Another M.I.A.S. (Montgomery Investor Australian Success)

You know we love an Aussie success story.

With large scale manufacturing in apparent terminal decline, with the Asia Pacific hub of financial services rapidly gravitating to Singapore, and with our forward thinkers turning a cheaper and willing source of labour away, if we aren’t careful, we’ll soon be tilling the soil for foreign lenders and landlords, who took advantage of our low Australian dollar to pay us minimum wages that will never be enough to pay off the debt we accumulated to fund our profligate ways.

But there are Aussie success stories. One of them is JB Nicholas and Son Pty Ltd, the butchers in Church St, Geeveston, down in Tassie. Matthew Nicholas is a fifth generation butcher who took out the top prize at the annual Wrest Point Hobart Fine Food Awards last year and won the Richard Langdon Trophy for the best exhibit in show from more than 1400 entrants with his tasty traditional cooked-on-the-bone ham.

Be sure to secure your Christmas ham for pre-Christmas delivery next year as he now sells out well before.

Casting his net even further afield is Nick Palumbo and the subject of today’s post. Nick is the Sydney-based gelateria the Italians call when they want to train others to make gelato. As founder of Gelato Messina, Nick discovered Sydney-siders loved the extra effort he went to baking homemade apple pies just to smash them up and stir them through the apple pie gelato.

And now Messina is spreading its wings. After opening three stores in Sydney, Nick branched out opening Messina in Melbourne’s hipster-magnet Smith Street – a place where you don’t last long unless you’re authentic and likeable.

Of course, Nick has always been likeable: who doesn’t like a ‘Mr Whippy’ who hands out free ice cream to your children when they’re celebrating their ninth birthday!

Nick’s model isn’t about ‘biggering and biggering’ or growing to 200 stores or 100 stores or even 50 stores. Exclusivity and destination is the message; quality over quantity. If you have to drive a long way to get it, you can bet you’ll appreciate it more when you eat it. Your effort is only exceed by the effort Messina go to make sure only natural ingredients go into the flavour of ‘Elvis, the Fat Years’.

And now Nick is spreading the Messina message of quality and value (hey that sounds familiar!) even further.

According to analysts, global revenues for ice cream products, which includes gelato, were an estimated $36 billion in 2005, of which the impulse sector of the ice cream market constituted $10.2 billion, or 28 per cent of the total global market. Growth has exceeded 6 per cent per annum every year for the last 13 years.

According to the USDA, National Agricultural Statistics Service, in the US, about 1.53 billion gallons of ice cream and related frozen desserts were produced in 2011, and the ice cream industry generated total revenues of $10 billion in 2010, with take-home ice cream sales representing the largest section of the market – generating revenues of $6.8 billion or 67.7 per cent of the market’s overall value.

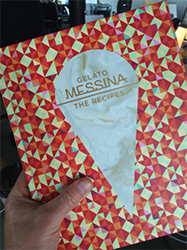

Heading overseas will clearly be an important milestone for Messina as is news that the first edition of Nick’s book, Gelato Messina The Recipes, has sold out.

Well done Nick and team. On behalf of your thousands of fans, thanks for the great joy your ice cream brings. Thanks also for the eponymously named flavour (Montgomery’s Gold Mine – pictured), and now for the signed book – it’s sure to be a collector’s item.

And finally, on behalf of all Australians, thank you Matthew in Tassie and Nick in Sydney for showing our leaders that they shouldn’t give up; that we can cut it on the world stage. Let’s give start ups a tax holiday and let them get investing, inventing and employing. We can be so much more than raw iron ore and beef.

Adam Easter

:

I will have a double waffle cone of Montgomery’s Goldmine please!!!!

Congratulations Nick and Matthew

xiao fang xu

:

Congratulation to JB Nicholas and Son Pty Ltd, and wish them many years of success.

“With large scale manufacturing in apparent terminal decline, with the Asia Pacific hub of financial services rapidly gravitating to Singapore, and with our forward thinkers turning a cheaper and willing source of labour away, if we aren’t careful, we’ll soon be tilling the soil for foreign lenders and landlords, who took advantage of our low Australian dollar to pay us minimum wages that will never be enough to pay off the debt we accumulated to fund our profligate ways.”

Question is Why,Why,Why…

Sometimes foreign lenders and landlords are better than your own; example : I was born in Socialist Federative Republic Yugoslavia my parents were taxed there in excess of 80%. Well if i compare my new country tax of 30% it is much better, but if i can get Switzerland tax rate of 10-15% i would be more happy.

Or another example is USA they change English masters for they own and they tax rat went up from 2,5% under english, to 20-50% under own masters.