On Wednesday November 2 Woolworths held a strategy briefing for professional investors. Woolworth’s effectively asked us to adopt a longer time frame before judging its performance and revealed four strategic priorities that I will describe in a moment.

Prior to the strategy day, the company updated the stock market with a growth outlook that was the lowest in a decade. The market responded negatively to the change and it entrenched previous sentiment by professional investors to switch from Woolworths to Coles.

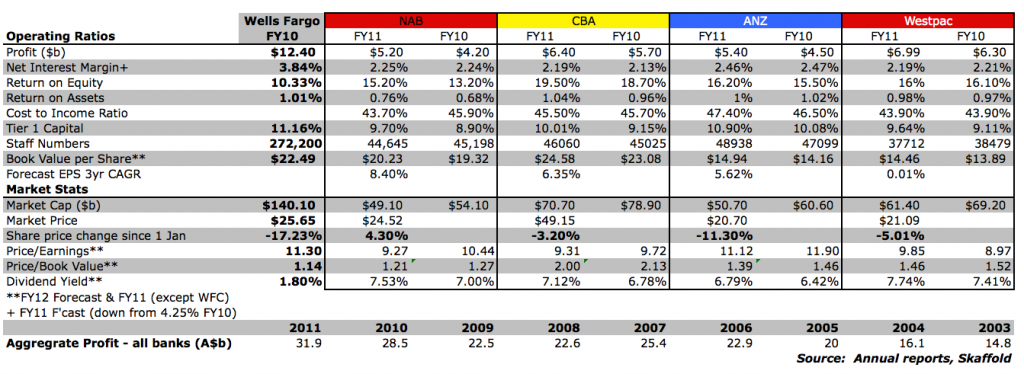

But Woolworths remains a superior business from a business economics perspective, with high return on equity and it also remains cheaper than its competitor as measured by the larger discount to an estimate of its intrinsic value.

The wider sentiment towards Woolworths Supermarkets is that the period of strong growth is over, and the other businesses, such as Big W, the New Zealand supermarkets, the Masters hardware venture and a possible acquisition of The Warehouse group could be the focus of earnings growth for the company. Gambling pre-committments would not be.

Meanwhile, the Woolworths-owned Dick Smith electronics business appears to have failed to excite consumers and has certainly failed to excite investment professionals. Dick Smith is a relatively weak offering in a market that has been hit particularly hard by the empowerment of the consumer through high Australian dollar.

Moreover, in many ways these businesses are peripheral since the Australian Food & Liquor division accounts for 80% of earnings before interest and tax.

The impact of the company’s lower growth profile on intrinsic value, particularly intrinsic values over the next two years, has been negative and intrinsic value does not appear to be going anywhere in a great hurry (see Skaffold chart below).

This combination of circumstances, in my experience, set Woolworths shares up to be vulnerable to any negative shocks.

Estimating intrinsic value is not the same as predicting price direction, however the above circumstances are not unique historically in putting a lead on price appreciation.

On top of the above combination of factors, there is also the continuing debate in Parliament about the introduction of preset loss limits for poker machines, which, if introduced, would negatively impact Woolworths’ gaming business. Though it is most closely associated with supermarkets, Woolworths is actually the largest poker machine owner in the country, with more than 10,700 pokies.

And a few weeks ago, The Economic Times of India also reported that Woolworths appears to have been dumped by its Indian partner, Tata Group. Woolworths enjoyed a five-year partnership with Tata, introducing Dick Smith-style electronics stores to India under the Infiniti Retail brand. Even though foreign retailers are not permitted to have a direct presence in India, Woolworths partnership offered the hope of growth – albeit with a partner – if the rules were ever relaxed.

Nonetheless, despite these accumulative negative factors, Woolworths is regarded by conventional analysts and investors as a defensive’ company. Its strong cash flows and its status as a major retailer of food makes it an ideal investment in a recessionary or slow or low growth environment. The company also enjoys entrenched competitive advantages over smaller rivals that, until now, the ACCC has done little about. One example of this are the new EFTPOS charges.

From the first of this month, the new Eftpos Payments Australia Limited (EPAL) fees mean retailers incur a 5¢ fee for every transaction over $15 (75% of all EFTPOS transactions). Previously there was no fee and that will still be the case for transactions under $15, which means 25% of transactions.

The retailer’s bank will charge the retailers, some of whom are describing the charges as an “EFTPOS tax”, and they will have no choice but to pass on to the consumer.

Unsurprisingly, EPAL’s members include the major banks, Coles and Woolworths and, because they manage their own terminals, they can opt out of the new charges.

But despite these entrenched advantages, Woolworths has been hit – or so it says – by the state of the economy, noting in its annual report: “Consumer confidence remained historically low as customers reacted adversely to rising utility costs, interest rate hikes in the first half of the year and general global uncertainty, and opted to save rather than spend their money”.

From an investment perspective it is worth noting that retail investors now have a choice of supermarkets, with Coles improving its offering to consumers and taking market share from the incumbent Woolworths.

The investment community is not convinced that further changes to private-label offerings or more innovation around the supply chain will make a dramatic difference to the growth prospects for Woolworths, which set below forecast growth in household income, population and the economy.

One other source of earnings growth is cost-cutting, but the reality is that gains from such strategies are one-offs and again unlikely to excite investors.

Having presented the negatives – which have caused the share price to fall 12% since July, one positive was the strategy briefing’s opportunity to showcase new CEO Grant O’Brien, who replaces Michael Luscombe. The company announced that it planned to extend and defend its leadership in food and liquor, act on the “portfolio” to maximise shareholder value, maintain its track record of building new growth businesses (we’ll ignore Dick Smith) and finally, put in place the enablers for a new era of growth.

In the supermarkets business WOW hopes to grow fresh produce from 28% market share to 36% market share. If achieved this would be an additional $2.5b in sales. Woolies also wants to target a doubling of home brand sales and this aim flies in the face of the ACCC’s stated concerns.

The company will also open 35 new BIG W stores in next 5 years reaching 200 by 2016.

In a reflection of the massive structural shift online, BIG W’s 85,000 in-store SKUs will be expanded and all put online.

And the topic on the tip of everyone’s tongue; Masters. There are now five stores open, another two are due to open in December/January, there are 16 under construction another 100 in the pipeline and the company reported the venture is well ahead of budget.

I also note the advertised sale of $900 million of property ($380 million of which was sold last financial year); and, most recently, the oversubscribed $500 million hybrid note raising that substantially extend the balance sheet strength of the company.

Below we examine the intrinsic value track record and prospects for Woolworths based on current expectations for earnings growth and returns on equity using Skaffold.com

Woolworths (MQR: B2) is currently trading at the same price it was in December 2006 and February 2007, despite the fact profits have risen 11.1% pa, from $1.3 billion to a forecast $2.2 billion in 2012. This growth in profit however is offset by having 16 million more shares on issue; by increased borrowings – up $1.8 billion to $4.8 billion; and by retained earnings, which have risen by $2 billion. The increase in shares on issue and retained earnings have offset the positive impact on return on equity rising profit would normally have.

The latest estimate of its intrinsic value, of $23.23, is forecast to rise modestly over the next two years. For investors looking at opportunities to investigate only when a meaningful discount to intrinsic value is presented, a price of $19 or less for Woolworths would represent at least 20 per cent.

Posted by Roger Montgomery, Value.able author and Fund Manager, 17 November 2011.