debt that is funding it. Actually…that does sounds a whole lot like negative gearing????

Of course, some observers reckon the empty houses in Brisbane as sellers wait for prices to improve is a sign that the market is already crashing. Others suggest for a crash to happen home owners have to be willing to sell their property at that lower price. A lot of home owners are removing their property from the market if they can’t get the price they want. Whether the lower price gets a print or not however is not relevant. If my neighbour cannot sell his house for the price he wants, then the market price must be lower. We don’t need a transaction to occur to confirm it.

Gone are the days when the dream was to have one nice house with a Clark Pool, a BBQ and a new Holden in the carport. Now everyone wants to be a millionaire DIY developer and fixer-upper with his and hers BMW X5s. That simple progression leads to more volatility in the prices of assets those investors pursue. So what’s the impact on QBE and the banks now that Genworth have pulled their float? Would love to hear your thoughts, insights and observations. What are property prices doing in your area?

Posted by Roger Montgomery, Value.able author, SkaffoldChairman and Fund Manager, 20 April 2012.

by Roger Montgomery Posted in Property.

- 124 Comments

- save this article

- 124

- POSTED IN Property.

Given the outlook for Chinese growth and iron-ore prices, is it time to cast a critical eye over your BHP holdings?

Roger Montgomery

April 20, 2012

Roger Montgomery discusses how and if you should respond to the impact of changing global conditions on your BHP [BHP] stock holding. Read here.

by Roger Montgomery Posted in Energy / Resources, On the Internet, Skaffold.

- save this article

- POSTED IN Energy / Resources, On the Internet, Skaffold.

Guest Post: Can you beat the worlds biggest banks?

Roger Montgomery

April 19, 2012

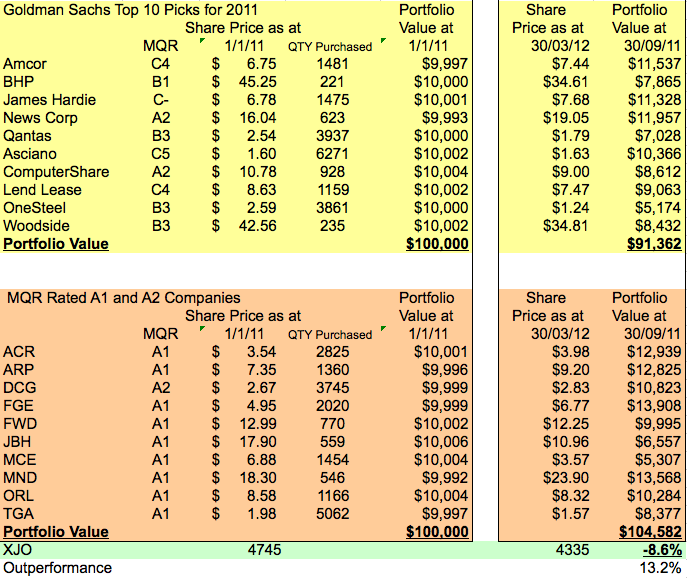

For new readers to the blog, welcome. Here at Roger’s blog we are conducting an ongoing study comparing the performance of investment portfolios recommended by major broking houses verses a loose selection of A1 and A2 stocks bought as a big a discount to IV as possible.

For new readers to the blog, welcome. Here at Roger’s blog we are conducting an ongoing study comparing the performance of investment portfolios recommended by major broking houses verses a loose selection of A1 and A2 stocks bought as a big a discount to IV as possible.

(Its Roger here: Its important to understand this is a hypothetical investment portfolio based on one of the Twin’s consistent approaches to stock selection. In that regard it is not a collection of small high risk bets whose returns could be easily ramped. I will be very surprised if you see high double digit returns from such an approach for that reason. At Montgomery, managing +$200 million simply precludes us from investing in the small companies that would produce higher returns on relatively insignificant $5000 sums – irrespective of whether or not the returns can be boosted by disingenuous marketing by social media marketing experts or worse, even ramping. Its easy to make 50% per annum on $100,000. Much harder on $1billion. Even personally our individual speculative selections may have a couple of hundred thousand dollars allocated to them and so we are also precluded from employing capital where liquidity may be boosted only by the participation of a small group of invisible Facebook friends. Worse, our experience tells us that such anonymous groups can be a manic depressive bunch and when they’re told that a holding has been sold, the illiquid volumes of the companies they are toying with will produce the very opposite result of that which they aspired to achieved.)

We have been following twin brothers and their investment decisions and performances since December 2010.

The twins each inherited $100,000 and sought differing advice how to invest it, the quarterly reports of their investments can be found here:

http://rogermontgomery.com/will-david-beat-goliath/

http://rogermontgomery.com/how-are-the-a1-twins-performing/

http://rogermontgomery.com/which-a1-twin-is-outperforming/

By the end of 2011 our first twin, the regional Queensland accountant was still head down, trying to help hundreds of clients recover from all the natural disasters of the previous 12 months, government help was available but so was the paperwork. As these tasks drew to a close, Queensland entered a bitter and hard fought state election, so comprehensive was the coverage, it was hard to watch anything else. There had been a lot on, and checking on the performance of his portfolio had really been at the bottom of the list.

Our NSW based public servant had pretty much had the same six months, but for very different reasons. Being in the Foreign Affairs office of the federal public service, he was now getting used to the third minister in 2 years, much changed, often needlessly and nobody had any time for anything other than redeploying resources and priorities.

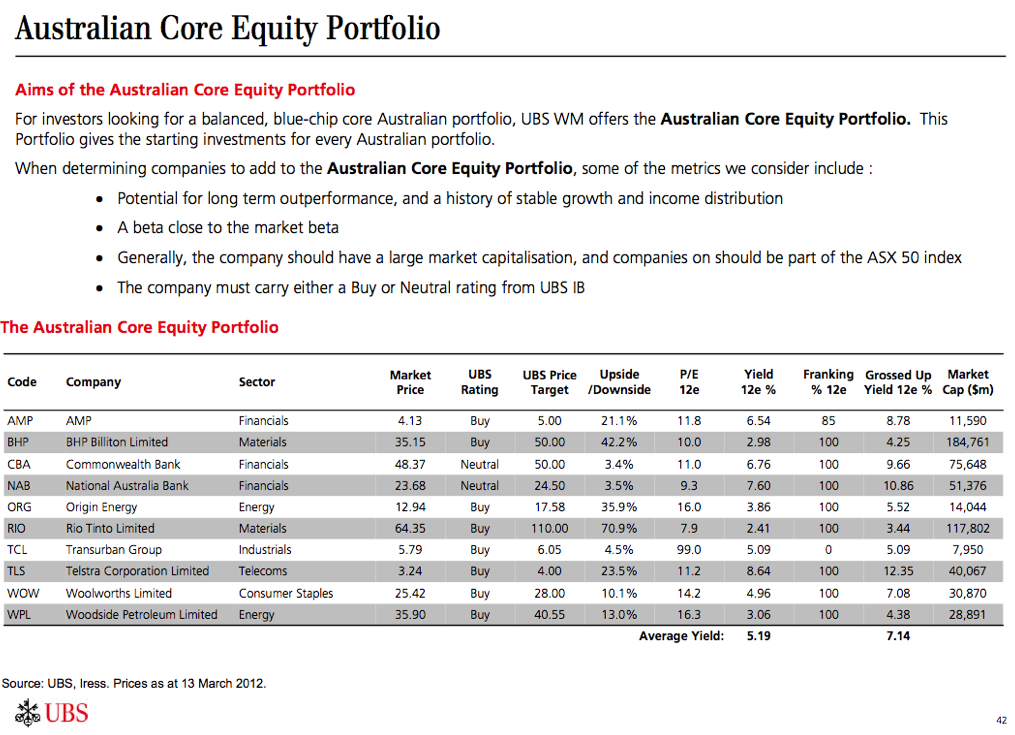

As March ended and the weather cooled, both brothers had a chance for a bit of R&R and to catch up on personal business. Neither were particularly thrilled with the performance of their portfolio; Our public servant , who had always invested through Goldman Sachs had performed exactly in line with the broader market, his portfolio was down 8.6% over the 15 months, and had lost nearly $9 000. He felt he could do better, and had been thinking about getting other advice for quiet a while now, and decided to act. He now only had $91 000 left and decided to switch brokers and became a client of the giant international broking firm UBS, who provided him with their Australian Equity Core Portfolio. Here is an image of the advice from UBS and how his $91 000 was divided amongst the 10 stocks listed.

Source: March 2012 ASX Investor Hour. www.asx.com.au

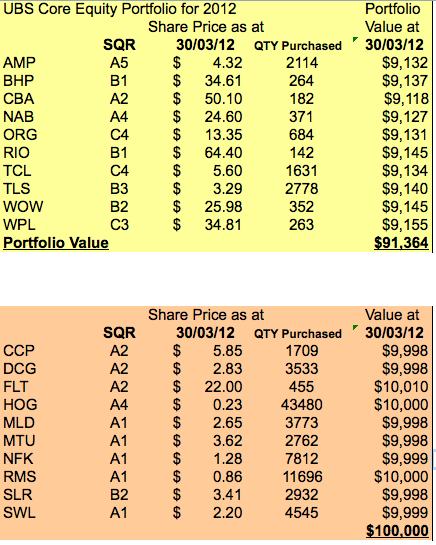

Our Queensland accountant had faired significantly better, by investing in A1 and A2 stocks he had outperformed the market by 13.2% over the 15 months. However, he acknowledged that a couple of his investment decisions had performed poorly and wanted to rebalance his portfolio, he too decided to act. With over $104 000 available to invest he decided to round down his investable sum back to $100 000 and spend the surplus on a short Gold Coast holiday with his family and the balance on a membership to Skaffold. Skaffold is the research tool that would help him scour the every listed company to find quality stocks that may be selling at a price that offered a discount to estimated intrinsic value. Skaffold would also save him the time of sorting through ten years of annual reports for every listed company. Armed with ability to narrow down the choice of stocks, he would able to focus on the few that met his criteria and do further research on them before investing.

Here are the twin’s portfolios side-by-side:

The varying quality ratings of the 2 portfolios makes for interesting reading. On the basis of quality, the UBS portfolio doesn’t look very disciplined yet the portfolio chosen with the help of Skaffold looks pretty consistent. Except for 1 stock that is an A4. Our Skaffold user feels this cash flow positive producer may be about to be rerated by the market and A4 is as speculative as he could bring himself to be.

We will revisit our investing twins just after June 30 to see which portfolio is performing better, many thanks to Roger for putting the stocks to the test and actively encouraging this ongoing project.

All the Best

Scott T

Keep in mind this is a hypothetical and educational exercise only and not a recommendation of any kind.

Authored by Scott and posted by Roger Montgomery, Value.able author, SkaffoldChairman and Fund Manager, 19 April 2012.

by Roger Montgomery Posted in Investing Education, Skaffold.

- 37 Comments

- save this article

- 37

- POSTED IN Investing Education, Skaffold.

Guest Post: Thoughts on Risk.

Roger Montgomery

April 19, 2012

RISK: Successful investing is all about managing risk and, as luck would have it, this is one of the things that we, as a species are not particularly good at.

It is demonstrably true that humans are terrible at evaluating the complex risks associated with modern environments. This is not new information and there are plenty of oft referred examples which you can probably bring to mind; how we assess the actual probability of death from road vehicles vs. the perceived risk of death from spiders, snakes, sharks and aircraft (1,414 deaths vs. 32 in Australia 2009), the detrimental health risks of nuclear power vs. the dangers of fossil fuels (for every nuclear power linked death, there are an estimated 4,000 coal related deaths. Both candles and wind power are linked to more deaths than nuclear energy), or the real risk of bacterial infection vs. swine flu or mad cow disease (septicaemia alone was responsible for 993 Australian deaths in 2009).

Even if we acknowledge this shortcoming and integrate this knowledge to inform our everyday decisions, humans are hardwired to act on perceived risk, and are thus influenced to varying degrees by emotion. This is an evolutionary thing, and was suitable during the times that most of our transition to the dominant species occurred, but far less so now. The data necessary to evaluate complex risk often requires computers to calculate, and gut feel just won’t cut it anymore. To make it worse, we (as an aggregated faceless mass of humanity) are more inclined to trust information that reinforces existing beliefs (a well established phenomena known as confirmation bias). In a world where prominent politicians (and others) oppose the use of vaccines responsible for the eradication of polio and smallpox, in direct contradiction of peer reviewed science, finding someone who will tell us that we are right about pretty much anything is not challenging.

In summary, our natural instinct is to assess risk using our perception rather than facts, our perception is very often wrong, and even if we go looking for facts, we are inclined to assign more validity to data that supports our predisposition rather than to conduct an objective assessment.

You want more? In an apparent contradiction, this inability to overestimate our abilities may even confer an evolutionary advantage. Unfortunately, this would work at a species level, rather than for the wealth of the individual, and is a complex topic for another day (more about it here van Veelen,M. and Nowak,M.A. (2011) Evolution: Selection for positive illusions. Nature, 477, 282-283)

So, why is this important, and how is it relevant to investment?

Investment, as we all know, is about accurately assessing risk, and requiring an appropriate return to compensate for these risks to our capital. The more accurately we can assess risk in our investments AND act accordingly, the more likely we are to maximize returns. Knowing that investment is about managing risk however, is VERY different, and a lot easier than doing the work that this understanding requires.

Risk is managed using facts and knowledge. There is no place for gut feel. The more relevant facts we have about an investment, and the more knowledge we have about how to integrate this mass of data, the more accurately we can ascertain risk. As investors, we are looking for opportunities where professionals, with millions of dollars allocated to data collection, and which have analysts with years of experience, have mispriced this risk.

It could be argued that this is not necessarily so, that we could accept the average rate of return, such as with an index ETF. In this case we are accepting the risk premium applied by the market, and the inferred risk premium is out of our control. Historically, the 10 year compound annual rate of return for the ASX is 2.4% (excluding dividends), and for 5 years -3.1%. Even going back 22 years to 1990 only gets you just over 4%. In my opinion, the reward over any of these time frames is clearly inadequate, even allowing for dividends. These returns are comparable or worse than much lower risk investments including cash (not accounting for tax).

This leaves us competing against experienced, well resourced professionals and, more dangerously, many not-so-great investors as we try to outperform the market. In this context a quick look at P/E ratios is unlikely to yield the stocks that will lead to suitable returns. We need to be able to value businesses, find those that are mispriced and, most importantly, identify and assess the risks inherent in our calculations.

There are many tools for valuing businesses, such as the intrinsic value method described by James E Walter and explained much more accessibly in Valu.able, and even some for assessing risk (such as the Macquarie Quality Rating). The research necessary to even partially determine such metrics for all of the companies on the ASX (let alone internationally) with any accuracy is far beyond that available to the average retail investor, so historically we have had to only work on a handful of stocks recommended by professional researchers or investment publications, or use our gut as a first pass.

Like so many other things, the information age has turned this on its head. These days, a single service can value, and assess the quality of, the entire ASX, identifying companies worthy of further, thorough analysis. And this is exactly what products like Skaffold are useful for, and why they always come with a disclaimer.

When you make an investment, it is your cash, and your decision. You will reap the rewards if you get the risks right and pay the price if you do not. Tools like Skaffold (as an implementation of the MQR and intrinsic method) simply remove the noise, and allow you to find gold without having to pan too much gravel. When I first came across the MQR, both Forge Group and JB Hi-Fi were A1 and trading at a discount to estimated I.V. The decision to invest in the former and not the latter was not a function of luck, but an exercise in risk management.

The reason I invested in Forge was, that I know the industry, because I worked in it. I know the way high ROE is achieved in construction and mining services, the kind of businesses that can maintain it, and how such businesses generally grow. After carefully considering all of the available data and quantifying what I did not, or could not know, I felt I really did understand the risk and the potential reward, and as such made the investment.

In contrast, I did not understand how JB Hi-Fi would continue its level of growth, even in the medium term. I also work in the technology industry, and the threat to margins from online retailers was obvious, even two years ago. (This threat and the maturing nature of JBH was written about by Roger Montgomery some years ago) The discount to I.V was there, but the risk that ROE could not be maintained was too high for me. This is not a comment on the quality of JB Hi-Fi as a company, but on its valuation as a growth stock using historical ROE.

Generally, the more we know about managing businesses, the industries in which they operate and the products they are selling, the better we are at identifying and managing risks associated with these activities. If we were running the business we would be assessing strengths, weaknesses, opportunities and threats, barriers to entry, competitive advantage, brand awareness, and R&D just for starters. If we are considering about buying even a small part of a company, we should be doing the same.

In my opinion, I would rather have large investments in a smaller number of companies where I have control of the risk than rely on the brute force of diversification where I accept the risk premium of the market in general. I miss out on a lot of really good stories as a result (I don’t invest in mining exploration stocks for example) but at least I sleep well at night. My capital has been the result of far too much work for me to treat it cheaply.

There will be times when you can’t accurately assess risk, and times when no high quality stocks whose risks you understand are trading at a discount to their intrinsic value. It is times like this that it is hardest to hold your nerve. Remember, you don’t have to invest in the stock market, you can assess other asset classes, or alternatively you can follow Arnold Rothstein’s advice to Nucky Thompson (Boardwalk Empire – I recommend it if you haven’t seen it) for when the path forward isn’t immediately clear or the risks too great.

Do nothing.

Postscript:

- What is more common in Australia, suicide or homicide

- Motor vehicles are the most common cause of deaths attributable to “external causes”, what are the next 3 most likely

- What is the more common cancer in Australian women? Respiratory, digestive or breast?

Answers

- Suicide represents 24% of all deaths by “external causes” compare to 2.4% for deaths attributable to assault. While this probably didn’t surprise you suicide is also far more common in the USA.

- In order; Suicide, Falls and Accidental Poisoning (Snakes, spiders, jellyfish and crocs hardly rate a mention. There were not deaths attributable to snakes on a plane).

- In order; Digestive (4,917), Respiratory (3,080) and Breast (2,722)

Data from ABS census 2009

http://abs.gov.au/AUSSTATS/abs@.nsf/mf/3303.0/

1. van Veelen,M. and Nowak,M.A. (2011) Evolution: Selection for positive illusions. Nature, 477, 282-283, 10.1038/477282a. Available at: http://www.ncbi.nlm.nih.gov/pubmed/21921904 [Accessed September 15, 2011].

“Dividend policies and common stock prices” James E Walter

Author: Dennis Gascoigne is, or has at some time been; a Civil Engineer, Application Developer, Molecular Biologist, Management Executive and Professional Musician. He has held senior management roles in international Australian construction companies, has founded successful businesses in both civil engineering and information technology, and more importantly, played at the Big Day Out. These days he splits his time between genome research, and working on his cattle farm at Tenterfield in the NSW tablelands.

by Roger Montgomery Posted in Insightful Insights.

- 28 Comments

- save this article

- 28

- POSTED IN Insightful Insights.