Looking for regular income? Private credit is booming. Watch our latest Fear + Greed Podcast from our summer series here.

-

Disinflation’s bumpy road

Roger Montgomery

February 19, 2025

Last year, the stars were aligned for gains in equities. In 2023, we alerted investors to three key ingredients pointing in the right direction for 2024. Disinflation, positive economic growth and a massive injection of liquidity all helped investors feel confident about piling into the AI thematic, which drove equity indices to new all-time records. Continue…

by Roger Montgomery Posted in Economics.

- save this article

- POSTED IN Economics.

-

CSL’s mixed half-year: plasma strength offsets vaccine weakness, bright outlook maintained

Roger Montgomery

February 18, 2025

CSL (ASX:CSL) has posted its half-year results, delivering results that are best described as mixed. At the headline level, revenue climbed around five per cent, while net profit after tax and amortisation (NPATA) also nudged upward in the low single digits. Beneath these top-line numbers, the company reported a robust rebound in plasma collections, which was offset by weaker sales of its Seqirus influenza vaccines. Despite these mixed signals, management has reaffirmed guidance for FY25, projecting 10-13 per cent NPATA earnings per share (EPS) growth and a five to seven per cent lift in revenue. Continue…

by Roger Montgomery Posted in Companies, Stocks We Like.

- save this article

- POSTED IN Companies, Stocks We Like.

-

JB Hi-Fi delivers (again)

Roger Montgomery

February 17, 2025

JB Hi-Fi Limited (ASX:JBH) has again outperformed market expectations with its first-half of 2025 (1H25) earnings results. JB Hi-Fi continues to demonstrate its knack for navigating economic uncertainty while driving shareholder returns through impressive cash generation and dividends. Continue…

by Roger Montgomery Posted in Companies.

- save this article

- POSTED IN Companies.

-

The Commonwealth Bank of Australia’s stellar result

Roger Montgomery

February 14, 2025

The largest position in The Montgomery Fund’s portfolio, at almost eight per cent of the portfolio, is the Commonwealth Bank of Australia (ASX:CBA), purchased back when the price was below $78 per share. This week, the company released its December half-year profit results, revealing a business reinforcing and extending its competitive advantages in a fiercely competitive market. Continue…

by Roger Montgomery Posted in Companies, Stocks We Like.

- 2 Comments

- save this article

- 2

- POSTED IN Companies, Stocks We Like.

-

Discover how to value the best stocks and buy them for less than they’re worth.

NOW FOR JUST $49.95

buy nowSUBSCRIBERS RECEIVE 20% OFF WHEN THEY SIGN UP

“This is a book you simply must read.

The very best investors in the world are “value” investors.” -

Breville Group’s half-year results

Roger Montgomery

February 13, 2025

Breville Group (ASX:BRG) is a high-quality company, profitably held in the Montgomery Small Companies Fund. Breville released its half-year earnings this week – and the numbers point to a robust underlying performance. Nevertheless, investors will debate whether the guidance for the remainder of the fiscal year is deliberately conservative or signalling a more challenging road ahead. Continue…

by Roger Montgomery Posted in Companies, Small Caps, Stocks We Like.

- save this article

- POSTED IN Companies, Small Caps, Stocks We Like.

-

Nick Scali reports strong 1H25 results

Roger Montgomery

February 12, 2025

Nick Scali Limited (ASX:NCK), a holding in the Montgomery Small Companies Fund has released its half-year 2025 (1H25) results. Despite the mixed headline picture, Nick Scali’s 1H25 results outperformed consensus estimates. Continue…

by Roger Montgomery Posted in Companies, Small Caps, Stocks We Like.

- save this article

- POSTED IN Companies, Small Caps, Stocks We Like.

-

MEDIA

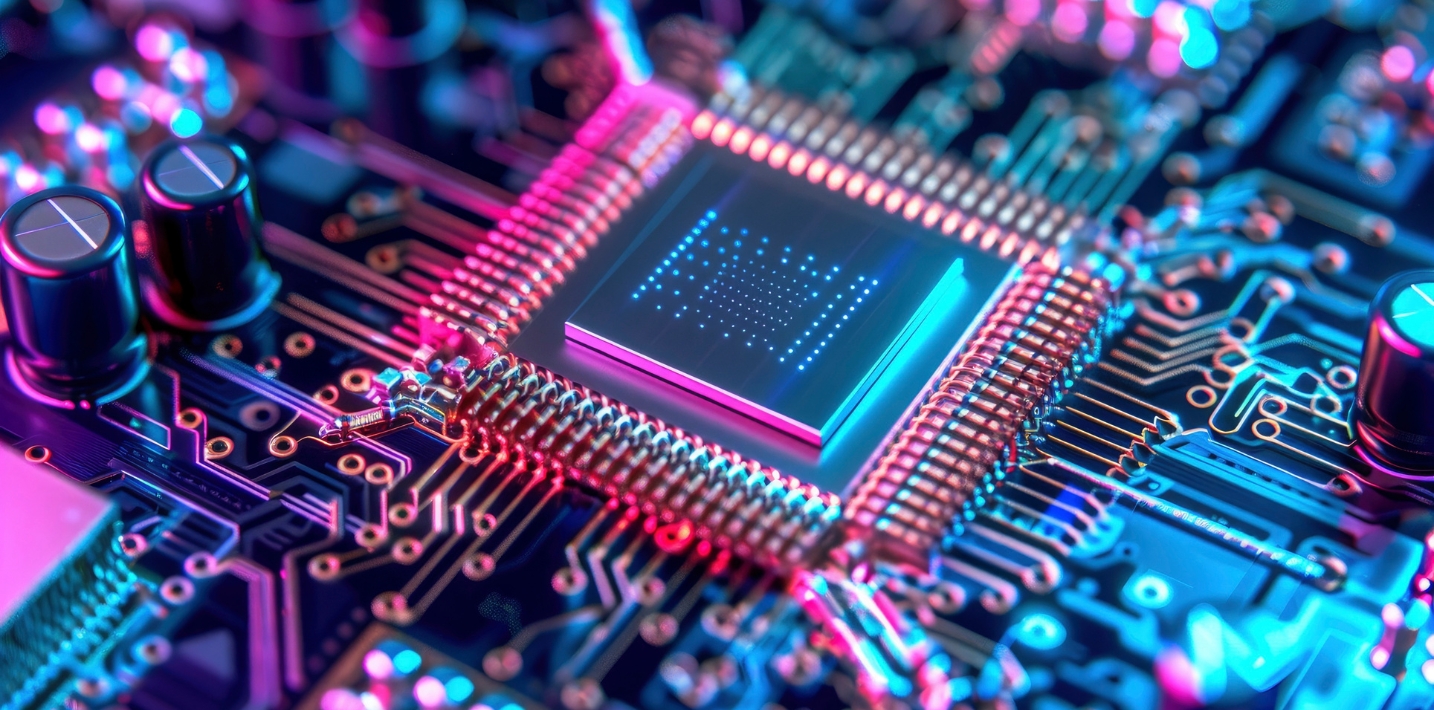

How DeepSeek has exposed the short lifespan of monopolies

Roger Montgomery

February 12, 2025

What are the best businesses? The answer to that question is “monopolies” and investors need to ask whether the current crop of artificial intelligence (AI)-driven large language models (LLM’s) and the suppliers of their chips, storage and energy need have the monopoly characteristics they assumed.

by Roger Montgomery Posted in In the Press.

- READ

- save this article

- POSTED IN In the Press.

-

Does winning the AI race still require massive spending?

Roger Montgomery

February 11, 2025

The artificial intelligence (AI) arms race shows no signs of slowing, and this week’s fourth quarter results announcement by Google, owned by Alphabet Inc. (NASDAQ:GOOG), suggests that significant investment is still seen as a necessity – especially when it comes to powering the next generation of AI models. Following the release of China’s DeepSeek, the question is not only whether the hefty spending is sustainable, but whether it truly gives U.S. tech giants the edge they’re hoping for? Continue…

by Roger Montgomery Posted in Market Valuation, Technology & Telecommunications.