GEM’s Multicurrency Debt Programme

G8 Education (ASX: GEM) have just announced a multicurrency debt issuance programme to issue $500m of notes, denominated in any currency agreed between G8 and any dealer.

This announcement does not come as a surprise to us, as the company had previously informed investors that they were looking to raise money, but were spending a lot of time in Singapore where debt is significantly cheaper.

We recall a previous childcare group that raised capital to buy more centres at higher and higher multiples, before borrowing a stack of money to expand overseas. We are not implying that the same pattern is occurring here, but we do believe there are some signs investors should look out for.

First, of course, is that the earnings multiples for the largest recent purchase was some degree higher than the company had previously indicated. We also note that the stated multiple is based on a forecast EBITDA in 2015 – more than a year away.

The company today announced the debt issuance, releasing a 356-page document entitled the Establishment of Multicurrency Debt Issuance Programme, along with a 33-page Investor Presentation. Rather than wading through the entire 356 pages, below are some covenants we think are worthy of keeping your eye on.

[Note: Current debt is $114m, net debt ~$0m, and market capitalisation $1.5b]

(vi) Any security interest incurred by any member of the Group including those described in sub-paragraphs (i) to (iv) above provided that, upon the incurrence thereof, the ratio of Consolidated Secured Debt to Consolidated EBIT (as defined below) is not more than 3.0 : 1.

(b) The Issuer has further covenanted with the Trustee in the Trust Deed that for so long as any of the Notes or Coupons remains outstanding, it will ensure that:

(i) the Consolidated Total Equity will not at any time be less than A$280,000,000;

(ii) the ratio of Consolidated Total Borrowings to Consolidated Total Equity will not at any time be more than 1.75 : 1;

(iii) the ratio of its Consolidated Secured Debt to Consolidated Total Assets will not at any time be more than 0.5 : 1 ; and

(iv) the ratio of Consolidated EBITDA to Consolidated Finance Charges will not at any time be less than 3.5 : 1.

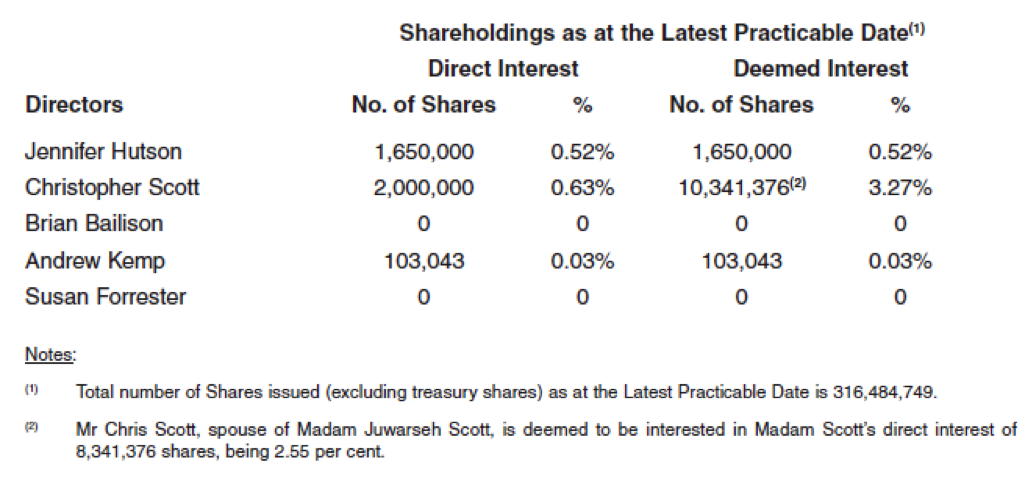

Finally, and worthy of factual observation only, is that Chris Scott has included the interests represented by the 8.3m shares controlled by his estranged wife as a deemed interest, but not the 20m shares stated by The Australian Financial Review today to be owned by the Geosine entity, controlled by Ms Kimberly Yin and reported to be of the same address as Mr Scott.

Sam Fimis

:

Hi Roger, considering the above, are you still a fan of the childcare industry in general, and if so, what are your general thoughts on Affinity Education Group (ASX:AFJ)? Keep up the good work.

Roger Montgomery

:

Hi Sam,

generally, I think it is fair to make the observation that their appears to be little or no real synergies from scale. We might be proven wrong and we have been discussing this issue in our research meetings but that’s the question…

craig.cory.54

:

My childcare property valuer mate has never liked them. Told me he actually heard that Eddy G walked past a mirror the other day and smiled, then said ‘see that bloke (in the mirror), he’s the same one Mr G8 will soon be seeing when he looks in his mirror!’ Caveat emptor, indeed.

Terry Cleal

:

Do you still hold G8 shares

Roger Montgomery

:

No.

komal.pandya.940

:

So have you taken any significant action(s), in view with the above?

Roger Montgomery

:

yes