Why we think NSR is an exceptional REIT

The real estate investment trust sector is not a traditional hunting ground for the Montgomery Small Companies Fund. REITs tend to be passive asset owners or rent collectors. So they’re not a natural fit for our philosophy of investing in talented management teams that can generate compounding wealth for our investors. But National Storage REIT (ASX:NSR) is an exception.

What is NSR?

National Storage REIT owns and operates over 200 storage centres in Australia and New Zealand, under the National Storage brand; you will have seen their big yellow logo as you pass through the edge of your town or city as these premises tend to exist in industrial parks near significant population centres to provide handy amenity to those that want extra storage close to home. Note the word “operates” in the description, NSR is not a passive rent collector, management has greater value creation levers at their control than most REITs, and we will discuss those later.

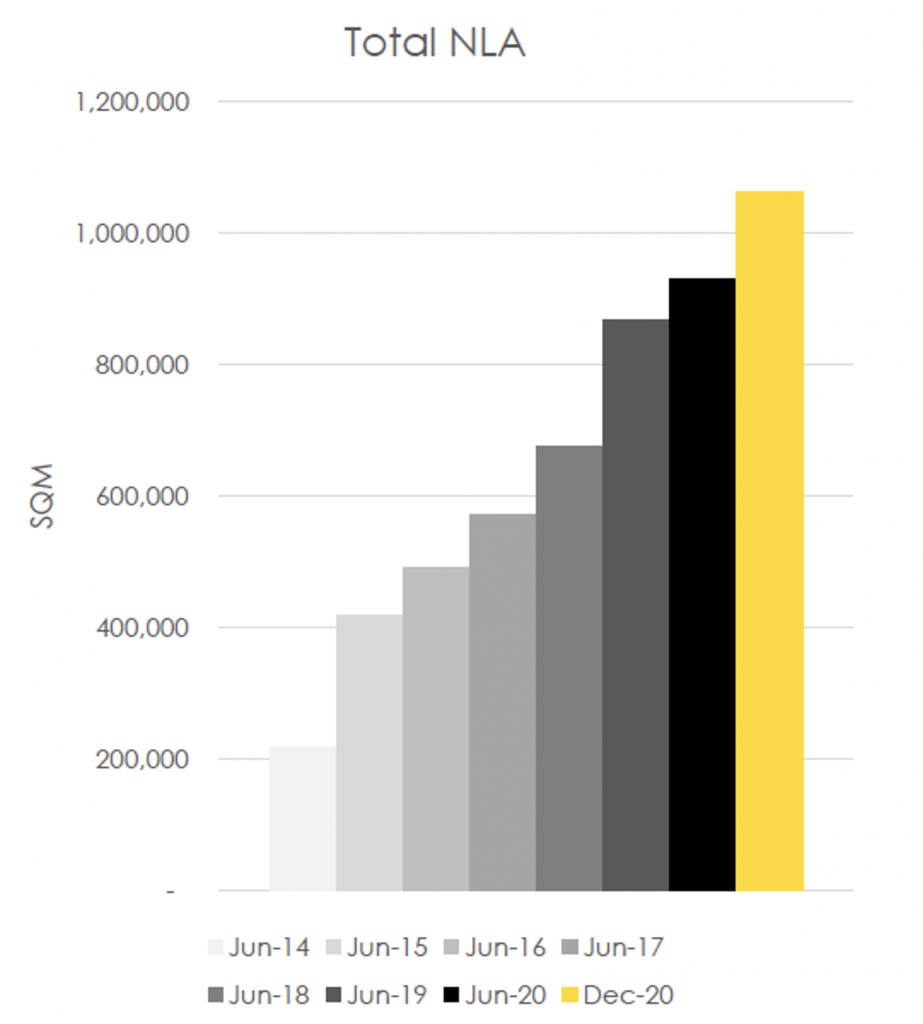

NSR listed in December 2013 at 98 cents, with a market cap of $240 million on a dividend yield of 8 per cent, with a strategy to acquire and grow assets under management in the storage sector. NSR IPO’d with management of and partial ownership of 330,000 square metres (sqm) of lettable space over 62 centres with 71 per cent occupancy. Today NSR had ownership of 204 centres with over 1.06 million sqm of lettable space, that we calculate is 80 per cent occupied.

Growth in hard assets like storage centres is a capital-intensive business, so NSR has deployed capital in bucketloads during the pursuit of this strategy. Consequently, share count has quadrupled and NSR’s market cap today stands at $2.1 billion, at 1HF21 (31/12/20) NSR had $890 million of debt, and so has a look through EV of $3 billion, with an investment property portfolio (the storage centres) of $2.82 billion on its balance sheet. NSR has paid dividends every year of its listed life, and IPO shareholders have enjoyed a 15.5 per cent compound annual return to the $2.13 the share price today. Pretty good for the risk accepted over that period in our view. NSR’s strategy has created value.

That’s history; what about our reason to continue to own it today?

NSR is what we call a stable compounder in our portfolio, it delivers a high degree of certainty of steady value creation, but it’s also got what we look for – Latent optionality. Times 2.

Latent optionality 1: Profits driven by technology edge & cyclical tailwinds

Today NSR’s portfolio, using 1HF21 data, generated $97 million in revenue and $46 million in EBIT, or $194 million and $92 million respectively at an annualised run rate. NSR’s portfolio is 80 per cent occupied, with customers paying a rate on average of (we calculate) $220 per sqm. However, 1 in 5 storage units are empty. NSR regularly report on the occupancy and rate metrics of a subset of mature centres in its portfolio, these mature centres operate on “a steady state” at 90 per cent + occupied. NSR suggest that once all centres in the portfolio reach “maturity” an incremental 110,000 sqm of space would be occupied in its portfolio. Doing the maths this is worth $24 million on that $220 rate. This is all incremental revenue with limited or no incremental cost, it drops straight through and would give rise to a 25 per cent or so rise in the run rate profits, should over time the portfolio fully “mature.” This is where the optionality is. The earnings are there, but what’s the catalyst the market needs to see to believe this outcome gets crystalised? REVPAM.

REVPAM growth is the catalyst

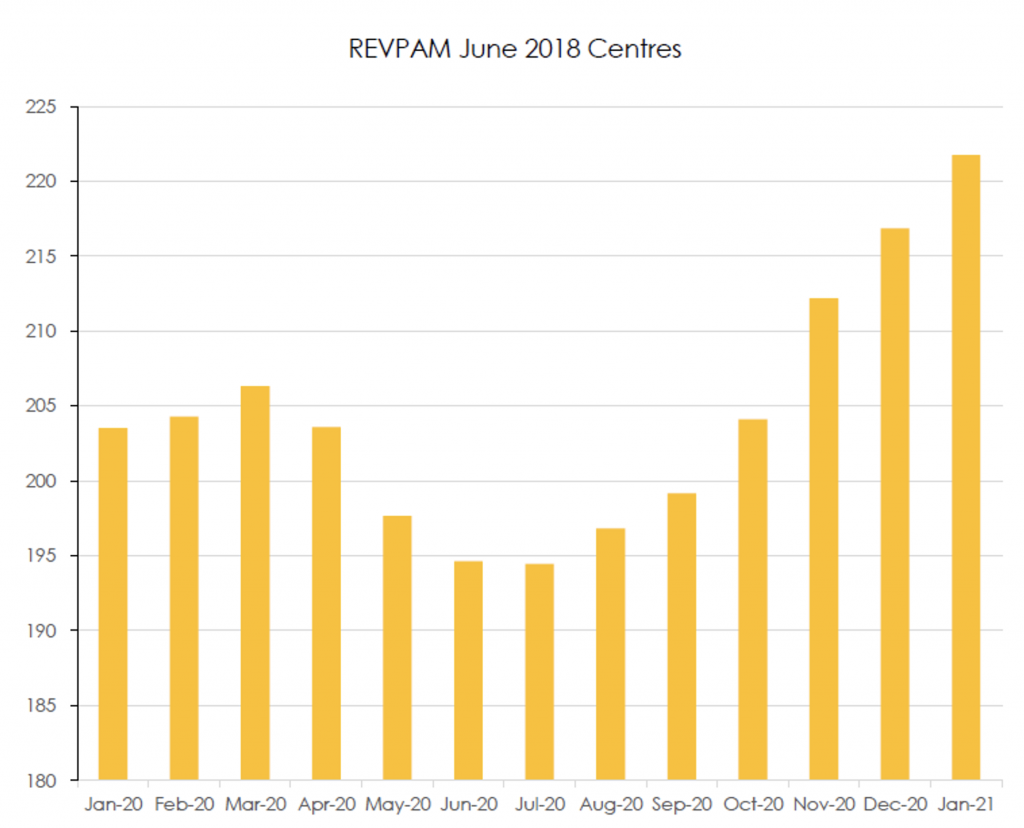

Rental income economics of storage units are easy to understand – revenue is maximised by having as many storage units occupied for as high a price as you can manage for as long possible. Rate x Occupancy is called REVPAM (Revenue per available metre) and is the critical metric the market follows when assessing NSR’s management’s ability to create value. NSR’s acquisition strategy has doubled the size of its portfolio in the past 3 years, but in doing so it has diluted the REVPAM of the portfolio as NSR have been acquiring less mature centres (on average) clouding the unit economics of its asset pool. We think the direction of REVPAM is changing driven by NSR’s use of technology and changes to demand for storage in our post-COVID world.

Blockbuster net lettable area or floor space growth on NSR’s acquisition growth strategy.

Source: NSR 1H21 Results presentation

Technology

Whilst the economics of storage centres is easy to understand, optimising revenue outcomes from them it appears isn’t. At NSR the key REVPAM metric occurs across a portfolio of many thousands of individual units, of different shapes and sizes, in centres at various stages of their maturity cycle, in 200 plus different locations, all of which have their own specific market conditions to manage to, including local competition and supply and demand dynamics. So in 2020 NSR, now with sufficient scale in its portfolio, turned to technology to optimise revenue management. This involved resetting rates in the market for new customers (not existing ones) in to drive occupancy for each class of units, on a centre by centre basis to a desired level and then managing rates for the entire book, including price rises for those units on lower rates. Effectively trading price for occupancy and vice versa, to obtain an efficient REVPAM frontier by unit type, by centre in an automated way in real time. We think technology can make a difference here and this drives a permanent structural uplift in REVPAM, in a step shift way to that point of optimised REVPAM equilibrium for each market. And we think we have started to see this work, post a small short COVID induced bump REVPAM is now ripping.

REVPAM is coming back, and we think there is more to go.

Source: NSR 1H21 results presentation

Technology improvements have been made elsewhere too; we have also noted an improved user experience on the NSR website, you can now go through the whole process contactless; from search, obtain a real time quote, pay, receive access instructions and digital keys, and gain access to your new storage unit without interacting with another human. No doubt handy in a post-COVID world. But it’s also a tool for improving lead conversion and deepening the demand pool on a centre by centre basis, resonating the impact of the revenue management technology deployment outlined above.

Post-COVID tailwinds

Sometimes timing is everything. A technology tool resetting prices for NSR’s front book during a pandemic probably wasn’t plan A. But it does position the portfolio well to deal with demand trends in the aftermath of one in our view.

Work from home (WFH) lifestyle shift started on the kitchen table alongside the kids’ homework, which was ok on a temporary basis. But there is now a desire to have the ability to WFH, if and when you want to. The spare room is being turned into the home office, the garage has become the home gym and the demand for incremental storage is up. Economic activity generally, housing activity specifically are also historically correlated with rising demand for storage, and those are both strong right now. We think that revenue optimising technology will be lifting price strongly, driving REVPAM further. Maybe the market will start to consider that latent optionality we see?

Latent optionality 2: Valuation driven by resilient property asset performance

Storage assets hardly missed a beat during the COVID downturn. At its COVID pain peak NSR’s rent collection dipped just 0.2 per cent. Management reported in May 20 that of its 70,000+ customers less than 100 had requested COVID hardship assistance. The other listed storage player, Abacus Property (ASX:ABP), reported similar experiences. Storage asset resilience and performance were in stark contrast to that seen in other REIT asset sectors, especially retail and office. We don’t think that this has gone un-noticed. And certainly not by property valuers.

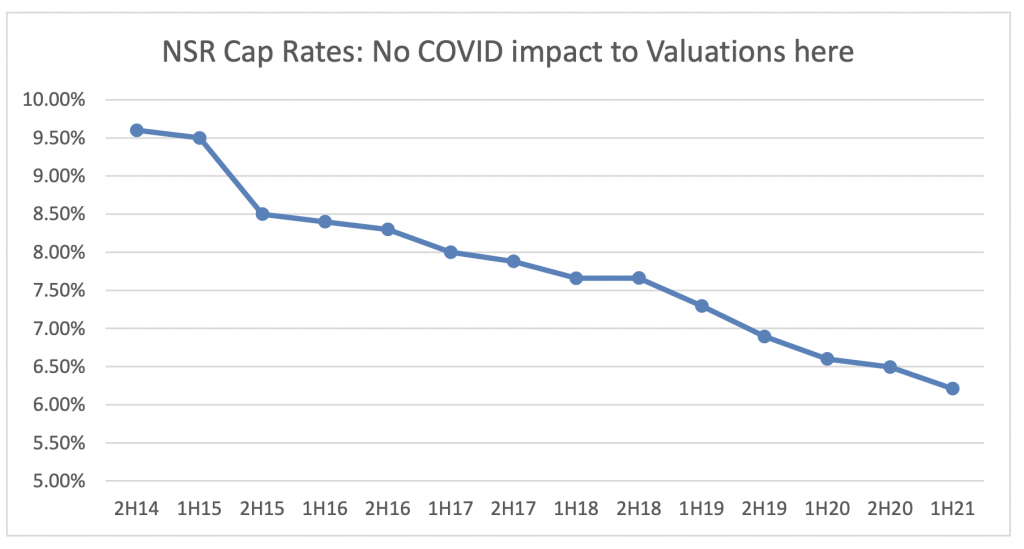

NSR, like other REITs, gets parts of its asset portfolio revalued each accounting period, valuers have continued to raise their valuation metrics for NSR’s portfolio, this is observed in a continued decline in NSR’s cap rate. We think the resilience of storage assets is going to continue to attract capital to the asset class in a post-COVID world, we think it’s likely that cap rates continue to fall and asset inflation continues.

Source: NSR & Montgomery

Asset valuations are important to NSR, and NSR’s equity holders. REVPAM is a key input into the valuation process, as REVPAM lifts, so does the income stream for the assets, which the valuers use to determine their value. Higher REVPAM and income, and falling cap rates, point to strong asset price, or NTA growth for NSR’s portfolio. NTA growth is a key input to how investors assess value in NSR’s share price. In addition, stronger asset revaluations allows more debt funding to be made available against the portfolio, which NSR have historically used to fund acquisitions to drive growth.

Is NSR an acquisition target?

The market structure and characteristics of the storage market is attractive to long term investors. Today there are around 2000 storage assets in Australia and New Zealand, the top 3 players own around 20 per cent or so. NSR is the largest player at 10 per cent share, beyond those top 3 players it starts getting fragmented, beyond the top 10 you are starting to meet small family operators, with single digit numbers of centres under their control and limited means to acquire the capital needed to grow. The opportunity to consolidate this market and enjoy multi-years of growth in a resilient asset class is attractive. NSR is seen as a platform to enable that to happen by large financial and storage industry players from overseas.

In early 2020 NSR had three bids to acquire it from three separate parties. GAW Capital & Warburg Pincus kicked a process off that resulted in NYSE listed Public Storage (NYS:PSA) emerging with the highest bid. That was in February 2020, PSA pulled out when COVID struck in early March. Since then ASX listed competitor Abacus Property Group (ASX:ABP), which owns the Storage King brand here in Australia as part of a broader property portfolio, has taken a now 9.9 per cent stake in NSR, announcing it has lifted its holding as recently as 4/3/21.

Who own’s NSR for the long term remains to be seen, but in the meantime we look forward to seeing the impact of the recent technology deployments on key value drivers in NSR’s business.

The Montgomery Small Companies Fund owns shares in National Storage REIT. This article was prepared 22 April 2021 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade these National Storage REIT you should seek financial advice.

Simon Johns

:

Hi Gary, thanks so much for taking the time to respond and for the quality of your response

Cheers

Simon

Simon Johns

:

Hi Gary

Besides NSR could you recommend any high quality reit that you think are worthy or further reasearch?

Gary Rollo

:

Hi Simon. Thanks for your message. Interesting question, in a relatively boring sector! REITs aren’t an area where we normally go hunting for investments, as we look to place capital in the control of talented managers with their hands deftly gripped to the value creation levers in their business. REITs are more of a passive rather than an actively managed value creation play. However we own more REITs than we have done for quite some time. They fall into two categories – one like NSR where management value add is driving the business, INA is another where its possible for management to add value in market exposures that we like (sea-change housing for seniors). The second category is where we note the valuation disconnect between real world asset prices and the valuation implied by the market. We think its worth looking at COF and WPR in that regard, both are trading at implied cap rates for their assets that are quite disconnected from the prices we can see being paid in the “real” world. Who is right the real world or the stock market? Regards. Gary