Is Bitcoin a rational investment?

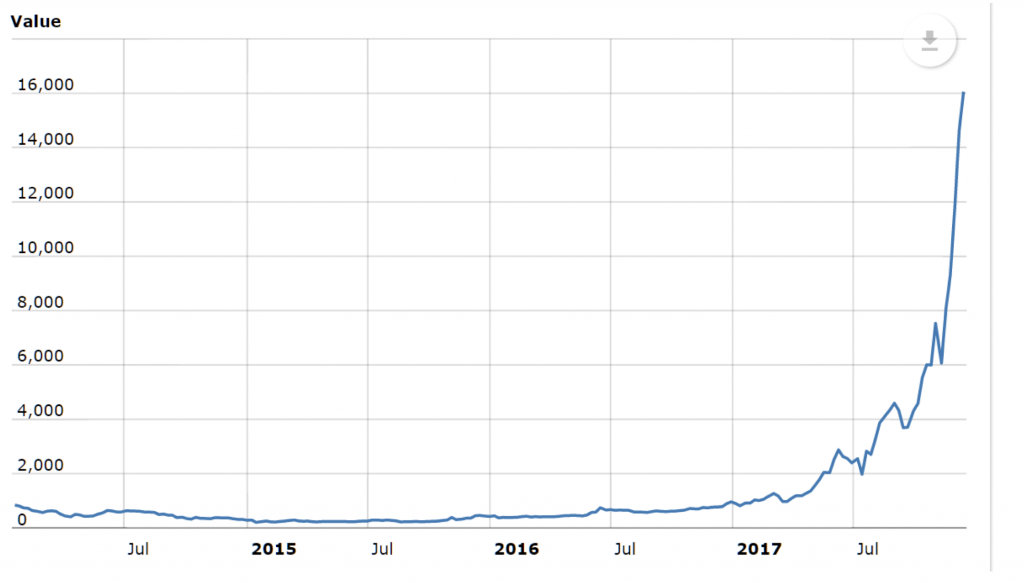

Bitcoin has enjoyed an extraordinary surge in both value and public attention recently. The chart below maps the rise in the price of a Bitcoin in USD over the last few years, and a similar chart could probably be plotted for the number of column inches, the number of internet searches and the number of experts confidently proclaiming it to be either a speculative bubble, or the gold of the future.

The strong divergence of views is a particularly interesting feature of Bitcoin. Most commentators seem to fall firmly into one of the two main camps: the camp that says it is an obvious speculative bubble that will surely end badly, and the camp that says it is the global currency and store of value of the future, with considerable scope for further price appreciation. There doesn’t seem to be much middle ground – the equivalent of a broker “Hold” call.

Clearly Bitcoin isn’t amenable to valuation in the way a company or bond is – it doesn’t produce any cashflows on which to ground an estimate of intrinsic value, and so discounted cashflow techniques point to a value of zero. However, that doesn’t mean that we should ascribe zero value to it. In this regard, better analogues can probably be found in currencies or gold, which derive their value from utility rather than from cashflows.

Thought about in these terms, Bitcoin is a fascinating phenomenon, whose value is probably a function of the extent to which it is – or becomes – widely trusted and used as a unit of exchange. So, it’s informative to think about it terms of the likelihood of that happening, and the implications if it does.

We can set out a simple framework that contemplates two extreme scenarios: one scenario in which Bitcoin fails to gain mainstream adoption, in which case its value falls to somewhere in the region of zero; and a second scenario in which Bitcoin becomes a universal currency and store of value. For the second scenario we might draw comparisons with the aggregate value of existing major currencies and of gold, which gives us numbers in the order of US$1.4 trillion for the case of the US dollar, and around US$7 trillion in the case of gold.

Taking an average of these, we could adopt a high scenario aggregate valuation of $4.2 trillion. This is the aggregate value we might expect Bitcoin to represent in a world where it becomes a legitimate alternative to US dollars or gold.

There are currently around 16.7 million Bitcoins in circulation, and the hard limit to the number that can be created is 21 million, which gets us to a value per Bitcoin of around US$200,000. We can then arrive at an indication of the “correct” price for a Bitcoin today by multiplying this high case number by the probability of the high case scenario eventuating.

Obviously, there are different scenarios and end-point values that can be constructed, but based on these simple numbers, we can calculate that the current trading price of around US$17,000 implies a probability of the high scenario in the order of 10 per cent. If you believe that the likelihood of this scenario emerging over time is greater than 10 per cent, you may well be justified in buying Bitcoin at the current price.

Estimating that probability is obviously not a straightforward exercise, but we can list some of the considerations that might be taken into account in arriving at an estimate. On the positive side we have:

- With a hard limit on the number of Bitcoins that can be created, it is protected from devaluation via central bank printing. In this sense it has advantage over most other currencies;

- It offers a low-friction and potentially anonymous form of exchange; and

- While it is not yet widely accepted, the number of bitcoin transactions and accepting parties appears to be growing steadily, as attention and awareness increase.

On the negative side we have:

- Governments may seek to regulate against the use of Bitcoin, given concerns around anonymity, taxation etc;

- There are some technical questions that will need to be satisfactorily addressed by the Bitcoin community over time, including the possible need for enhanced security in an age of quantum computing, and the implications for security once the hard limit of 21 million Bitcoin is reached;

- Confirming Bitcoin transactions can take time, in some cases hours, which presents obvious difficulties for time-sensitive transactions; and

- While there are clearly network effects at play, and Bitcoin has first mover advantage on its side, in the event that a demonstrably superior alternative emerges, Bitcoin could be overtaken by that alternative; and

- It may be hard for people to fully trust a cryptocurrency in the way they trust physical gold or US dollars.

There are many other considerations to take into account, as well as some Bitcoin myths that may need to be dispelled over time, but to my mind these are some of the more important issues.

How you balance these sorts of considerations is a matter for personal judgement, but it strikes me that neither the “bubble” camp nor the “future gold” camp currently has a convincing case. There is clearly a good chance that Bitcoin implodes (and that should tell you something about how much exposure you want to have), but there is also some probability that it has a bright future, and that probability may well be enough to make sense of the current price.

To summarise, while the exponential growth in the price of a Bitcoin looks ridiculous, and it would be tempting to call “bah humbug” on this one, I’m just not sure that we can. If the end-point is a reasonably significant valuation, and the starting point is close to zero, then getting from the starting point to the end-point will naturally involve some eye-watering growth and extreme volatility.

Herman

:

You have to be very careful when you talk about the aggregate value of major currencies.

The number of 1.4 trillion USD that you quoted is the amount of USD COINS and PAPER money IN CIRCULATION. The can be explained in the below wikipedia link.

https://en.wikipedia.org/wiki/Circulation_(currency)

To give you an indication – the number you quoted for USD would imply that per capita the average aggregate amount of USD held per citizen is 4500 dollars which is obviously not the case.

The 4.2 trillion dollar number you arrived has come from an erroneous method. You’ve taken the average of the aggregate value of gold and amount of USD in circulation to get a number for what bitcoin could potentially be worth. That would be like me taking average of the market cap of BOQ and the earnings of commbank to get the market cap of Bendigo Bank.

Ultimately, whether it is AUD, USD, gold or bitcoin, all currencies are worth as much as what people are willing to transact them for. This doesn’t mean we should avoid them. It merely means that currencies have to be valued by supply/demand factors and not income streams or any kind of intrinsic value.

MICHAEL

:

Is it Bitcoin or BETCOIN?

Luke

:

Great article. First to declare my allegiance, I’m thinking bubble but it won’t burst to zero, it will still have a place as a value store, just not at the levels currently.

To the article though, if you consider the “Bitcoin becomes a universal currency and store of value” scenario it wouldn’t be 1BTC=$200k as the dollar effectively becomes worthless (BTC is now the universal currency). Meaning 1 BTC is worth 1BTC. I understand though it needs a comparison in relative terms so makes sense to compare to $.

This throws up a very interesting scenario and a wildly different valuation. Given the limited supply of BTC and the fact there is currently ~7.5B people in the world, if you took an assumption of an even spread of bitcoin, that’s roughly 0.003 bitcoin per person in the world. If you look at now that’s the total net worth of an individual, and all the wealth they’ll ever earn/own, a single bitcoin then is very valuable.

Australia’s current individual net worth is somewhere around $750k per person, if that was replaced with 0.003 BItcoin it makes 1 BTC worth $250M in todays terms.

Now there’s a lot of assumptions, doesn’t take into account net wealth differences in say US v Africa, it assumes even spread of bitcoin which is way different from the truth today, but hopefully I have conveyed the point.

Thanks

Sergey Golovin

:

Thanks Tim good article.

Question or two I have are somewhat broad I guess –

1. If there are so many different cryptocurrencies available then some of them will end up on exchanges, like NASDAQ, or others, etc, and some will stay in shadows, or they will become exchanges in their own right. If that is the case than how one could determine the quality of the exchange (the house) and transaction (the deal), meaning how can one guaranty that exchange of products or services for the currency will be completed to the satisfaction of the participants? Yes I hear that superior quality it is built into the software itself, but who controls the software? And what stops them to tweak that software?

Reason I’m asking is that I was watching Mr. McAfee on Youtube talking to bunch of developers during presentation and trying to point out to them that during his simple transfers from one cryptocurrency to the next he was losing thousands of dollars because the complexity of the transactions and poor security of the systems. Say when he transfers from Bitcoin to Ethereum, etc.

2. So if that is the case, that dubious quality and poor security is still present, will there be system of ranking which will determine which exchange (or currency) is of a better quality? Very much same as Skaffold does with stocks?

Thank you.

Regards,

Sergey G

Luke

:

Surely the biggest treat to the value of a Bitcoin (and any other crypto-currency) are the growing plethora of crypto currencies? What is to stop the world being flooded with crypto-currencies to the point where they are all worth nothing? I am definitely in the bubble camp and think it is even worse than Tulips which at least had to be grown which takes time, the rate at which crypto-currencies can be created (and none of which are government backed) is limited only by the number of people coding them.

Chris

:

I’m in the bubble camp, especially after hearing stories of “Uber drivers” who are wanting to trade it and on a particular breakfast FM radio station today (which has a big Gen Y / Millenial following), the presenters were all egging each other on and one person was going to buy a single bitcoin, but hadn’t done so, and they were coming out with phrases like “this is INVESTING, it’s taking the risk, we HAVE to do it !” and “We missed out on making 20% over the past week !”.

When things like this that are popular media start to spout catchphrases like that, and us older hands smile and shake our heads (because we understand Speculating vs Investing), then you KNOW it is in a bubble, and it’s not going to gently deflate and hide because everyone forgets about it, it will burst and spectacularly so.

Speculating on this, a few people have made a lot, most will make some but many will lose even more.

Simon oaten

:

Paul, I take a counter-view:

Bitcoin has “utility” (at least 2 types) – being a mechanism for exchange (that has increased in value!), and also a mechanism for annominity (if one were of “shady” past-times – then it could be an excellent mechanism to “wash” money……..re your comment regarding exchanges – go down to the casino – and ask around – its around15%+/- to convert $ to “winnings” ,….). there is little doubt that the underlying technology (blockchain) has significant value……separating the two may be an issue ! blockhain appears secure ……..storage (via wallets) ….a little less so!

BTC also has “optionaility” – arguably it is a put option over paper based currency systems ……

the supply-demand, is just a function of its design. one of the entertaining things is that (with a flat energy price), the “cost” to mine increases exponentially as the number of remaining coins decreases …….does this imply “energy” is cheap ??

will BTC be around “forever” …….I don’t know – gold will be (but doesn’t generate a return!).

there are now a large number of ICO’s…..and its apparent that a lot of them are a “business idea” that have much (much much) less utility…..

given the “price” is becoming / behaving exponential …….I see it as a bubble (or option value increasing re currencies????)……some of the other ICO’s are (arguably) fraudulent!

may we live in interesting times

rgds

simon

Adrian

:

A great article. I for one am firmly in the bubble camp, as recently I was reading in a newspaper the story of a lady who had just made a profit of $4,000 trading in bitcoin. She described her success as phenomenal and Bitcoin as the way of the future. Consequently, she was now considering giving up her day job as a ‘pole dancing fitness instructor’ in order to take up trading bitcoin full time!

Justin Smith

:

Great article Tim! Well balanced and thoughtful.

Punter

:

1. Bitcoin’s ‘scarcity’ means it’s inherently deflationary and as such is poorly designed as a means of exchange, e.g. if I gave you $100 today you wouldn’t spend it if it was worth $200 next week.

Even if prices moderate for a time, this will cause investors to sell, therefore becoming inflationary, e.g. where your $200 from last week is now worth $100. Both cases don’t work for a means of exchange. Remember, we’re led to believe that BitCoin’s original intent was as a means of exchange. The only crypto that could work a means of exchange would be stably priced, but that’s no good for speculators.

3. Paradoxically, cryptos as a whole aren’t scarce, and are therefore are less useful as a store of wealth compared to truly scarce assets.

Roulette wheels are also asymmetric in the context of your description.

Richard Whan

:

*exchange*

Richard Whan

:

I suspect the energy intensity of Bitcoin (it currently consumes more energy that either Ecuador or Ireland, and it’s not even a common means of change yet) will compel governments to intervene to curtail its more general use.

Jaco

:

I think this is a very balanced article about the topic.

xiao fang xu

:

“BTC supply is limited and it lasts indefinitely; virtues that it shares with other stores of value like gold.”

BTC supply is limited, but cryptocurrency itself is not scares any one can make it/start it.

There are over 1000 cryptocurrencies in the world — it looks like any one can start its own cryptocurrencies many times over.

I/you/he… can make BTC number 2,3,4….

Why use some one else bitcoin when you can start your own?

it is not as gold or silver — it is like paper money — Fiat money is a currency without intrinsic value

if gold or silver is not used as money it can be used in Electronics, Jewelry, Medicine…

can bitcoin be used for any other purpose except as digital currency ?

fiat money can be used as toilet paper.

Paul Audcent

:

Caution is needed. It seems to me that the whole business is built on greed. Great for Crime. Wonder who started this whole fairy tale? My hope is Tim our funds are kept well away, your essay was very instructive. Thank you for that.

Paul

:

Bitcoin, tulips -what’s the difference?

Tim Kelley

:

A valid question, Paul. There are a couple of things that make tulip bulbs an unlikely choice as a store of value, including that they can be grown from tulip seeds, and have a finite life. In contrast, BTC supply is limited and it lasts indefinitely; virtues that it shares with other stores of value like gold.

Also, a fun fact: the popular understanding of the Dutch tulip mania comes from Charles Mackay’s book “Extraordinary Popular Delusions and the Madness of Crowds”, published in 1841 – some 200 years after the event. Many modern scholars now seriously question the veracity of Mackay’s account, even to the extent of questioning whether a bubble actually existed.

Having said that, bubbles certainly have arisen from time to time, and it is entirely possible that with the benfit of hindsight BTC will come to be counted among them.

Paul

:

I dont know about anyone else but I AM firmly in the hold camp. Long term the potential is as good as any new social media stock, short term there are alarm bells of excesses in the market with hundreds of thousands of mums and dads buying in not understanding what cryptocurrency is or what its for. If we get a correction and long consolidation where the speculators get grinded out, bitcoin is a screaming buy based on the massively asymmetric risk/reward.

Fundamentally I view bitcoin as digital gold and the first digital commodity. Strip away the industrial/jewelry applications of gold but add weightlessness, extreme counterfeit protection (via the blockchain), extreme divisbility (can be split into 8 decimal places), and the ability to teleport it across any communications channel. At a 20:1 payout I’ll take the bet that it surpasses golds total value any day of the week.

Other thoughts:

1. The bitcoin network is fundamentally a settlement system not a payment system. It burns electricity to make the blockchain insanely secure (mining), and each transaction has to be transmitted and processed by 100k+ nodes across the network. This can end up using 1000x more energy than a regular credit card swipe. So what the engineers are doing are building payment systems on top where they bundle 1000s of real world transactions into 1 and settle them on the blockchain (see: Lightning Network, or payment services like Bitpay).

What this means is that, when youre talking about slow confirmation times, youre better off comparing bitcoin to wire transfers and other high value transactions that can take days or weeks to settle, whereas bitcoin takes 10-30 minutes.

2. The Quantum computing threat has been discussed to death by bitcoin developers over the past 6 years. It will require a system upgrade but wont nearly be the threat people are screaming about. Some discussion here (https://en.bitcoin.it/wiki/Myths#Quantum_computers_would_break_Bitcoin.27s_security)

3. The launch of Bitcoin futures this week is a strong signal that other hedging instruments will come in, and a Bitcoin ETF is inevitable. If you wanted to make a case for the continued bull market, an ETF will allow any institution or retailer to invest without worrying about custody & security issues of holding private keys. It makes all the sense in the world for large players to allocate a small % to a brand new uncorrelated asset with asymmetric risk reward.

Otherwise I think this article is pretty well balanced, much better than the majority of financial commentary out there.