IS GOLD A SOUND INVESTMENT? (29/1/2013)

Tim joined Montgomery in July 2012 and is a senior member of the investment team. Prior to this, Tim was an Executive Director in the corporate advisory division of Gresham Partners, where he worked for 17 years. Tim focuses on quant investing and market-neutral strategies.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Andrew Legget

:

I think you have summed it up quite well Tim.

My issue with gold is that it does not have anything intrinsically behind it to generate value. It has little industrial uses and seems to be more of a collectable for people trying to hedge against inflation etc. A noble cause and i don’t disagree with them but if it cannot be valued, can it really be an investment?

At least businesses have dividend streams and an earnings strem that can be compounded at the generated returns year on year. There for there is an entity whose value can rise and fall intrinsically. Gold, does not earn a return whether through dividends or retained growth. A gold bar cannot obviously retain part of itself to generate into more gold bars.

I have always thought that it just seems like it was decided that gold is valuable and if people decided that it isn’t then the price would plummet and there would be little effect to the world other than the collective price of the worlds gold hoards.

If a price rise and fall has little effect on the world, then can there really be value ever. Luckily there are enough people (many of whom give the impression that gold is a religion) that believe it is something to want and there for there will be a market.

On a more subversive note, part of me wonders if the collective engery and economic resources spent on finding and mining gold was spent on things like medical research and technology that we would have a lot more valuable businesses with true value accretive elements to them.

Good luck to those that own gold, i don’t believe gold is inherantly bad or worthless, but the value investor in me can’t help but look at it in a strange way, especially when prices are so high.

To those that like it, good luck finding and accumulating those gold bits of metallic rocks, i hope for your case the price goes ever higher.

Mathew

:

Hi Roger,

I have recently read your book Value.Able (via ebook) and found to contain some wonderful insight into value investing (I have also read Ben Graham’s Security Analysis but struggled with some of the main messages) for people not formally trained in economics, finance or investing.

The reason for my message is the tables and figures (particularly/importantly Tables 11.1 and 11.2) cannot be viewed on my kindle making the task of calculating the intrinsic value of a company very difficult. Is it possible that I can be supplied them via email.

Thanks,

Mathew.

PS – If this is not possible, I will be happy to purchase a printed copy of the book as I believe your approach to investing is key to producing long term wealth from the sharemarket.

Roger Montgomery

:

Hi Matthew,

I will have my team look into whether they can make an amendment to the Kindle version to make the table larger. It will take some months. I’d be delighted to send you a signed copy of my book. Simply order it online and then send me an email at roger@rogermontgomery.com, letting me know that you have ordered Value.able and would like it signed.

Kelvin Ng

:

Hi Tim, really appreciate your work at the Montgomery Fund.

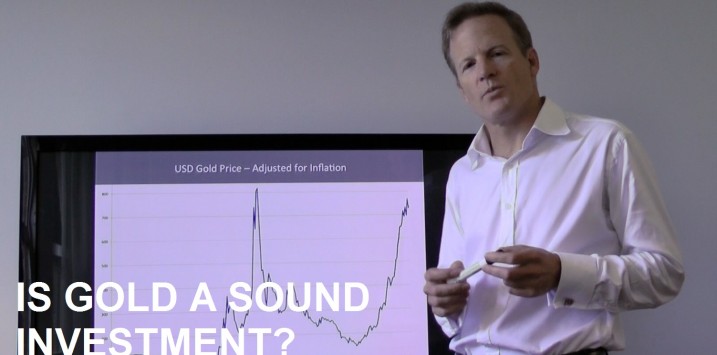

However, I think that just looking at a chart of the inflation adjusted gold price without looking at the cost of production is misleading. The truth is, the rates of inflation of various essential commodities in the last ten years have greatly exceeded the CPI, arguing for a paradigm shift (see Jeremy Grantham’s various essays on the GMO website). Despite the huge increase in the gold price in the last ten years, annual world production of gold has not increased at all in that time. Now one reason for that is that the costs of the inputs of gold production (e.g. energy & steel and other commodities) have concomitantly increased. Another reason is that high grade deposit are increasingly difficult to find. Where 30 years ago people wouldn’t bother with 1.5 – 2.0g per tonne deposits, now miners are happy to discover these types of grades. These reasons mean that the average cash cost per ounce of gold today is around US$750 and the all in cost per ounce (including exploration and capex) is around US$1200.

Given gold’s cost of production, its very unlikely that gold would fall below US$1,300. Just looking at a chart of the gold price won’t tell you that.

Kind regards,

Kelvin

Jim

:

First I suppose when you say “adjusted for inflation” you mean CPI, which is a bogus index. Secondly why one would have such a mechanical view? US and most other nations are drowning in debt unlike ever before in history, therefore it seems absurd to view the world as unchanging (in terms of currency stability/devaluation). Would you regard a currency equally stably regardless of country’s debt levels and other econ indicators? Gold is more of a currency, so you are betting of paper currency to outperform gold.

Lester Green

:

Thanks Tim – enjoyed your insights on the gold as an investment option. I have been thinking about this option for my portfolio and your comments have crystalised my thoughts – perfect timing – thank you.

Could you consider as an Insight topic, the effects of the current shale gas boom in USA, Canada , etc on the price of gas in Australia in the next 5/10 years.

Continue to look forward to the weekly Insights updates.

Lester