Value.able

-

Value Investing According to Browne

Roger Montgomery

April 22, 2014

Those of you have read anything or even, possibly, everything written about Warren Buffett, you would know that he has said many flattering things about Charles Browne and Forrest Tweedy and the brokerage-come-funds-management firm they founded Tweedy Browne LLC. continue…

by Roger Montgomery Posted in Investing Education, Value.able.

- 4 Comments

- save this article

- POSTED IN Investing Education, Value.able

-

US Corporate Profit Margins at Record-High

David Buckland

April 18, 2014

I have just returned from a short trip to the US, where I saw Bubba Watson win the US Masters at The Augusta National Golf Club. While this is indeed an extraordinary sporting event, I think I now have a better idea why US corporate profit margins (as a percent of nominal GDP) are at record-high levels. continue…

by David Buckland Posted in Foreign Currency, Insightful Insights, Value.able.

-

Talking about: operational leverage

Ben MacNevin

April 7, 2014

Operational leverage can have a powerful effect on a company’s earnings, in both a positive and a negative sense. When considering an investment in companies with high operating leverage, you must be comfortable with the company’s ability to manage downside risk. continue…

by Ben MacNevin Posted in Insightful Insights, Value.able.

- save this article

- POSTED IN Insightful Insights, Value.able

-

Focus on value, and don’t be afraid of cash

Roger Montgomery

March 11, 2014

Last week, you might have caught an article published in the Australian Financial Review by contributing editor and friend of mine Christopher Joye. I was also interviewed for AFR TV, the resulting video of which has recently popped up on the Fin Review’s homepage. Read the full article here.

by Roger Montgomery Posted in Value.able.

- 5 Comments

- save this article

- POSTED IN Value.able

-

Read between the lines…

Roger Montgomery

March 10, 2014

As you can imagine, we are delighted when we read the newspapers or see interviews to find other fund managers speaking effusively about the individual companies we have owned shares in for some time. Recent examples include Veda and CoverMore. continue…

by Roger Montgomery Posted in Value.able.

- 7 Comments

- save this article

- POSTED IN Value.able

-

White Paper Reports

Roger Montgomery

January 16, 2014

Are you looking for our January or March white paper reports?

You can find them via the links below:

January 2014: RECKON AND DULUXGROUP: DOUBLE EDITION WHITE PAPER REPORT

March 2014: BEYOND PRODUCTIONS AND THE QUESTION OF ECONOMISTS: DOUBLE EDITION WHITE PAPER REPORT

by Roger Montgomery Posted in Value.able.

- save this article

- POSTED IN Value.able

-

Another M.I.A.S. (Montgomery Investor Australian Success)

Roger Montgomery

December 23, 2013

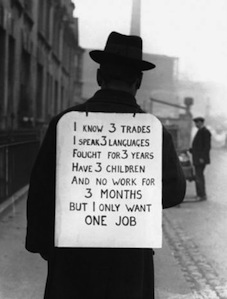

You know we love an Aussie success story.

With large scale manufacturing in apparent terminal decline, with the Asia Pacific hub of financial services rapidly gravitating to Singapore, and with our forward thinkers turning a cheaper and willing source of labour away, if we aren’t careful, we’ll soon be tilling the soil for foreign lenders and landlords, who took advantage of our low Australian dollar to pay us minimum wages that will never be enough to pay off the debt we accumulated to fund our profligate ways. continue…

by Roger Montgomery Posted in Value.able.

- 2 Comments

- save this article

- POSTED IN Value.able

-

Another Montgomery Investor Wins

Roger Montgomery

October 15, 2013

Australia, it is said, loves a winner, and I must confess it would be irrational at Montgomery for us to celebrate anything less. Our investors should demand, over the long run, a series of wins that compound to maintain or increase their purchasing power. That’s our job and so we aren’t backwards in coming forwards when we ourselves rank Number #1 or Number #2 in the fund manager rankings – as has been the case recently. continue…

by Roger Montgomery Posted in Montgomery News and Updates, Value.able.

-

Welcome Scott Phillips!

Roger Montgomery

October 14, 2013

We are delighted today to welcome Scott Phillips to the Montgomery Investment Management team as Head of Distribution. Welcome aboard Scott! continue…

by Roger Montgomery Posted in Value.able.

- save this article

- POSTED IN Value.able

-

Seeking Perfection* (*with apologies to George Orwell)

Ben MacNevin

September 13, 2013

It was a rather gloomy week of economic data releases – total job advertisements in Australia and New Zealand were down by 2 per cent for the month of August, while unemployment rose from 5.7 per cent to 5.8 per cent over the same period. And yet the share price of Seek, Australia’s leading employment classifieds website owner, has risen by 1.7 per cent over the week. That raises the question; why are the rising unemployment headlines not having the same adverse impact on the company’s performance as they once did? continue…

by Ben MacNevin Posted in Companies, Economics, Insightful Insights, Value.able.