Value.able

-

Gunns collapse. If only they’d been Skaffold members!

Roger Montgomery

September 29, 2012

Chalk up another win for Skaffold members.

Substantial capital losses are difficult to make back and irrespective of whether you are still in accumulation mode, retiring or retired it is essential to avoid major losses. One way to do this of course is to diversify and ensure that losses are mitigated through position sizing. Another technique and the one we will discuss here, is to simply avoid the companies most likely to collapse.

This week Gunns (ASX:GNS), was placed into voluntary administration and happily for Skaffold members it is unlikely that anyone owned shares.

Gunn’s was never investment grade. Anyone who purchased the stock from 2003 onwards were taking a massive risk and Skaffold can explain why.

Skaffold’s Verdict (Figure. 1) is a picture of danger.

by Roger Montgomery Posted in Companies, Insightful Insights, Market Valuation, Skaffold, Value.able.

-

Overnight Wednesday in Europe

David Buckland

September 28, 2012

After jumping nearly 20% over the September 2012 Quarter, Wednesday saw the leading 50 European blue chip stocks from 12 Eurozone countries, as measured by the STOXX, decline by 2.7%. The Spanish market, which had rebounded 35% from its low point in early July, fell 3.9%. On Thursday, Spanish Prime Minister Rajoy announced his fifth austerity package in nine months of Government. The target is to cut the budget deficit from 6.3 percent in 2012 to 4.5 percent in 2013.

Economists responded by saying “they’ve increased the taxes for next year and cut spending but they didn’t change the growth forecast”. Economists expect the Spanish economy to contract around 1.5%, while the Government is forecasting a contraction of only 0.5%. With their ten year bonds selling above 6%, Spain will likely need to raise the white flag and go “cap in hand” to the European Central Bank for another bail-out. Spain’s declining property market and 25% unemployment is causing a significant solvency issues for their banking system, as the contraction of private sector lending continues.

continue…by David Buckland Posted in Insightful Insights, Market Valuation, Value.able.

-

Global trade slowing – FedEx

David Buckland

September 24, 2012

Fred Smith, CEO of FedEx, the express parcel and logistics operator, said that over the last 25 years global trade had generally grown at a faster rate than the world economy, but over recent months that process had broken down. “That’s what is really going on – that exports and trade have gone down at a faster rate than GDP”. Although Fed Ex announced its revenue for the three months to 31 August 2012 was up 3% to $10.8 billion, it guided down its net earnings for the year to 31 May 2013 to around $6.40 per share. At the current $87, FedEx is on a prospective PE of 13.6X.

Fred Smith, CEO of FedEx, the express parcel and logistics operator, said that over the last 25 years global trade had generally grown at a faster rate than the world economy, but over recent months that process had broken down. “That’s what is really going on – that exports and trade have gone down at a faster rate than GDP”. Although Fed Ex announced its revenue for the three months to 31 August 2012 was up 3% to $10.8 billion, it guided down its net earnings for the year to 31 May 2013 to around $6.40 per share. At the current $87, FedEx is on a prospective PE of 13.6X.by David Buckland Posted in Value.able.

- save this article

- POSTED IN Value.able

-

MEDIA

What are the ongoing prospects for Queensland Mining?

Roger Montgomery

September 12, 2012

Roger Montgomery discusses the new Qld Government levies on mining, and the likely impact on mining stocks with Ross Greenwood on Radio 2GB. Listen here.

This program was broadcast on 12 September 2012.

by Roger Montgomery Posted in Companies, Insightful Insights, Radio, Value.able.

- save this article

- POSTED IN Companies, Insightful Insights, Radio, Value.able

-

Big Apple?

Roger Montgomery

September 12, 2012

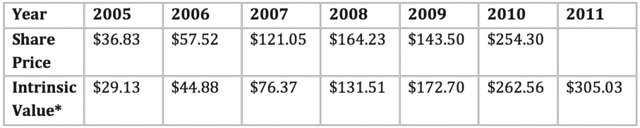

Did you know that the market capitalisation of Apple Inc. is now more than the entire equity markets of Spain, Portugal, Ireland and Greece combined? Its stunning. Surely Forrest Gump from Greenbow Alabama would be writing to Jenny with much enthusiasm. But what about its intrinsic value? Back in 2010 (http://rogermontgomery.com/is-apple-an-a1/) I wrote that Apple’s intrinsic value was higher than the share price at the time. The table below first published in July 2010 reveals the company’s pattern of rising intrinsic values. back then the price was indeed showing a small margin of safety.

A couple of blog readers have subsequently told me they purchased Apple shares and obviously they have done nicely. But what about today?

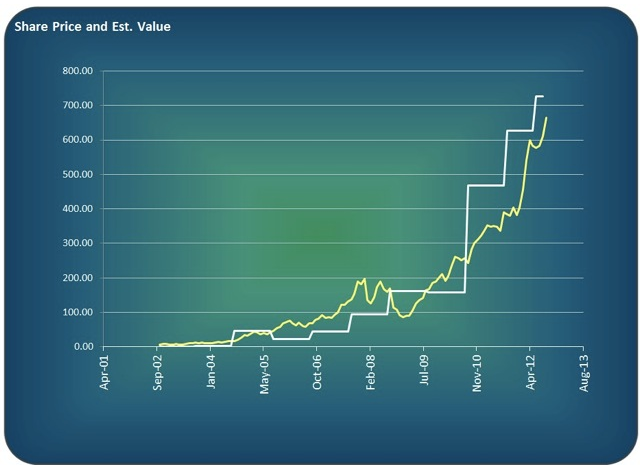

Only last year, when the share price hit $600 I wrote that I thought price had run ahead of intrinsic value (but not forecast intrinsic value) and the share price subsequently fell slightly. We also noted declining margins and market shares losses. But improving quarterly results and rising forecasts means revisions have resulted in IV estimates continuing their stellar rise so a revisit of our assumptions might be worth our time.

The graph below reveals that our ‘revised’ back-of-the-envelope intrinsic value estimate for Apple is forging ahead. If you are confident that Apple’s pipeline of products will usurp the competition, take back market share and fill Apple’s coffers towards 1000 billion dollars and that the iPhone 5 – expected to be revealed this week – will knock everyone’s socks off, then the massive rises in intrinsic value, might not seem so extreme.

Of course all intrinsic values are just estimates and while our haven’t done too badly for us – we’ve been spot on with BHP at $30 and done well on others – the reality is they can change dramatically as new information comes to hand.

So lets keep an eye on whether Apple impresses this week with its new release.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Market Valuation, Value.able.

-

MEDIA

Bright prospects for Computershare?

Roger Montgomery

September 10, 2012

Computershare’s court victory allows it to proceed with its digital post business – and Roger Montgomery discusses its potential in this edition of ABC1’s Inside Business broadcast 2 September 2012 . Watch here.

by Roger Montgomery Posted in Insightful Insights, TV Appearances, Value.able.

- save this article

- POSTED IN Insightful Insights, TV Appearances, Value.able

-

Montgomery University – “When Earnings ain’t Earnings”

Roger Montgomery

September 7, 2012

I’d like to offer the opportunity to invest in my new business. No not the new Montgomery retail fund (although I’d be delighted to welcome you as an investor) but an operating company. Like many of the companies reporting earnings this reporting season I will guarantee it will report to you record earnings every year.

This promise is easier to keep than you might initially realise. If companies making such headline-grabbing announcements impress you, then you might be interested to know its not that hard to achieve.

All you need is a bank account and a rocking chair. Lets start with a million dollars in a bank account earning five per cent. First year earnings will equal fifty thousand dollars. Now let’s reinvest all of the interest. Now we have $1.05 million earning five per cent. Year two’s earnings would be $52,500. And there you have it, record earnings! Magic.

When a company reports record earnings, there is nothing more miraculous than the power of compounding. Indeed, if a company cannot increase its earnings, then perhaps a bank account is better.

by Roger Montgomery Posted in Value.able.

- 3 Comments

- save this article

- POSTED IN Value.able

-

MEDIA

Who were the big winners and losers in 2012 Reporting Season?

Roger Montgomery

September 5, 2012

Roger Montgomery discusses the 2012 results season with Ross Greenwood on Radio 2GB, and how amongst technology stocks there are both big winners and big losers. Listen here.

This program was broadcast on 5 September 2012.

by Roger Montgomery Posted in Radio, Value.able.

- LISTEN

- save this article

- POSTED IN Radio, Value.able

-

Value.able digital edition now available on the iBookstore

Roger Montgomery

September 5, 2012

“Follow the steps outlined in Value.able, and I believe that over the long run, you cannot help but beat the market.”

“Follow the steps outlined in Value.able, and I believe that over the long run, you cannot help but beat the market.”The stock market can be richly rewarding and the broad market indices relatively simple to beat over time but you must first discover the steps to identifying the very best stocks and the steps to buying them for less than they’re worth. Value.able invites you to not only discover and master the steps to successful value investing but to also hear and watch how Roger Montgomery applies the steps to identifying the best stocks and avoiding the worst with stunning audiovisual clips and screencasts from his own trading screen and using the software he invented.

Using this visually rich and captivating premium version of Montgomery’s best seller will entertain, engage, educate and enrich through all of the stock market’s trials and tribulations.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Value.able.

-

New Retail Fund Launch

Roger Montgomery

August 22, 2012

Until now, Montgomery Investment management’s (“MIM”) unique intrinsic-value investing approach was only available to those with more than $1 million to invest. And since inception, The Montgomery [Private] Fund has provided those investors with significantly higher returns than the broad market indices.The new The Montgomery Fund is now open to individuals, families and trustees of self managed superannuation funds, comfortable investing less than $1 million.

The minimum investment amount for The Montgomery Fund is $25,000 and investors will receive regular reports that include the top stocks held by The Montgomery Fund.

Links to The Montgomery Fund’s Product Disclosure Statement, which includes the Application Form, the Information Booklet and a Welcome Letter, are available via email and you need to request them by visiting Montgomery Investment Management.

The next step is to carefully read the documents, seek advice where necessary and if you elect to proceed, complete and return the Application Form at your earliest convenience.

MIM looks forward to welcoming you as an investor and to working for you.

Montgomery Investment Management.

Important InformationThe issuer of units in the Fund is the Fund’s responsible entity Fundhost Limited (ABN 69 092 517 087). The Product Disclosure Statement (PDS) contains all of the details of the offer. Copies of the PDS are available from Montgomery Investment Management (02) 9692 5700 or at www.montinvest.com.

An investment in the Fund will only be available through a valid application form attached to the PDS. Before making any decision to make or hold any investment in the Fund you should consider the PDS in full.

by Roger Montgomery Posted in Value.able.

- 2 Comments

- save this article

- POSTED IN Value.able