Stocks We Like

-

Accenture: the twenty-year illustration of patient investing

David Buckland

May 27, 2021

The Polen Capital Global Growth Fund attempts to own 25-35 of the highest quality businesses which meet all of the manager’s five guardrails – a sustainable return on equity exceeding 20 per cent; exceptionally strong balance sheet; stable or growing profit margins; abundant free cashflow; and real organic revenue growth. And with Polen Capital’s exceptionally low portfolio turnover, global investors have a “sleep well at night” offering. continue…

by David Buckland Posted in Companies, Polen Capital, Stocks We Like.

- save this article

- POSTED IN Companies, Polen Capital, Stocks We Like

-

Why Webjet could be set to soar again

Stuart Jackson

May 26, 2021

Travel businesses have really suffered due to the COVID-19 travel restrictions and border closures, but with many economies re-opening, unleashing a likely tsunami of pent-up travel demand, the future is looking brighter. And companies like Webjet (ASX:WEB), the Australasian online travel agent and global hotel room intermediary, should be major beneficiaries. continue…

by Stuart Jackson Posted in Companies, Stocks We Like.

- save this article

- POSTED IN Companies, Stocks We Like

-

Regis Resources Limited – could the share price indigestion be coming to an end?

David Buckland

May 21, 2021

The Australian gold sector occasionally throws out an interesting opportunity, and the severe share price decline of Regis Resources (ASX: RRL) over the past nine months, coinciding with the recent $650 million capital raising (241 million new shares at $2.70 per share) to acquire the 30 per cent interest in the Tropicana operation, may soon be a buying opportunity. continue…

by David Buckland Posted in Companies, Stocks We Like.

- 5 Comments

- save this article

- POSTED IN Companies, Stocks We Like

-

What’s behind Tencent Music Entertainment’s share price decline?

David Buckland

May 13, 2021

After performing admirably for much of the March 2021 quarter, Tencent Music Entertainment (TME) (market capitalisation of US$25.7 billion), has experienced significant share price dislocation over recent weeks, declining from over US$30 to the current US$15 per share. continue…

by David Buckland Posted in Companies, Polen Capital, Stocks We Like.

- save this article

- POSTED IN Companies, Polen Capital, Stocks We Like

-

Universal Store continues to grow sales

Stuart Jackson

May 5, 2021

Universal Store (ASX: UNI) is a youth-focused retailer of trend-led and casual fashion, shoes, accessories, lifestyle and ‘gifting’. It only listed last November, but has managed to surprise market estimates to the upside three times since then with impressive and accelerating rates of organic growth. Clearly, it’s a great story, and I like the firm’s short to medium term prospects. continue…

by Stuart Jackson Posted in Companies, Stocks We Like.

- save this article

- POSTED IN Companies, Stocks We Like

-

More strong Quarterly results, particularly from Facebook and Amazon

David Buckland

May 3, 2021

Facebook’s March 2021 Quarter revenue increased 48 per cent to $26.2 billion from $17.7 billion with strong demand for advertising from the social network’s 2.85 billion monthly active users, across its Facebook, Instagram and WhatsApp platforms, up 10 per cent. Net income in the March quarter jumped 94 per cent from $4.9 billion to $9.5 billion, easily exceeding analysts’ expectations. continue…

by David Buckland Posted in Companies, Stocks We Like.

- save this article

- POSTED IN Companies, Stocks We Like

-

Is Megaport at an inflection point?

Tim Kelley

April 29, 2021

Network as a Service provider (NaaS), Megaport (ASX:MP1) is a company we follow with interest, and one that we have commented on in several previous articles. continue…

by Tim Kelley Posted in Companies, Stocks We Like.

- save this article

- POSTED IN Companies, Stocks We Like

-

Polen Capital Global Growth Fund’s holdings and the bumper March Quarter results

David Buckland

April 28, 2021

In terms of the weighting of the Polen Capital Global Growth portfolio, each of Microsoft, Alphabet and Starbucks produced bumper March 2021 Quarterly results and a summary follows. continue…

by David Buckland Posted in Companies, Polen Capital, Stocks We Like.

- save this article

- POSTED IN Companies, Polen Capital, Stocks We Like

-

What to expect from the upcoming bank results

Stuart Jackson

April 23, 2021

The major banks will release their results over the next couple of weeks. Having generally lagged the market over the last few years, the bank stocks have been relative winners in the last six months as fears around bad debts eased. continue…

by Stuart Jackson Posted in Companies, Financial Services, Stocks We Like.

- save this article

- POSTED IN Companies, Financial Services, Stocks We Like

-

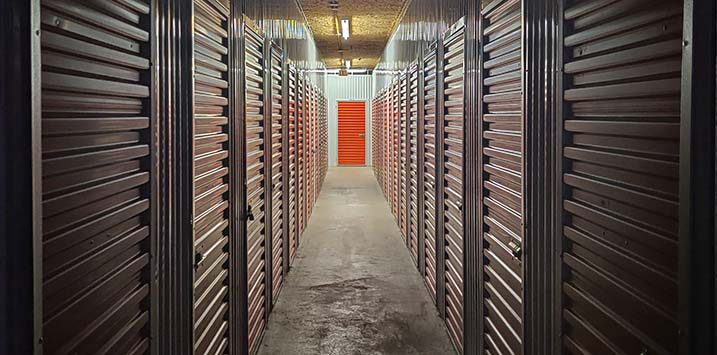

Why we think NSR is an exceptional REIT

Gary Rollo

April 22, 2021

The real estate investment trust sector is not a traditional hunting ground for the Montgomery Small Companies Fund. REITs tend to be passive asset owners or rent collectors. So they’re not a natural fit for our philosophy of investing in talented management teams that can generate compounding wealth for our investors. But National Storage REIT (ASX:NSR) is an exception. continue…

by Gary Rollo Posted in Companies, Editor's Pick, Stocks We Like.

- 3 Comments

- save this article

- POSTED IN Companies, Editor's Pick, Stocks We Like