Whitepapers

-

WHITEPAPERS

FlexiGroup quick out of the blocks

Roger Montgomery

December 22, 2012

But market has factored in too much growth too soon.

Buying a stock that has doubled in a year and become a “market darling” is hard work for value investors. It gets even harder when the company has declining return on equity (ROE), patchy earnings per share (EPS) growth, high debt, and an aggressive growth strategy.

Based on its current valuation, the market seems to think FlexiGroup can do no wrong. The fast-growing provider of consumer and retail point-of-sale finance has done remarkably well after raising $264 million through an Initial Public Offering in 2006.

by Roger Montgomery Posted in Financial Services, Whitepapers.

- 1 Comments

- save this article

- POSTED IN Financial Services, Whitepapers

-

WHITEPAPERS

Interest Rates (White Paper)

Roger Montgomery

December 21, 2012

Roger provides his insights on Interest Rates in this final White Paper for 2012.

by Roger Montgomery Posted in Economics, Whitepapers.

- 8 Comments

- save this article

- POSTED IN Economics, Whitepapers

-

WHITEPAPERS

Three Microcaps to Consider

Roger Montgomery

December 8, 2012

One of the advantages that retail investors enjoy over institutional investors is that they can more readily invest in smaller and less liquid issues. While the larger fund managers may have a relatively limited set of companies into which they can deploy meaningful chunks of capital, enterprising small investors are free to roam, and roam they should: research indicates that their investment returns can be significantly enhanced by focusing some attention on the smaller end of the market.

The challenge for the enterprising retail investor is sifting through large numbers of lackluster small companies to find the few that deserve their investment capital. Good broker research at the smaller end can be scarce, and the company names (as well as their products or services) may be unfamiliar.

by Roger Montgomery Posted in Market commentary, Whitepapers.

- 7 Comments

- save this article

- POSTED IN Market commentary, Whitepapers

-

WHITEPAPERS

Servcorp at a crossroads

Roger Montgomery

December 1, 2012

Expansion success hinges on global economies

Two analysts, presented with the same set of facts can, and often do, arrive at entirely different conclusions. Indeed, every day and every time a stock trades, the buyer and seller are arriving at vastly different conclusions.

On the one hand a renewed interest in cyclical stocks does not make it difficult to imagine Servcorp shares racing higher – the company having boldly positioned itself for an economic upturn by doubling its floor portfolio and expanding in the United States in anticipation of a strengthening global economy.

by Roger Montgomery Posted in Companies, Whitepapers.

- 1 Comments

- save this article

- POSTED IN Companies, Whitepapers

-

WHITEPAPERS

Miclyn Express Offshore Limited

Roger Montgomery

November 23, 2012

As you know at Montgomery Investment Management we have held a very cautious view on iron ore for almost a year, noting the apparent over-investment in supply and reliance on Chinese demand. However, we have a more positive outlook in other areas.

Energy is one area where we feel that the supply and demand outlook is more favourable, and we have turned our minds to which companies might benefit from this.

As we have written about elsewhere, one such company is Miclyn Express Offshore Limited (ASX:MIO).

by Roger Montgomery Posted in Energy / Resources, Whitepapers.

- 9 Comments

- save this article

- POSTED IN Energy / Resources, Whitepapers

-

WHITEPAPERS

Extending Finance (White Paper)

Roger Montgomery

November 16, 2012

Returns from lending people money or from giving them what they want before they can afford it, are enormous. Here we discuss two companies profiting from the impatience of others.

This white paper is exclusively for Roger Montgomery.com subscribers.

by Roger Montgomery Posted in Whitepapers.

- 6 Comments

- save this article

- POSTED IN Whitepapers

-

WHITEPAPERS

Become a Member – Subscribe Now!

Roger Montgomery

November 2, 2012

Here’s what you are missing out on. This is sample of the feature reports our members receive each and every month.

Become a member and don’t miss the next report exclusively for members. Join Now – Its Free!

Download SAMPLE REPORT – ‘Don’t Reject The The Reject Shop (TRS)’ HERE

by Roger Montgomery Posted in Montgomery News and Updates, Whitepapers.

-

WHITEPAPERS

Why the Stock Market Doesn’t Work (White Paper)

Roger Montgomery

October 19, 2012

What is ailing the stock market and why have investors deserted it in droves?

Founder of Montgomery Investment Management and author of value-investing bestseller Value.able reveals the steps he is taking to ensure investor returns and investors return.

This white paper is exclusively for Roger Montgomery.com subscribers.

by Roger Montgomery Posted in Investing Education, Whitepapers.

-

WHITEPAPERS

Legend builds its reputation

Roger Montgomery

September 18, 2012

Some smaller manufacturers have good momentum in a tough market.

The media often portrays Australia’s manufacturing sector as on its knees. The high dollar, rising wage and input costs, and soft demand are clearly taking a toll. But to suggest all manufacturers are struggling is wrong. Some smaller listed manufacturers are performing well.

Transport parts manufacturer Maxitrans Industries almost tripled net profit to $12.3 million in FY2012 and its shares have rallied from 40 cents in January to 79 cents. Another parts manufacturer, Supply Network, said in July it expected full-year earnings before interest and tax (EBIT) to rise $2.2 million to $6 million. Its shares have almost doubled this year to $1.26.

Engineering solutions manufacturer, Legend Corporation, also has good momentum. In August it reported full-year net profit after tax (NPAT) grew 18.2 per cent to $9.4 million, for its fourth consecutive year of profit growth. Legend’s total shareholder return over one year (including dividends) is 8.1 per cent. Over three years, the average annual total shareholder return is 49 per cent.

by Roger Montgomery Posted in Manufacturing, Whitepapers.

- 7 Comments

- save this article

- POSTED IN Manufacturing, Whitepapers

-

WHITEPAPERS

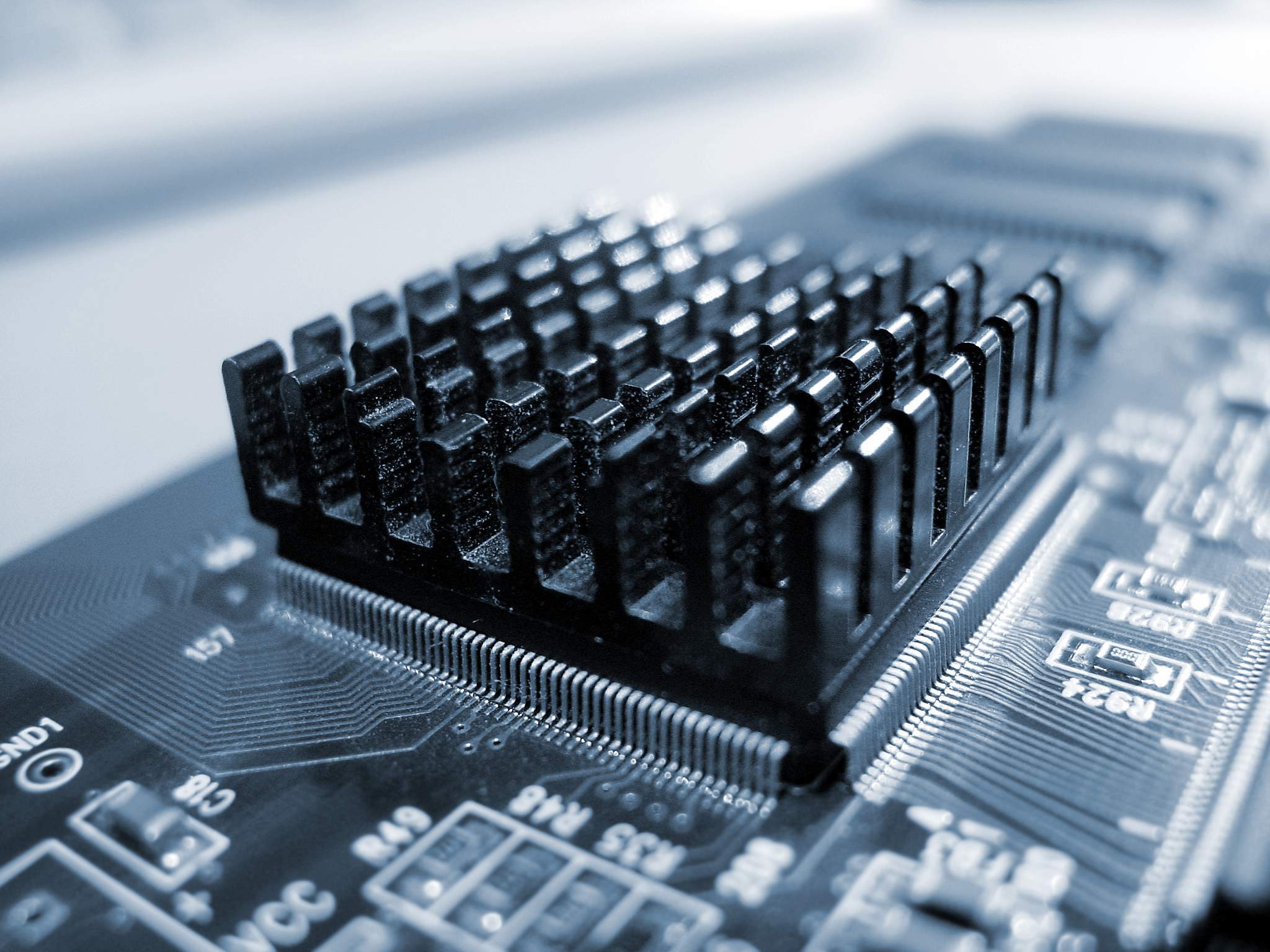

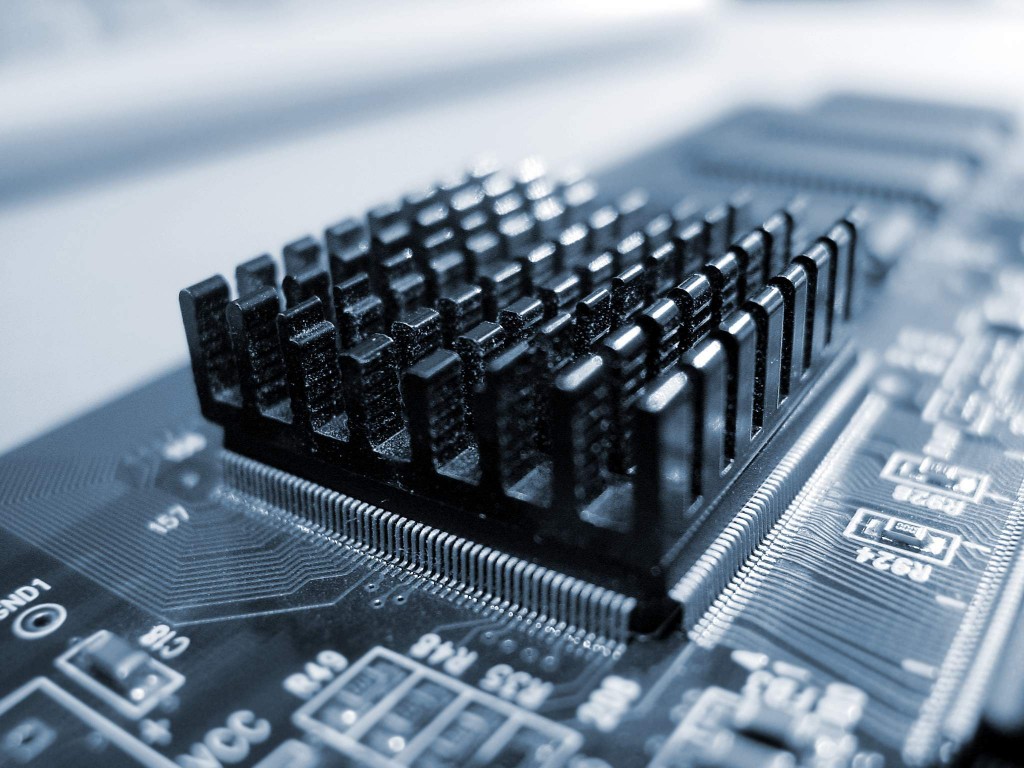

Dicker Data’s unusual profile

Tony Featherstone

August 28, 2012

High return on equity, high yield – and high debt – makes Dicker a challenging investment.

Australian technology floats have been rare in the past three years. Most initial public offerings (IPOs) have been for exploration companies and the majority are trading below their issue price. In a risk-averse market, investors have shunned information, biotechnology and clean technology floats.

The wholesale technology hardware distributor, Dicker Data, has had little fanfare since listing on ASX in January 2011, despite stellar earnings growth, a high return on equity and a share price that has more than doubled since listing, making it among the best-performed small IPOs.

by Tony Featherstone Posted in Technology & Telecommunications, Whitepapers.