Energy / Resources

-

Gas-rich Australia is facing a looming energy shortage

Ben MacNevin

March 13, 2017

How has it come to this? The Australian Energy Market Operator has just released its 2017 Gas Statement of Opportunities. It makes sobering reading, with warnings of a looming gas or electricity shortfall in eastern Australia. The nation is demanding solutions, but how long will it take, we wonder, for political debate to turn into action? continue…

by Ben MacNevin Posted in Energy / Resources.

- 5 Comments

- save this article

- POSTED IN Energy / Resources

-

Why our oil refineries are shutting down

Lisa Fedorenko

February 21, 2017

Back in the 1960s, manufacturing contributed 25% to Australia’s GDP. Today, this figure has dropped below 9%, largely due to an inability to compete on cost. A similar story has been playing out in our oil refining industry, where we have seen refinery after refinery shutting down. This has led us to ask: does our oil refining industry have a future and, if so, what does that future look like? continue…

by Lisa Fedorenko Posted in Energy / Resources.

- 8 Comments

- save this article

- POSTED IN Energy / Resources

-

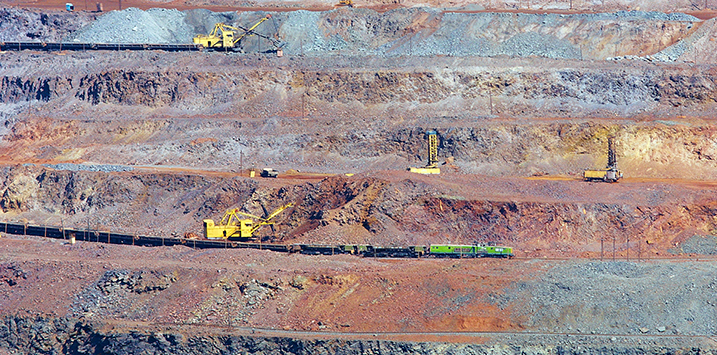

Should you invest more in resources?

Tim Kelley

December 13, 2016

Resource stocks have enjoyed a stellar year. Anyone who invested in the sector at the start of the year is enjoying bumper returns, while those who did not are lagging badly. It begs the question: should you invest more heavily in resources stocks? Our short answer is “no”. And here’s why. continue…

by Tim Kelley Posted in Energy / Resources.

- 8 Comments

- save this article

- POSTED IN Energy / Resources

-

The bellwether resource service stock

David Buckland

November 28, 2016

Monodelphous Group Limited (ASX: MND) is the bellwether company for the Australian resource service sector. After seeing the MND share price decline 80 per cent from $28.50 to $5.50 in the three years to early-2016, it has more than doubled this year, indicating investors appetite to switch into cyclical stocks as the expectation for resource projects proceeding has increased with the recovery in commodity prices. continue…

by David Buckland Posted in Energy / Resources.

- save this article

- POSTED IN Energy / Resources

-

Is investing in resources stocks worth the heartache?

Stuart Jackson

November 17, 2016

If you’re an investor in resources companies, you know it’s a bumpy, rollercoaster ride, with periods of glee interspersed with periods of gloom. But is all that volatility worth it? Or are investors better off in the long term investing in the broader market? We did some research, and the results are worth reading. continue…

by Stuart Jackson Posted in Energy / Resources.

- 9 Comments

- save this article

- POSTED IN Energy / Resources

-

Despite massive reserves, Australia may need to import natural gas

Ben MacNevin

November 15, 2016

Three years ago, AGL Energy warned of the dramatic imbalance between Australia’s LNG export commitments and inadequate domestic supply. Today, AGL is assessing the merits of building a gas import facility. That’s right. Australia, with some of the world’s largest natural gas reserves, may soon need to import gas for domestic consumption. How has it come to this? continue…

by Ben MacNevin Posted in Energy / Resources.

- 3 Comments

- save this article

- POSTED IN Energy / Resources

-

Going up! The rise and rise of Australia’s gas prices

Ben MacNevin

September 16, 2016

The laws of supply and demand would suggest that Australians, sitting on bountiful gas reserves, should be enjoying cheap gas prices. But that’s not the case. continue…

by Ben MacNevin Posted in Energy / Resources.

TaggedACCC, gas- 2 Comments

- save this article

-

POSTED IN Energy / ResourcesTaggedACCC, gas

-

The Revolution at Evolution Mining

David Buckland

September 15, 2016

Gold miners generally don’t meet our quality requirements at Montgomery. But there is one miner that has gone through a massive transformation over the past eighteen months – Evolution Mining (ASX: EVN). continue…

by David Buckland Posted in Energy / Resources.

TaggedEvolution Mining (EVN)- 6 Comments

- save this article

-

POSTED IN Energy / ResourcesTaggedEvolution Mining (EVN)

-

Should you buy gold?

Roger Montgomery

September 6, 2016

A bubble blown large enough will inevitably pop. And as gold bugs pump up the price of the precious metal, we hasten to warn our readers that this, too, is a bubble that will, sooner or later, burst. Moreover, gold is not a long-term investment. Our advice is to heed the words of Warren Buffett and stay away from gold. continue…

by Roger Montgomery Posted in Energy / Resources.

- 17 Comments

- save this article

- POSTED IN Energy / Resources

-

Fallout from the Perfect Storm

Ben MacNevin

July 7, 2016

Despite Australia’s comparative advantage in natural gas reserves, domestic residents are likely to pay higher prices due to large-scale export contracts. AGL Energy warned about this perfect storm in 2013. Three years later, the storm has arrived, and the company is now feeling its effects. continue…

by Ben MacNevin Posted in Energy / Resources.

- save this article

- POSTED IN Energy / Resources