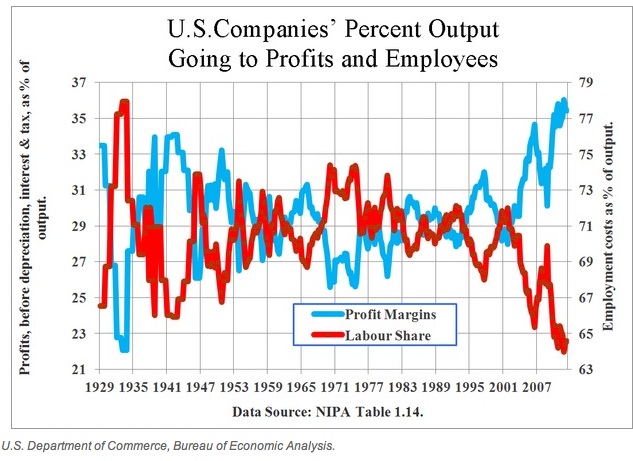

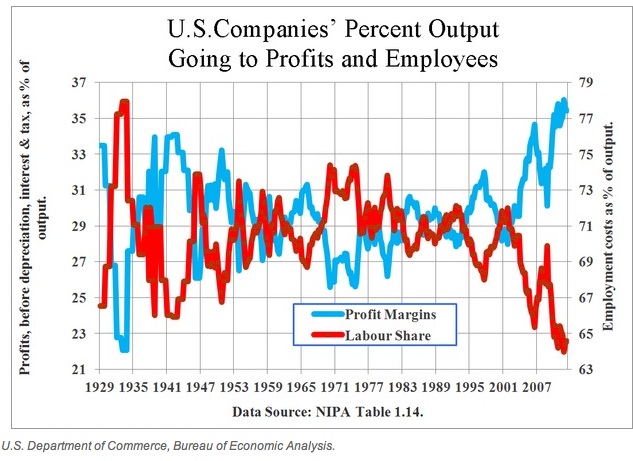

The US – Capital’s share of output at an all time high

The US S&P 500 recorded a multi-year low in March 2009, at 667 points.

Today the Index is at 1517 points, delivering a capital gain of 127 per cent in less than four years, or a compound annual average return of 23 per cent.

A significant reason for this rally is based on the fact “labour’s share of output” has, in recent years, declined from 70% to 64%.

Conversely, “capital’s share of output” has jumped from 30% to an all time high 36%.

Those who watched the ABC’s Four Corners program on Monday night will be horrified at the under-employment in the USA.

A large number of corporations are keeping a lid on pay rises and driving through improved profit margins.

Some academics however argue US profit margins are (eventually) mean reverting.

Any reversal in the “profit margin/ labour share of output” will have interesting ramifications for the price of various asset classes, especially long bond yields.

MORE BY DavidINVEST WITH MONTGOMERY

Chief Executive Officer of Montgomery Investment Management, David Buckland has over 30 years of industry experience.

David is a deeply knowledgeable and highly experienced financial services executive. Prior to joining Montgomery in 2012, David was CEO and Executive Director of Hunter Hall for 11 years, as well as a Director at JP Morgan in Sydney and London for eight years.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Gurkamal Kanwar

:

Can you please provide a clear definition of ‘labour’s share of output’. What do you mean by that?

sean.trewartha

:

I see sometime in the future, their is possibly going to be a huge pool of unemployed massive interest rates and fantastic wages for the people who can manage to keep their jobs….