Insightful Insights

-

Making sense or losing cents?

Roger Montgomery

June 3, 2014

If you’re a smaller shareholder in either Westfield Group (ASX: WDC) or Westfield Retail Trust (ASX: WRT), then you might be forgiven for thinking you’re in the middle of World War Three. continue…

by Roger Montgomery Posted in Consumer discretionary, Insightful Insights, Property.

-

Japanese CPI growth hits 23-year high

David Buckland

June 2, 2014

The make up of consumer price index (CPI) data in many countries is not necessarily closely related to the cost of living. For example, in the US, ‘everyday’ consumer expenditure on food and energy has less than a 25 per cent weighting on their CPI, and is excluded altogether from a ‘core’ inflation. continue…

by David Buckland Posted in Economics, Foreign Currency, Insightful Insights.

-

WHITEPAPERS

Just in case you were thinking of looking at the Resource Service Sector…

David Buckland

May 30, 2014

Yesterday, the Bureau of Resources and Energy Economics released their biannual Resources and Energy Major Projects—April 2014 report, providing analysis on resources, energy, infrastructure and processing projects. continue…

by David Buckland Posted in Energy / Resources, Insightful Insights, Whitepapers.

-

Looking to: SAI Global

Ben MacNevin

May 29, 2014

SAI Global (ASX: SAI) is a company that we’ve identified as having some attractive investment prospects, but one that we prefer to watch rather than invest in. Since it has recently received an indicative and non-binding proposal from private equity, was it the correct decision to wait on the sidelines? continue…

by Ben MacNevin Posted in Companies, Insightful Insights.

- 1 Comments

- save this article

- POSTED IN Companies, Insightful Insights

-

Mini Bubble Burst

Russell Muldoon

May 28, 2014

In October last year, we offered you the opportunity to buy a diversified digital ‘business’ that generated $16.9m in revenue, and made a $4.1m loss in 2013 – for $292m. Whilst this didn’t sound like a great deal (and it wasn’t), the business had amazing prospects according to market announcements that were replete with industry buzzwords such as ‘cloud’, ‘mobile’, ‘payments’ and ‘online scale’. In reflection of this, shares in the company were performing strongly. continue…

by Russell Muldoon Posted in Insightful Insights.

- 1 Comments

- save this article

- POSTED IN Insightful Insights

-

Boost your returns, Part II – It’s alive!

Tim Kelley

May 28, 2014

Boost your Returns Part 2 – It’s Alive!

In Part 1 of our Boost your Returns series, we introduced the idea of using pattern recognition technology to assist in the selection of potential investment candidates. You may recall we proposed using a machine learning model called a Support Vector Machine (SVM) to identify the features that separate good investment opportunities from poor ones. Having done that, we can aim the model at the A1-B3 universe in search of some hidden gems. continue…

by Tim Kelley Posted in Insightful Insights.

- 5 Comments

- save this article

- POSTED IN Insightful Insights

-

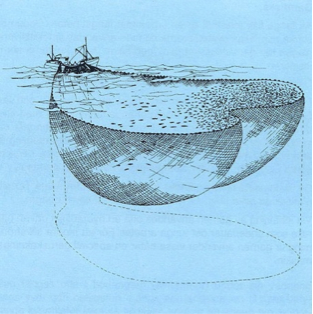

Russia and China’s 30-year gas deal

David Buckland

May 27, 2014

After years of negotiations, Russia’s Gazprom and China’s National Petroleum Corporation have signed a historic gas deal which will supply China with natural gas for the next 30 years. continue…

by David Buckland Posted in Energy / Resources, Insightful Insights.

-

Telcos, revamped

Russell Muldoon

May 26, 2014

In the last decade or so, Australian mobile phone services have risen from 8 million to 30.2 million. Internet penetration has risen from 30 per cent to 89 per cent of households. And, despite unique anti-syphoning legislation, which ensures free-to-air TV gets to broadcast the big sporting events; Pay TV has increased to 30 per cent household penetration (despite being stuck there since 2008), from virtually nothing in 1995. continue…

by Russell Muldoon Posted in Insightful Insights, Market Valuation, Technology & Telecommunications.

-

Boost your returns – Join our online course

Tim Kelley

May 23, 2014

The field of machine learning has advanced in leaps and bounds in recent decades. A milestone was passed in 1996 when IBM’s Deep Blue became the first machine to win a chess game against a reigning world champion and, since then, advances in computing power and pattern recognition technologies have seen machines improve their performance at tasks that previously could only be accomplished by humans. continue…

by Tim Kelley Posted in Insightful Insights.

- 7 Comments

- save this article

- POSTED IN Insightful Insights

-

Caterpillar machine sales cratering outside North America

David Buckland

May 22, 2014

Caterpillar Inc’s March 2013 quarterly net income was down 45 per cent to $0.88 billion, on a 17.5 per cent reduction in revenue to $13.2b (click here to read our original post on the reduction). continue…

by David Buckland Posted in Companies, Insightful Insights.

- save this article

- POSTED IN Companies, Insightful Insights