Investing Education

-

WHITEPAPERS

Long weekend reading: To yield or not to yield?

Roger Montgomery

October 3, 2014

Instant income by way of dividend payouts, or nothing now in the interest of potential long-term wealth accumulation? In Part I of this exclusive subscriber-only White Paper, I have a look at the conversation surrounding yield.

by Roger Montgomery Posted in Investing Education, Whitepapers.

-

Bubble watch #13 – get ready

Roger Montgomery

September 18, 2014

In recent months, the number of very successful investors doing ‘it’ themselves has surged.

So here’s a question:

Do you think the number of very successful investors will continue to surge when the market falls? continue…

by Roger Montgomery Posted in Insightful Insights, Investing Education, Value.able.

-

Our process in practice

Ben MacNevin

September 16, 2014

Today’s blog post is an example of our investment process in practice, the result of which has enforced our commitment to investing in quality companies with bright prospects at attractive discounts to our estimates of their intrinsic value. continue…

by Ben MacNevin Posted in Insightful Insights, Intrinsic Value, Investing Education, Montgomery News and Updates.

-

A pleasing two years for The Montgomery Fund

David Buckland

September 4, 2014

The Montgomery Fund was launched on 17 August 2012, with a minimum initial investment of $25,000, and has just celebrated its second anniversary. In the period to 31 August 2014, The Fund has delivered an absolute return of 51.32 per cent, after expenses. continue…

by David Buckland Posted in Investing Education, Montgomery News and Updates.

-

Looking again at value

Tim Kelley

August 18, 2014

In recent months we have looked at valuation from a few perspectives. Our conclusion has been that the Australian market is on the expensive side of fair value, but not to an alarming degree. continue…

by Tim Kelley Posted in Insightful Insights, Investing Education, Value.able.

-

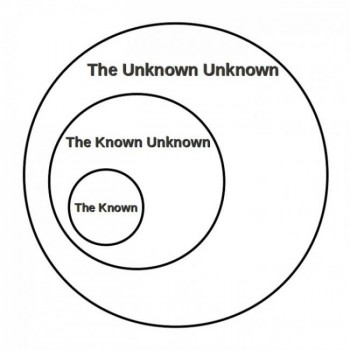

Learn your knowns and unknowns

Roger Montgomery's Team

August 1, 2014

In this article for Cuffelinks, Roger helps investors to better judge when they know enough about a company to make an investment. Read here.

by Roger Montgomery's Team Posted in Investing Education.

- 1 Comments

- save this article

- POSTED IN Investing Education

-

Colonial FirstWrap: Looking for support

Scott Phillips

July 25, 2014

We’ve had a lot of demand from advisers wanting to access The Montgomery Fund on the Colonial FirstWrap platform – so if you’re an adviser and would like to see it added, then let us know. Alternatively, if you aren’t a financial adviser but you know that your adviser uses FirstWrap, feel free to pass them my details. continue…

by Scott Phillips Posted in Investing Education.

- save this article

- POSTED IN Investing Education

-

The Top 10: What is possibly cheap right now

Roger Montgomery

July 21, 2014

Each week, we scan the market for fresh opportunities. If you’re doing the same – only to come up with a very small handful of desirable candidates (many of which you probably own already) – then you’re in good company. We can’t find a plethora of opportunities either. continue…

by Roger Montgomery Posted in Insightful Insights, Investing Education.

-

Going back to (investment) basics

Roger Montgomery

July 15, 2014

In this interview with Ross Greenwood on Radio 2GB on July 15, Roger goes back to investment basics and reminds us why waiting for good businesses to become bargains is the best strategy for long-term success. Listen here.

by Roger Montgomery Posted in Investing Education.

- save this article

- POSTED IN Investing Education

-

Where are we in the valuation cycle?

Tim Kelley

July 4, 2014

This is a frustrating market for value investors. Like many of our ilk, we are struggling to find high quality companies trading at prices that we consider attractive. As a result, we now hold significant cash balances in our funds waiting for opportunities to emerge. continue…

by Tim Kelley Posted in Insightful Insights, Investing Education.