Insightful Insights

-

Will David beat Goliath?

Roger Montgomery

April 6, 2011

I am deviating from my regular style of post, handing over the stage to Value.able Graduate Scott T. Scott T has taken up a fight with conventional investing by tracking the performance of a typical and published ‘institutional-style’ portfolio against a portfolio of companies that receive my highest Montgomery Quality Ratings. I reckon in the long run the A1/A2 portfolio will win, but let’s not get ahead of ourselves.

I am deviating from my regular style of post, handing over the stage to Value.able Graduate Scott T. Scott T has taken up a fight with conventional investing by tracking the performance of a typical and published ‘institutional-style’ portfolio against a portfolio of companies that receive my highest Montgomery Quality Ratings. I reckon in the long run the A1/A2 portfolio will win, but let’s not get ahead of ourselves.Over to you Scott T…

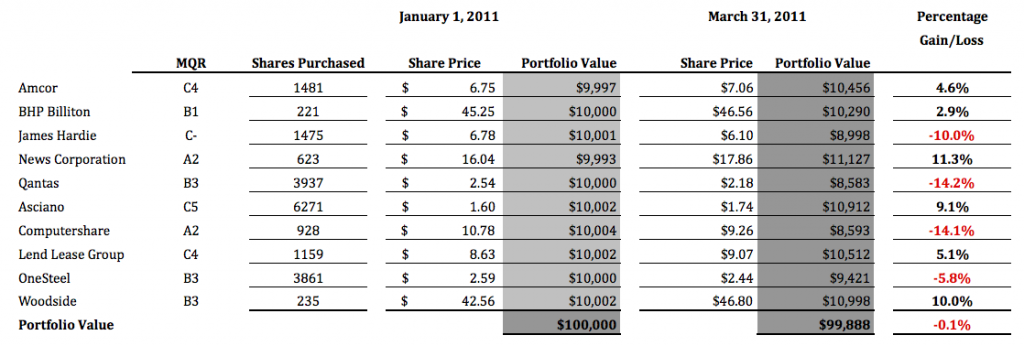

In December 2010, a large international institution released their “Top 10 stockpicks for 2011”. Click here to read the original story.

I thought it would be interesting to compare the performance of these suggestions against an A1 and A2 Montgomery portfolio.

So I imagined this scenario…

Twin brothers in there 30’s each inherited $100,000 from their parent’s estate. One was a conservative middle manager in the public service; he had little interest in the stock market or super funds and the like, so he decided to go to an internationally renowned, well-credentialed and highly respected firm to gain specific advice. Goldman Sachs advised him of their top ten stocks for 2011, so he decided to achieve diversification by investing $10,000 in each of the ten stocks he had been told about.

His twin had a small accounting practice in a regional Queensland and was a keen stock market investor. Specifically he was a student of the Value Investing method, and liked to think of himself as a Value.able Graduate. He too thought diversification would be a suitable strategy so decided to invest $10,000 in each of 10 stocks that were A1 or A2 MQR businesses and that were selling for as big a discount to his estimate of Value.able intrinsic value as he could find.

For this 12-month exercise, running for a calendar year, we shall assume that neither brother is able to trade their position. One brother has no inclination to, and his regional twin is fully invested, and more inclined to hold long anyway.

For the companies who have declared dividends in this quarter, most are now trading ex-dividend, but only 2 or 3 have actually paid. Dividends will be picked up in Q2 and Q4 of this study.

Now after just 3 months let’s look at the how the two portfolios have performed…

Institutional Bank Top 10 Picks for 2011

Montgomery Quality Rated (MQR) A1 and A2 Companies

We will visit the brothers again in 3 months on 30/6/2011 to see how they are fairing.

All the best

Scott T

How has your Value.able portfolio performed compared to the ASX 200 All Ords?

Posted by Roger Montgomery, author and fund manager, 6 April 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

Have you booked your seat The SMSF Strategy Day – for charity?

Roger Montgomery

March 8, 2011

UPDATE: I spoke with Graham, editor of thesmsfreview.com.au, this afternoon. There are only a few (around ten) seats left at the event. If you would like to attend, Graham has asked me to kindly request you do so before 5pm Friday 11 March. Click here to book online.

The SMSF Review and Alan’s Eureka Report, together with my team, have gathered some of Australia’s most respected self managed superannuation and investment experts – Alan Kohler, the Cooper Review’s Jeremy Cooper, ATO Superannuation Assistant Commissioner Stuart Forsyth, Jonathan Payne and Super System Review panel member Meg Heffron, to name a few.

The SMSF Strategy Day – for charity will be held in Sydney on Tuesday, 15 March. The day begins at 8.30am with a Keynote speech from ATO Assistant Commissioner (Superannuation) Stuart Forsyth and concludes at 4pm.

I will speak at 10.30am and at 12pm will join Alan Kohler, Jonathan Payne and Jeremy Cooper for a panel discussion to debate the most popular SMSF investment strategies.

Tickets are $77 (including GST) and 100 per cent of the net proceeds will be donated to those most affected by Australia’s recent spate of natural disasters.

Click here to book your seat online.

To download the event brochure, click here.

I look forward to meeting you next week for this valuable cause.

Posted by Roger Montgomery, author and fund manager, 8 March 2011.

by Roger Montgomery Posted in Insightful Insights, Investing Education.

-

Will JB Hi-Fi continue to groove?

Roger Montgomery

March 3, 2011

Since listing in October 2003, JB Hi-Fi has left analysts and shareholders spellbound by the impact of its extraordinary returns on equity. As you know, the Value.able magic began to fade for me late last year.

Since listing in October 2003, JB Hi-Fi has left analysts and shareholders spellbound by the impact of its extraordinary returns on equity. As you know, the Value.able magic began to fade for me late last year.Why? Well JB Hi-Fi’s business appears to be maturing. And there are only so many stores you can put on an island!

No matter where you live in Australia, and no matter which shopping centre you walk into, you will never be too far from a JBH store – music blaring behind trademark billboard style placards screaming for your attention.

Yes, there are more stores in the pipeline (currently 153 with a target of 210). At an opening rate of 15 stores a year, that implies another 4.5 years of growth. But will the new stores be as profitable as the existing ones?

Retailers often have two, if not more, ‘Tiers’ of stores and JBH is no different. Of its target of 210 stores, 160 will be Tier-1 and 50 will be Tier-2. Tier-1 stores cost $2.5 million to set up, while Tier-2 are 20% cheaper. But Tier-2 stores generate only 70% of the revenue of a Tier-1 store.

Of the 67 stores yet to open, 31 will be Tier-2. That’s half of JBH’s newest stores less profitable! Currently Tier-2 stores account for just 13 per cent of JBH’s business.

JBH has $180 million sitting idle in the bank. With growth on the horizon, suppliers covering the cost of goods, high margins and low net debt, management’s decision earlier this year to review its capital management policy didn’t come as a surprise.

As we enter the first month of Autumn, the Chairman will no doubt be preparing to reveal the results of this review.

Whatever the company’s initiatives – buy back shares, return capital or increase the dividend payout ratio – the actions will have a material impact on my Value.able estimate of JBH’s value.

With that in mind, I would like you consider which is more valuable… one dollar in a bank account earning 45% and that figure compounds at 45% year after year, or one dollar in a bank account earning 45% and that figure is paid out in dividends each year?

If you’re a Value.able graduate, I’m certain you know the answer.

The first bank account is more valuable, and that’s precisely why any changes in JB Hi-Fi’s capital management policies will have a material impact on its Value.able value.

If JBH buys back shares (a disaster if management did that at a price higher than what the shares are worth) or lifts its dividend payout ratio, then my estimate of intrinsic value will decline.

Business maturity is generally accompanied by a leveling off of intrinsic value (followed by a serious drag if a silly acquisition is made).

Watch for how JBH reports its profit. Has return on equity stabilised, or will it continue to rise? Will your estimate of JBH’s Value.able intrinsic value continue to rise?

Whist JBH remains one of my preferred retailers, I am less optimistic it will continue to generate the returns on equity shareholders have enjoyed over the past. What are your thoughts? Feel free to chat here about other retailers too.

Posted by Roger Montgomery, author and fund manager, 3 March 2011.

by Roger Montgomery Posted in Insightful Insights.

- 95 Comments

- save this article

- POSTED IN Insightful Insights

-

Is there any value around?

Roger Montgomery

February 28, 2011

Two themes seem to be gaining traction amongst Value.able Graduates at the moment.

1. Value is becoming harder to find (yes, I agree), and

2. Questions related to share buybacks have increased remarkably

This afternoon I will address the growing problem of finding value (and save buybacks for another day).

As I scan the market for great quality businesses trading at large discounts to my estimate of their Value.able intrinsic value, I am finding fewer and fewer opportunities. And when it comes to ‘small caps’, the prospects are few and far between.

On Peter Switzer’s show last Thursday a caller asked me what was good value in the small cap space. I define ‘small cap’ as anything between $300 million and $2 billion (below that is micro caps and nano caps). The fact is, only four or five of my highest Montgomery Quality Rated (MQR) businesses (think A1, A2, etc) are cheap. And most of them you already know about.

Forge and Matrix Composite are still below rising intrinsic values (more on those soon), and Cabcharge and ARB Corporation are just below intrinsic value. The remaining value is in much smaller companies and of course, the risk when investing in this space can be much higher.

Many Value.able Graduates have commented that investing in these micro and nano cap stocks is akin to scraping the bottom of the barrel. Whilst I tend to agree, I also believe that when it comes to investing, little is more satisfying than discovering an extraordinary business beyond the reach of the managed funds that have self-imposed restraints and must only invest in the top 200 or 300 companies.

There is merit in the concept of investing in small businesses that have the potential to become large. And there are profits to accrue when they do. Before you dismiss this idea, keep in mind that many of the large companies dominating Australia’s competitive landscape today were once small. Admittedly, in many cases they were small while they were buried in private ownership or private equity ownership, but in some examples they were small and grew to be large whilst they were listed. Can you think of a few examples? The Value.able community has shared a few here at my blog.

Given Australia’s small population, the big businesses that dominate the investment landscape are mature and have to make smart decisions and continually reinvent themselves to continue to grow. Think about Harvey Norman. Its failing is not in the fact that the economy is slow or that consumers can buy cheaper goods overseas. Its failing is that it is a tired old concept that has lost its mojo. The company has failed to change and failed to reinvent itself. Its own failure has seen it fall victim to the JB Hi-Fi’s and the buy-online-from-overseas-cheaper.com merchants of the world.

So whilst scouring for smaller companies may seem like bottom-fishing, there is merit in catching the smaller fish. And for those investors who prefer to stay clear, patience, bank bills and term deposits are the solution.

Far better is it to be in the safety of cash than in inferior investments, such as companies trading at premiums to intrinsic value.

Forewarned is forearmed. And to be forewarned, don’t miss out on your copy of Value.able. As I told Peter last week, there aren’t too many Second Edition copies left.

Posted by Roger Montgomery, author and fund manager, 28 February 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education.

-

What is your WOW Value.able valuation now Roger?

Roger Montgomery

February 14, 2011

With food prices on the way up and Woolies share price on the way down, I have received many requests for my updated valuation (my historical $26 valuation was released last year). Add to that Woolworths market announcement on 24 January 2011, and you will understand why I have taken slightly longer than usual to publish your blog comments.

With food prices on the way up and Woolies share price on the way down, I have received many requests for my updated valuation (my historical $26 valuation was released last year). Add to that Woolworths market announcement on 24 January 2011, and you will understand why I have taken slightly longer than usual to publish your blog comments.With Woolworths’ shares trading at the same level as four years ago (and having declined recently), I wonder whether your requests for a Montgomery Value.able valuation is the result of the many other analysts publishing much higher valuations than mine?

Given WOW’s share price has slipped towards my Value.able intrinsic value of circa $26, understandably many investors feel uncomfortable with other higher valuations (in some cases more than $10 higher),

Without knowing which valuation model other analysts use, I cannot offer any reasons for the large disparity. What I can tell you is that no one else uses the intrinsic valuation formula that I use.

So to further your training, and welcome more students to the Value.able Graduate class of 2011, I would like to share with you my most recent Value.able intrinsic valuation for WOW. Use my valuation as a benchmark to check your own work.

Based on management’s 24 January announcement, WOW shareholders can expect:

– Forecast NPAT growth for 2011 to be in the range of 5% to 8%

– EPS growth for 2011 to be in the range of 6% to 9%The downgraded forecasts are based on more thrifty consumers, increasing interest rates, the rising Australian dollar and incurring costs not covered by insurance, associated with the NZ earthquakes and Australian floods, cyclones and bush fires. The reason for the greater increase in EPS for 2011 than reported NPAT is due to the $700m buyback, which I also discussed last year.

Based on these assumptions and noting that WOW reported a Net Profit after Tax of $2,028.89m in 2010, NPAT for 2011 is likely to be in the range of $2,130.33 to $2,191.20. Also, based on the latest Appendix 3b (which takes into account the buyback), shares on issue are 1212.89m, down from 1231.14m from the full year.

If I use my preferred discount rate (Required Return) for Woolies of 10% (it has always deserved a low discount rate), I get a forecast 2011 valuation for Woolworths of $23.69, post the downgrade. This is $2.31 lower than my previous Value.able valuation of $26.

If I am slightly more bullish on my forecasts, I get a MAXIMUM valuation for WOW of $26.73, using the same 10% discount rate.

So there you have it. Using the method I set out in Value.able, my intrinsic valuation for WOW is $23.69 to a MAXIMUM $26.73.

Of course, I only get excited when a significant discount exists to the lower end of these valuations and until such a time, I will be sitting in cash.

Posted by Roger Montgomery, author and fund manager, 14 February 2011.

by Roger Montgomery Posted in Companies, Consumer discretionary, Insightful Insights, Investing Education.

-

How has my Switzer Christmas Stocking Selection performed?

Roger Montgomery

February 10, 2011

On the last show of 2010, Peter Switzer asked me to list six of my A1 businesses that, at the time, were displaying the largest margins of safety. Tonight Peter has invited me to join him once again to review how those six A1s have performed (and chat about Telstra’s result no doubt). Tune into the Sky Business Channel (602) from 7pm (Sydney time).

On the last show of 2010, Peter Switzer asked me to list six of my A1 businesses that, at the time, were displaying the largest margins of safety. Tonight Peter has invited me to join him once again to review how those six A1s have performed (and chat about Telstra’s result no doubt). Tune into the Sky Business Channel (602) from 7pm (Sydney time).Here’s the article/transcript from that appearance.

Click here to watch the latest interview and discover how my A1 picks performed.

A1 stocks are the cream of the crop, but how do you know which stocks measure up? To find out, Roger Montgomery joins Peter Switzer on his Sky News Business Channel program – SWITZER.

Montgomery explains he classes companies from A1 down to C5.

“A1 is a business, I think, that has the absolute lowest probability of what I call a liquidity event – the lowest chance of having to raise capital, the lowest chance of needing to borrow more money, the lowest chance of defaulting on any debt that it has, breaching a banking covenant or a debt covenant, the lowest chance of needing money or going bust,” he says.

Montgomery says he’s interested in consistency of performance – A1s that he think will be A1 in the next 12 months.

“I’m looking for the companies that have been consistently A1s or A2s over a longer period of time,” he says. “They’re the ones that I think are most likely to be next year as well.”

Montgomery stresses that it’s important to diversify and get professional advice.

“Make sure you don’t bet the farm on any one company,” he says. “That’s why you need personal professional advice, because you’ve got to make sure that you’re doing the right thing for you and everybody has different risk tolerances.”

Montgomery’s A1 stocks

Platinum Asset Management – he says this is an “obvious A1 – a great performer, has no need for debt, pays all of its cash out.” The company is trading at about its intrinsic value, so it’s not a bargain, but it’s good quality. The intrinsic value is expected to rise around 14 per cent over three years.

Cochlear – “It’s been an A1 for years,” he says adding that its current share price is not cheap enough. Its intrinsic value is expected to rise around 13 per cent over the next three years.

Blackmores – “Expensive at the moment,” he says. “The intrinsic value is only expected to rise about five per cent over the next three years.”

Real Estate.com – “It’s expensive again – it’s trading at about 15 per cent above its intrinsic value.” The intrinsic value is expected to rise 15 per cent in a year. Its intrinsic value is forecast to rise by about 15 per cent a year. “In a year’s time, its intrinsic value will be its current price.”

M2 Telecommunications – This company is trading at a 10 per cent premium to its intrinsic value, Montgomery says. “It’s not cheap, but its intrinsic value is forecast to rise by eleven and a half per cent.”

Mineral Resources – This is a mining services business and is trading around its intrinsic value. The intrinsic values are forecast to increase by around 30 per cent a year over the next three years – “So that’s not bad.”

DWS Advanced – Montgomery says this IT services business is trading at a three per cent discount to intrinsic value and its intrinsic value is expected to rise by about 13 per cent.

Centrebet – Montgomery explains that people tell him there’s not many competitive advantages with the company because barriers to entry to the industry are low. “The owners of the licenses for these things would say they disagree – barriers to entry are quite high,” he says. Centrebet is at a six per cent discount to intrinsic value and it’s forecast to rise around five per cent a year, Montgomery says.

ARB – “Trading at about 11 per cent discount to its intrinsic value. Forecast intrinsic value is going to rise by about three-and-a-half per cent,” he says.

Oroton – “There’s been some talk about the CEO selling shares. The issue is I’ve bought shares from CEOs and founders who’ve sold shares and the share price has gone up a lot since then. I’ve also seen situations where the CEO has sold and that’s been the best time to have sold.”

Montgomery says there hasn’t been research to show CEOs selling shares indicated anything, but there has been research to suggest CEOs buying shares may indicate something. Oroton is trading at a 13 per cent discount to intrinsic value and is expected to rise 13 per cent per annum.

Companies trading at premiums to their intrinsic value

Reckon

Thorn Group

GUD Holdings

Fleetwood

Wotif

Monadelphous

The intrinsic value on these companies are rising anywhere from six per cent to around 17 per cent per year over the next three years, Montgomery says.

Montgomery says it’s important to do further research on the companies – “you can’t just go out and buy them – some of them, as I’ve pointed out, are expensive, so I wouldn’t be buying them. Some of them are A1s but that doesn’t mean that they’re amazing businesses and they’re the best businesses to buy. They’re the least chance of having a liquidity event.”

Companies trading at discount to intrinsic value

Montgomery explains he isn’t predicting share price; he’s valuing the company.

“Valuing a company is different to predicting where the share price is going to go”.

In descending order – biggest discount to smallest discount:

Matrix

Composite and Engineering

Nick Scali

JB Hi-Fi

Oroton

ARB

Centrebet

DWS

“We’ll come back in the New Year, we’ll have a look at how the index has gone, and we’ll have a look at how that little group of companies has performed.”

Important information: This content has been prepared by www.switzer.com.au without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek and take appropriate professional advice.

Posted by Roger Montgomery, author and fund manager, 10 February 2010.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Value.able.

-

Is your stock market still turned off?

Roger Montgomery

February 3, 2011

At this time of year, well-meaning articles on the subject of how to invest in the year ahead abound. Indeed I have contributed to the pool of wisdom in my recent article for Equity magazine titled Is your stock market on or off?.

At this time of year, well-meaning articles on the subject of how to invest in the year ahead abound. Indeed I have contributed to the pool of wisdom in my recent article for Equity magazine titled Is your stock market on or off?.Value.able Graduates know to turn the stock market off and focus on just three simple steps. Even if you have read Value.able, or joined in the conversation at my blog, its not just me that believes they’re worth repeating. Ashley wrote about the article ‘More of the same stuff for the Value.able disciples but the more you read it the more you will practise it’ and from David ‘’twas a good refresher indeed!’.

Step 1

The first step of course is to understand how the stock market works. Once you understand this, turning it off is easy. And you do need to turn of its noisy distraction.

Step 2

The second step is to be able to recognise an extraordinary business (Go to Value.able Chapter 5, page 057).

I have come up with what are now commonly referred to by Value.able Graduates as Montgomery Quality Ratings, or MQR for short. Ranking companies from A1 to C5, my MQR gives each company a probability weighting in terms of its likelihood of experiencing a liquidity event.

Step 3

Finally, the third step is to estimate the intrinsic value of that business. Use Tables 11.1 and 11.2 in Value.able.

Three simple steps. If you get them right, you too can produce the sorts of extraordinary returns demonstrated and published, for example, in Money magazine.

The key is to buy extraordinary companies. To save you some time, I would like share a current list of companies that don’t meet my A1 rating. Indeed these are the companies that receive my C4 and C5 ratings, the worst possible. Avoiding these is just as important as picking the A1s because even diversification doesn’t work when your portfolio is filled with poor quality companies or those purchased with no margin of safety.

Whilst the eleven companies listed above are low quality businesses, they won’t necessarily blow up. This is not exhaustive, nor is it a list of companies whose share prices will go down. It is however a list of companies that I personally won’t be investing in.

If your first question is what are the chances of loss?’ then my C5 rating represents the highest risk. But of course risk is based on probability. And a probability is not a certainty. Nevertheless, I prefer A1s and A2s. More on those lists another time.

Posted by Roger Montgomery, author and fund manager, 3 February 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education.

-

Will your portfolio repeat its 2011 performance?

Roger Montgomery

February 2, 2011

If you are new to my stock market Insights blog, welcome. And to the Value.able community, thank you for your many comments and encouraging words. It gives me great encouragement and motivates me to hear how your investing and returns have improved as a result of reading Value.able and the collection of comments posted by Graduates here at my blog. Thank you also for spreading the word and purchasing additional copies for family and friends.

If you are new to my stock market Insights blog, welcome. And to the Value.able community, thank you for your many comments and encouraging words. It gives me great encouragement and motivates me to hear how your investing and returns have improved as a result of reading Value.able and the collection of comments posted by Graduates here at my blog. Thank you also for spreading the word and purchasing additional copies for family and friends.Taking a look back over the stocks we discussed last year, it appears the Value.able approach to investing in the highest quality businesses, with a true margin of safety, has been doing quite well.

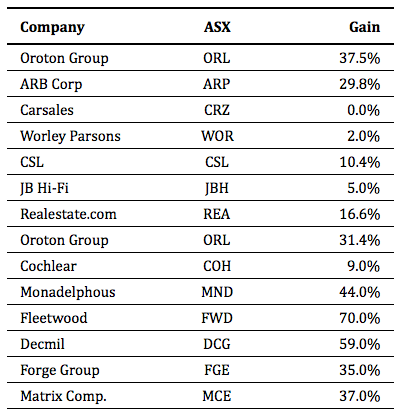

In addition to the blog, I also wrote about many of the stocks that achieve an A1 Montgomery Quality Rating (MQG) in my Value.able stocks for Money magazine over the last six months of 2010.

The stocks are listed in the table below. The column titled ‘Gain’ demonstrates you can do well without exposing yourself to lots of risk – for example the risk that is inherent in speculative stocks.

The returns exclude the dividends received, which would obviously boost results materially. The correct comparison therefore is the All Ords price index rather than the All Ordinaries Accumulation Index. Since 30 June 2010 the All Ordinaries has risen 12%. That is a stark contrast to many of the returns produced by the high quality businesses listed above.

The returns stand even higher above the Index when the selection is ranked by those that I regarded as offering the greatest margin of safety at the time the stock was mentioned: Oroton (up 37.5%), ARB Corporation (up 29.8%), JB Hi-Fi (bought and then sold the next month (up 5%), Monadelphous, Forge, Decmil and Matrix (up 44%, up 59%, up 35%, and up 37% respectively). The average, six month, price-only return of these businesses is 34.8%. And some of these A1 businesses, a margin of safety still exists.

If you are new to value investing you will, when searching around, find many commentators, portfolio managers and investors who may disparage value investing generally. They may question the method of calculating intrinsic value or even dismiss the valuations produced, but quite seriously, the proof is in the eating. And the returns offered have been nothing short of mouth watering.

But six months is NOT enough to hang your hat on, as Tony and Adam recently pointed out on my Facebook page. So if you have been an investor in any of these companies, following a conversation with your adviser of course, remember that the change in price over a year or two shouldn’t excite or concern you. It’s the change ahead in the Value.able intrinsic value of the company that matters.

If you haven’t already purchased your copy of Value.able, I commend it to you. It will change the way you think about investing in the stock market for the better, and as the many independent comments elsewhere here on the blog can attest, it may also materially improve your results. Value.able is available exclusively at www.rogermontgomery.com

Posted Roger Montgomery, author and fund manager, 2 February 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

How do your holiday homework results score?

Roger Montgomery

February 2, 2011

I was thrilled to see so many Value.able Graduates dive in the holiday homework I set just before Christmas. Well done. It is wonderful to see so many Graduates from the class of 2010, and now undergraduates of 2011, keen to continue building on their value investing knowledge in real time.

If you didn’t do your homework, let me remind you of your school days. Homework is a vital part of the learning process (even Buffett has been described as a learning machine). It was through all those nightly exercises and practice that you developed and refined the skills you continue to use today. When it comes to investing, the knowledge that you continue to refine, over time, will empower you to make smarter investment decisions.

So get out your red marking pen, it’s time to check the answers. If you are new to my Insights blog, click here to review to the Holiday Homework I set on 22 December 2010.

Challenge 1, Task 1

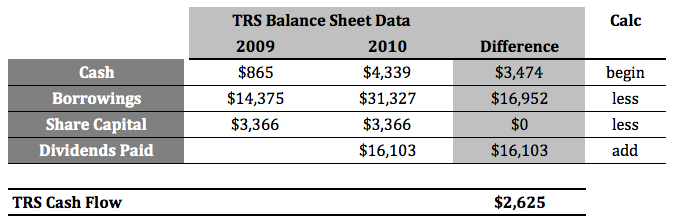

Using a Required Return of 11%, calculate the 2010 Value.able intrinsic valuation for The Reject Shop (TRS).

What is your answer? Using the numbers from TRS’s Balance Sheet, Profit & Loss and Dividend statement, I calculated $15.62. Here are my workings (click the image to enlarge):

Of course business is fluid and the most fluid businesses are impossible to get a bead on – so it’s important to constantly review your valuations and inputs based on fresh news and events. Even a quality business like TRS (which I wrote about becoming less enamoured with many months ago) requires this attention and is not immune to earnings downgrades or for TRS more recently, flooding of vital infrastructure that services 90 out of a total 211 stores.

Challenge 1, Task 2

Calculate the 2010 cash flow for The Reject Shop using the method outlined in Value.able on page 152.

What is your conclusion? The numbers tell me… had TRS paid more than $2.6 million in dividends, in addition to the $16.1m dividends already paid, the business would require even more borrowings to fund the dividends.

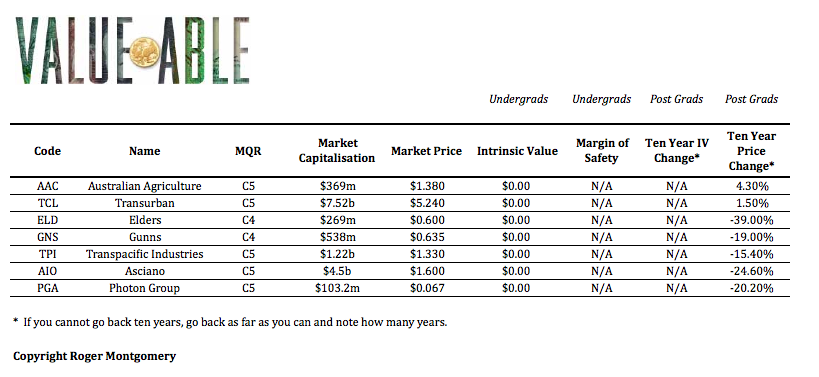

Challenge 1, Task 3 – C Rated Companies

Use the Value.able Valuation Worksheet to complete the Christmas Holiday Spreadsheet, and then rank the companies by their Safety Margin.

Before viewing these valuations (click the image to enlarge), heed the following lesson from Charlie Munger:

If I taught a course on company evaluation, I would ask the following question on the exam, “Evaluate the following internet company.” Anyone who gave an answer would be flunked.

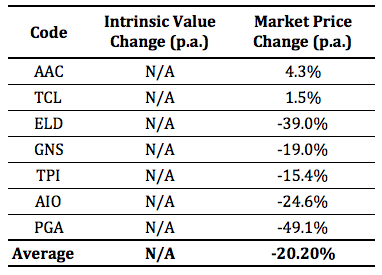

If you completed the Christmas Holiday Spreadsheet you will know my MQRs for the seven companies listed above – Australian Agriculture, Transurban, Elders, Gunns, Transpacific Industries, Asciano and Photon Group.

MQRs for these businesses range from C4-C5. C4 and C5 represent the lowest quality and poorest performing businesses listed on the stock market. These businesses are not investment grade.

What would I pay for them if I wanted to own a small piece of them? I wouldn’t. These businesses generate sub-optimal and even negative returns – my Value.able intrinsic valuations for all seven businesses is $0.00.

My advice? Move on. Don’t spend another minute conducting your own research. You and your portfolio will be much happier, and you will have more time to spend with family and friends.

Challenge 2

Calculate the historical change in intrinsic value and price over the last ten years. To do this, estimate the Value.able intrinsic value a decade ago (2001) and compare it to the 2011 Value.able intrinsic value.

To do the calculations, I used the ASX website (www.asx.com.au) to access past annual reports.

Prior to 2003 annual reports were published as text documents, which made finding the relevant inputs confusing. So I chose to start at 2003, the first year annual reports were published as PDF documents (click the image to enlarge).

Since 2003, the seven C4-C5 MQR businesses listed in the holiday homework have returned an average share price performance of -20.2% p.a.

With the Value.able intrinsic value of all seven businesses ‘about’ $0.00, the average change in intrinsic value was much worse (even though it could not be calculated using the formula provided).

When Ben Graham said ‘in the long run the market is a weighing machine’, he was spot on. There is indeed a relationship between value and price.

So I present the completed Holiday Homework Spreadsheet. How do your results compare?

Some warnings – very important and must be read by all investors

First, my Montgomery Quality Ratings (MQRs) and Value.able valuations are subject to one constant – change. I can assure you they will change. A business achieving a high MQR (A1-A2) today may become poor quality at anytime and a business currently ranked lower on my MQR scale could become high quality. Moreover my MQRs may not have any bearing on the current market price and the Quality Score (A-C) is NOT a predictor of price. Share prices will move independently of my MQRs, but as you can attest, for these seven businesses, there is a strong relationship between my current poor MQR and share price performance.

Although this is to be expected given the businesses underlying fundamentals and low MQRs, you must not rely on these in any way whatsoever. Consistent with my previous comments, I insist you use my blog as general information and consult your adviser, who will be able to discuss decisions with full awareness of your financial goals, needs, circumstances and risk profile. I do not have this information and so cannot offer any personal financial advice.

Posted Roger Montgomery, author and fund manager, 2 February 2011.

by Roger Montgomery Posted in Insightful Insights.

- 36 Comments

- save this article

- POSTED IN Insightful Insights

-

TV this week?

Roger Montgomery

January 27, 2011

Tonight at 6.30pm on Today Tonight I will share my insights on a well known stock.

Tune into Channel 7 from 6.30pm Sydney time. More insights will be posted tomorrow.

An all-time record for the shortest post ever Posted by Roger Montgomery, 27 January 2011.

by Roger Montgomery Posted in Insightful Insights, Investing Education.