Value.able

-

The Good, The Bad and the Ugly

Roger Montgomery

August 10, 2012

Both Breville Group (BRG) and Flexigroup (FXL) saw solid gains yesterday.

Breville’s share price hit new highs in terms of price (not that we’re looking of course) in anticipation of a solid result. EBITDA was previously forecast to be in the range of $65 to $67 million but not long ago the company upgraded guidance to $71 to $72 million. Investors who are focusing on depressed local retailing and consumption need to have a look at the US retailing index which is up more than 275% since the March 2009 lows. More than half the company’s revenues now come from outside Australia, with roughly a third coming from North America, and growing despite the weak US economy.

FLEXIGROUP (FXL)

Two days ago, Flexigroup announced that it had successfully priced AUD255m of asset-backed securities, supported by a pool of Australian unsecured, retail, “no interest ever” payment plans, originated by Certegy Ezi-Pay Pty Ltd (“Certegy”), a wholly owned subsidiary of FlexiGroup Limited.

This securitisation of Certegy receivables is part of FlexiGroup’s strategy to diversifying its funding sources by regularly accessing wholesale capital markets. The term securitisation is FlexiGroup’s third and its also the second rated by Moody’s.

According to Spencer Wilson, Associate Director in Fitch’s Structured Finance team, “A valuable tool in Certegy’s underwriting strategy is its access to large volumes of historical data, which is then used to identify key risks across product types, demographics and borrower types,” adding “This transaction follows on from the Flexi 2011-1 deal, with notable features being the short weighted average life of the receivables, small contract size and significant levels of excess that are available to offset potential losses”.

by Roger Montgomery Posted in Value.able.

- 4 Comments

- save this article

- POSTED IN Value.able

-

Results to 30 June 2012

Roger Montgomery

August 8, 2012

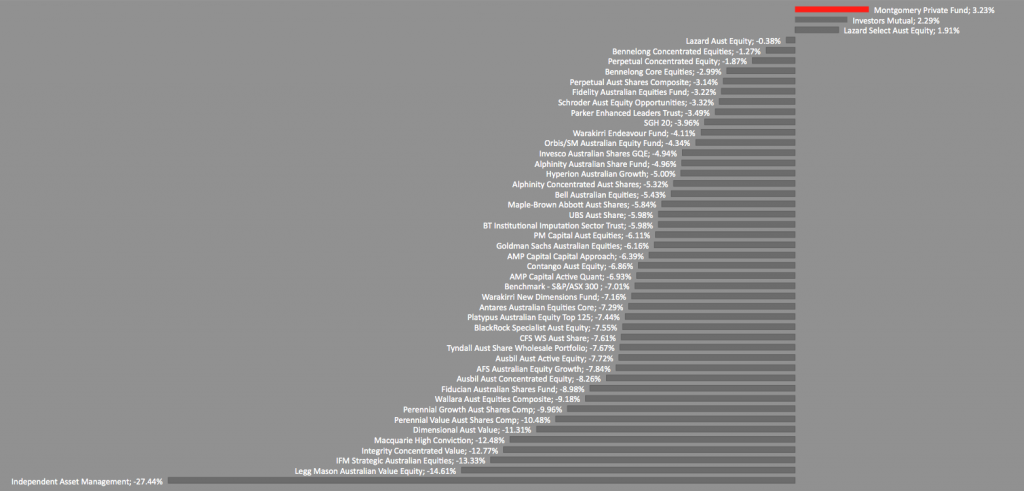

On behalf of the Montgomery Investment Management Team, I am delighted to display the full year results for the Montgomery [Private] Fund as measured and ranked against the 98 funds surveyed by Mercers.If you would like to discuss an investment in The Montgomery [Private] Fund please contact The Office by email at Office@montinvest.com or call (02) 9692 5700.Alternatively, if you would like to pre-register to be contacted when the fund re-opens to investment visit www.montinvest.com and select Apply to Invest.

Fig 1. Selected Australian Long Only Equity Funds as reported by Mercers and compared to The Montgomery [Private] Fund.

NB. The Montgomery Private Fund was not included in the Mercer Survey however the below chart reveals the fund’s comparative performance as if it were.by Roger Montgomery Posted in Insightful Insights, Investing Education, Value.able.

-

The mining boom IS over

Roger Montgomery

August 2, 2012

Roger Montgomery discusses how the latest data reveals that the mining boom has ended, and he discusses the implications of this on mining stocks with Ticky fullerton on ABc1’s The Business. Watch here.

This program was broadcast 1 August 2012.

by Roger Montgomery Posted in Companies, Insightful Insights, Manufacturing, Value.able.

- save this article

- POSTED IN Companies, Insightful Insights, Manufacturing, Value.able

-

China Rongsheng Heavy Industries – the good, the bad and the ugly, part 2

Roger Montgomery

August 2, 2012

We had a wry smile this morning after reading Macquarie Equities daily newsletter.

China Rongsheng Heavy Industries’ net earnings have been downgraded by 37% in 2012, 68% in 2013 and an astonishing 79% in 2014. Forecast 2014 profitability is now one-sixth of the the level recorded in 2011.

A significant factor which had come to light is the fact that Rongsheng has provided highly attractive pre-delivery finance to customers to win market share.

As Rongsheng has had operational (and credibility) issues, it has had to increase its working capital and gearing to meet expenses during during the shipbuilding construction period. With the fast decline in their order book, from US$6.6 billion in 2011 to an estimated US$3.6 billion in 2014, cash flows are under pressure.

The extraordinary rise and fall of Rongsheng and the outlook for the Chinese shipbuilding industry lends support to Montgomery’s caution with respect to the materials industry.

We will become more positive on materials stocks when the outlook from the Chinese steelmaking, cement and shipbuilding industries is less pessimistic.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Manufacturing, Value.able.

-

Steve Keen has his supporters…..

Roger Montgomery

July 31, 2012

In late 2008 Steve Keen, Associate Professor of Economics and Finance at the University of Western Sydney had a bet with Rory Robertson, who at the time was Interest Rate Strategist at Macquarie Bank. The bet was Australian housing prices would decline by 40% in two years, and the loser would walk 200km from Canberra to Mt Kosciuszko. Despite losing the bet, Steve Keen still has his supporters. Last week, Dean Baker the co-founder of US based the Centre for Economic and and Policy Research said the housing bubbles of the United Kingdom, Canada and Australia, are larger, relative to the size of their economies, than the one that collapsed and wrecked the US economy. In each county, there has been a sharp increase in the sale price of homes that has not been matched by a corresponding increase in rents. In Australia’s case, Baker claims house prices rose by more than 80 per cent between 2001 and 2009, a period when rents rose by roughly 30%. Baker argues the price of the median house in Australia is 225 per cent of the median house in the US. Given that wages in the US are higher it is difficult to see how this huge gap in house prices can make sense, said Baker.

by Roger Montgomery Posted in Insightful Insights, Property, Value.able.

- save this article

- POSTED IN Insightful Insights, Property, Value.able

-

US Housing Starts – About to Mean Revert?

Roger Montgomery

July 27, 2012

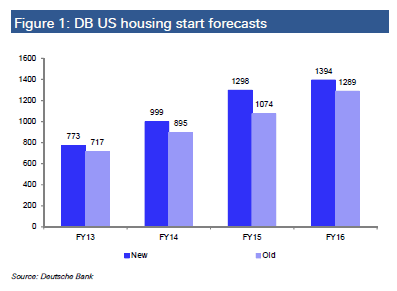

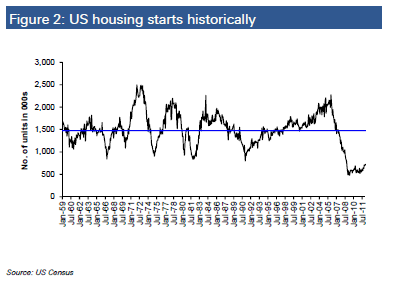

Over the past fifty years, US housing starts have averaged 1.5m per annum. Currently, starts are less than half the long term average.

In recent months there have been some tentative signs of recovery from this record low base. According to the Economist, America’s houses on average “are now among the world’s most undervalued: 19% below fair value, according to our house-price index”.While Deutsche Bank have cut their 2013 and 2014 housing start expectations in Australia to 128,000 and 144,000, respectively,they are looking for a jump in US housing starts to 1.0m by 2014 and 1.4m by 2016, as follows.

by Roger Montgomery Posted in Insightful Insights, Property, Value.able.

- save this article

- POSTED IN Insightful Insights, Property, Value.able

-

The Conference call with Consequences?

Roger Montgomery

July 26, 2012

On Monday night I attended a conference call with the exceptionally articulate George Papandreou, Prime Minister of Greece from October 2009 to November 2011. He said a sudden exit from the European Union would be chaotic. Greek GDP could quickly decline by 20% and the cost of major imports of oil and foodstuffs would go through the roof.

While Greece accounts for only 2% of the European Union GDP, Papandreou felt the threat of kicking Greece out could set a precedent for Portugal, Italy and Spain, which together account for 23% of European Union GDP. It would mean the beginning of the unraveling of Europe and create further weakness with massive consequences.

by Roger Montgomery Posted in Insightful Insights, Value.able.

- save this article

- POSTED IN Insightful Insights, Value.able

-

MEDIA

Is Weaker Chinese Demand a Worry?

Roger Montgomery

July 21, 2012

Roger Montgomery certainly thinks so, and he explains why in this Weekend Australian article published 21 July 2012. Read here.

by Roger Montgomery Posted in In the Press, Insightful Insights, Investing Education, Value.able.

-

Is the slow-down finally gaining momentum Down-Under?

Roger Montgomery

July 11, 2012

Monday’s announcement of total ANZ job ads falling by 8.9% year on year in June 2012 indicates the slowdown in many Western world economies is gaining momentum Down Under.

Monday’s announcement of total ANZ job ads falling by 8.9% year on year in June 2012 indicates the slowdown in many Western world economies is gaining momentum Down Under.The ANZ Australian job ad market series (combined newspaper and online) fell by 1.2% in June 2012 on May 2012. In turn, May’s figure was down 2.6% from April.

The 8.9% year on year decline was driven by 8.5% and 17.5% year on year declines in online and newspaper job advertisements, respectively.

by Roger Montgomery Posted in Insightful Insights, Value.able.

- save this article

- POSTED IN Insightful Insights, Value.able

-

What do the most widely held stocks in Australia all have in common?

Roger Montgomery

June 29, 2012

EXCLUSIVE CONTENT

subscribe for free

or sign in to access the articleby Roger Montgomery Posted in Financial Services, Skaffold, Value.able.

- 9 Comments

- save this article

- POSTED IN Financial Services, Skaffold, Value.able