Insightful Insights

-

Nothing happened but who should we believe?

Roger Montgomery

February 14, 2013

It seems even the facts are up for interpretation when reading reports of what happened overnight. Is the invention of news signs of indigestion?

As you know I have long suggested that the daily market wrap is a bit of an information free zone for long-term investors. Occasionally however it can be funnier than the comic strips. This morning the overnight reports that arrived in our inbox gave us reason to have a chuckle.

Perhaps nothing happened but no journalist could possibly write “nothing happened”…

by Roger Montgomery Posted in Insightful Insights, Market Valuation, Value.able.

-

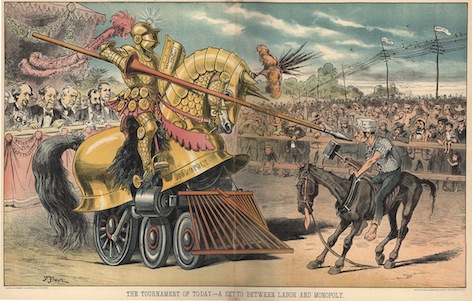

The US – Capital’s share of output at an all time high

David Buckland

February 14, 2013

The US S&P 500 recorded a multi-year low in March 2009, at 667 points.

Today the Index is at 1517 points, delivering a capital gain of 127 per cent in less than four years, or a compound annual average return of 23 per cent.

A significant reason for this rally is based on the fact “labour’s share of output” has, in recent years, declined from 70% to 64%.

continue…by David Buckland Posted in Insightful Insights, Value.able.

- 2 Comments

- save this article

- POSTED IN Insightful Insights, Value.able

-

Too Much Bull?

Roger Montgomery

February 13, 2013

Last week several media outlets reported that Merrill Lynch had released a prediction that the market may correct. Without giving you the entire report – you need to become a client of Bank of America Merrill Lynch for that (To enquire about becoming a client contact: Bank of Amercia Merrill Lynch: Lvl38/ 1 Farrer Pl, Governor Phillip Tower, Sydney NSW 2000 (02) 9225 6500) – we thought you should be aware of the interesting work they are doing.

continue…by Roger Montgomery Posted in Insightful Insights, Market Valuation, Value.able.

-

MEDIA

Retail on the Rise (Again)

Roger Montgomery

February 12, 2013

In discussion with ABC1’s Ticky Fullerton Roger provides his insights into the outlook for Retail Stocks in the half-year reporting period.

This interview was broadcast 12 February 2013. Watch here.

by Roger Montgomery Posted in Consumer discretionary, Insightful Insights, TV Appearances.

-

Cochlear? A second bite of the cherry for investors?

Roger Montgomery

February 11, 2013

Cochlear will be familiar to all of you. The company manufactures an implant that provides the gift of hearing to many thousands of hearing impaired people around the world. As you are also now aware Cochlear voluntarily recalled its Nuclear CI500 series in September 2011. Cochlear immediately switched to distributing its previous Nucleus CI24RE model with the new processors. And finally, you would be aware that Montgomery believed the recall was a rare buying opportunity buying as many shares as our portfolio construction process would allow at $50.

continue…by Roger Montgomery Posted in Insightful Insights, Technology & Telecommunications.

-

MEDIA

Back to Equities? We never left!!

Roger Montgomery

February 8, 2013

In this special ‘Bonds vs Equities’ edition of Sky Business’ Your Money Your Call (broadcast 8 February 2013), Roger provides his insights into why the so-called rotation back to equities is a fallacy for value investors, and in discussion covers a broad range of topics including:-

– Inflation Linked bonds

– The likelihood of a GFC Part 2

– The impact of the new prevalence of SMSFs

– and the performance of specific stocks including ARB Corporation, QBE and Sydney AirportWatch here.

by Roger Montgomery Posted in Insightful Insights, TV Appearances.

- save this article

- POSTED IN Insightful Insights, TV Appearances

-

The Meaning of Value

Roger Montgomery

February 8, 2013

Turning your back on speculation and becoming a value investor would be impossible without an understanding of the tenets of value and valuation.

In this interview with the ASX’s Tony Hunter and my friend Michael Glennon, we explore aspects of valuing companies as well as the practical application of a value investing mindset.

Enjoy!

by Roger Montgomery Posted in Insightful Insights.

- 2 Comments

- save this article

- POSTED IN Insightful Insights

-

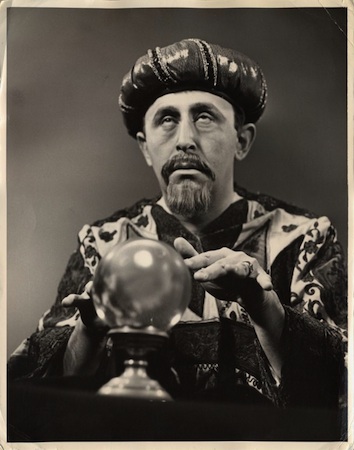

Forecasts and predictions

Tim Kelley

February 7, 2013

With the market having woken up in a good mood in January, we have recently seen a number of commentators revise upwards their forecasts for where the index may finish the year. Declaring 2013 to be a year for the bulls is very much in fashion. Admitting how wrong most of these forecasts were for 2012 is rather less fashionable.

To add some context, I thought it might be helpful to refer to some interesting research that has been done on the reliability of expert forecasts.

continue…by Tim Kelley Posted in Insightful Insights, Investing Education.

-

Dear Under-50 Investor

Roger Montgomery

February 6, 2013

Dear Under-50 Investor,

Superannuation will be no good for you if you are under 50 today, so invest the absolute minimum amount into super.

That means, no salary sacrificing, no co-contributions, no non-concessional contributions. Ignore the calls to save tax and boost your super you will be soon contributing 12% of your salary anyway. This is not advice but a challenge to others, much more qualified than I, to dispute it and explain why I am totally wrong. By the way, as a fund manager of course, I am financially delighted to be completely wrong on this one!

continue…by Roger Montgomery Posted in Insightful Insights, Investing Education.

-

MEDIA

Stick to stocks with edge

Roger Montgomery

February 1, 2013

In his February 2013 Money Magazine column, Roger outlines why it serves rational value investors to ignore the predictors of market fluctuations. Read here.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Market Valuation, On the Internet.