To visit the February 2026 reporting season calendar Click here .

-

Exchange Traded Everything

Dean Curnow

June 25, 2018

The rise of Exchange Traded Product’s (ETP) has been a blessing for some investors but a headache for others. With a buffet of listed strategies now available via the ASX, investors are asking which structure is best for me? And what are the differences between each? Continue…

by Dean Curnow Posted in Investing Education.

- 2 Comments

- save this article

- 2

- POSTED IN Investing Education.

-

Listen to this!

Roger Montgomery

June 25, 2018

Cochlear (ASX:COH) is one of Australia’s shining examples of technical adroitness and export attractiveness, an example to entrepreneurs of what can be achieved in Australia despite punitive wages and regulation. Continue…

by Roger Montgomery Posted in Companies.

- 2 Comments

- save this article

- 2

- POSTED IN Companies.

-

Which Retailers are exposed to falling Property?

Roger Montgomery

June 22, 2018

As you well know, we have been calling an end to the Australian property price and construction boom/bubble for some time. And now property prices appear to be declining and auction clearance rates falling, the latter suggesting price falls are not over yet. Continue…

by Roger Montgomery Posted in Companies, Property.

- 8 Comments

- save this article

- 8

- POSTED IN Companies, Property.

-

-

Discover how to value the best stocks and buy them for less than they’re worth.

NOW FOR JUST $49.95

buy nowSUBSCRIBERS RECEIVE 20% OFF WHEN THEY SIGN UP

“This is a book you simply must read.

The very best investors in the world are “value” investors.” -

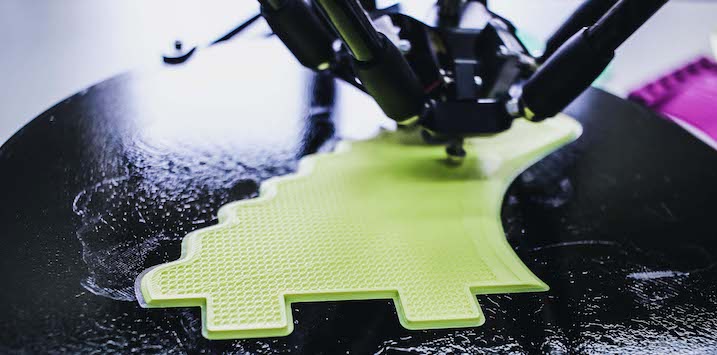

You want to see disruption? Take a look at 3D printing

Roger Montgomery

June 20, 2018

The relentless pace of technological disruption shows no signs of abating. The latest major disruptor is 3D printing, which looks set to revolutionise the way we make almost everything – from cars to houses, and even human body parts. Continue…

by Roger Montgomery Posted in Technology & Telecommunications.

-

Exclusive interview with Codan CEO

Andreas Lundberg

June 19, 2018

There are usually several opportunities for institutional investors to meet with any Australian company’s management during conferences or as they do the rounds following their results. Continue…

by Andreas Lundberg Posted in Stocks We Like, Video Insights.

- watch video

- 1 Comments

- save this article

- 1

- POSTED IN Stocks We Like, Video Insights.

-

Where to find value in global tech stocks

Roger Montgomery

June 19, 2018

This bull market has featured stellar performances from a small group of technology stocks, like Apple, Facebook and Netflix. Indeed, we’ve not before seen so much capital concentrated in a single sector. Despite the lofty valuations of most of these businesses, we continue to see some excellent investment opportunities. Continue…

by Roger Montgomery Posted in Companies, Editor's Pick, Stocks We Like.

- save this article

- POSTED IN Companies, Editor's Pick, Stocks We Like.