Insightful Insights

-

RBA: Liquidity, here today but tomorrow?

Ben MacNevin

April 22, 2015

The latest speech by the Governor of the Reserve Bank of Australia (RBA) is well worth a read. RBA speeches typically provide greater insights of issues considered by the Board, and it seems that the Bank is becoming increasingly concerned with the state of global financial markets. continue…

by Ben MacNevin Posted in Financial Services, Insightful Insights.

-

Own Telco stocks? Read this.

Scott Shuttleworth

April 21, 2015

As reported in the Sydney Morning Herald, iiNet (ASX: IIN) customers have reportedly experienced internet speed slowdowns from the later afternoon into the evening post the release of its Netflix offering. Note, watching Netflix doesn’t use up any of the users monthly data allowance. continue…

by Scott Shuttleworth Posted in Insightful Insights, Technology & Telecommunications.

-

Be Alert and Alarmed!

Roger Montgomery

April 20, 2015

If you think Sydney’s record auction clearance rate is high, have a look at the number of billionaire hedge fund managers warning the US Federal Reserve to wait before raising rates, lest it be a mistake from which reversal will not be easy nor pretty. continue…

by Roger Montgomery Posted in Foreign Currency, Insightful Insights.

-

China’s softening demand becomes a reality

David Buckland

April 17, 2015

In Tuesday’s Video Insight I discussed the fact that Australia’s Terms of Trade had nearly doubled from its 55 year average of 67 to 118.5 Index Points by mid-2011. However, with the slowdown in the Chinese economy, I suggested Australia’s Terms of Trade, which had declined 26 per cent to 87.9 Index Points by late 2014, could get somewhat worse over the foreseeable future. continue…

by David Buckland Posted in Insightful Insights.

- 3 Comments

- save this article

- POSTED IN Insightful Insights

-

BOARD MOVEMENTS FOR MARCH 2015

Roger Montgomery

April 17, 2015

We recently received an interesting email, that we thought we should share with our blog subscribers.

by Roger Montgomery Posted in Insightful Insights.

- save this article

- POSTED IN Insightful Insights

-

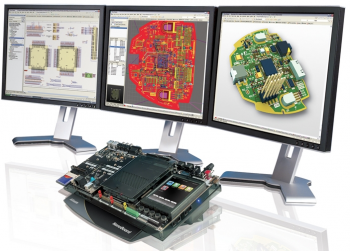

Altium continues its run

Scott Shuttleworth

April 16, 2015

On Friday, Altium Limited (ASX: ALU) reported results from the third quarter and its stock enjoyed a swift ride north to $5.00 shortly after. continue…

by Scott Shuttleworth Posted in Companies, Insightful Insights.

- 3 Comments

- save this article

- POSTED IN Companies, Insightful Insights

-

Housing Bubble?

Roger Montgomery

April 15, 2015

My friends Ticky Fullerton and Michael Yanda at the ABC are running a three part series on Sydney’s property market. continue…

by Roger Montgomery Posted in Insightful Insights, Property.

- 2 Comments

- save this article

- POSTED IN Insightful Insights, Property

-

Is Time Money?

Tim Kelley

April 14, 2015

Just for some light entertainment, here’s a question to test your sense of time and money. continue…

by Tim Kelley Posted in Insightful Insights.

- 11 Comments

- save this article

- POSTED IN Insightful Insights

-

Is it business as usual for IMF Bentham?

Ben MacNevin

April 13, 2015

In a class action funded by IMF Bentham (ASX: IMF), the Full Federal Court of Australia has ruled in favour of ANZ, arguing that late payments on credit card fees are not exorbitant or unconscionable. While IMF Bentham has announced its intentions to pursue the matter to the High Court, the implications of a high-profile loss would certainly be front of mind for investors in the company. continue…

by Ben MacNevin Posted in Financial Services, Insightful Insights.

-

What does the future hold for the Big 4 Banks?

Russell Muldoon

April 11, 2015

Let’s say four years ago you were offered the opportunity to buy a portfolio of well-known businesses for $272.3 billion, which are expected to generate $24 billion in after-tax earnings. While this implies an earnings yield of 8.8 per cent, you decide to forgo the investment. continue…

by Russell Muldoon Posted in Financial Services, Insightful Insights, Investing Education.