Market commentary

-

Keep an eye on New Zealand as the lead indicator

David Buckland

December 14, 2023

In this week’s video insight, I delve into the discussions surrounding the Reserve Bank of New Zealand’s proactive approach to inflation, the nuanced shifts in major economies, and the potential impacts of tightening monetary policies. continue…

by David Buckland Posted in Global markets, Market commentary, Video Insights.

-

Aura High Yield SME Fund: Low dispersion of returns and no negative months (to date)

David Buckland

December 13, 2023

The standard deviation, or measure of the amount of variation, of the S&P/ASX 300 Accumulation Index over the period between 1 August 2017 and 31 October 2023 was 15.2 per cent. One standard deviation (or plus or minus 15.2 per cent) means the dispersion around the average occurs 68 per cent of the time, whilst two standard deviations (or plus or minus 30.4 per cent) means the dispersion around the average occurs 95 per cent of the time. continue…

by David Buckland Posted in Market commentary.

- 8 Comments

- save this article

- POSTED IN Market commentary

-

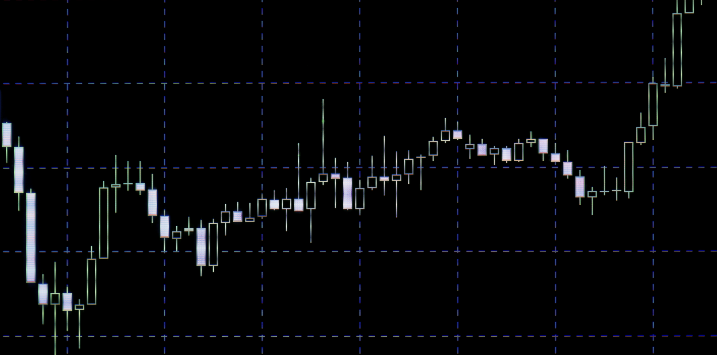

Are small caps finally taking off?

Roger Montgomery

December 12, 2023

Back in July, I wrote about the historically large gap between large and small-cap companies, noting that the extremely narrow rally in the largest technology companies, now more commonly referred to as the Magnificent Seven, resulted in many smaller caps being relatively undervalued. The highest-quality names with earnings growth may present a compelling opportunity, especially if professional investors conclude the macroeconomic and interest-rate backdrop is supportive. continue…

by Roger Montgomery Posted in Global markets, Market commentary.

- save this article

- POSTED IN Global markets, Market commentary

-

What can we expect from stocks and bonds in 2024?

Roger Montgomery

December 8, 2023

Since late October, financial markets have witnessed a significant shift, adjusting to a softer labour market and persistent disinflation. As an aside, the latter – disinflation – was a condition we wrote about a year ago, suggesting it should support the share prices of innovative growth companies, especially those with pricing power. continue…

by Roger Montgomery Posted in Global markets, Market commentary.

- save this article

- POSTED IN Global markets, Market commentary

-

Could deflation be the next surprise?

Roger Montgomery

December 7, 2023

After the well-documented U.S. money printing spree of 2020-21, something interesting happened in the U.S.: Inflation started picking up in 2021-2022. Just as it takes time for water to fill a bucket, it took time for inflation to emerge, but when it did, annualised inflation averaged 7.7 per cent for 18 months from January 2021 to July 2022 (Figure 1). continue…

by Roger Montgomery Posted in Companies, Global markets, Market commentary.

-

Except for AI, private equity and VC investors are sitting on the sidelines

Roger Montgomery

December 6, 2023

Private market data provider Pitchbook recently released their quarterly Emerging Technology Indicator (ETI) insights, revealing the subsectors in which private equity deals, and angel, seed, and early-stage venture capital (VC) fund-raising rounds are being completed. continue…

by Roger Montgomery Posted in Market commentary.

- save this article

- POSTED IN Market commentary

-

Highlights from ChatGPT’s first year: AI evolution unpacked.

Roger Montgomery

December 4, 2023

It’ll be a surprise to many but last week, on November 30, was ChatGPT’s first birthday. While many see Artificial Intelligence (AI) and large language models (LLM) as humanlike, AI’s first year has been nothing like the first year of a human’s life. A human child’s first year is mostly consumed with sleeping and feeding. ChatGPT’s first year has been far more dramatic. continue…

by Roger Montgomery Posted in Market commentary, Technology & Telecommunications.

-

Boosting your portfolio’s cash component in a high inflation environment

David Buckland

December 1, 2023

On the day of the Melbourne Cup, the Reserve Bank of Australia (RBA) announced an increase of the official cash rate to 4.35 per cent. Interestingly, the term deposit rates offered by my friendly bank remained the same as the previous week. This suggested an unwillingness of the bank to increase interest rates on deposits, despite the 13th RBA official cash rate hike in the past 18 months. continue…

by David Buckland Posted in Aura Group, Market commentary.

- save this article

- POSTED IN Aura Group, Market commentary

-

MEDIA

Ausbiz – A deflationary surprise?

Roger Montgomery

December 1, 2023

In my recent interview with Ausbiz, I aimed to provide insights into prevailing economic trends, particularly focusing on the U.S. economy. It’s evident that the market sentiment has transitioned from recession concerns to the possibility of enduring inflation, a shift I believe might stem from potentially overreaching actions by the Federal Reserve to curb economic momentum. Additionally, I discussed the likelihood of the Australian economy already being in a recession and the potential impact on both the broader equity market and small-cap stocks in general. You can watch the full interview here. Ausbiz – A deflationary surprise?

by Roger Montgomery Posted in Economics, Market commentary, TV Appearances.

- save this article

- POSTED IN Economics, Market commentary, TV Appearances

-

Temple & Webster’s share price soars following its AGM update

Roger Montgomery

November 30, 2023

As we monitor the behavior of the Australian consumer, it’s crucial to acknowledge that consumption constitutes approximately 50 per cent of Australia’s GDP, significantly influencing decisions related to interest rates. The robust trading update presented during the annual general meeting (AGM) by Temple & Webster Group (ASX: TPW), an online retailer specialising in furniture and homewares, prompts thoughtful consideration. continue…

by Roger Montgomery Posted in Companies, Market commentary.

- save this article

- POSTED IN Companies, Market commentary