Value.able

-

Have you been getting your daily dose?

Roger Montgomery

November 9, 2010

If only it worked that well all the time!

If only it worked that well all the time!Last Thursday evening (4 November) on Peter’s Switzer TV I listed, amongst other companies, Credit Corp and Forge Group as two I would have in the hypothetical Self Managed Super Fund Peter challenged me to set up that day.

Why did I nominate CCP and FGE? Both receive my A1 or A2 MQR and both have been trading at a discount to their intrinsic value.

If you are a regular reader of my blog you would have read my insights for some months on these companies. And if you saw today’s announcements, you can imagine why I am a little happier than usual.

Credit Corp’s previous 2011 NPAT guidance was $16-$18 million. Today the company announced FY11 would likely produce an NPAT result of $18-$20 million.

Forge Group’s announcement states “The Board wishes to advise that the company forecasts net profit before tax for the half year ending 31st December 2010 to be in the range of $25-$27 million. This represents an improvement on the previous corresponding period (pcp $19.04m) of up to 42%.”

As I fly to Perth for a presentation and company visit, I am encouraged that several of the companies Value.able graduates mentioned in our lists are also hitting new 52-week highs. In a rising market that lifts all boats, it is perhaps unsurprising, but nevertheless it should be an encouragement to Value.able graduates and value investors that companies like FLT, DCG, MIN, FWD, FGE, CCP, NCK, DTL, MCE, MTU and TGA have all hit year highs – some of them yesterday. More importantly those prices are perhaps justified by their intrinsic values.

Of course I am not here to predict where those prices will go next, because I simply don’t know. Short-term prices are largely a function of popularity and the market could begin a QE2-inspired correction, an Indian infrastructure-inspired bubble or a China liquidity-inspired bubble tomorrow. I have no way of telling and instead, I focus on intrinsic values and only pay cursory attention to share prices.

So, as I always say, seek and take personal professional advice before taking any action and remember that 1) I don’t know where the share price is going 2) I am under no obligation to keep you up-to-date with my thoughts about these or any company, my Montgomery Quality Ratings or my valuations and I might change my views, values and MQRs at any time so don’t rely on them and 3) I may buy or sell shares in any company mentioned here at any time without informing you.

And so I remind you one more time. Please seek and take personal professional advice and always conduct your own research.

Posted by Roger Montgomery, 9 November 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

Are you drowning in a sea of complexity?

Roger Montgomery

November 3, 2010

I don’t know if you have noticed but some of my recent posts and comments have been getting a little technical. I am sorry about that, I get a bit carried away sometimes.

I don’t know if you have noticed but some of my recent posts and comments have been getting a little technical. I am sorry about that, I get a bit carried away sometimes.Of course on this blog, I am not alone. Joab’s brilliant heads-up on the forthcoming changes to the treatment of leases and the impact on the financial statements is exactly the sort of thing that excites those of us who make investing a full time occupation.

In this field it’s easy to want to prove how much detail one can accumulate about a company or what one knows about valuations or credit analysis. Then of course debates and polite but pointed arguments begin about whose mousetrap is better.

Yet for most of us, it’s a storm in a tea cup, and meanwhile someone has made a million dollars quietly accumulating a few shares in the recently listed company XYZ Ltd.

In most cases there is one pearl that counts and the rest is noise. Our job is to find the pearls. Of course with so much rubbish to sift through it can be challenging to pluck up the enthusiasm to even start searching. For many investors, time is of the essence and short cuts are needed.

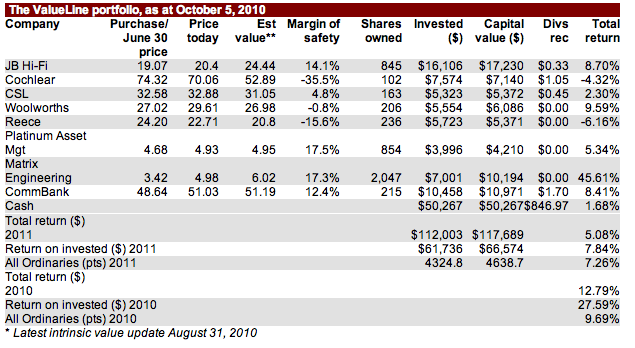

Well, I am here to deliver. But this not a post about buying the next hot uranium or gold explorer – tips I do receive and some I even regret missing sometimes. Today’s post is about a shortlist of A1 companies, their proximity to intrinsic value, my expected change in those intrinsic values and the associated net debt to equity ratios.

Why? It’s about getting back to basics.

Investing is simple. Not easy, but simple. Much work went into the classification process to come up with my A1, A2, C5, etc Montgomery Quality Ratings using, for example, industry specific KPI’s to ensure that future sweat was reduced.

And recently one Value.able Graduate Ken, reinforced my resolve to keep it all very simple. Ken D wrote:

Hi again Roger,

Out of curiosity, last week I constructed 2 hypothetical portfolios: 1) with your A1 stocks in equal proportion; and 2) the same with your A2 stocks. I have attached some numbers. I was impressed by the average past performance (i.e. investment performance) from both portfolios and also noted quite a difference between the A1 and A2 portfolios (attached). I doubt whether the result is fortuitous. Without asking you to outline your ranking process, I was wondering whether the strong past performance might be expected as a direct result of criteria used in the A1, A2 classification process – e.g. reference to historical earnings growth for instance, or perhaps more interestingly, a product of the inherent quality of the business as measured by current performance measures.

Ken

In answer to Ken’s question and for everyone’s benefit, remember Ben Graham’s quote about short-term voting machines and long-term weighing machine? Over longer periods of time, price follows intrinsic value and because my Value.able method of calculating intrinsic value is related to the performance of the business, one should expect price to follow performance. Over time A1 businesses should do better and a portfolio filled with just A1s purchased at big discounts to intrinsic value, should, in theory, do best.

Ken looked at all the A1s that I had mentioned on the blog and went backwards (I’ll ignore survivor bias for now) to have a look at the annual returns a portfolio of A1s would have produced.

While there is more refinement required, the early results are impressive. Over the last ten years Ken’s portfolio of 16 A1 company stocks returned 24 per cent, per annum. The same 24 per cent per annum result was produced with a portfolio of 23 stocks over five years and there were 31 A1 stocks in the last year that combined, returned 31 per cent.

Thanks for putting in the time Ken.

With all that in mind, here is my latest list of A1 companies, their proximities to intrinsic values and a few other salient stats.

What I would like to see as comments here are your thoughts or insights about any of these companies. Go right ahead and share whatever you know or think. But only about the companies in the list. Keep the comments to the topic set and we will build a useful library of insights. Just click the Leave a Comment link below.

Posted by Roger Montgomery, 3 November 2010.

by Roger Montgomery Posted in Companies, Investing Education, Value.able.

-

Where will Value.able appear next?

Roger Montgomery

October 11, 2010

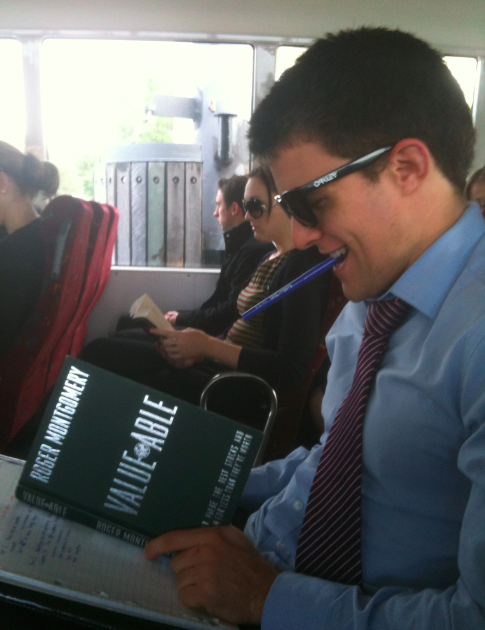

We have seen Value.able being applied on an offshore oil rig, in a deck chair on one young man’s private island and also a plunge pool in Bali. Here are two more stories from Graduates showing how they are applying Value.able in practice.

Roger,

I was recently in Galle, Sri Lanka, and was able to share some of your insights with a local spice trader, Yasiru. He was particularly interested in your comments on quality businesses and was happy to say that he maintained a competitive edge by controlling costs – he grinds and mixes the spices himself. I can report that his product is excellent and sells at bargain prices (I have no shares or other interest in his business).

Justin

And from Michael…

I felt compelled to shine light the legion of your followers that are not simply reading Value.able while sitting in lazy pacific island deck-chairs, exotic pools-with-a-view or even far reaching oil rigs. I give you the Montgomery Aussie Battler: An 8am-6pm, 5-day-week worker, traveling to and from work via a crammed and smelly public transport system (namely Brisbane’s CityCat). Who smiles to themselves knowing ‘the final salvation’ is possible – an early retirement thanks to Value.able, intrinsic value, margin of safety and high ROE to name a few. Thanks for starting a revolution!

Michael

P.S. Note the studious working scribbles underneath Value.able.

Please keep sharing your Value.able adventures with our community. We are enjoying the journey.

Posted by Roger Montgomery, 11 October 2010.

UPDATE: 13 October 2010

Here is another pic from Matt I received today… ‘Operating Value.Able’

Hi Roger, I don’t have a tropical or relaxing environment from which to share my experience of Value.Able – I send you this picture from the Trauma theatre at 2am after an emergency operation on a car accident victim. Not a place normally associated with relaxing thoughts. However, you may not know how good an operating theatre can be for reading. After all, it has the two most important ingredients: very good lighting and plenty of fresh air (via the ultra clean ventilation systems of course). Your book has been an excellent addition to my investing education and I look forward to meeting you at one of your upcoming presentations.Cheers, Matt

P.S. the patient is doing just fine

UPDATE: 14 October 2010

I was just reading up on the “formula” when some of the guys were curious. Then, just before the game started I was trying to explain to my team mates the difference between a company’s yeild, PE and ROE. Told them to just get the book.

Cheers….Rad

by Roger Montgomery Posted in Insightful Insights, Investing Education, Value.able.

-

No more Value.able Roger?

Roger Montgomery

October 7, 2010

The First Edition of Value.able has sold out.

The First Edition of Value.able has sold out.Thank you. Thank you for purchasing copies for your family and friends. And thank you for allowing me to share my way of investing with you.

If you haven’t yet purchased your copy, don’t worry. I plan to release a Second Edition paperback in November. The manuscript is with the designers and will soon be on the printing press.

You can pre-order and secure your copy at my website, www.rogermontgomery.com. Or if you haven’t yet done so, join up to my mailing list and I will let you know when then Second Edition is available.

I have received a few emails from investors who purchased their First Edition copies in early September and are patiently waiting for them to arrive. The books are delivered by Australia Post. If no one is home at the time of delivery, a parcel reminder will be left at your front door or in your letterbox and your book will be taken to your local post office. Unfortunately I have heard of occasions where no reminder note was left.

If you haven’t yet done so, please check with you local post office and if you don’t have any luck, please let me know.

Posted by Roger Montgomery, 7 October 2010.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Value.able.

-

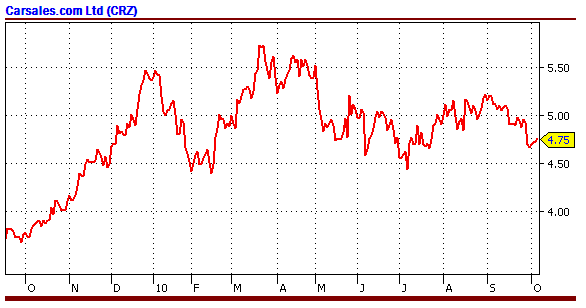

Carsales.com.au is an A1 business, but is it cheap?

Roger Montgomery

October 7, 2010

Each Wednesday I write my ValueLine column for Alan Kohler’s Eureka Report. Usually I post a link to my article the following day here at the blog. This week Alan has generously allowed me to republish my insights. Visit the Eureka Report website, www.eurekareport.com for more details about Alan’s newsletter.

Each Wednesday I write my ValueLine column for Alan Kohler’s Eureka Report. Usually I post a link to my article the following day here at the blog. This week Alan has generously allowed me to republish my insights. Visit the Eureka Report website, www.eurekareport.com for more details about Alan’s newsletter.ValueLine: Carsales.com

Ever noticed that the biggest and best online businesses are lists? Lists of websites, lists of houses, lists of flights, lists of jobs, lists of hotel rooms … even lists of people!

The business of curating and providing lists can be an extremely lucrative one because there is no need for a warehouse or a manufacturing plant. Nor is there a need for inventory and there is potentially very little maintenance spending required.

But because anyone with access to a server and knowledge of a programming language can imitate the business model, what is needed to be successful is a sustainable competitive advantage. More about that in a moment.

Last year nearly one million cars were sold in Australia; this year the figure is expected to be even higher. Of Australia’s adult population of 19.3 million, 5.3% buy a new car every year. Excluding January sales (when everyone is on holidays) and June sales (with end of financial year run-outs) about 85,000 new cars are sold each month.

That’s a lot of new cars being bought, and one suspects that just as many second hand-cars being sold too. One company leveraged to this industry without having to buy stock, lease a showroom or pay the wages of mechanics is Carsales.com (CRZ).

After a decade of business under private ownership, Carsales.com was floated at $3.50 a share in September 2009 in one of the most highly anticipated listings of the year. As is often the case with such floats, very few retail investors were able to get an allocation.

Today Carsales (CRZ) is Australia’s largest online list of cars, with about 205,000 units available for sale as of June this year.

For the year to June 2010, Carsales reported a profit of $43.2 million, which was $16.8 million less than listed car dealership Automotive Holdings (AHE). Automotive Holdings reported a profit of $60 million but required $1 billion of assets and $376 million of equity to produce it.

By way of comparison, Carsales required just $114 million of assets and $89 million of equity. Automotive Holdings generated a return on assets of 6.5%; Carsales’ figure was 39%.

If they were your assets, which return would you prefer?

For every dollar of sales, Automotive Holdings generates earnings before interest, tax, depreciation and amortisation (EBITDA) of 3.8¢. Carsales generates EBITDA of 52¢ from every dollar of sales.

If you could own one of these businesses, which would you prefer?

Carsales dominates Australia’s online lists of cars, capturing roughly half the market. Its next nearest competitor is the Newscorp-owned Carsguide with 93,000 cars for sale at mid-August, followed by the Trading Post with 69,000 cars.

For the full year to June 2010, Carsales’ revenues increased by 28%, with operating costs rising by less than 12% and net profits increasing by over 41%.

One of the keys to sustaining this kind of performance is a competitive advantage and while many conventional reports cite brands and systems as sources of competitive advantage, Carsales’s advantage comes from what is known as the network effect.

This is arguably one of the strongest sources of competitive advantage and it is evident when the value of a service increases for both new and current users as more people begin to use that good or service.

Think about it like this.

As more people list their cars/jobs/properties on a website, more people visit that website because it has the more cars listed. As more people visit the website, it justifies more people listing their cars there and this virtuous circle continues to work in favour of the dominant site, until an unbridgeable moat exists between Carsales.com and the other brands.

In an effort to break the cycle, one of Carsales’ competitors offered vendors the opportunity to list their cars for free but even that failed to put a dent the growth trajectory of Australia’s leading car classifieds website.

Carsales enjoys the same benefits of the network effect as Seek (SEK) does in job ads, REA Group (REA) does in real estate and Wotif (WTF) does in accommodation. This network effect is as visible and obvious as it is entrenched for Carsales.com and investors looking to buy a wonderful business would be hard-pressed to find many more attractive (for more of Roger’s thoughts on web-based businesses, click here).

Now the reality is that Carsales’ largest shareholder, PBL Media, owns 49% of the company and at some point that stake will be sold. But investors fearing the overhang should be less concerned by who buys and sells the shares and more concerned with whether the intrinsic value of the company is rising or not.

Carsales’ intrinsic value is rising. My forecasts suggest intrinsic value will rise 19% for each of the next three years and, let me assure you, there are few companies that can even promise that.

But a rising intrinsic value is just one of the characteristics the ValueLine portfolio seeks. The other is a discount to today’s intrinsic value. And that is the only test that Carsales.com. does not pass.

Carsales.com is an A1 business with a strong competitive advantage that is generating excellent returns on assets but, according to my calculations, its intrinsic value is $3.77. If we compare this to yesterday’s closing price of $4.72, it is approximately 25% overvalued.

In 2012, my estimated intrinsic value for Carsales rises to $4.65 and in 2012 to $5.24, but disciplined value investors need to make sure that everything lines up perfectly to pursue a successful investment strategy.

Carsales is not currently trading at a discount but it is a great business to keep in mind, should the market temporarily change its mind.

Posted by Roger Montgomery, 7 October 2010

by Roger Montgomery Posted in Companies, Value.able.

- 48 Comments

- save this article

- POSTED IN Companies, Value.able

-

Value.able review by Student2trader.com

Roger Montgomery

October 1, 2010

Very few books get me this excited.

The anticipation I had when opening my package upon receiving Roger’s book was huge! Boy was I not let down!

Roger’s book literally reignited my interest toward fundamental valuation of firms. Investors should rejoice, finally a logical approach to valuing ANY company that literally ANY investor can use. I have put many friends and family on to this book! I have no doubt that Value.able is going to take the nation, possibly the world, by storm.

I really enjoy Roger’s simple approach to valuing companies and the way he explains his concepts in the book are commendable. Some of his best concepts involve seeking both qualitative and quantitative margins of safety when using his simple yet very effective valuation method.

Roger gives a lot of value to his readers in this book. I personally never accept anything I read unless I completely understand exactly what is happening, how the concept works and how the assumptions affect the outcome. Subsequently, Value.able was a fantastic read for those reasons; Roger leaves nothing to the imagination, makes no unjustifiable assumptions, and bases his methods on proven and simple logic. Best of all, you don’t need a degree in finance to understand his book.

I honestly recommend you read Value.able. Many people are already looking forward to the second edition of the book, which will no doubt add further value for readers, based on the feedback Roger received from the first release.

If you are an investor, a student, a simple person wanting an easier logical way to make your decisions or even if you are academically challenged, you will understand Roger’s approach.

Well done Roger, I look forward to reading your future books!

Co-founder of Student2Ttrader.com.

by Roger Montgomery Posted in Value.able.

- 4 Comments

- save this article

- POSTED IN Value.able

-

How do Value.able graduates calculate forecast valuations?

Roger Montgomery

October 1, 2010

I know of no other book in the world that discusses the concept of calculating future intrinsic values. You may think that is a bold statement, but its true. I have seen many books that claim to reveal Warren Buffett’s intrinsic value formula, but not one that lays out, step-by-step, what investors need to look at to determine whether intrinsic value is rising at a satisfactory rate in the future.

I know of no other book in the world that discusses the concept of calculating future intrinsic values. You may think that is a bold statement, but its true. I have seen many books that claim to reveal Warren Buffett’s intrinsic value formula, but not one that lays out, step-by-step, what investors need to look at to determine whether intrinsic value is rising at a satisfactory rate in the future.I confess to chuckling recently when one investor told me that they were finding it a little difficult to source the data they needed to calculate future intrinsic values. They also believed that my book lacked an explanation for how to calculate future intrinsic values.

So I asked whether or not they had even thought about future intrinsic values before having read Value.able? Sheepishly, the investor accepted that my book was much more valuable than they had initially concluded and subsequently told other people.

I have not found any other book in the world that has taken that little Buffett quote about finding businesses growing intrinsic value at a “satisfactory rate” and making it part of a clearly explained and defined investing process.

And for those of you who are looking for a reference to forecast equity per share in Value.able…. see Page 188, Step A.

The missing worked example for future equity. It’s easy!

How can you estimate future equity if you don’t have a forecast number such as those readily available in analyst research notes? It’s easy. Take the last known equity per share figure, add the estimated profits, subtract the estimated dividends, add any capital raised through new shares issued and subtract any equity paid back to shareholders through buybacks and you have it.

Here’s an example: In the 2010 annual report for The Reject Shop, equity at 30 June 2010 was $51.543 million (click here to see) and there were 26.034 million shares on issue. Dividing the 2010 ending equity by the shares on issue ($51.543/26.034) equals equity of $1.98 on a per share basis.

According to Commsec (click here to see), consensus analyst estimates for 2011 earnings per share and dividends per share are $1.028 and $0.744 respectively.

Starting with the 2010 equity per share of $1.98, add the earnings per share of $1.028 and subtract the dividends per share of $0.744 to arrive at an estimated ending equity for 2011 of $2.26. (If you are aware of any shares issued since the end of the financial year, you may want to take the amount raised and divide it by the number of shares issued and then add that result to the $2.26)

Now that you have seen it done, how easy is that?

A global movement begins!

I couldn’t be happier that a small group of passionate Australian value investors are even contemplating future intrinsic values! Nobody in the world is presenting you with estimates for intrinsic values, two, three or four years out and I have never seen any investor ever do it. I know of nobody else in Australia doing that, nobody has written about it before and I haven’t ever come across anyone else in the international business media discussing it either.

And now you are all doing it! It has become part of your vocabulary.

Think about that for a minute… after reading Value.able, investors are now estimating future intrinsic values, posting their estimates at my blog and Facebook page,and chatting about them online in forums and in boardrooms where previously nobody was.

If before reading Value.able you weren’t discussing future intrinsic values and now you are, then my book has had a positive impact and I am delighted. And all for just $49.95!

Consider how you are now subconsciously framing your investing decisions with future intrinsic values in mind.

Warning!

Don’t blindly combine numbers with Value.able’s valuation tables to produce intrinsic values. As I say in my book, you MUST understand the business and its prospects. I devoted an entire chapter to cash flow and its calculations. Don’t ignore it. I also devoted an entire chapter to competitive advantages. Don’t ignore that either.

Recently, Buffett sold down his holding in Moody’s because it had lost some of its competitive advantage. He isn’t selling because he has recalculated intrinsic value. It’s the competitive advantage that drives the intrinsic value.

Be careful you aren’t so focused on the intrinsic value number that you ignore all the other important factors.

Its one of the reasons I have my Montgomery Quality Ratings (MQRs). They are my own filter to help narrow the universe of companies to conduct further research on.

I put a lot of effort into writing my book and making an investment plan out of the best of what the world’s most successful investors have revealed, published and taught. And I am delighted that you have allowed me to share that with you. Thank you.

Where do I get the raw data Roger?

I have previously posted a document called ‘Source Data’, where Value.able graduates contributed their solutions to obtaining the data. Because I am receiving so many requests for help finding the data, I thought it useful to republish it. Click here or click the Value.able Source Data button to the right.

I was saddened to hear that one Value.able reader thought getting the data was all too hard and gave up. That’s like knowing there’s silver and gold a metre under your feet but saying that grabbing a shovel and digging is just too hard. If you don’t want to do the work that’s fine, but please don’t blame the guy who gave you the map, the pick and the shovel.

Using the information in my Source Data document, you should now be in a rock solid position to start estimating future intrinsic Value.able values.

Take a look at the Source Data document and you will see that the raw data is freely available. Indeed every single number you need to estimate the current intrinsic value is also available in a company’s annual report, and its all free at ASX.com.au.

With sources like Commsec and the formula I have given you for future equity, you can now freely estimate the forecast intrinsic value as well. Just go to ASX.com.au, click on the announcements link, select the company code and the year you need and voila! All the information is there in the annual report.

Value.able outlines the way I invest. I don’t have a green button that I press each day that automatically goes and buys the best opportunities. Value investing requires research and analysis. We can build devices that give us some short cuts, but they don’t replace the need to understand the business and the risks.

Why are my valuations different to Roger’s?

If everyone uses exactly the same inputs, our Value.able valuations will all be identical. Any differences therefore are due to different data. Some examples of sources of variation are:

- Online brokers’ ROE numbers are calculated differently to the way I suggest in Value.able. They use ending equity and I suggest average equity.

- Generic net profit after tax figures available on various online summary lists may or may not remove abnormal/significant or non-recurring items. Intrinsic values should be based on recurring profits, revenues and expenses. (Yes there is some subjectivity in this).

- I have noticed many of you using 10% discount rates for all companies. As I suggest in Value.able, this may be too low in some cases.

There are a variety of reasons and your Value.able valuations are different to mine.

Recently on TV I indicated that my valuation of Telstra was closer to $2.30-$2.50, but one Value.able graduate produced $3.68. I suspect that the difference is simply the choice of discount rate. Many investors will use a low discount rate because TLS such a big company with plenty of liquidity and very low risk of significant change. I however might use a higher rate because I want compensation for the fact that its future prospects are opaque and its profits haven’t grown a dollar in a decade.

Thinking about differing results, I am encouraged that many Value.able graduates were able to replicate my results exactly, or within a couple of cents.

Value.able will stand the test of time because it is based on a method of investing that works. It is a method of investing that requires time to demonstrate its value. And in time I look forward to hearing many more of your success stories.

Only a few First Edition hardback copies of Value.able remain. So if you haven’t purchased your reserved copy yet, now is not the time to ponder.

There was only one print run of the First Edition hardback. The paperback Second Edition will be available in mid November.

Posted by Roger Montgomery, 1 October 2010.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

Is Value.able and relaxation mutually exclusive?

Roger Montgomery

September 29, 2010

It seems that putting your feet up on a deserted island is becoming the standard accompaniment for Value.able graduates. Young Les was one of the first graduates to receive his copy of Value.able in early August, but until now has struggled to find a deserted island to go and read it…

It seems that putting your feet up on a deserted island is becoming the standard accompaniment for Value.able graduates. Young Les was one of the first graduates to receive his copy of Value.able in early August, but until now has struggled to find a deserted island to go and read it…Hi Roger,

Finally found that deserted island you often talk about. Some one thought it funny to take a picture of me with the pies hat. If only they had known – the real value was in the book. If only we had looked at the intrinsic value of Collingwood and St Kilda on the weekend we would have gone for the draw. At 50 to 1 it was the only value.

Best regards,

Young LesPS – Going for the pies this weekend… the value is better!

Posted by Roger Montgomery, 29 September 2010

by Roger Montgomery Posted in Value.able.

- 36 Comments

- save this article

- POSTED IN Value.able

-

How do investors apply Value.able in practice?

Roger Montgomery

September 16, 2010

Everyone has their own unique way of learning new skills.

Everyone has their own unique way of learning new skills.Michael had the opportunity to read Value.able whilst on holiday in Bali – in his own private plunge pool.

Michael’s classroom may be slightly more lavish than Jesse’s offshore rig, but reassures us that a comfortable chair and place to put your feet up is all that’s needed to put Value.able into practice. And here is more evidence from Young Les who managed to find his own deserted island.

Posted by Roger Montgomery, 16 September 2010.

by Roger Montgomery Posted in Value.able.

- 100 Comments

- save this article

- POSTED IN Value.able

-

Part II: What else has the reporting season avalanche uncovered?

Roger Montgomery

August 24, 2010

The second full week of reporting season has just been and gone and saw another 80-100 companies report their financial results. More than 200 have reported and yes I am working feverishly to keep up and cover them all. I am happy to report that I’m ready for another week.

The second full week of reporting season has just been and gone and saw another 80-100 companies report their financial results. More than 200 have reported and yes I am working feverishly to keep up and cover them all. I am happy to report that I’m ready for another week.So far the results have been mixed. Information Technology, Banking and Mining/Oil & Gas Services sectors have stood-out, receiving high Montgomery Quality Ratings. The remainder have been distributed somewhat randomly amongst the other sectors.

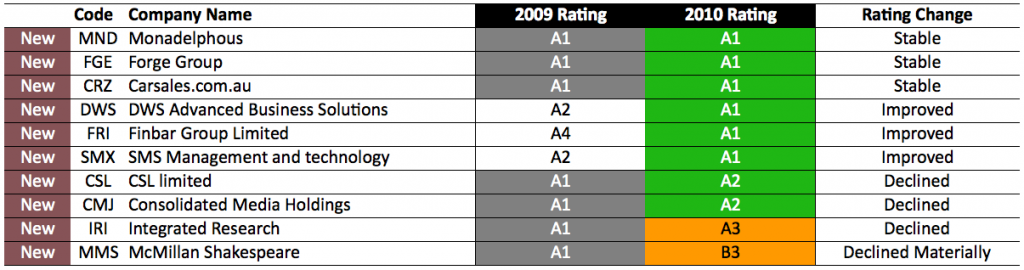

And having analysed all of them so far, I can reveal that only 11 (5.5%) of the 200 have achieved my coveted A1 status (an additional six on top of the five from my previous post). These businesses have all passed my rigorous stress tests and come up trumps.

You may be surprised that after another full week and 80-100 individual results, only six additional companies have made it. But my A1 rating system has been specifically formulated to yield only the best and it is performing its function very well.

Of the six companies, three held onto their A1 status. These are Carsales.com.au (CRZ), Forge Group (FGE) and Monadelphous (MND) which have been joined by 3 new entrants in DWS Advanced Business Solutions (DWS), Finbar Group Limited (FRI) and SMS Management and technology (SMX).

Unfortunately, on a net basis we lost one A1 this year with four other businesses experiencing ratings declines from A1. These businesses include CSL limited (CSL), Consolidated Media Holdings (CMJ), Integrated Research (IRI) and McMillan Shakespeare (MMS). While CSL and CMJ have both declined to A2 status – nothing to be sneezed at, IRI and MMS have had larger rating declines.

Most notably, MMS has declined materially in terms of quality as I predicted it might after its acquisition, and it is now a ‘B3’. The mostly debt-funded acquisition of Interleasing (Australia) is the cause of this fall which I will cover in a separate post.

There are also another 20 A2 businesses that have passed my stress tests and rate in the top 15 per cent of the market in terms of overall quality.

Don’t forget to combine these lists with the A1 and A2 businesses I highlighted last week to continue identifying the best of the rest and stay tuned, I will post my intrinsic valuations for all 11 A1 businesses soon.

Finally, an update on my Telstra valuation. Last week I said that my valuation following the annual result was $2.50. I have updated my numbers and now get $2.30.

I sincerely hope that my Telstra comments have served your research well and that you have not been caught by all of the “it’s high yield and therefore a cheap stock” talk.

While others may have been tempted to buy shares for ‘yield’, you can use Value.able to first discover the intrinsic value. To save you a little time, Telstra’s valuation has declined since it listed. Even in the past year intrinsic value has fallen from $3.00 to $2.30! And the share price has fallen from $3.55 to the current $2.77.

In reality this is a widely reported and closely tracked company and its weighting in the index ensures a level of support from the large, conventional, index-based and tracking-error-focused funds. Indeed this is one of the reasons it has taken so long for Benjamin Graham’s weighing machine to catch up to the valuation – ten years! An improvement in the clarity for Telstra (forgetting whether its profitable for the business) could be enough to result in substantial price rises. Of course as a disciplined value investor focused on only the highest quality business, I cannot let that speculation tempt me.

Posted by Roger Montgomery, 24 August 2010.

by Roger Montgomery Posted in Companies, Investing Education, Value.able.