Why our oil refineries are shutting down

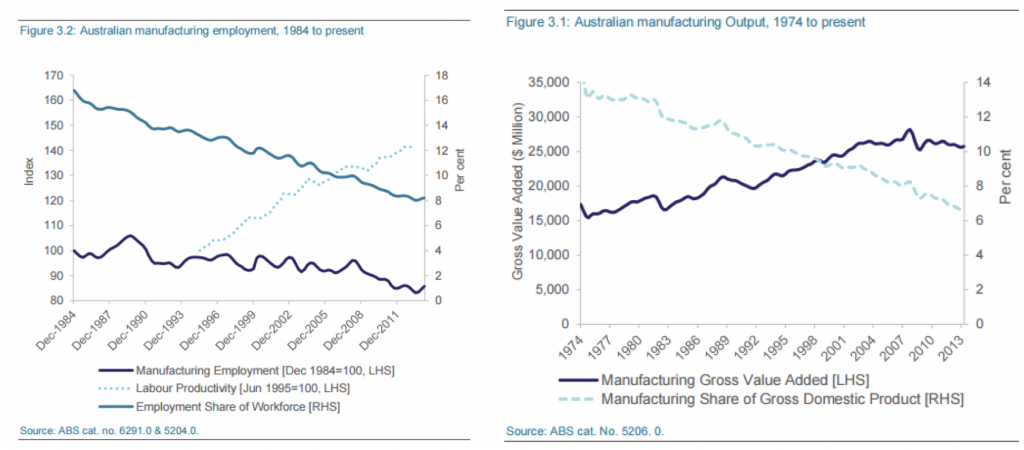

Back in the 1960s, manufacturing contributed 25% to Australia’s GDP. Today, this figure has dropped below 9%, largely due to an inability to compete on cost. A similar story has been playing out in our oil refining industry, where we have seen refinery after refinery shutting down. This has led us to ask: does our oil refining industry have a future and, if so, what does that future look like?

In oil refining, economies of scale provide a very efficient way to bring unit costs down. In the most common way to refine oil, you obtain crude oil (a variable input cost), run it through a boiler and feed it into a distillation column (both high fixed cost items). This causes the crude oil to separate into various layers with different length hydrocarbons chains. These can then be extracted as different products such as natural gas or petrol. Newer techniques involve using different chemicals or treating components.

Regardless of the technical details, it is a business with large fixed capital costs. If you increase volume (of input crude oil), you lower the average cost per litre by spreading these fixed costs more thinly, lowering unit costs of production.

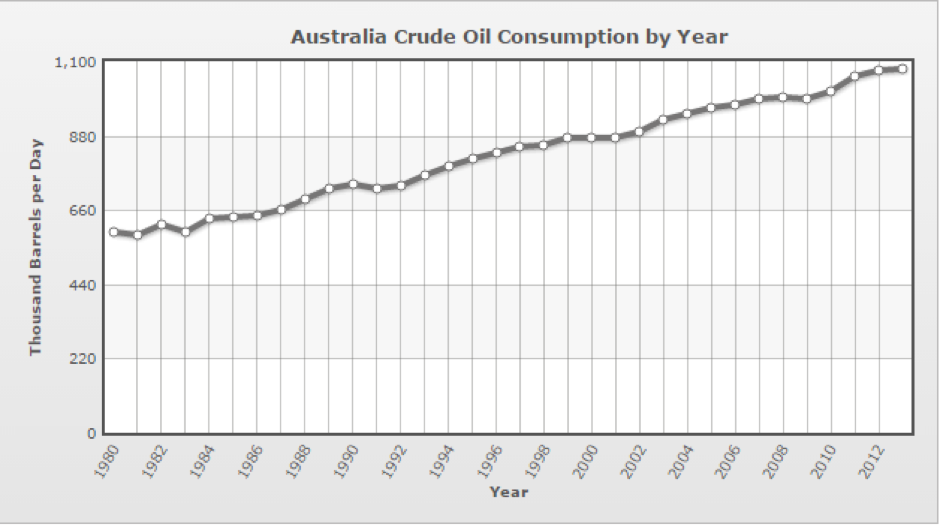

The problem is, Australia’s overall demand isn’t that big in relative terms. It’s been hovering at around 1 million barrels per day (mbpd). Whilst this sounds like a lot, the Jamnagar refinery in India produces 1.24 mbpd. That’s more than all of Australia’s needs from one source. And it’s not alone – Paraguana in Venezuela produces 955 bpd and Ulsan in South Korea 840 bpd. It’s pretty hard for Australia’s 211 bpd total refining output to compete with that!

Despite this, most refineries in Australia have remained profitable. So how does Australia remain competitive without the same scale benefits? By rationalising – just like refineries have done in Europe, and the US.

Australia has been progressively shutting refineries – Westernport in 1984, Matraville in 1985, Port Stanvac in 2009, Clyde in 2012, Kurnell in 2014, Bulwer in 2015. With each shutdown, the rest become a little more economic.

What does this mean going forward? It’s clear to see that refining crude in Australia, like many manufacturing businesses, works at a competitive disadvantage to larger scale markets. If normal market forces prevail we should see the continuation of shutdowns of less efficient Australian refineries and an increasingly larger percentage of our petrol being shipped from the larger Australian refineries, located so conveniently close to our shores.

This is in fact a good thing for all market players involved. Reducing less efficient Australian capacity is a win-win for domestic players; increasing capacity would increase costs for the industry as a whole.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Teddy

:

But the only pwople that see any real benifit in savings in the company

How can european counties refine and still make it profitable why cant our greedy companies invest if not make them charge taxes yo import manufactured goods as if a war or incedent happends australia will be fuel rastions in 3 weeks

Max Zan

:

Hi Lisa

Came across this article in smh and remembered your article on the topic – thought it would be of interest to you. It makes sense to beef up reserves as we are very vulnerable. Time will tell if the Government lifts and mandates minimum supply reserves.

https://www.smh.com.au/politics/federal/declining-fuel-reserves-prompts-turnbull-government-security-review-20180506-p4zdmq.html

Lisa Fedorenko

:

Hi Max,

Very thoughtful of you, thank you for linking the article – indeed an interesting read. We certainly have a lot less fuel on hand with the many refinery shut-downs over the past decades.

Doug Bullivant

:

We will have no ready access to road materials either, even though they can be imported, but I can’t imagine them being cheaper than if produced here as by-product. Why we have not actively encouraged our national fleet over the last 20 years towards ethanol let alone NG or LPG (now there’s a problem) is anybody’s guess.

Max Zan

:

Thanks Lisa

That AIP publication was very informative. On page 15 it shows that we have 25 days of refined product and a further 5 days of crude oil on land – a further 14 to 21 days of refined and crude at sea. Because we are so dependant on imports any disruption to those imports for whatever reason will be felt within a very short period. If you read what’s on page 20 you understand that fuel suppliers, refiners, wholesalers and importers want the end user to have plans in place to cover supply disruption . The problem is that the whole Fuel industry works with a “just-in-time” attitude right through to the end user. Holding stock reserves ties up working capital which is a drag on Business performance and a cashflow issue so very few end users do it.

The bottom line is that we are not self sufficient and imports make us vulnerable no matter how confident you are about continuity of supply. The US understands this issue and is working towards self sufficiency thanks to their fracking initiative – Australia will continue to work with a “just -in-time” attitude and nothing will change. That;s fine as long as imports are not disrupted.

Joel M

:

Seems like a bit of a trend of industries shutting down due to lack of scale. Sounds like the solution is to increase immigration so that we have a bigger population.

Max Zan

:

Hi Lisa

Having worked in Petroleum Distribution for over 20 years I found your comments interesting.

At present we have only four refineries operating – Mobil Altona and Viva Energy Geelong in Melbourne, Caltex Lytton in Brisbane and BP Kwinana in WA. Fuel security is already an issue due to the high level of imports that are required to meet demand and if any of these four were to close it would become more of an issue. There is no easy answer as these refineries are old and require major Capex to upgrade and there is a reluctance to go down that path. Closing one refinery in Melbourne would make the other more efficient in theory but not sure if the extra volume could be handled due to their size – they might be operating at capacity already. If the other two were to close we would be in real trouble. Fuel has become a national security issue which the government will need to step in and address at some point, but it’s only when a crisis arises that they stand up and take note – by then it’s too late. I’m not confident that oil refining will survive in Australia because of the inefficiencies and lack of scale. If that was to happen Australia would then become very vulnerable. Any hiccups with imports and everything grinds to a halt as reserves are currently less than one months requirements.

Lisa Fedorenko

:

Hi Max, some very interesting points there. There are some detailed papers looking into this very matter – you may like this one from the Australian Institute of Petroleum. Australia has progressively been moving towards more fuel importation rather than refining crude itself. From an open-trade perspective this makes economic sense – it is cheaper to produce petroleum products from larger, newer, more efficient refineries like those in South East Asia than in the older smaller scale existing ones in Australia. As this trend has grown, the supply chain from these plants has developed and become more efficient too. Current petroleum shipping routes take 14 days to reach the Sydney market and only 6 days for the West coast.