To visit the February 2026 reporting season calendar Click here .

-

How AI will put a lid on incomes – and inflation

Roger Montgomery

June 15, 2023

Despite all the money that’s been pumped into the economy, inflation may not be a problem in the longer term. After all, money supply has been rising at an exponential rate since the 1960s and yet, since 1980, inflation has been in decline. I believe there are two key structural reasons for this – the massive drop in unionized labour, and the rise of job-displacing automation. Continue…

by Roger Montgomery Posted in Companies.

- save this article

- POSTED IN Companies.

-

Thinking about retailers right now?

Roger Montgomery

June 14, 2023

Australian consumer-facing companies have faced unprecedented challenges and undergone significant transformation since the bushfires of 2019. From the profound impacts of the COVID-19 pandemic to violent mix-shifts from goods to services, and digital advancements, the sector has navigated a complex landscape. Continue…

by Roger Montgomery Posted in Consumer discretionary.

- save this article

- POSTED IN Consumer discretionary.

-

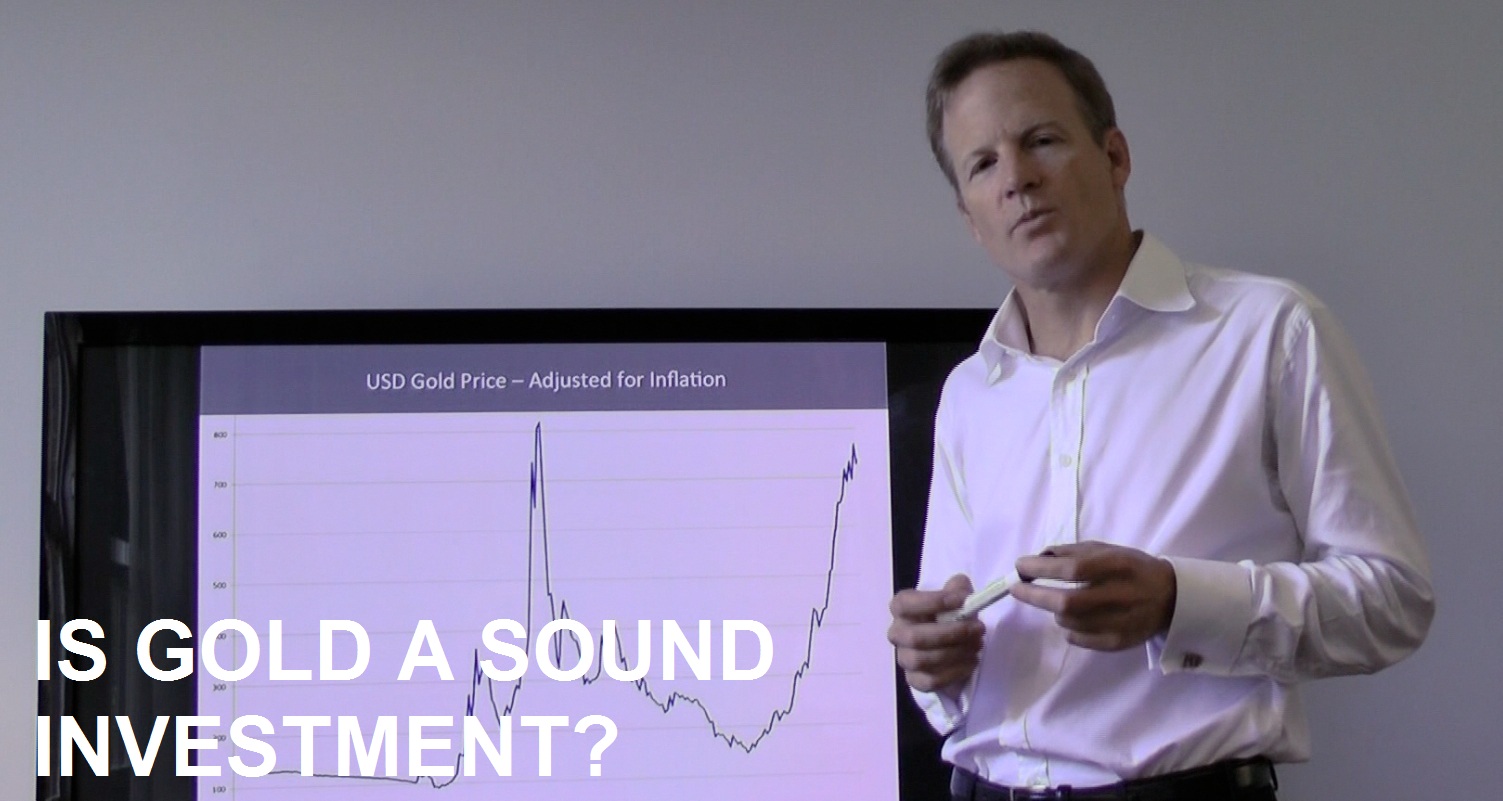

Some analysts are forecasting big gains for Gold and Bitcoin

Roger Montgomery

June 13, 2023

A theory doing the rounds is that we’ve entered a new epoch where central banks will have no option but to create monetary inflation to fund structural fiscal deficits. To be clear monetary inflation is not the same as consumer price inflation. Monetary inflation is brought about through central bank balance sheet expansion or quantitative easing. Continue…

by Roger Montgomery Posted in Editor's Pick, Market commentary.

- 2 Comments

- save this article

- 2

- POSTED IN Editor's Pick, Market commentary.

-

MEDIA

My Millennial Money: All things investing

Roger Montgomery

June 9, 2023

Roger Montgomery joined My Millennial Money to discuss how to invest in the current climate, how to look for quality companies and share with you some ASX darlings and much more to do with investing.

by Roger Montgomery Posted in Podcast Channel.

- 3 Comments

- save this article

- 3

- POSTED IN Podcast Channel.

-

Discover how to value the best stocks and buy them for less than they’re worth.

NOW FOR JUST $49.95

buy nowSUBSCRIBERS RECEIVE 20% OFF WHEN THEY SIGN UP

“This is a book you simply must read.

The very best investors in the world are “value” investors.” -

Avita Medical receives FDA approval for full-thickness skin defects

David Buckland

June 9, 2023

It has been 30 years in the making, when Dr Fiona Wood and scientist Marie Stoner recognised the potential of tissue engineering to treat burns and a skin culture facility was borne. Their product evolved from cultural sheets of cultural epithelial autograph (CEA) to aerosol delivered cell-clusters and today it is known as “spray-on skin”. The skin cells then grow on the patient and the technology has been patented and commercialised through Clinal Cell Culture, which became Avita Medical (ASX:AVH). Continue…

by David Buckland Posted in Companies, Stocks We Like.

- save this article

- POSTED IN Companies, Stocks We Like.

-

WHITEPAPERS

With Private Credit Funds it’s protection not a recession that matters

Roger Montgomery

June 8, 2023

Private credit offers investors with an opportunity to earn steady monthly income, a simple way to diversify your portfolio – whilst providing protection against inflation and performance through the economic cycle. Continue…

by Roger Montgomery Posted in Editor's Pick, Whitepapers.

- 2 Comments

- save this article

- 2

- POSTED IN Editor's Pick, Whitepapers.

-

MEDIA

Why stocks in this sector are near an inflection point

Sean Sequeira

June 7, 2023

Sean Sequeira from Australian Eagle joined Livewire to discuss whether we are seeing a turning point for consumer discretionary stocks. Sean points out that a deceleration of revenue lines is something to watch and the ongoing demand for travel services is a standout – as confirmed by recent updates from Flight Centre and Webjet. Read here: Why stocks in this sector are near an inflection point

by Sean Sequeira Posted in On the Internet.

- READ ONLINE

- save this article

- POSTED IN On the Internet.

-

Australian consumers tighten their collective belt (Part 2)

David Buckland

June 7, 2023

Twelve interest rate increases to the RBA’s official cash rate to 4.10 per cent (as at 6 June 23), in combination with a large portion of fixed mortgages transferring to a variable rate, has impacted Australian consumers and we’ve seen several discretionary retailers use the “confession season” to downgrade their profit expectations. Continue…

by David Buckland Posted in Consumer discretionary.

- save this article

- POSTED IN Consumer discretionary.